Why This Vanguard Real Estate Fund Got an Upgrade

This passive approach is more than a match for its active rivals, and other ratings highlights from January.

Vanguard Real Estate Index’s VGSNX accurate, effective, and cheap representation of the U.S. real estate market earned it a Process Pillar rating upgrade to High from Above Average in January, which lifted the strategy’s most expensive investor shares to a Morningstar Analyst Rating of Gold from Silver, like its other three share classes.

This fund offers an accurate snapshot of the complete U.S. real estate market. It takes a sensible approach and has demonstrated its efficacy, warranting a Process upgrade to High from Above Average. Cheap, broad exposure to U.S. REITs and real estate-related stocks has proven to be a winning combination. Each of the fund’s share classes provides broad diversification at fees that rank in the U.S. real estate Morningstar Category’s cheapest decile. DFA Real Estate Securities DFREX, also an inexpensive passive option, is the only other Gold-rated U.S. real estate offering in the peer group.

The strategy tracks the MSCI U.S. Investable Market Real Estate 25/50 Index, which owns mostly REITs and up to 5% in real estate management companies. The benchmark and fund tend to be less concentrated than the typical peer. The market-cap-weighted index lets the market’s collective wisdom determine position sizes, which minimizes transaction costs. Low fees give strategy a big head start on more expensive actively managed rivals. The strategy’s Institutional share class’s 6.7% annualized return since adopting its current benchmark in February 2018 bests the U.S. real estate category average of 6% through January 2023; it also beats the category’s average active strategy, which gained 6.2% in the same period.

Execution Hiccups

Some missteps by Fidelity High Income’s SPHIX relatively new trio of managers drove a January Process downgrade to Average from Above Average and dropped the overall ratings of the strategy’s cheapest share classes to Neutral from Bronze.

Manager Michael Weaver took over this strategy when predecessor Fred Hoff retired in October 2018. Comanagers Alexandre Karam and Benjamin Harrison joined in 2018 and 2022, respectively. They’ve been able to lean on a deep and experienced group of 21 analysts to help with the bottom-up credit selection on which this strategy relies.

Unfortunately, this group has struggled and strayed from the fund’s heritage as a moderate option in its category. The team mismanaged the strategy’s energy stake in 2020 and has made some bad sector calls in recent years, particularly among higher-risk CCC rated securities. The managers’ longstanding preference for the telecommunications sector, where the fund has been consistently overweight, also has hindered performance. The strategy’s slim 1.2% annualized gain for its Z share class over Weaver’s four-year-plus tenure lags the ICE Bank of America U.S. High Yield Index’s 2.8% as well as its high-yield bond category peer median’s 2.6%. The strategy’s subpar performance in recent credit-driven selloffs, formerly an area of strength for the portfolio, is even more concerning.

New to Coverage

Polar Capital Emerging Markets Starts POLEX earned an initial qualitative rating of Bronze. The growth-oriented strategy has amassed nearly $100 million in assets since launching in December 2020. It struggled in 2020 but still has a solid, disciplined approach for finding consistent and enduring growth companies in burgeoning markets.

Ratings Roundup

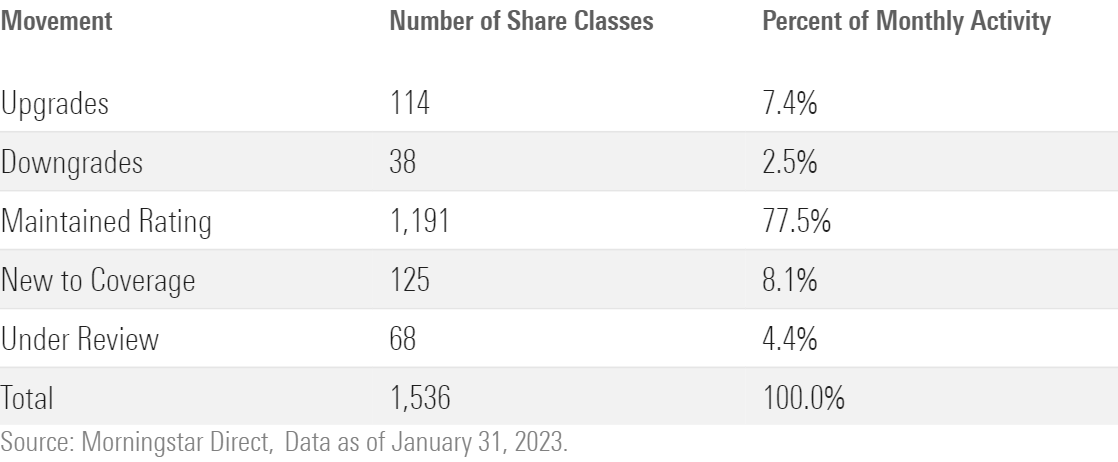

Morningstar updated the Analyst Ratings for 1,536 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in January 2023. Of these, 1,191 retained their previous rating, 114 earned upgrades, 37 received downgrades, 125 were new to coverage, and 68 went under review owing to material changes such as manager departures or subadvisor changes. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 329 Analyst Ratings throughout January. Of these, 20 were new to coverage and 20 were under review. Although there were 19 strategies receiving upgrades and 12 downgrades, the majority (245) retained their previous ratings.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f490381f-5450-44be-b474-313f03204bfb.jpg)