Tax Benefits for Active and Passive Real Estate Investors

Investors can save on taxes through the tool of depreciation.

When most people think of the financial benefits of rental properties, they think of income generation and price appreciation. However, property owners’ tax benefits are also substantial, as you can save thousands of dollars in taxes each year through depreciation.

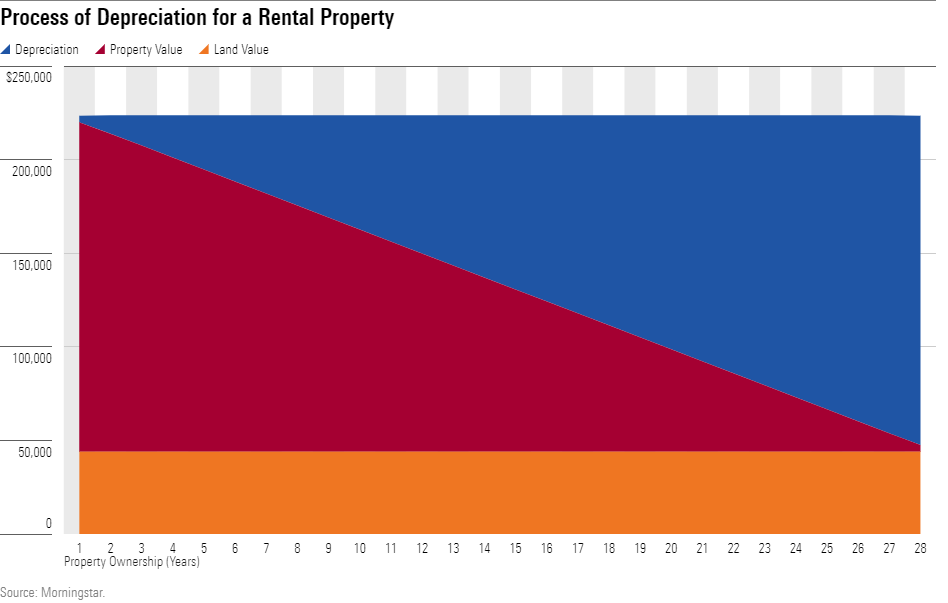

Rental properties have what the IRS calls a “determinable useful life,” meaning they’ll wear out or somehow lose value over time. That is, they depreciate (their recorded value goes down) every year.

Depreciation, a noncash expense, reduces your earnings and leads to a lower tax bill, as owners can deduct from taxes the cost of buying and improving the property over that determinable useful life. This cost represents no cash out of your pocket but lowers cash taxes. Exhibit 1 showcases that this benefit is long-lasting, covering nearly 30 years of ownership.

How Much Can You Save Through Real Estate Depreciation?

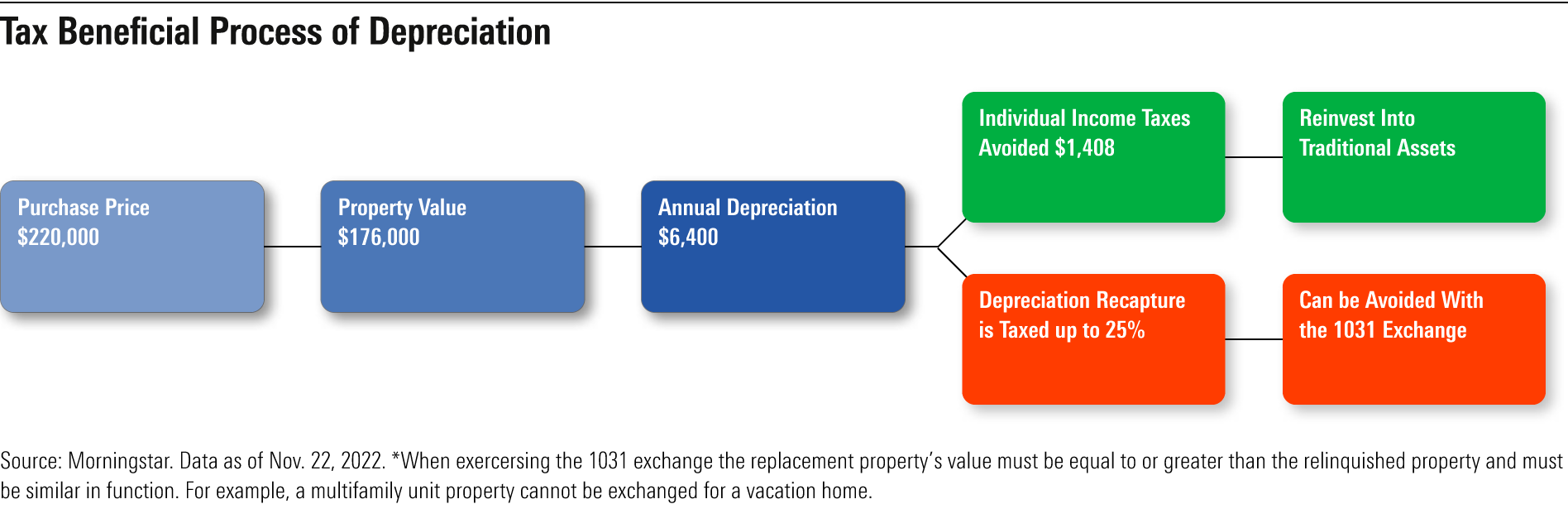

Let’s say you purchased a single-family residential rental property 22 years ago in Chicago for $220,000. The IRS only allows homeowners to depreciate the value of the building but not the land. Perhaps, the land only accounted for 20% of the home value; then you could depreciate the building’s value ($176,000) at the standard rate of 3.636% annually for 27.5 years. You would recognize $6,400 in depreciation each year.

Assuming you’re in the 22% tax bracket (which reflects a single head-of-household annual income range of $54,201 to $86,350 and those married filing jointly with an annual income range of $81,051 to $172,750), you would save around $1,408 a year in taxes thanks to depreciation.

And while you could buy a big-screen TV, let’s assume you reinvest the savings. Reinvesting depreciated-related tax savings can add up to a substantial long-term benefit.

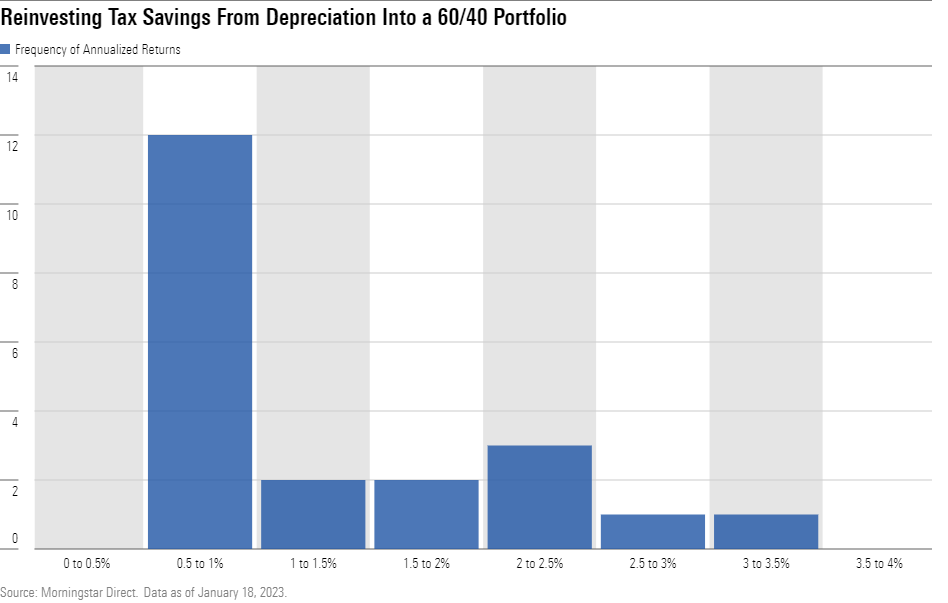

The value of a stock and bond portfolio typically compounds or increases exponentially, whereas the tax bill grows linearly. The chart below shows how your annualized return would look if you invested depreciation-related tax savings into a traditional 60% stock and 40% bond portfolio. The figure highlights the annualized return after owning a property for 20 years, stepping forward one year at a time from 1980 to 2000.

On average, investors would see an annualized return of 1.3%, but most returns look closer to a 0.8% return on capital after considering tax burdens such as depreciation recapture, which is the gain realized by the sale of depreciable capital property.

That said, if you decide to sell the property, you can still defer capital gains and depreciation recapture taxes by reinvesting the proceeds into a similar investment property. In other words, the replacement property’s value must be equal to or greater than the relinquished property and must be similar in function. For example, a multifamily unit property cannot be exchanged for a vacation home.

This is called a 1031 exchange, which requires advanced planning. The IRS allows you only 45 days from the sale of your property to identify a replacement property and 180 days to purchase it.

There are no limits on the number of times you can use the 1031 exchange, allowing for tax-free profit growth. If you’re willing to maintain your allocation to real estate, it makes sense to defer capital gains and frequently reinvest.

This is particularly beneficial for individuals who are frequently transacting property, but it is still a powerful tool for long-term investors. For instance, infrequent transactions using this process can allow you to replenish the value you can depreciate.

What Are the Tax Benefits of Active Real Estate Investment?

It is clear that real estate’s tax treatment is a boon to expected returns, but not all investors benefit equally. All investors are eligible for the various tax deductions related to buying, operating, and maintaining the property; a few examples of these deductions include mortgage interest, rental property depreciation, repairs and improvements, and property taxes.

A passive investment could be suitable if you want a hands-off role and prefer hiring a management company to take care of day-to-day operations. While passive investors cannot use rental property losses to reduce other taxable income, passive income and capital gains tax rates are lower than federal income tax rates that apply to active investors.

However, the tax benefits can be more significant for investors actively participating in their rental activities.

An active investment could be suitable if you want to be involved in the management and decision-making for real estate, like a landlord. In addition to directly handling property management, active real estate investors dedicate time to researching different property markets and optimizing investment outcomes for each property.

Active investors can receive additional tax deductions depending on their modified adjusted gross income, or MAGI, levels. For instance, to reduce net operating income taxes, you can place your rental property under contract through a limited liability company, or LLC, consider yourself self-employed, and be qualified for the pass-through tax deduction. That means an investor can deduct 20% from their pass-through income, reducing the base income level that they are taxed. Furthermore, you can avoid payroll tax as a self-employed real estate investor. You would not have to pay the employer and employee portion of the FICA tax since your income is considered business-related and not earned.

Depending on your level of commitment to real estate business activities, you may identify as a passive investor or an active investor. The differences between the two approaches are shown below.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)