Why Municipal-Bond Funds Are Worth a Look

Higher taxable-equivalent yields add to their appeal.

Like all bond investors, municipal-bond fund investors have had a rough go of things recently. As interest rates have continued climbing, the average intermediate-term municipal-bond fund shed about 11.8% for the first 10 months of 2022. In response, investors sold off about $91.6 billion of assets across all municipal-bond Morningstar Categories over the same period.

In the short term, ongoing interest-rate hikes could lead to continued trouble in muni land. But with fundamentals relatively strong, the tax breaks make these funds worth considering, especially for investors in higher tax brackets.

Background on Municipal Bonds

Municipal bonds are issued by state or local governments to fund their day-to-day operations or raise funds for public projects, such as bridges, roads, and new schools. The interest paid on these bonds is usually exempt from federal income taxes and may also be exempt from state and local taxes for investors who live in the same state or municipality where the bond was issued.

Municipal bonds often pay out less than taxable bonds but can often be appealing for investors in higher tax brackets, particularly now that fewer people are able to take itemized deductions. The best way to figure out how they stack up is to calculate a taxable-equivalent yield, which allows you to make apples-to-apples comparisons between the aftertax income from taxable and tax-exempt vehicles. To calculate it, take the nominal, or pretax, yield for the tax-advantaged vehicle and divide it by the percentage of income you’ll keep after taxes, or 1 minus your tax rate. The answer represents how much income you would have to receive from a taxable investment to make it more competitive than the municipal choice.

For example, if you’re in the 32% tax bracket and own a municipal-bond fund with a nominal yield of 3.25%, you’d have to earn more than a 4.78% yield, or 3.25 divided by 0.68, from a taxable investment for the latter to be more attractive after taxes. That calculation doesn’t include any adjustments for state or local taxes, so if you live in a high-tax state, you can garner additional tax benefits by choosing a fund that invests in bonds issued within your home state.

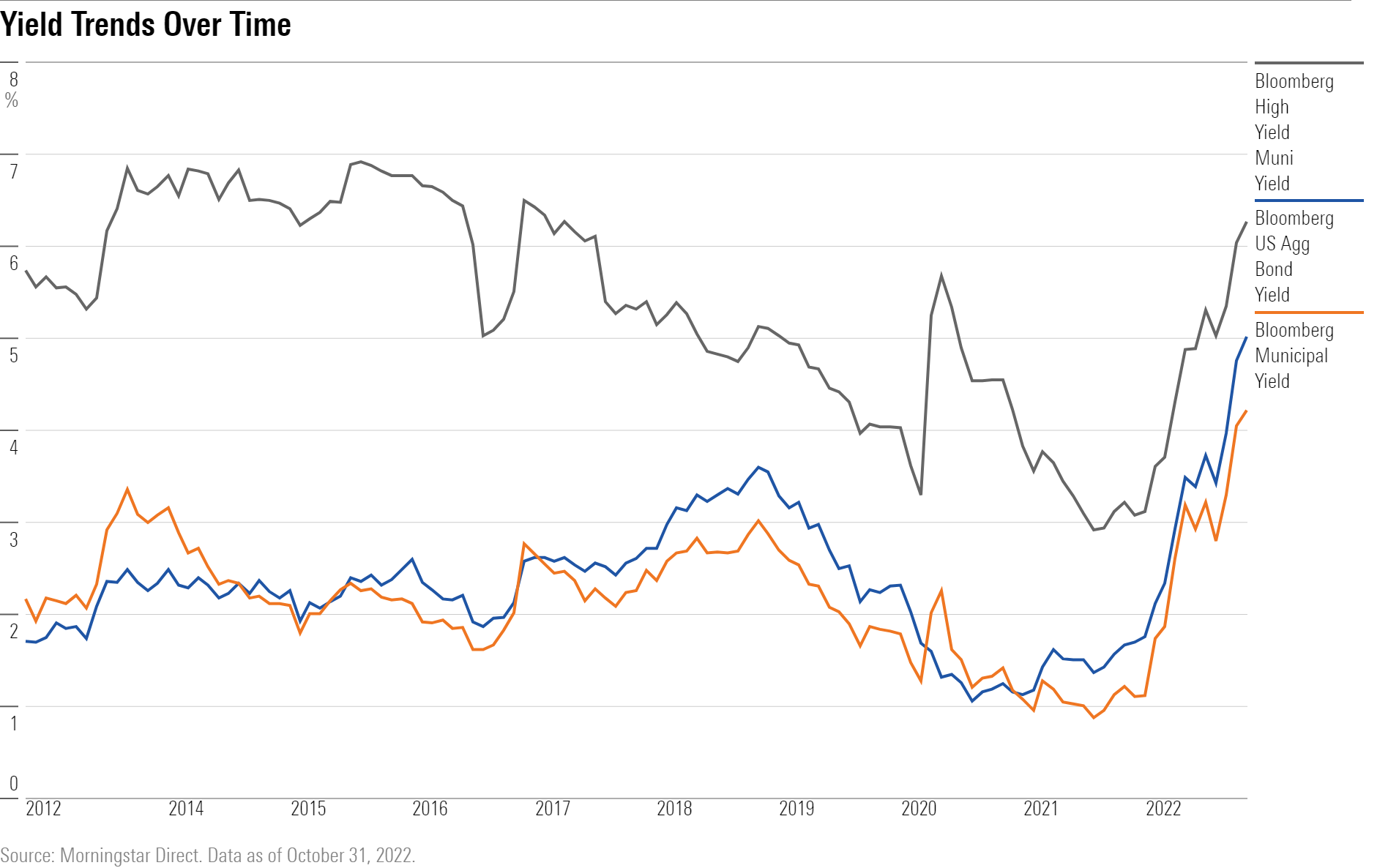

Yield Trends Over Time

As the Federal Reserve has repeatedly hiked interest rates to try to get inflation under control, yields on major bond market indexes have significantly increased. As shown in the chart below, the yield on the Bloomberg U.S. Aggregate Bond Index stood at about 5.0% as of the end of October. Yields for the Bloomberg Municipal Bond Index edged up to 4.1%, while the high-yield municipal benchmark yielded 6.3%.

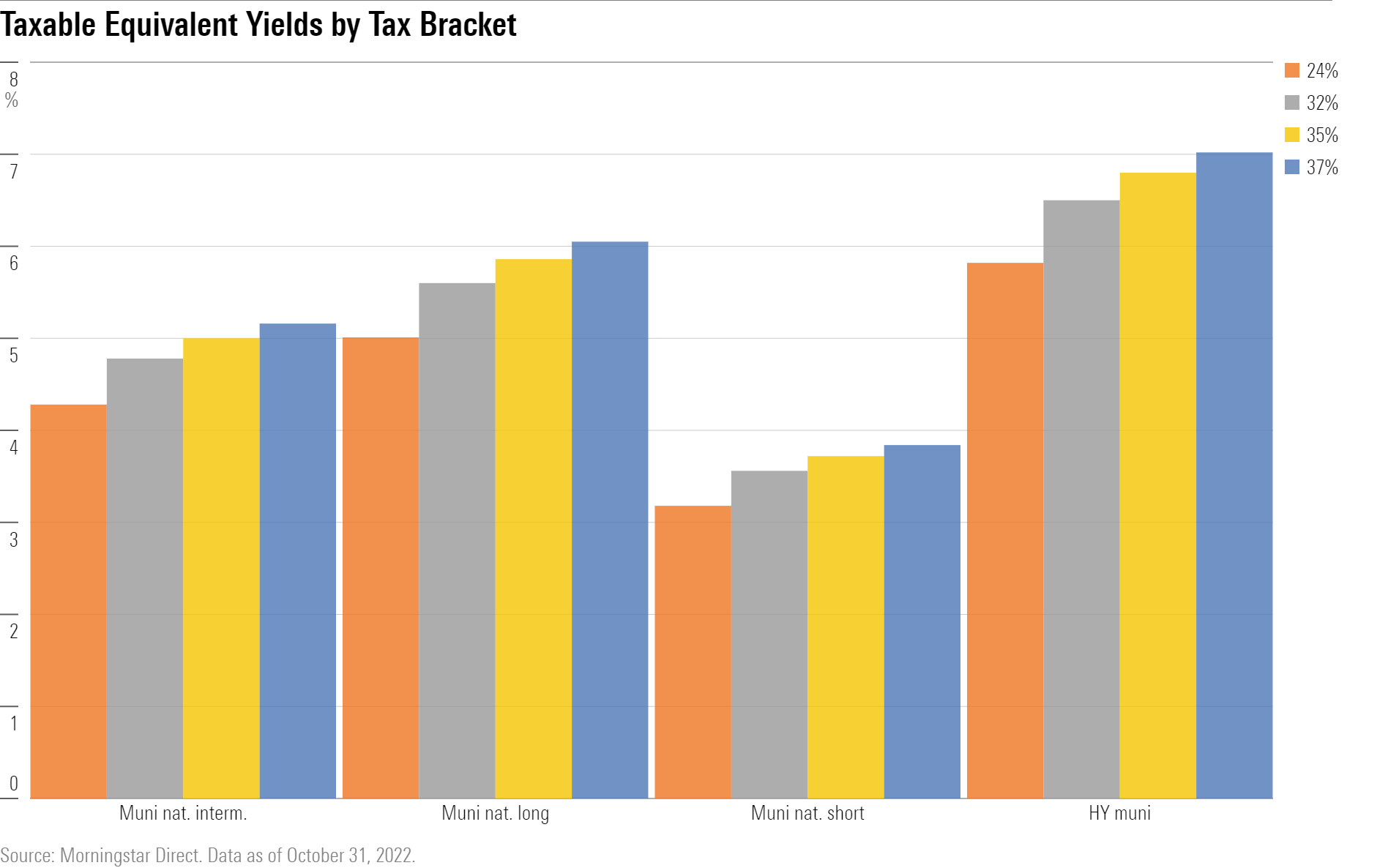

As mentioned above, though, taxable-equivalent yield is a better measure because it accounts for differences in individual tax rates. While municipal bonds usually don’t make sense for investors in lower tax brackets, muni yields are currently high enough to make them worth considering even for investors with more moderate income levels. For investors who are married filing and jointly in tax-year 2022, for example, the 24% tax bracket spans a range of taxable income from $178,151 to $340,100. Investors in that bracket can currently earn a taxable equivalent yield of 4.28% for a typical intermediate-term muni fund, which compares favorably with the average yield of 3.55% for intermediate-term core bond funds.

In fact, yields for most municipal-bond categories are currently generous enough to make them worthwhile for investors in tax brackets of 24% or higher. Those in the highest tax brackets can benefit the most, as shown in the chart below.

These estimates don’t include additional benefits from the net investment income tax, an extra 3.8% tax on investment income and certain other types of income that generally applies to investors with a modified adjusted gross income greater than $250,000 who are married and filing jointly. This additional tax can make munis even more attractive for higher-bracket investors who also have investment income.

Munis haven’t always offered such a generous yield advantage. As of December 2019, for example, the gap between taxable and tax-equivalent yields for funds in the muni-national intermediate category was only 3 basis points for investors in the 32% bracket and 10 basis points for investors in the 35% tax bracket. Investors in the top 37% bracket could eke out 20 additional basis points versus the average intermediate-term core bond fund.

What Could Go Wrong?

Municipal bonds aren’t free of risk. Funds that bill themselves as high-yield often dip into lower-credit-quality rungs, and that has led to heavier losses during bond market downturns, such as 2008, when the average high-yield municipal-bond fund lost 25%. Although default rates on municipal-bond funds have typically been low overall, potential or actual defaults can roil the market from time to time. The city of Stockton, California, filed for bankruptcy in 2012, as did Detroit in 2013. Puerto Rico, whose bonds were widely owned by U.S.-based funds, went into a debt crisis starting in 2014 and eventually defaulted on its debt. Morningstar’s home state of Illinois (and home city of Chicago) has long suffered well-publicized budget deficits and unfunded pension obligations. For high-yield municipal bonds, liquidity is a related risk factor that can lead to heavier losses during periods of market stress.

At the moment, though, municipal credit quality looks relatively strong. As articles from Vanguard and AllianceBernstein have recently pointed out, the federal stimulus provided to municipalities and consumers during the pandemic has helped shore up municipal finances. With unemployment still running at historically low rates, state and local governments have also been collecting more revenue from income taxes and property taxes. Many municipalities have used this extra cash to build up their reserves, which should help cushion the blow if a weaker economy leads to lower tax revenue.

Conclusion

For investors in taxable accounts, higher-quality municipal-bond funds can play a valuable role as core holdings. But because the municipal-bond market can be somewhat idiosyncratic, it’s also worth including other types of bond funds, such as U.S. government securities and inflation-protected bond funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)