In Financial Services Sector, Benefits of Higher Interest Rates Must Be Weighed Against Likely Slowing Economy

Key items to watch for include a slowdown in economic growth, normalization of credit costs, and a potential pivot by the Fed to a easier monetary policy.

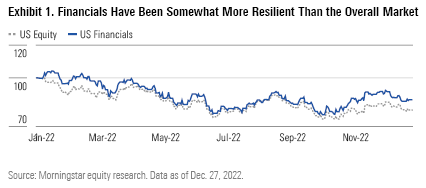

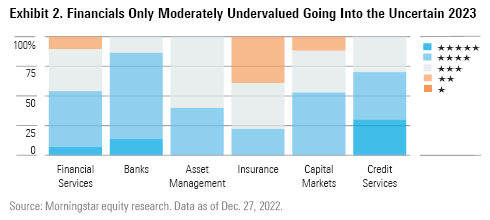

The Morningstar US Financial Services Index outperformed the Morningstar US Markets Index year to date through Dec. 27, 2022, down 12.98% compared with 19.70%, and outperformed fourth quarter to date, up 11.89% compared with the market that’s up 6.91% (Exhibit 1). The median North American financial sector stock trades at a 10% discount to its fair value estimate compared with a 23% discount at the end of the third quarter of 2022 and a 2% premium at the end of fourth quarter of 2021. We currently rate around 45% of the North American financial sector stocks coverage as undervalued 5- or 4-star stocks with about 10% rated overvalued 2- and 1-star stocks (Exhibit 2).

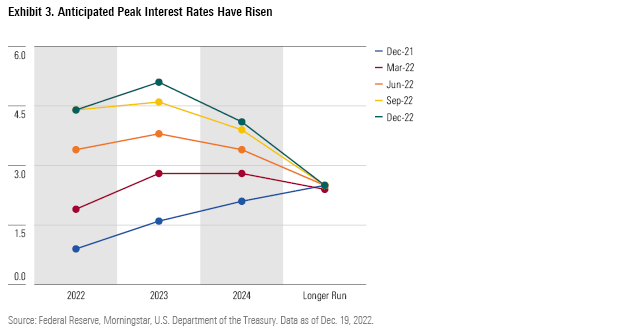

Key items to watch for in 2023 for financial sector stocks include a slowdown in the economy, normalization of credit costs, and a potential pivot from the Federal Reserve to more accommodative monetary policy. In December, the Federal Open Market Committee raised the FFR by 50 basis points to a range of 4.25%-4.5%. The 50-basis-point raise is lower than the four most recent raises that were 75 basis points each. The median FOMC member also now believes that the effective federal-funds rate should be 5.1% in 2023 and 4.1% in 2024 contrasted with the belief after the September FOMC meeting of 4.6% and 3.9% (Exhibit 3). With the federal-funds rate near its likely peak and recent inflation readings showing stabilization and the potential start of a downward trend, the moderate recent change in the federal-funds rate seems reasonable.

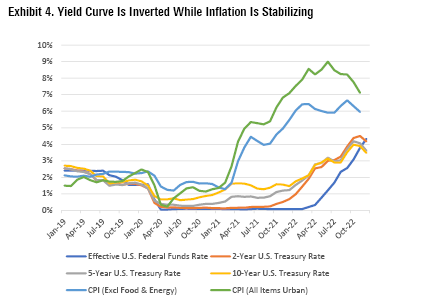

While high interest rates are a boon to many financial sector companies that earn interest income, many economic commentators are worried at the inversion of the yield curve, with short-term interest rates being higher than long-term interest rates (Exhibit 4).

An inverted yield curve, with a comparison of the 2-year and 10-year Treasury rate being common, is often seen as signaling a pending recession. Regardless of if the United States does enter a recession, it’s likely that economic growth will slow, the unemployment rate will rise, and bank credit costs will increase from unusually low levels to something more normal. When inflation is more firmly under control, which could occur in 2023 or 2024, the timing and magnitude of a Federal Reserve pivot to lowering interest rates will become a focus for the financial sector.

See our analysts’ Top Picks in the Financial Services sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)