Scapegoating the Fed Misses the Bigger Picture

The Federal Reserve’s critics see what they wish to see.

Guilty!

Everybody blames the Federal Reserve. If inflation rises, the Fed must have set interest rates too low. If the economy slows, it pushed them too high. When equities rise, the Fed erred by creating a stock-market bubble. When they fall, it was because the bubble collapsed. If the dollar is strong, the Fed is hurting the nation’s exporters. If the dollar is weak, … well, you get the point.

(Last month, criticism of the Fed added a new twist, when a major cryptocurrency investor argued that the central bank was partially responsible for that sector’s bear market. In other words, currencies that were created to avoid the Fed’s mistakes lost money because the Fed made mistakes.)

Such reactions are understandable. The Fed was born to be a villain, spawned by the controlling father of central government and the evil stepmother of usurious bankers. Its heritage gives both the political left and right something to dislike—and Main Street, as well. In addition, both underperforming portfolio managers and annoyed individual shareholders need a scapegoat. If the Fed did not already exist, they would need to invent it.

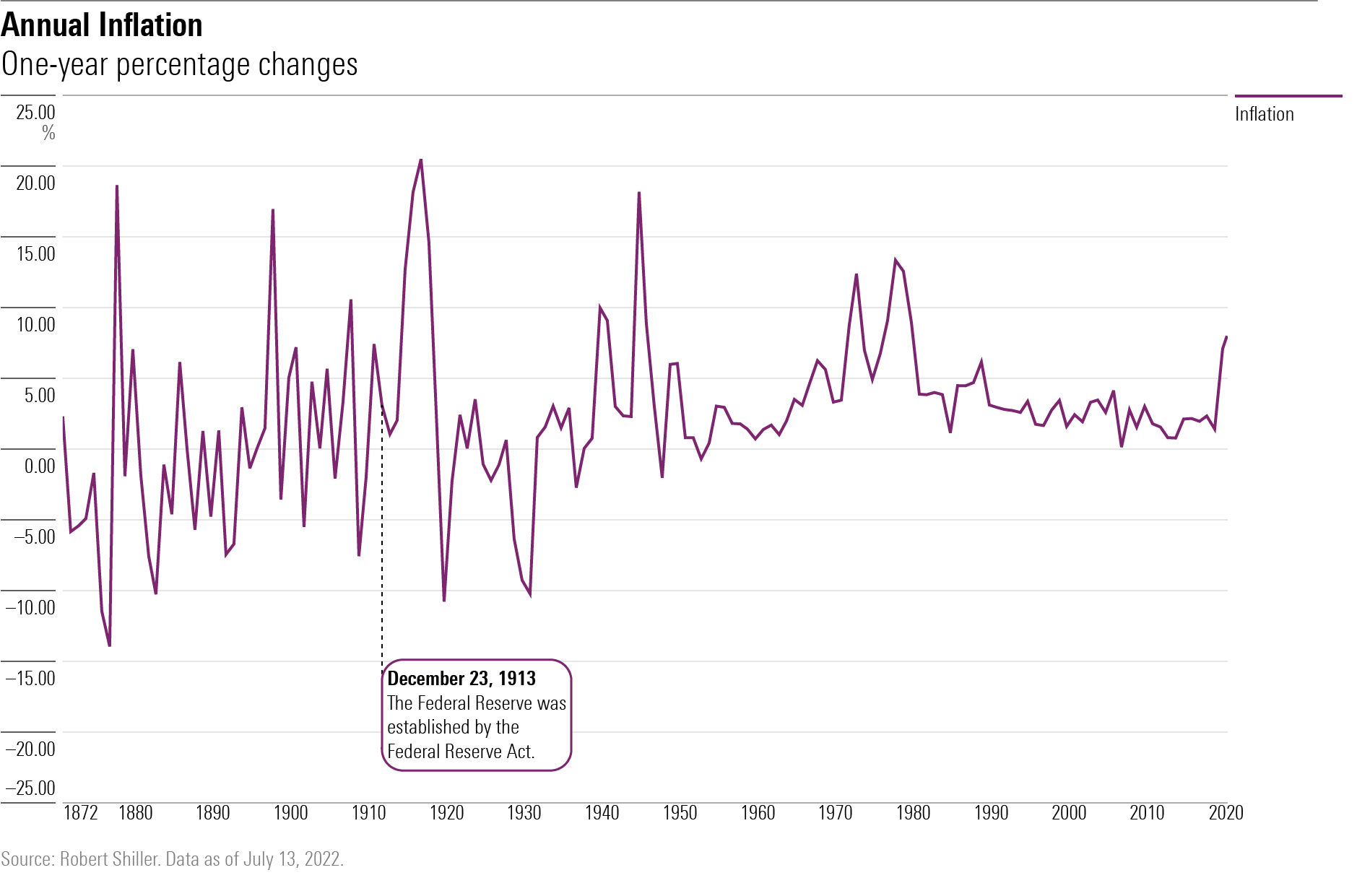

At any rate, it is not as if investors have much choice. Winston Churchill famously stated that democracy was the worst form of government—except for all other forms. (He did not, however, invent that aphorism.) That seems a fair assessment of the Fed’s role. Yes, the organization sometimes makes decisions that harm the U.S. economy. However, as depicted by this chart of annual U.S. inflation rates, the economy was more troubled yet before the Fed existed.

Surely it has been better to be on the right of the dotted line (which signifies the Fed’s inception) than to be on the left. (The same also holds true for recessions, which were both more numerous and deeper prior to the Fed’s inception.)

Motivated Reasoning

These items you may have anticipated. It is no secret that many people despise banks and/or government officials. Nor is it surprising that investment professionals forced to explain their underperformance might seek someone else to blame. But there is a third, less commonly cited, reason the Fed is so frequently attacked: motivated reasoning.

That is, people blame the Fed, at least in part, because it comforts them to think that it has the power to fix the nation’s economic ills. Better to believe that the Fed is equipped to address the economic dangers that the country faces but has executed improperly, than to admit that the tasks exceed the organization’s capability. Motivated reasoning involves faith—the conviction that somebody, somewhere, can correct what must be corrected.

This tendency can clearly be observed with sports fans. In public discussions, supporters of winning teams loudly praise their players for outdoing the competition. Rarely, however, do they point to the opposition’s failings. In contrast, fans of losing teams take the reverse approach. They castigate their players for their shortcomings, while giving little (if any) credit to the victors.

(A striking example of motivated reasoning followed the 2013 Cotton Bowl, when Heisman Trophy winner Johnny Manziel scored two touchdowns against Oklahoma and threw for two more. After the game, I visited an Oklahoma supporters’ board. Although Manziel’s performance was routine—during the regular season he had also averaged four touchdowns per game—Oklahoma’s fans overwhelmingly lambasted their team’s defensive coaches rather than acknowledge their opponent was far better than anybody they had faced.)

Home-Country Bias

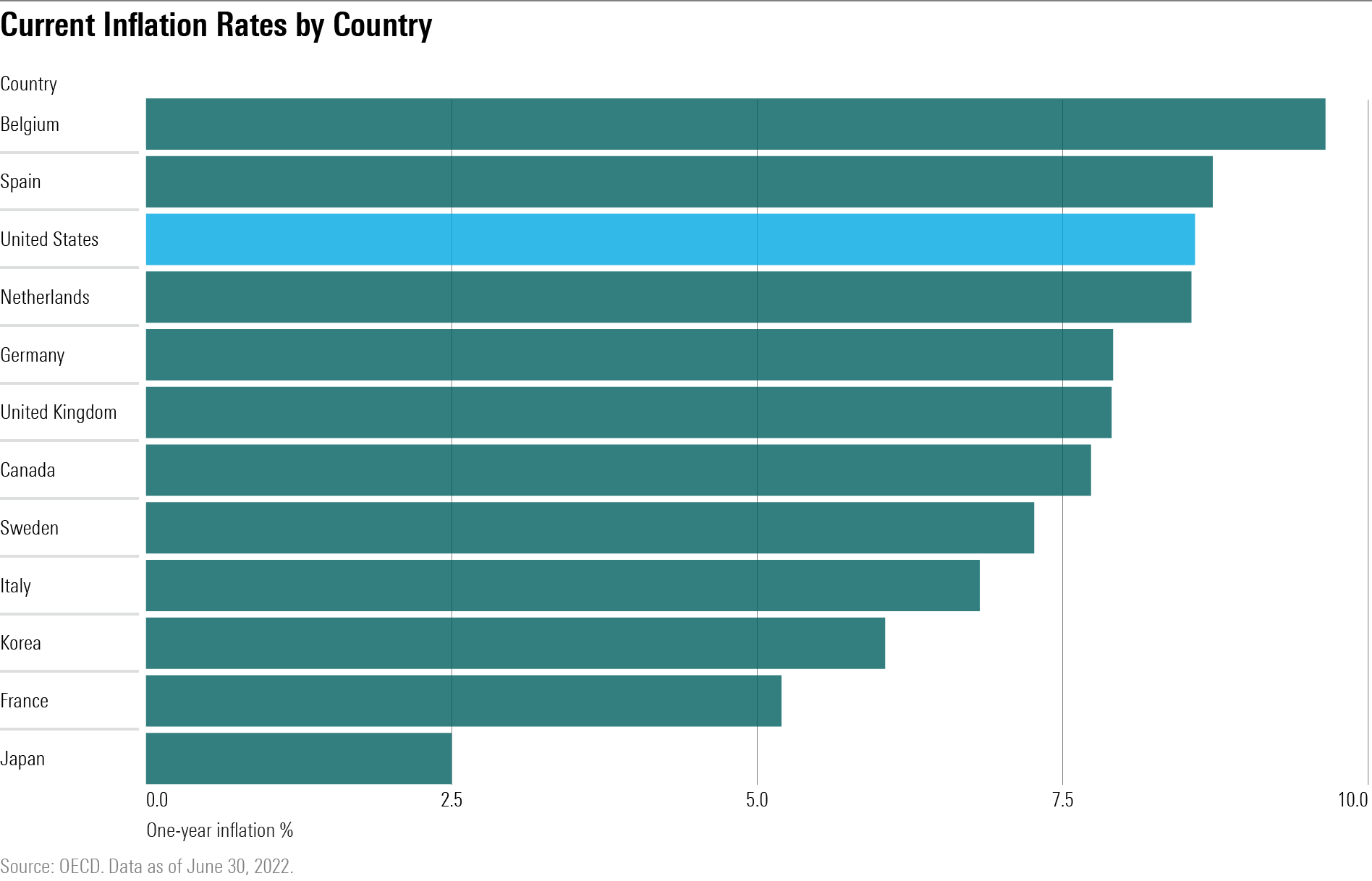

Motivated reasoning helps to explain why every email that I have received about the currently high U.S. inflation rate has cited domestic concerns. To be sure, the writers do not necessarily blame the Federal Reserve; Congressional spending is also a common culprit. Never, however, has any writer pointed out that the rest of the developed world has suffered similarly. Admittedly, inflation in the United States been somewhat higher than most other major developed economies, but, as this chart of 12-month inflation rates demonstrates, the U.S. is by no means an outlier.

It could be that the home team’s fans are correct. The true explanation for the resumption of global inflation may indeed be the American story, that the increase in prices owes primarily to U.S. polices—monetary, fiscal, energy, whatever. Because the dollar is such a dominant currency, accounting for 59% of global reserves, the rest of the globe necessarily follows in the wake of this nation’s economic policies. That explanation could hold, although to no great shock the European Central Bank is having none of it.

I do not know whether that hypothesis is correct. I doubt that anybody else does, either. Not the Fed’s bankers, nor Europe’s, nor academic economists, nor those at Goldman Sachs. Not even my excellent readers. The cause cannot be determined with any degree of certainty; there are too many moving parts and too few observations.

My intent is not to defend the Fed. Being staffed by humans, the organization is imperfect—maybe deeply imperfect. My point instead is that economic arguments that focus exclusively on domestic factors, such as the Fed’s alleged gaffes or Congressional budgets, tend to be strongly influenced by motivated reasoning. We would like our problems to have simple answers, ones that lie within our nation’s control. But often they do not.

Brick-Headed

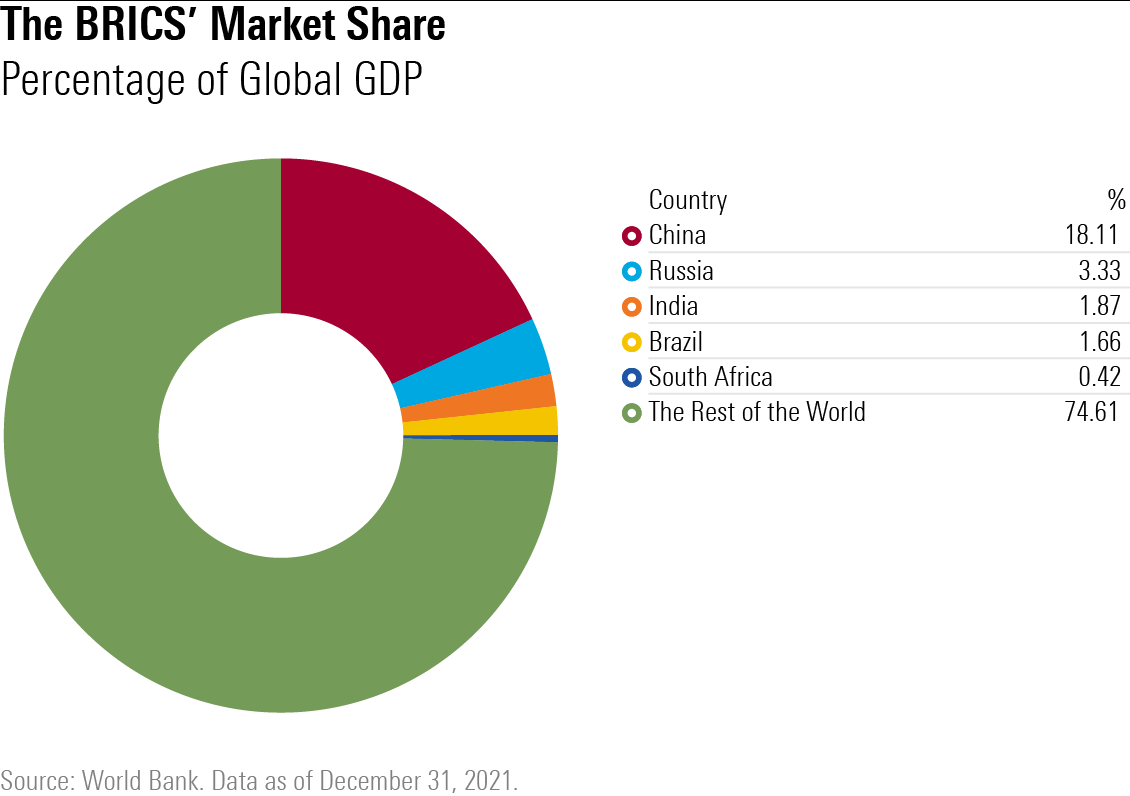

The other day an advertisement popped up on my telephone, urging me to invest in Brazil, Russia, India, China, and South Africa. By 2030, the spiel went, those five nations, collectively called BRICS, will provide half the world’s economic output.

Dumb and dumber. First, China’s economy is far larger than that of the other four countries combined; common sense was jettisoned for the sake of that acronym. Second, the claim is openly false. Those countries currently account for 25% of global production; by 2030, their aggregate market share should surpass 30%, but it will not reach 35%, never mind the absurd claim of 50%.

If a company displayed a fundamentally incorrect football statistic to NFL viewers while pitching a betting service, it would be lucky to record a single sale. The tactic might work for prospective investors, though.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)