Have Tactical Asset Allocation Funds Earned Their Keep?

At long last, the opportunity for tactical funds has knocked.

The Perfect Storm

This year has provided the ideal climate for tactical-allocation funds. Unlike strategic-allocation funds, which hold their positions through thick and thin, tactical funds hope to dodge bear markets. They cannot anticipate losses that arrive abruptly, such as those that chaperoned the arrival of the novel coronavirus. But when investment woes are telegraphed, as with the losses caused by the Federal Reserve’s interest-rate hikes, tactical funds should excel.

Tactical funds desperately need a victory. The decade that preceded this year’s turmoil was unusually quiet, featuring steady stock- and bond-market gains, punctuated by brief downturns in late 2018 and early 2020. That’s terrific for investors but unpleasant for tactical funds. Lacking opportunities to show their steps, while also burdened by their higher costs—like an extra pizza topping, tactical allocation does not come for free—the group badly trailed its rivals.

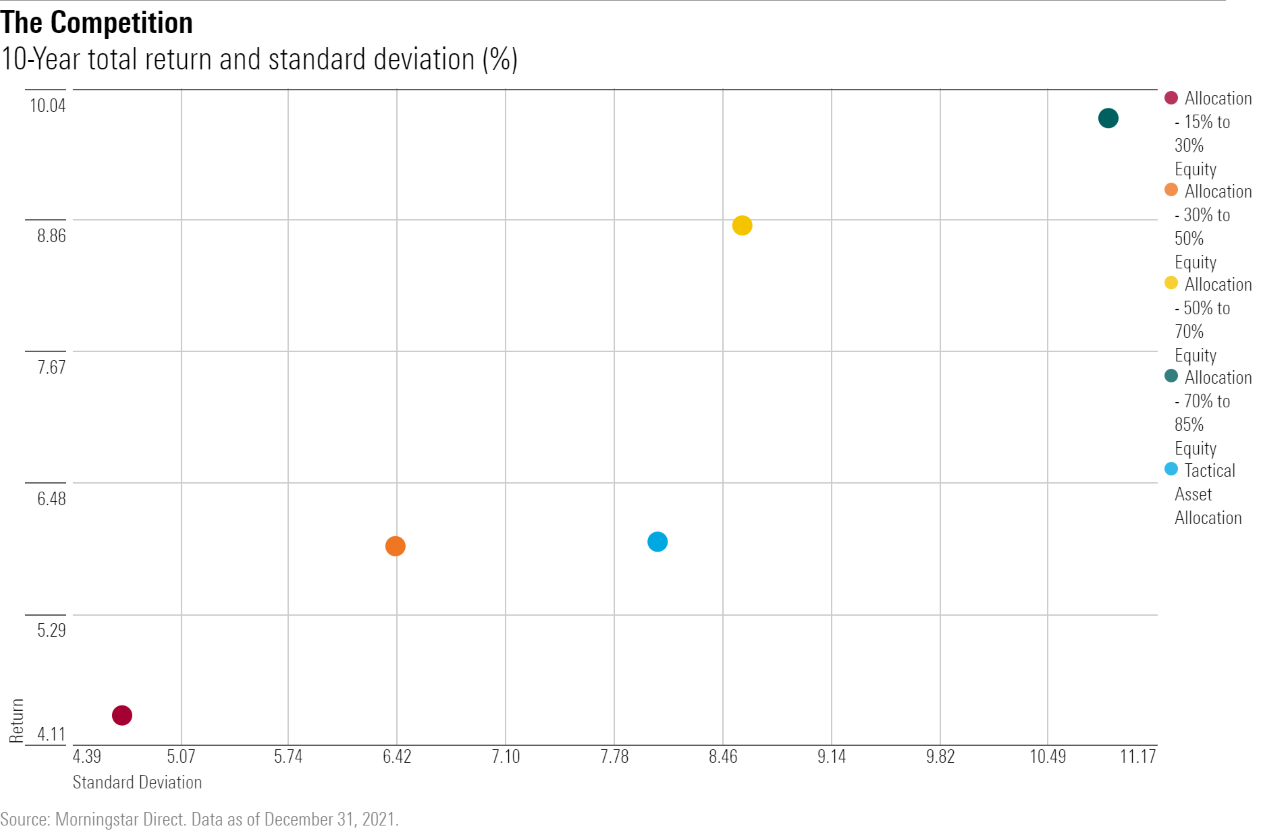

The proof lies below. The chart depicts the 10-year returns, through this past December, for several categories of allocation funds. The closer to the chart’s northwest corner, the better the category’s performance. Lamentably, the light blue dot that represents tactical funds lands somewhere near Mississippi.

Considering Survivorship

As measured by volatility, the closest competitor to tactical funds was the allocation—50% to 70% equity Morningstar Category. Over the decade, such funds outgained their tactical rivals by 3 percentage points per year. After adjusting for tactical funds’ lower volatility and steeper expenses, the deficit becomes 2 percentage points. That amount represents the average annualized loss from tactical funds’ trades. For tactical funds, less would very much have meant more!

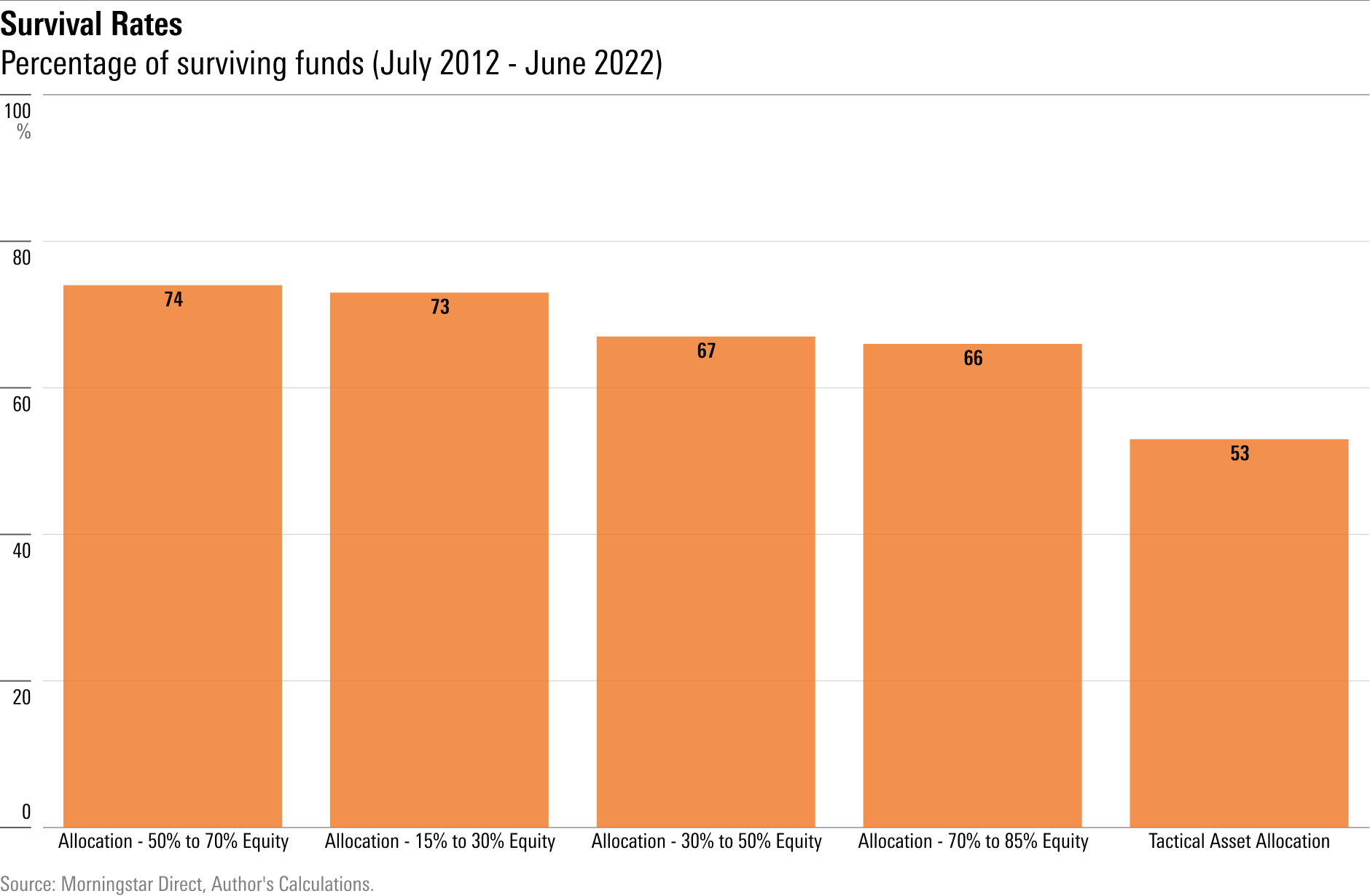

In fairness, that margin could be affected by survivorship bias, because the calculation excludes funds that expired between 2012 and 2021. It may be that tactical funds existed throughout the decade, while their competitors came and went. If so, the study will have treated tactical funds inequitably, by counting all their outcomes while overlooking some of their competitors’. The next exhibit tests that hypothesis. Its shows the percentage of funds in each category that survived the 10-year period.

Oh, dear. Tactical funds were more likely to vanish than other allocation funds, not less. Given that most mutual funds are axed because of poor performance—companies routinely shutter 1-star offerings but rarely their 5-star siblings—the figures imply that tactical funds have fared even worse than the numbers suggest.

This Year’s Model

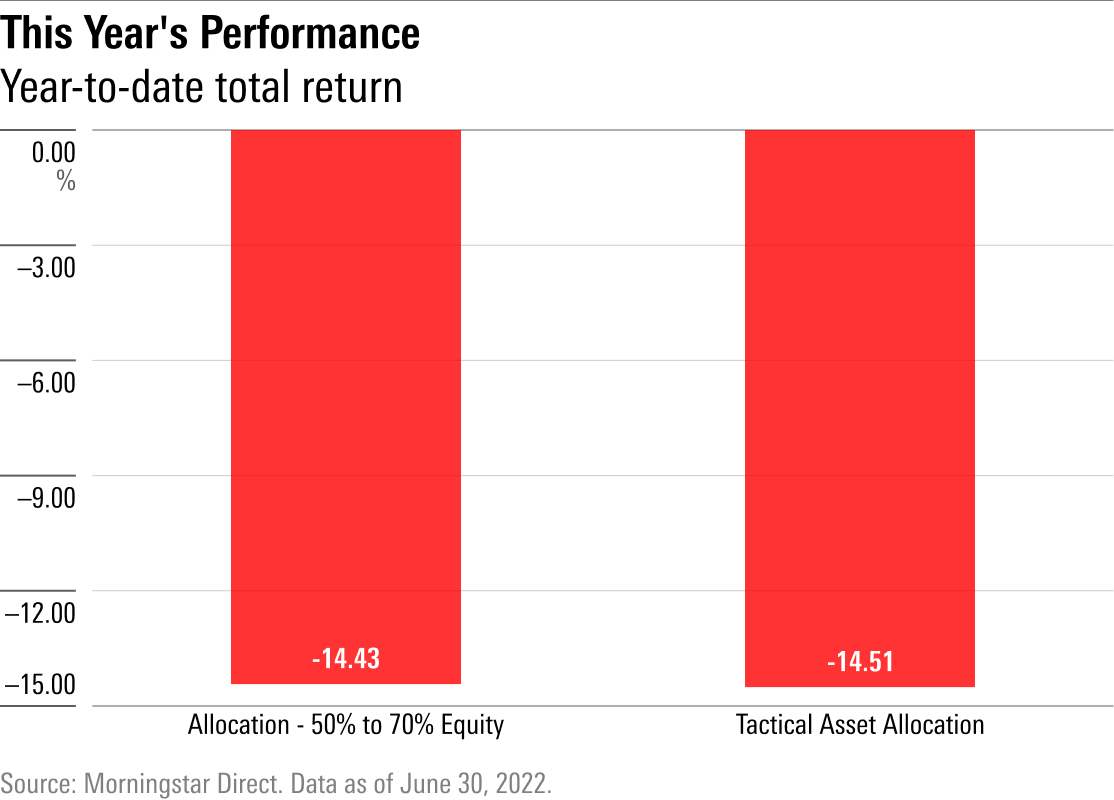

They cannot possibly have recouped that entire shortfall in 2022, but perhaps they have made significant inroads. Below appears the average year-to-date total return for tactical-allocation funds, along with that of its nearest competitor, the allocation—50% to 70% equity category.

One need not read the fine print to understand the lesson: As the lengths of the two bars demonstrate, the two groups have behaved almost identically. Through June, tactical funds had lost 14.4%, with their strategic competitors a smidge behind, losing 14.5%. In that rate of closing speed, tactical funds will fully regain their lost territory in … [checks spreadsheet] the year 2145. Give or take.

Does Performance Persist?

There is one last chance for redeeming tactical-allocation funds. As proponents of active management frequently state, shareholders own individual funds, not investment categories. For those who hold the best funds within a category, aggregate amounts are immaterial. After all, several tactical funds have notched outright profits this year, with several more landing only slightly in the red.

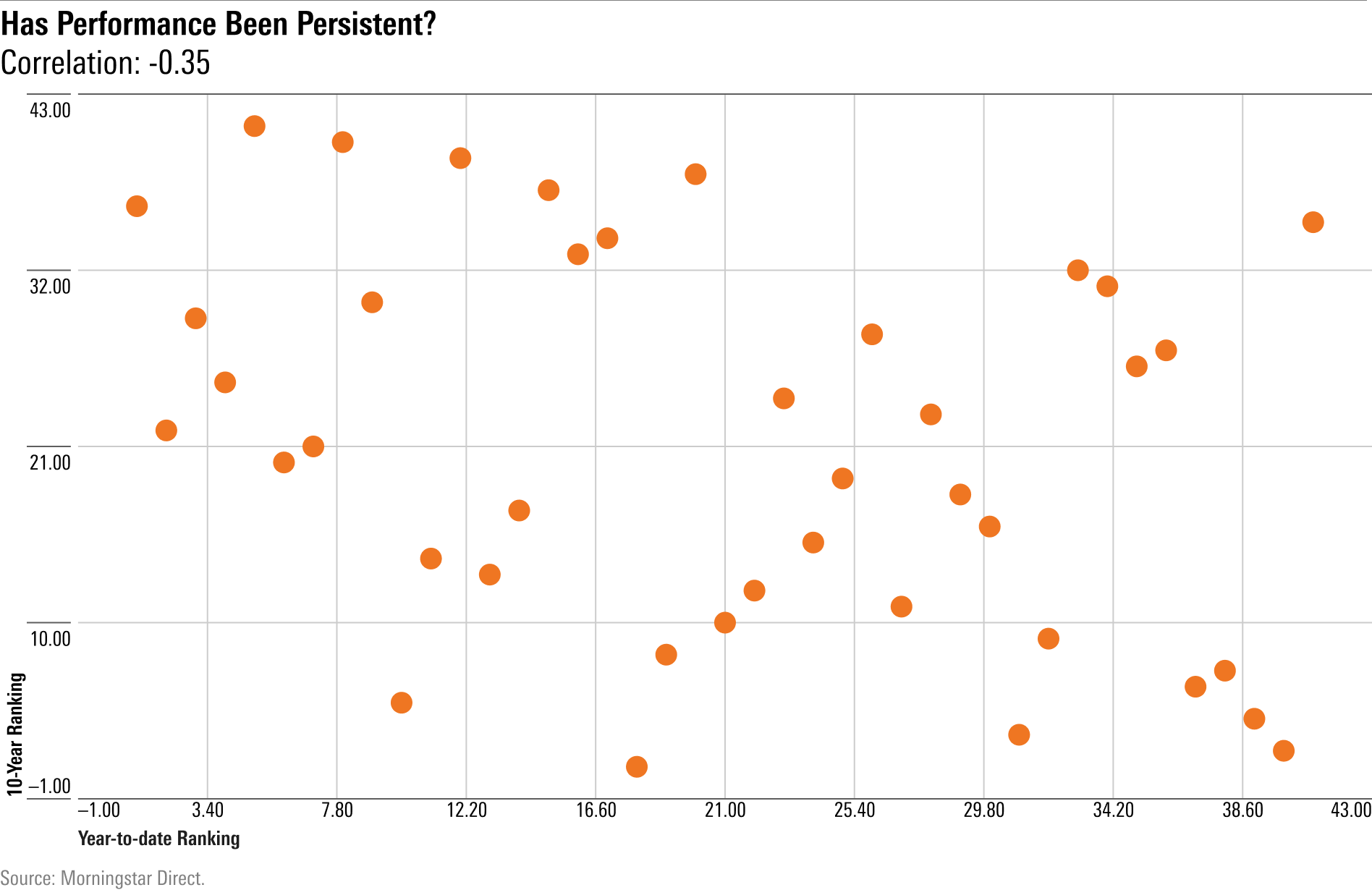

The question is whether shareholders can identify those funds before the fact. One simple but useful test is to see whether this year’s results align with those of the preceding decade. Were 2022′s winners also successful from 2012 through 2021? If so, investors might have spotted them in advance. However, if their 10-year returns were not particularly strong, it’s unlikely that many shareholders would have recognized the opportunity. For better or worse, most evaluations of active management include a healthy dollop of past performance.

I tested this proposition by comparing the total-return rankings for tactical-allocation funds over the 2012-21 period against the year-to-date rankings. To cite an example, Astor Sector Allocation Fund placed third among the 41 tactical-allocation candidates during the preceding decade. This year, it occupies 29th place. In that case, at least, past performance did not provide a useful indicator for future results. But it may be that with other funds the result was different.

It was not. This final exhibit plots the two series of rankings.

A pattern does exist. The dots faintly but perceptibly trend from the upper left to the bottom right. Unfortunately, that is the wrong effect. If the relative performances were persistent, with the stronger funds remaining superior, the dots would rise to the right. Instead, the opposite has occurred. In general, the tactical-allocation funds that had the highest 10-year returns entering 2022 have dropped the furthest. Meanwhile, the erstwhile laggards have led.

In summary, investors had little, if any, chance of selecting this year’s tactical-fund winners. Perhaps they could have identified the most conservatively positioned funds, in the belief that the Fed’s interest-rate increases would cause a bear market. But anybody who knew that much, in advance, should not be buying a tactical-allocation fund. They should be managing one.

Wrapping Up

Regular readers of this column will know that, in general, I prefer cheap and simple funds to their costlier and more ambitious rivals. History lies on the former’s side. However, I will readily recognize exceptions to the rule, should they appear. (I will happily do so, as exceptions are interesting.) Recent events gave tactical-allocation funds that chance. Regrettably, they fumbled the ball. I see no reason to invest in such funds.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)