Evaluating Our Picks for Best and Worst New ETFs Over the Years

What to consider when assessing fresh ETF launches.

Each year, our ETF research team selects the best and worst new ETFs that launched during the past 12 months. We have chosen 15 “best” and 24 “worst” new ETFs out of a whopping 2,565 ETFs launched on or after Jan. 1, 2015. That means we cherry-picked the best and worst ETFs from 55% of all historical launches. Choosing our favorites and least favorites from the flurry of launches was not easy, but each year we have settled on a small cohort to represent each group.

There are no hard-and-fast criteria for picking the best and worst. But in our experience evaluating ETFs, we have some idea of what makes a good or bad one. Put simply, we judge each on the likelihood of a long-term positive investor outcome.

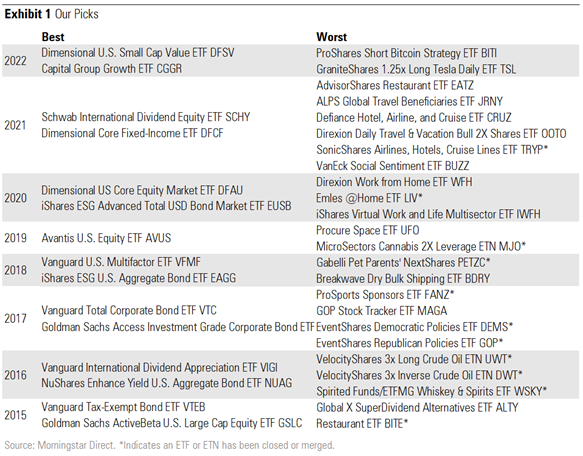

The best new ETFs tend to share a few key characteristics. They usually levy a low fee, cover a well-defined or mature market segment, and offer investors something unique they could not have easily invested in before. The worst new ETFs, on the other hand, usually charge a high fee, cover an opaque or nascent market segment, and usually have us asking, “Why would anyone want this?” Exhibit 1 lays out our picks since 2015.

Over the years, there has been white-hot competition in the “Worst New ETF” category, with funds like Procure Space ETF UFO, Restaurant ETF BITE, and VanEck Social Sentiment ETF BUZZ vying for dishonorable mention. These funds, and the rest of the “worst” cohort, have us questioning what long-term benefit they bring investors. In all, 24 ETFs made the cut, but countless more were left on the cutting-room floor. So, if your metaverse or inverse single-stock ETF is not on this list, it doesn’t mean it wasn’t considered. You should still proceed with caution, and maybe consider a pivot to one of our “Best New ETFs.”

The “Best New ETF” category was less hotly contested but featured some clear standouts from venerable firms. All of our favorites sport a low fee, cover a well-defined market, and offer something unique that should support positive long-term investor outcomes.

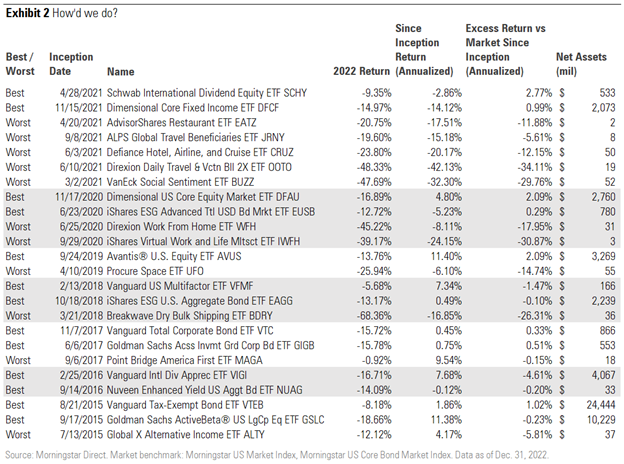

Exhibit 2 shows that we mostly did well with our picks. None of our “Best New ETFs” closed or merged, and more than half outperformed the relevant Morningstar Index since their respective inception. They also picked up around $52 billion in combined assets, with the boring but beautiful Vanguard Tax-Exempt Bond ETF VTEB leading the way. VTEB has gathered more than $24 billion since its 2015 inception.

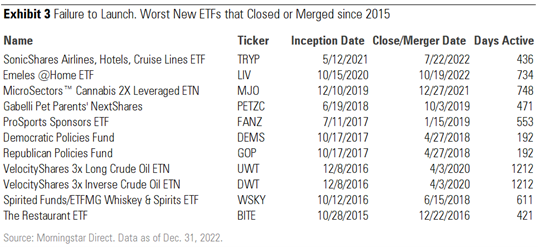

Our “Worst New ETF” picks struggled to collect assets, only amassing $311 million as a group through 2022. This cohort woefully underperformed the market, and only 54% of the funds managed to keep their lights on. Exhibit 3 shows the 11 ETFs that closed or merged and how long they remained open. Each was chosen as a “Worst New ETF” for their respective launch year.

Exhibits 2 and 3 paint different pictures for different ETFs. Our favorites have demonstrated staying power. Only one failed to gather more than $100 million in assets, and none ended up on the closed fund list. Meanwhile, none of the surviving “Worst New ETFs” has gotten close to $100 million in assets, putting the surviving funds in jeopardy of closing.

Investors have not shown an appetite for the niche thematic strategies of many ETFs in the “worst” column. Performance has not looked appetizing, either, with all surviving funds failing to better the market’s return. However, in what was truly a bizarre year for markets, one fund has stood out.

Point Bridge America First ETF MAGA was the best-performing fund last year in either group, losing less than 1% compared with the Morningstar US Market Index’s fall of more than 15%. MAGA invests its portfolio to align with Republican beliefs. Its heavy allocations to industrial, utilities, and energy stocks finally bore fruit while it fortuitously avoided technology stocks, which experienced a historically terrible year.

Now, before you go gaga for MAGA, Exhibit 3 shows that in 2017 we picked another Republican policy ETF and one Democratic policy ETF as two of the worst ETFs launched that year. Each fund from EventShares barely lasted half a year, demonstrating the lack of viability for a strategy of this type. MAGA’s assets under management, even with its relatively strong 2022, remains below $20 million and it may be a candidate for closure if it experiences a period of underperformance or can’t gain more assets.

Watch This Space

Every year, dozens of ETFs launch to much fanfare and with aggressive marketing campaigns. ETFs with staying power tend to be those offered for a reasonable fee by established firms. This retrospective shows that while some ultra-specialized, or otherwise questionable, strategies can perform well over short periods, the laundry list of dead funds highlights the poor odds that come with gambling on any ETF on the “Worst” list. Some are obviously intended to be a gamble, like ProShares Short Bitcoin Strategy ETF BITI, while others disguise their bets by centering on broader social or economic trends like Emeles @Home ETF LIV, which went belly-up in late 2022. Either way, investors should treat these types of ETFs with caution.

We don’t have a crystal ball, but our team has a finger on the pulse of the ETF market. And when it comes to new launches, we tend to have a good idea of what works and what doesn’t. So far, our picks have been accurate, and we expect that to continue. Our annual picks should provide investors a guide for what to earmark and what to avoid among fresh ETF launches. The growth of the ETF market cannot be stopped, with some new ETFs for the better and others for the worse. Our team is here to help filter through the noise.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)