Credit Suisse Plunges: The Weak Spot of European Banking Is in Zurich, Not Silicon Valley

The bank’s nosedive follows the loss of a key backer and only leaves difficult options on the table, Morningstar analyst Johann Scholtz says.

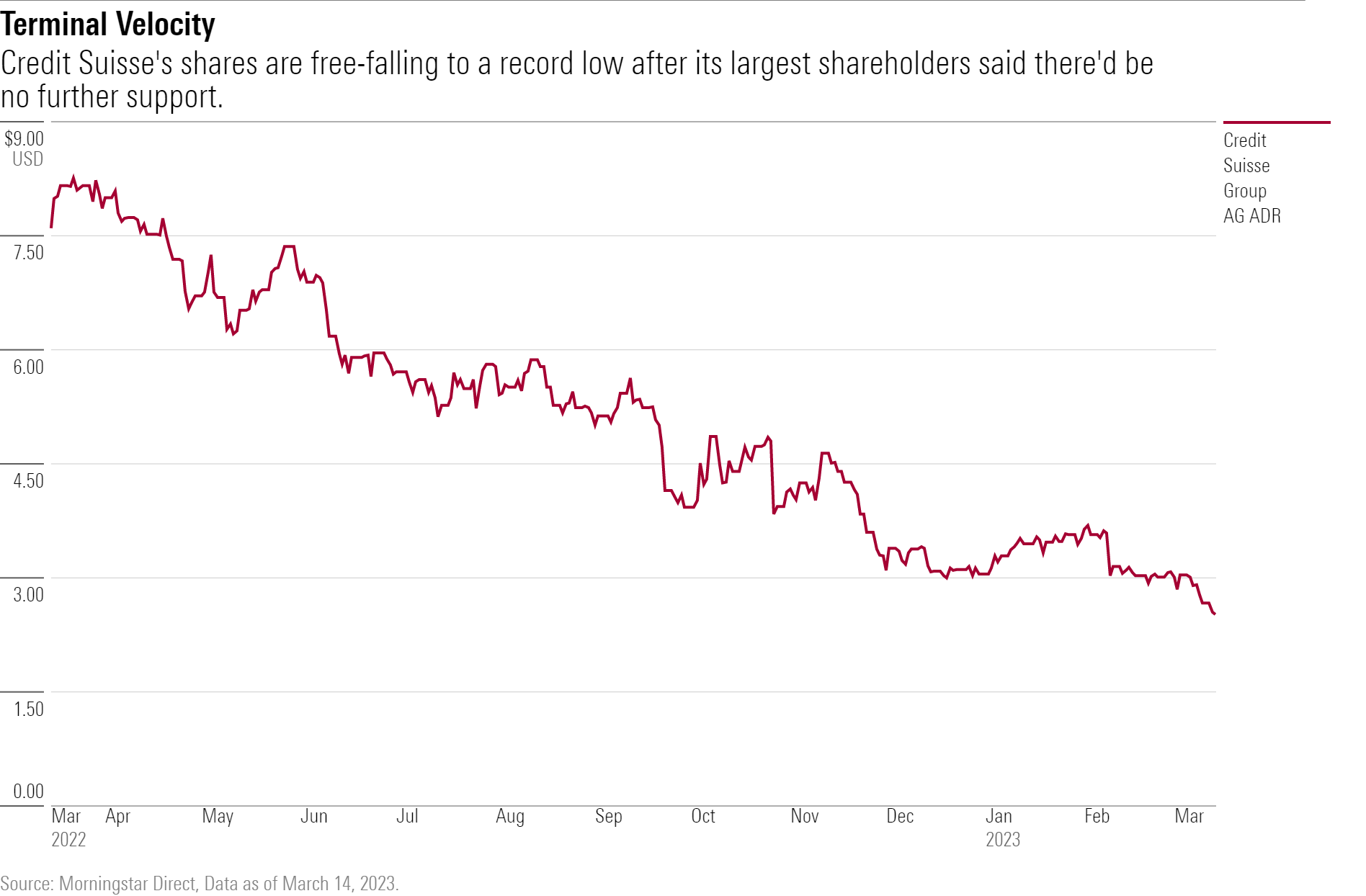

Switzerland’s second-largest lender Credit Suisse CSGN is down 29% after its largest shareholder, Saudi National Bank, said it could offer no further financial assistance. The selloff adds to the past week’s declines driven by the collapse of Silicon Valley Bank SVB and has pushed the stock to an all-time low of CHF 1.56. Morningstar banking analyst Johann Scholtz has put his fair value estimate under review as “Credit Suisse’s increased funding costs threaten its going concern status.”

“We now believe that the best-case scenario is that Credit Suisse successfully executes another rights issue to shore up the confidence of wholesale funders and clients,” Scholtz said on Wednesday, noting that credit default swaps now price in the possibility of a default. “While a default is still not our base case, we cannot rule out this possibility.”

The possible default of one of the region’s largest lenders has sent renewed shock waves through a sector that halted a string of SVB-driven losses only a day earlier. The Stoxx Europe 600 Banks Index, which does not count Credit Suisse among its constituents but includes major banks in the eurozone, Scandinavia and the United Kingdom, fell 7% by midday Wednesday.

“Credit Suisse’s funding costs have become so prohibitive that we expect the 2023 loss to increase to such an extent that its capital adequacy could be under threat,” Scholtz explained.

Its liquidity position seems adequate to handle deposit outflows, and it retains the fallback of borrowing against its bond holdings from the Swiss National Bank, he added, though such a step wouldn’t address Credit Suisse’s profitability challenge or address capital concerns.

An Uncertain Way Out

The bank’s best bet to stem outflows and ease the concern of providers of wholesale funding is yet another rights issue, Scholtz says. As recently as December, it raised CHF 2.2 billion in a rights issue to fund a restructuring and shore up its finances. At the time, CEO Ulrich Koerner said the raised capital would let Credit Suisse “further support our strategic priorities from a position of capital strength and create a simpler, more stable and more focused bank built around client needs.”

Three months on, doubts about Credit Suisse’s capital strength are stronger than ever.

There are two problems with a possible rights issue, according to Scholtz. First, shareholders would face significant further dilution after losing 75% of their positions’ value in the past 12 months. More importantly, without the Saudi National Bank, it’s unclear whether such a rights issue would even succeed. Buying CHF 1.75 billion through a private placement in December, the Saudis played a key role in the success of that funding round.

Instead, the bank could be broken up. Scholtz said that Credit Suisse’s Swiss banking, asset-management, and wealth-management operations could be sold off or listed separately, while the doomed markets or trading business would be run off. This could lead to a total wipeout for shareholders, assuming holding-company bonds would need to be bailed in.

The outlook is sinister for holders of Credit Suisse equity, who may have breathed a sigh of relief less than a day ago, when shares rose modestly, breaking a string of declines set off by the collapse of Silicon Valley Bank. That story seems rather distant now.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)