I Bonds Forever?

The long-range outlook for this year’s investment fashion.

The Time Is Right

Tuesday’s column showed that Series I savings bonds, commonly known as I Bonds, currently qualify as a free investment snack. Because the yield on I Bonds responds to past changes in inflation, with a substantial lag—the interest on I Bonds that are issued this month, August 2022, are based on inflation rates that held between October 2021 and March 2022—they will yield a minimum of 7.9% over the next 12 months no matter what happens with inflation.

(There are some catches. I Bonds are available only through the Treasury Department, and they cannot be traded. The annual investment limit is modest, at $10,000 per person and $15,000 if purchasing with a federal income-tax refund. Although the bonds immediately earn interest, they do not distribute cash until they are sold back to the Treasury. There is also some good news: Investors in I Bonds may redeem their securities whenever they wish once 12 months have passed, although bonds held for less than five years pay an interest penalty.)

After completing my column, I put $10,000 into I Bonds, as did my wife. Those are temporary accounts: repositories for short-term assets. When making those purchases, I did not think about the eventual future of I Bonds. Over at least the next year, they would easily outyield bank CDs. That was all I needed to know.

I Bonds for the Long Run

Left unanswered was the question of whether I Bonds are sound long-term investments. This column addresses that issue. To begin, I calculated the total return for the first I Bond ever issued, in September 1998. (Morningstar’s usually reliable Direct software, which contains 92,763 investment indexes, has no performance information for I Bonds. Nor does any other source that I could find.) I then compared that outcome against those of three competing investments: 1) Treasury notes, 2) Treasury bills, and 3) Treasury Inflation-Protected Securities.

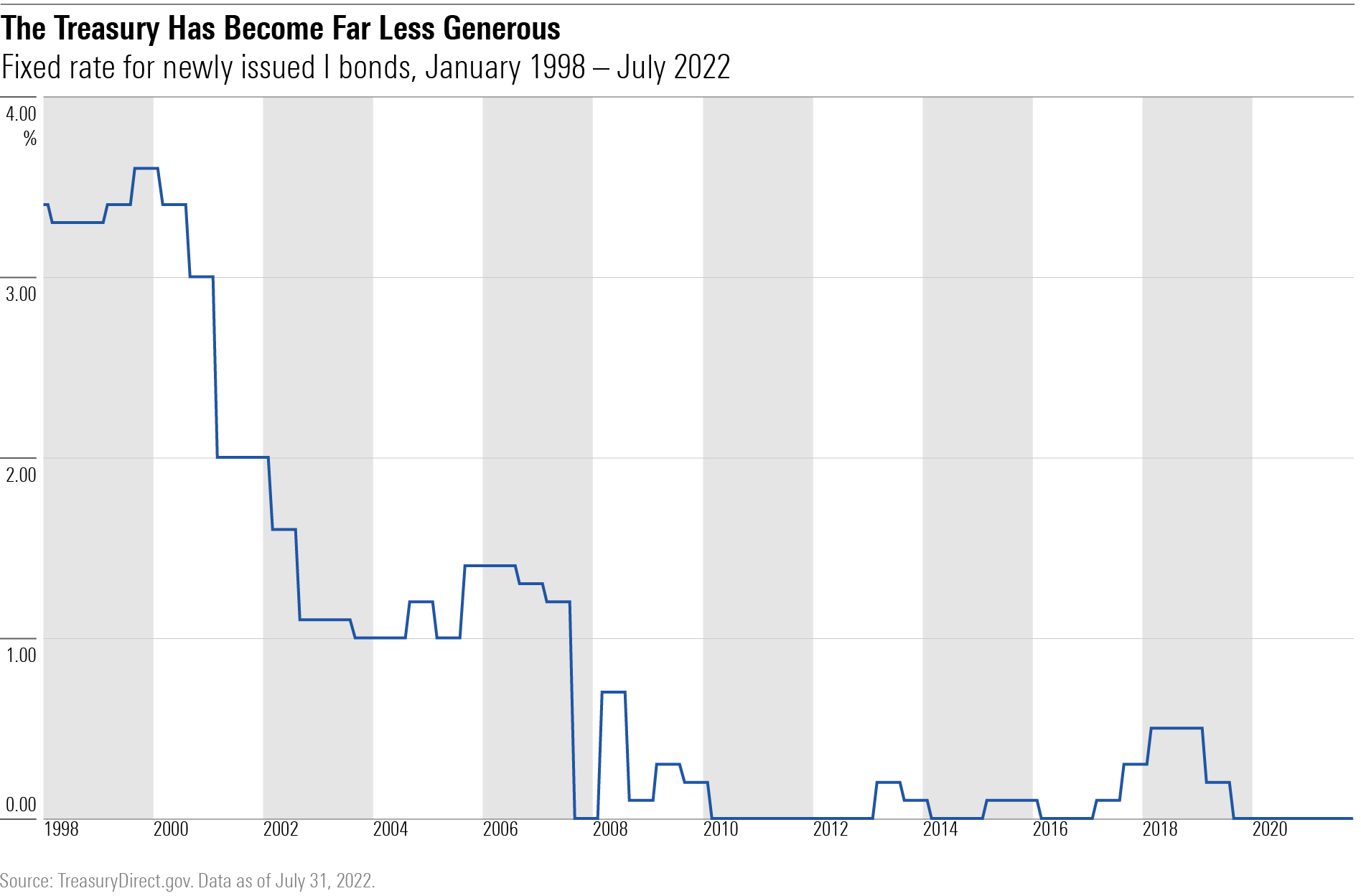

Before viewing those results, I must acknowledge that early versions of I Bonds were more attractively priced, to use a euphemism for being “drop-dead giveaways,” than are today’s models. In addition to offering a yield on I Bonds that is based on the inflation rate, the Treasury also provides an ongoing “fixed rate”—a separate interest rate that is independent of inflation, and that stays with the bond in perpetuity. The fixed rate on I Bonds is currently zero. In September 1998, however, the rate was both existing and substantial, at 3.4%.

The following chart displays the historic fixed-rate schedule for I Bonds.

That is a big shift! Although almost nobody recognized the opportunity at the time—total sales of I Bonds in 1999 were a paltry $363 million—a government-guaranteed security that delivers the inflation rate plus another 3.4% annually, and that bears low interest-rate risk, since its owners can redeem the security whenever they like, is an outstanding investment. But would it have been attractive had it carried no fixed-rate payment at all, as with today’s I Bonds?

Investment Battle Number 1

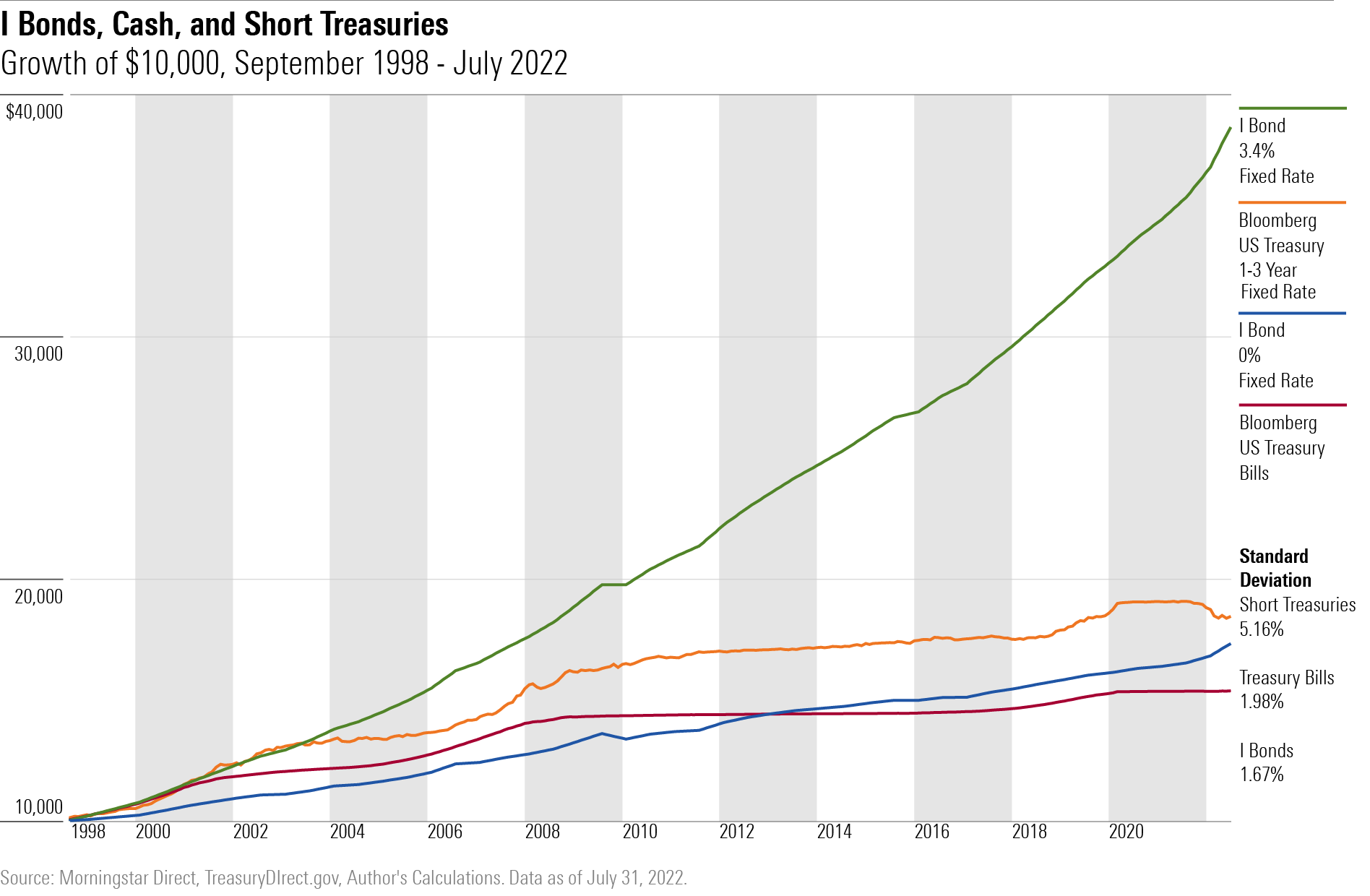

The next chart provides the answer. It depicts the growth of a one-time $10,000 investment, made in September 1998, in: 1) the I Bond as originally priced; 2) that same I Bond, deprived of its fixed-rate sweetener; 3) an index of short Treasury notes; and 4) an index of 30-day Treasury bills.

The actual I Bond, with its 3.4% bonus, crushed the investment alternatives. However, returns from the remaining three rivals were close. Treasury notes led the way, followed by the zero fixed-rate I Bond, with Treasury bills occupying the rear. However, as I Bonds were less volatile, even the stripped-down I Bond was best investment of the three, as measured by risk/reward.

Admittedly, this statement requires a caveat. Since I Bonds cannot be traded, their price never changes. The vanishingly low volatility that I calculated is therefore something of an artificial construct. That said, the finding is not without justification, because after five years I Bonds may forever be redeemed at par regardless of the markets’ movements. Long-term owners of conventional fixed-income securities, whether long bonds or laddered notes, lack that privilege.

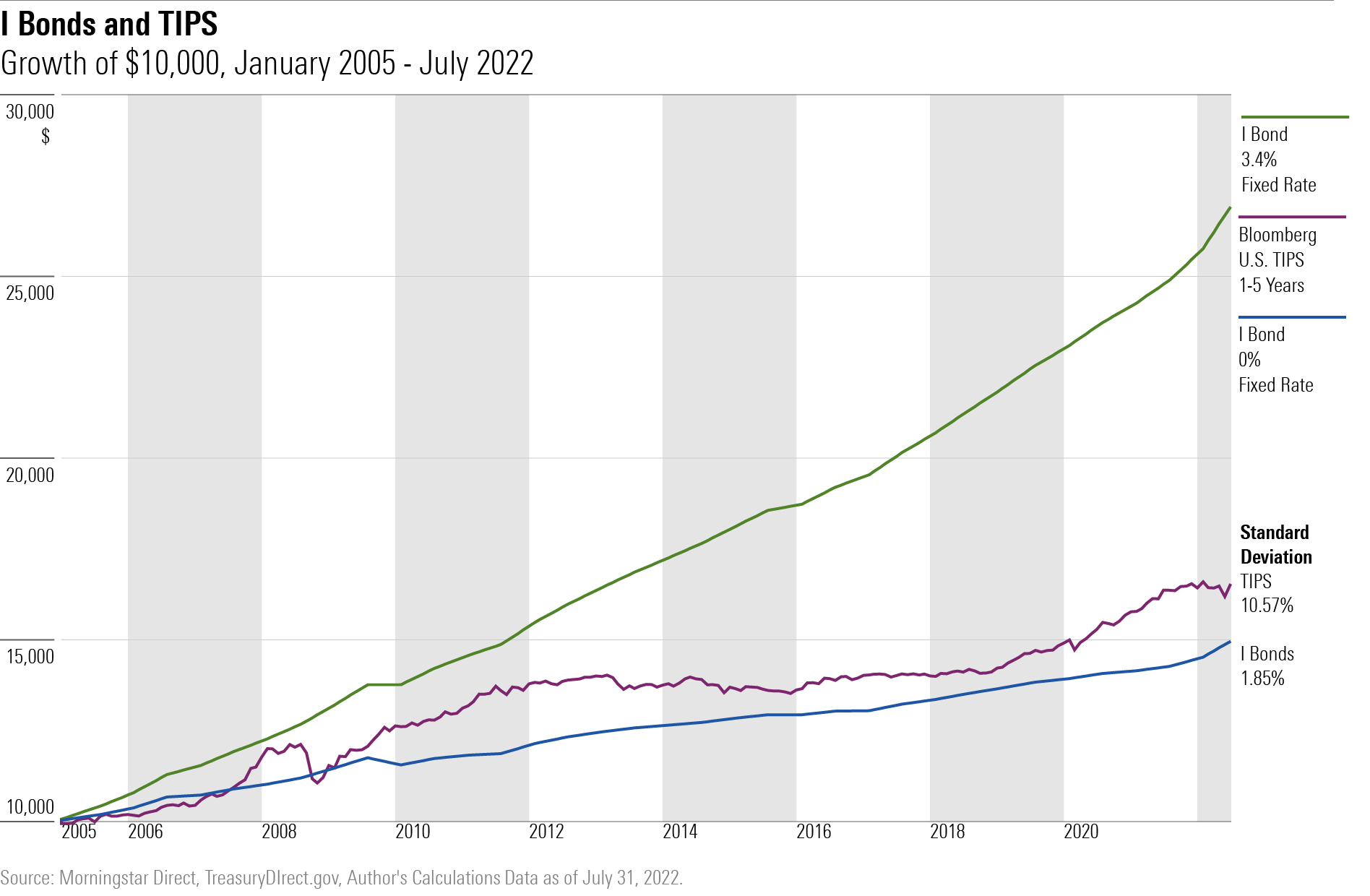

Considering TIPS

You may have wondered about TIPS, mentioned earlier in this article but omitted from that illustration. Five-year TIPS—a more appropriate comparison for I Bonds than longer TIPS—resumed operations in 2004 (they had been briefly offered in 1997, before the Treasury canceled that run), so they did not qualify for the previous illustration. But I can evaluate short TIPS similarly, beginning in January 2005.

The conclusion is unchanged. If you have a time machine, set it for 1998, invest in I Bonds, and watch them grow. Regrettably, the more relevant comparison is for I Bonds without their fixed-rate payment. There, as before, the I Bond had wonderfully steady returns, as befits an investment that was designed not to lose money, while posting moderately lower returns than its riskier competitor.

The Prognosis

The above discussion ignores taxes. Including them strengthens the case for I Bonds, because their interest accruals are not taxed until redemption. (That said, if the owner chooses, the interest can be paid along the way.) Although I Bonds cannot be owned by tax-sheltered retirement accounts such as 401(k) plans or IRAs, the restriction is immaterial. They are already tax shelters.

It is true that I Bonds possess several disadvantages. They cannot be bought in high quantities or held within brokerage accounts. Nor can they be traded. However, even without their now-departed fixed-rate payments, they merit serious consideration for strategic portfolios. Even when inflation has been dormant, as during most of the past 24 years, they have held their own against Treasury notes, bills, and TIPS. And should today’s higher inflation rates not subside, their relative performance will be stronger yet.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)