How Secure 2.0 Helps Protect Investors From Penalties and Excise Taxes

What your clients should know about the 90 provisions covered in the act.

Editor’s Note: This is the debut column by retirement consultant Denise Appleby. Like Natalie Choate before her, Appleby every month will cover the tax and legal angles of IRAs, defined-contribution plans, 403(b) plans, and governmental 457(b) plans.

I am honored to write for Morningstar, and I hope you find my content useful. I work with advisors to help their clients avoid making technical and operational mistakes with their tax-deferred retirement-savings accounts. Where possible, I help to fix errors that have already been made.

If you have suggestions on what I should write about in this column, please do not hesitate to contact me.

My first column introduces some of the provisions of Secure 2.0 that help to protect your clients’ IRAs and employer-plan accounts from penalties, excise taxes, and unintended distributions. Secure 2.0 comes bearing gifts of excise tax and penalty waivers.

Excise taxes and penalties can negate years of accumulated growth in an IRA or account under an employer plan. Take the case of Clair R. Couturier, Jr. v. Commissioner, T.C. Memo. 2022-69. The taxpayer owed the IRS about $8.5 million from years of accumulation of the 6% excise tax that applies to uncorrected excess IRA contributions. Helping clients avoid such excise taxes and penalties can be challenging, but Secure 2.0 makes the job easier.

Secure 2.0 Background

The Setting Every Community Up for Retirement Enhancement Act of 2019, better known as Secure 1.0, was signed into law on Dec. 20, 2019, as part of the Further Consolidated Appropriations Act, 2020. Secure 2.0 was signed into law on Dec. 29, 2022, as part of the Consolidated Appropriations Act, 2023. (For this article, “date of enactment” refers to Dec. 29, 2022.)

While Secure 1.0 upset beneficiaries and their advisors because it limited distribution options and planning opportunities for inherited accounts, Secure 2.0 attempts to “make nice” by including mostly tax-friendly provisions. The following are some of these provisions:

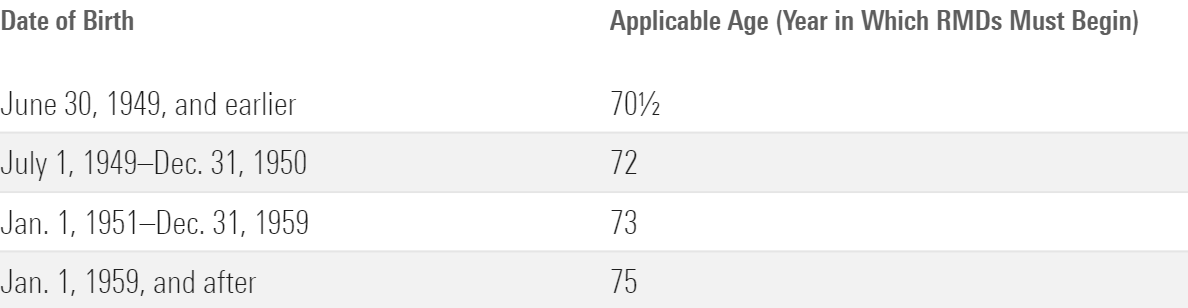

Later Ages for Starting RMDs

Secure 1.0 increased the starting age for required minimum distributions, or RMDs, from 70½ to 72. Secure 2.0 further increased the starting age for those who reach age 72 after 2022. As a result, your clients who reach age 72 after 2022 do not need to start RMDs until their new (later) applicable ages. Tracking clients by their birth dates is an effective way of knowing who should have already begun RMDs (and must, therefore, continue) and who benefits from the new starting ages.

You will notice that someone born in 1959 falls into the age 73 and 75 categories. But not to worry, as the IRS will likely issue technical corrections long before they reach RMD age.

For employer-sponsored plans, if the terms of the plan allow, the participant may defer RMDs past the applicable RMD age until retirement.

Code red alert: IRA custodians must send RMD notices to owners of traditional IRAs (including SEP IRAs and Simple IRAs) by Jan. 31 of the year for which they must take RMDs. Those who reach age 72 in 2023 have no RMDs for 2023. However, many IRA custodians could not stop the 2023 notices for those IRA owners because of the late date that Secure 2.0 was signed into law. Therefore, if your client is an IRA owner who attains age 72 in 2023, they may disregard any RMD notice for 2023.

If they took distributions because they received such a notice, they could roll over the amount if it would not break the one-per-year IRA-to-IRA rollover rule.

Impact on beneficiaries: Whether the IRA owner or plan participant died before their required beginning date, or RBD, is one of the factors that determine the distribution options available to their beneficiaries. Be sure to update your beneficiary checklist with these new RBDs.

Reduced Excise Tax on Missed RMDs

IRA owners, plan participants, and beneficiaries with inherited accounts who fail to take RMDs by the deadline owe the IRS an excise tax on any RMD shortfall. Secure 2.0 reduced this excise tax to 25% from 50%. This excise tax is further reduced to 10% for those who correct the RMD shortfall during a new “correction window.”

The modifications to the tax code, as made by Secure 2.0, did not repeal the option to request a waiver of the excise tax. Therefore, your clients may still request a waiver unless informed otherwise by the IRS. The 2023 version of IRS Form 5329, which is used to request the excise tax waiver, should include explicit information about the option to request a waiver.

This provision is effective for RMDs for 2023 and after.

Waiver of the 10% Additional Tax on Early Distributions

Distributions taken before age 59½ are subject to a 10% additional tax (early distribution penalty) unless the amount qualifies for an exception. Secure 2.0 added new exceptions to the existing list. The following are some of these exceptions:

- Terminal illness: Distributions made by individuals who have been certified by a physician as having an illness or physical condition that can reasonably be expected to result in death in 84 months or less after the certification date. (Effective for distributions made after Secure 2.0′s date of enactment.)

- Corrective distributions of excess contributions: When an IRA owner makes an excess contribution, any attributable earnings must be included in a correction (return of excess contribution) that is done by the IRA owner’s tax filing due date, plus extensions. Those earnings are subject to income tax. The 10% early distribution penalty also used to apply until it was repealed by Secure 2.0. As a result, effective for any correction made after Secure 2.0 was signed into law, the 10% early distribution penalty does not apply. (Effective for distributions made after the date of enactment.)

Observation: It appears that those who made excess IRA contributions in 2022 would qualify only if the correction occurs after the date of enactment.

- Transfers and rollovers will not cause a SEPP/72(t) to be “modified”: One of the exceptions to the 10% early distribution penalty applies to distributions taken under a substantially equal periodic payment, or SEPP, program—also known as 72(t) payment programs. These payments are subject to strict rules; breaking them would result in retroactive disqualification from receiving the waiver. For example, one of the rules prohibits transfer and rollover to or from an account running a 72(t) program unless the entire balance is rolled over or transferred to a new account. Secure 2.0 repeals that limitation effective for rollovers and transfers made after 2023—including allowing partial transfers and rollovers—providing the total payments for each year of the program equals the amount initially established under the program. (Effective for transfers and rollovers occurring after Dec. 31, 2023.)

Recommendation: While Secure 2.0 permits partial transfers and rollover, IRA owners and plan participants should keep 72(t) account balances segregated from other amounts. Doing so will help to maintain the integrity of the program and avoid any risk of breaking any of the rules—particularly failing to withdraw no less or more than the payment amount due for a year.

- $10,000 for victims of domestic abuse: Victims of domestic abuse may withdraw up to the lesser of $10,000 (adjusted for cost-of-living increase) or 50% of their vested account balance during the one-year period that begins on the date of the domestic abuse committed by a spouse or domestic partner. (Effective distributions made after Dec. 31, 2023.)

A terminal illness or domestic abuse distribution may be repaid to an eligible retirement plan within three years of receipt. To ensure that qualifying plan participants receive the full amount requested, the 20% mandatory withholding that applies to eligible rollover distribution from employer plans does not apply to these distributions.

Statute of Limitations for 6% and 25% Excise Tax

Before Secure 2.0, the statute of limitations for the 6% excise tax on uncorrected excess IRA contributions and the excise tax on RMD failures were started when IRS Form 5329 was filed for the violation.

For an excess IRA contribution, the 6% excise tax accrues for every year an excess contribution remains in an IRA. Taxpayers and many tax preparers were unaware of this requirement, causing the excise tax to accumulate indefinitely.

The statute of limitations starts when the IRA owner’s or plan participant’s tax return is filed—with six years for excess contributions and three years for the excise tax on RMD shortfalls.

This provision does not apply to bargains sales, including abusive Roth IRA transactions. (Effective on the date of Secure 2.0′s enactment.)

Nonaggregation of IRAs for Prohibited Transactions

Engaging in a prohibited transaction could disqualify an IRA, causing the entire balance to be subject to income tax and the 10% early distribution penalty. Unfortunately, such unintended distributions are a risk for those who invest in nontraditional assets such as real estate, limited partnerships, and nonpublicly traded stocks. An example is the Tax Court case of McNulty v. Commissioner [157 T.C. 120 (2021)], where the IRA was disqualified—resulting in an unintended distribution of the IRA—because the owner kept the investment coins at home.

To avoid the risk of other IRA assets being affected by a prohibited transaction, many IRA advisors often advise clients to keep those investments at risk of a prohibited transaction separate from other IRA assets. This separation avoids the risk of tainting other IRA assets should a prohibited transaction occur.

Secure 2.0 confirmed that this strategy does protect IRAs that do not hold the disqualifying investment from the consequences of a prohibited transaction.

Advisors Should Keep a List

Secure 2.0 includes more than 90 provisions affecting IRAs and employer plans. There is something for everyone, including low- to high-income taxpayers and small businesses that sponsor employer plans. The effective dates for these provisions vary, with some taking effect upon enactment. A section-by-section summary can be found here and can be used to create a list of the provisions and their effective dates.

Denise Appleby is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)