Are Dividend ETFs Still Worth a Look?

Maybe. Managing risk is the name of the game.

Almost no one has been spared by the turbulent markets of 2022. Domestic and international stocks are both down substantially, bonds failed to provide ballast for portfolios, and safe havens like gold have been anything but safe. Income-seeking investors have faced an even tougher dilemma with paltry bond yields and tumbling prices to begin this year. In this environment, where can income-seeking investors find shelter?

Dividend funds have provided some degree of sanctuary during the recent tumult, broadening their appeal beyond just income investors. For the year to date through September 2022, dividend exchange-traded funds have brought in an estimated $55 billion—a time when other ETFs and mutual funds have hemorrhaged assets. Investors in dividend ETFs have not been rewarded in the profit/loss column though, with the average fund down more than 19% through September. But that still beats the broad-based Morningstar US Market Index by more than 5 percentage points and lags the Morningstar Total Return Bond Index by only 2 percentage points. All the while, the average dividend ETF yields more than 4% while the Morningstar Total Return Bond Index barely reaches 2%.

There have been few places to hide throughout the year, but dividend ETFs have proved to be as good a place as any. These funds have rewarded investors with strong yields and moderately better returns than the broader market and should continue to offer decent yields while providing exposure to a potential rebound in equity markets. Here, I will highlight a few of our favorite options in this segment and outline what investors can expect moving forward.

Some of Our Favorites

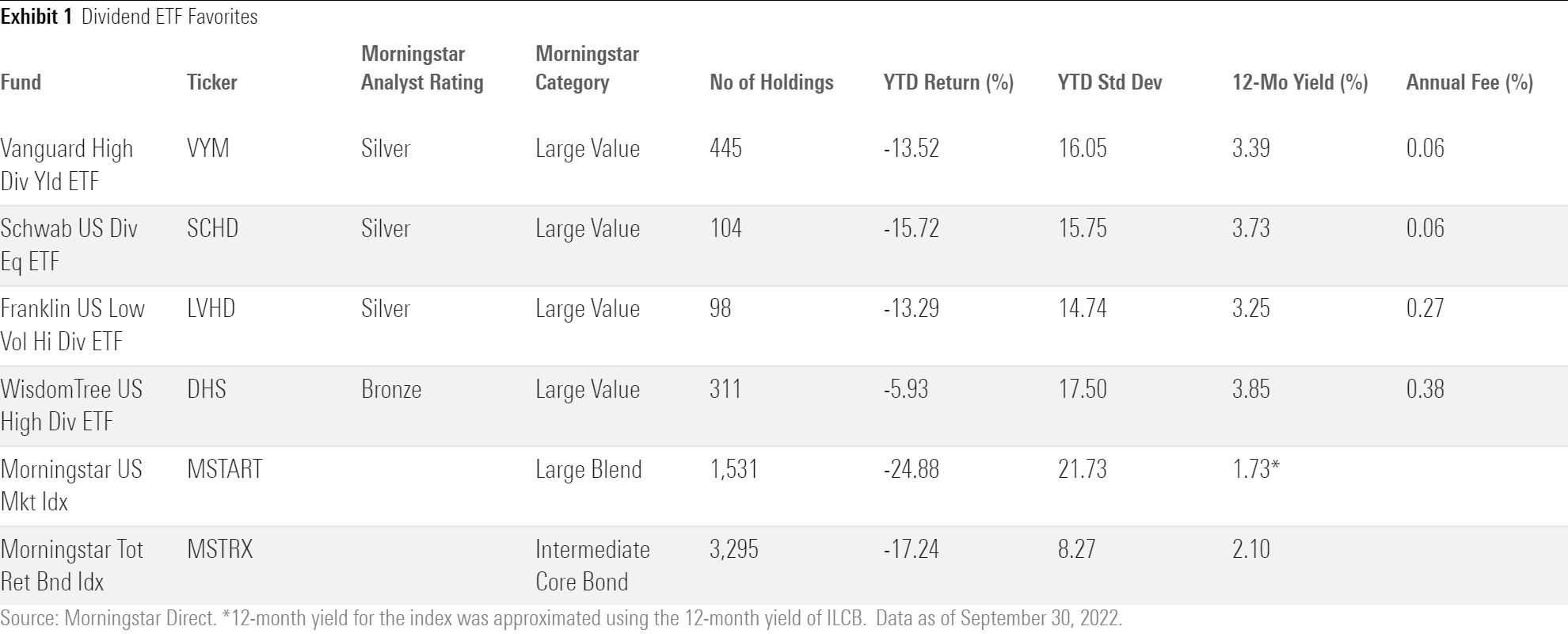

For investors seeking income, there are few great options out there right now. Investors are finally seeing yield out of their fixed-income sleeve, but that has been offset by falling prices. This brings us to dividend ETFs. These products target dividend-paying companies, but there are many different approaches managers take, offering investors a different flavor with each one. Below is a table of four dividend ETFs that we recommend, with Morningstar US Market Index and Morningstar Total Return Bond Index acting as proxies for the broad U.S. equity market and bond market, respectively.

All four dividend ETFs have fared better than the broad market this year, which has lost about 25% through September. Yields are similarly high for each of our recommended ETFs—and above that of the broader equity and fixed-income markets. What differentiates these ETFs are their risk-mitigation tactics in the historically volatile high-dividend yield market segment. Each is unique in this space, which has led to disparate returns, yields, and risk profiles so far this year.

Vanguard High Dividend Yield ETF VYM takes the simplest approach to selecting high dividend-payers. It captures the top 50% of the dividend-paying universe’s market cap, excluding REITs, and weights them by market cap. Market-cap weighting helps the fund mitigate the impact of value traps but takes away some of the emphasis on yield as a result. This fund is the best diversified of the bunch with around 450 holdings and only 23% of assets concentrated in the top 10.

Schwab US Dividend Equity ETF SCHD targets a narrower portfolio by tracking the Dow Jones US Dividend 100 Index, which also excludes REITs and assigns each eligible stock a composite score based on four fundamental metrics. This additional screen should tilt the fund toward the quality factor and provide a smoother ride through turbulent markets. The final list of 100 names is weighted by market cap with some buffers around the edges to cut down on turnover.

Franklin US Low Volatility High Dividend ETF LVHD includes REITs and uses profitability metrics to screen stocks for durable high dividends with low price and earnings volatility. These screens are used to generate a stable yield score that is run through an optimizer to determine the final lineup and weighting of its 75-100 holdings. The optimizer aims to maximize yield and minimize volatility, which this fund has done admirably.

WisdomTree US High Dividend ETF DHS considers momentum when selecting constituents. It uses a risk factor score to screen the dividend-paying universe for high-quality stocks with positive momentum. Stocks that make the cut are weighted by their projected cash dividend over the next year, which should help to maximize yield despite a relatively broad holdings list of 311 stocks.

Chasing Yields, Accepting Returns

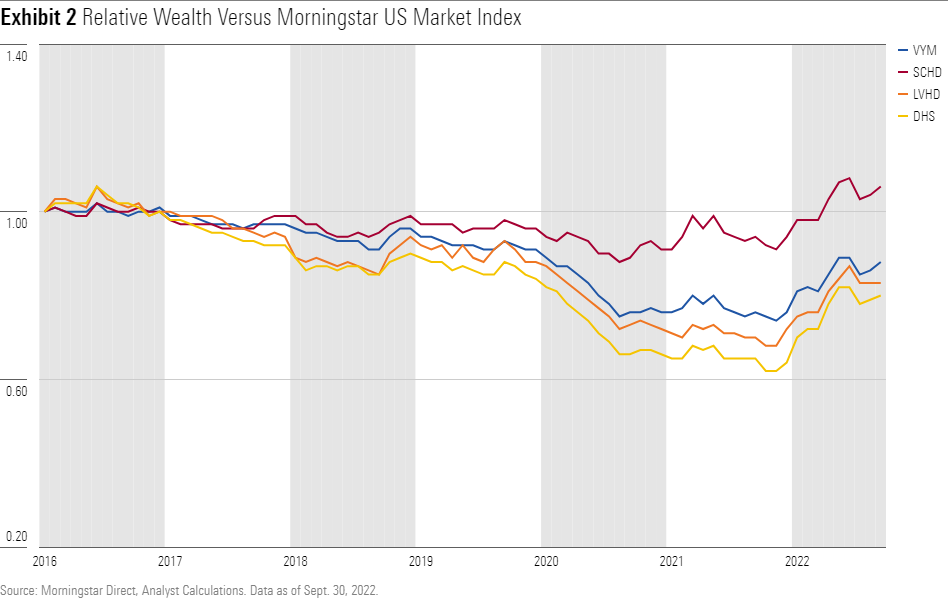

Exhibit 2 shows the relative growth of the four dividend ETFs compared with the performance of the Morningstar US Market Index since LVHD’s inception in late 2015. We can see that all except SCHD have underperformed the broad market, sometimes by a wide margin. The dividend-intentional strategies these funds employ limit the opportunity set and do not take full advantage of the market’s collective wisdom. They often lag during bull markets, especially when growth stocks lead the way.

Dividend ETFs have come alive recently, performing better than the market so far this year. Sky-high inflation and an aggressive response by the Federal Reserve have crushed stocks. Historically, dividend-yielding stocks outperform during periods of high inflation, and 2022 has been no exception. The relatively stable dividend-payers that each of these four ETFs feature have kept these funds afloat. However, these stocks may not provide shelter during all down markets. Each performed at least as poorly as the broad market during the coronavirus-driven selloff in early 2020.

SCHD was the standout of the group and the only to outperform the Morningstar US Market Index since 2016. But because of its defensive stance, it lagged the broader market until the second quarter of this year. A targeted list of 100 high-quality names helped it outpace its dividend rivals, but the relative wealth chart shows that buying the market may be the best option for total return. Dividend funds provide solid income, but they may not hold up in all market conditions.

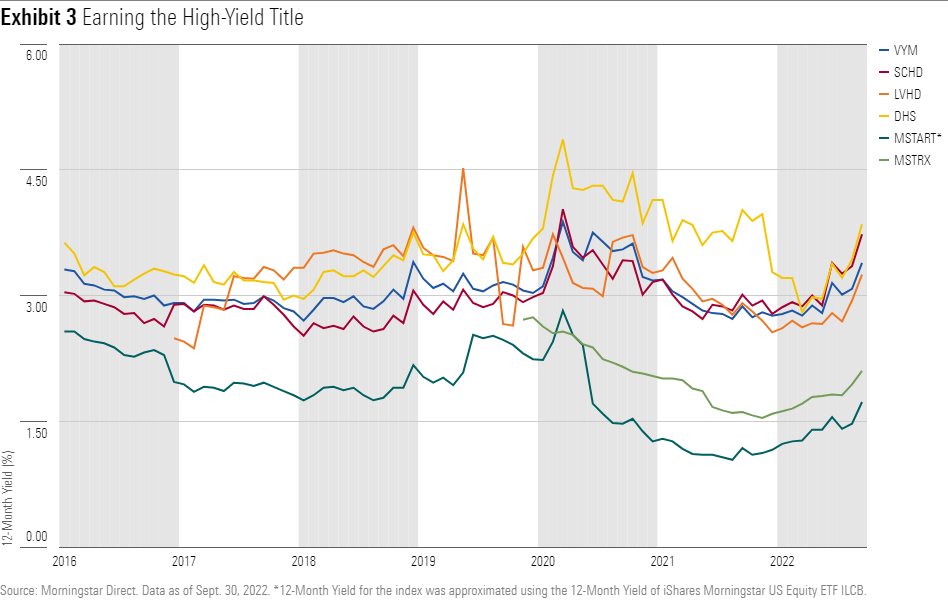

Exhibit 3 plots historical yield data since 2016 of the six names showcased in Exhibit 1. Not all investors purely seek return from their portfolios. Many also require a stream of income. And what these names may lack in recent historical returns, they have mostly made up for in yield.

Yield is a function of price, and as markets rally, the cash dividends paid by companies are a smaller percentage of their increasing share prices. This explains falling yields in most of 2020 and 2021.

However, as inflation rages and recession fears echo across markets, stocks have fallen into bear-market territory for the year. Lower equity prices have resulted in modestly higher yields. But as CFOs assess their company’s financial position, they may decide to be more conservative with cash and stop raising or even cut dividends. As an extreme example, many companies cut dividends starting in March 2020 at the onset of the COVID-19 pandemic. We may not reach that extreme scenario this time around, but it’s a good reminder that dividends are subject to change.

Why Do You Invest?

Dividend ETFs have gobbled up assets so far this year. SCHD and VYM collectively gathered more than $19 billion through September, while DHS also grabbed $378 million, more than 34% of its current total assets. LVHD has brought in a comparatively modest $68 million, but on the heels of great performance to begin this year, it has collected $206 million in the last three months, 28% of its current net assets. However, it’s unclear if this stampede into dividend ETFs will continue. Rising bond yields may raise the level of competition for income investors’ money right as economic stress weighs on companies’ dividend policies. This could result in bond funds making a comeback just as dividend yields begin to retreat.

It’s no secret that investors chase shiny objects. Recent flows into these dividend ETFs suggest they may be newly minted shiny objects following great market-relative performance lately. These ETFs can be great tools for providing yield in equity markets, but they may not be right for everyone. Chasing past performance is almost never a winning investment strategy. It’s always important to consider why you invest and make sure your portfolio aligns with your “why.” That’s a winning investment strategy.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)