Are Long Bonds Still for Fools?

Re-evaluating the prospects for 30-Year Treasuries.

The Bear’s Market

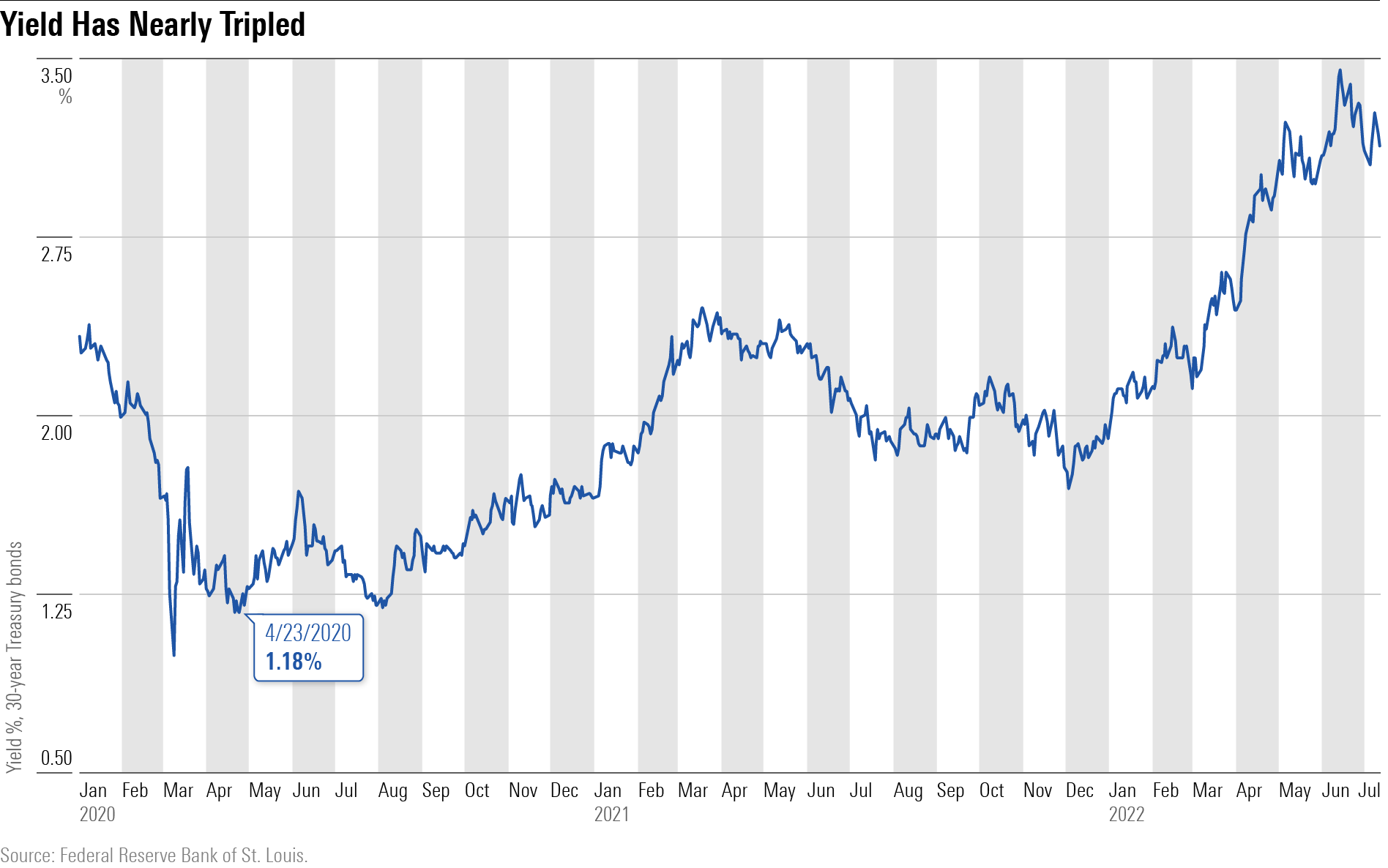

The only thing daring about my column published on April 23, 2020, “Long Bonds Are for Fools,” was its title. At that time, 30-year Treasury bonds were obviously and openly overpriced. However, as costly securities can always become more costly, the headline was nevertheless incautious. Long bonds could have extended their rally, making me look like one of those boastful sports personalities who “guarantee” outcomes that occur 50% of the time.

Not on that occasion. Even as the coronavirus news worsened, investors concluded that safety should not be that expensive. The very next day, long Treasury yields bottomed. (Now that I think of it, the sports announcer comparison was accurate: My occasional market-timing efforts are either spot-on or spectacularly wrong.) Treasury payouts are now almost 3 times their spring 2020 level.

The performance of long Treasuries has consequently been wretched. From May 2020 through June 2022, the total return for the Bloomberg U.S. Treasury 30-Year Bond Index was negative 16.6%. (When yields are so low, bond returns are determined almost entirely by price change.) Since that date, long Treasuries have trailed every conceivable rival: stocks, cash, intermediate-term notes, commodities, and cryptocurrencies. Long bonds have been the bottom of the investment barrel.

Return to Normalcy

The good news: After their pain, 30-year Treasuries are back on familiar ground. In spring 2020, yields on long Treasury bonds neared 1%—a mark well above anything they had previously recorded, even during the Great Depression. That was uncharted territory. In contrast, their current 3.1% payout is thoroughly mainstream. To be sure, long Treasury yields are below their century-long average of 5%, but at least today’s distribution lands within an established range.

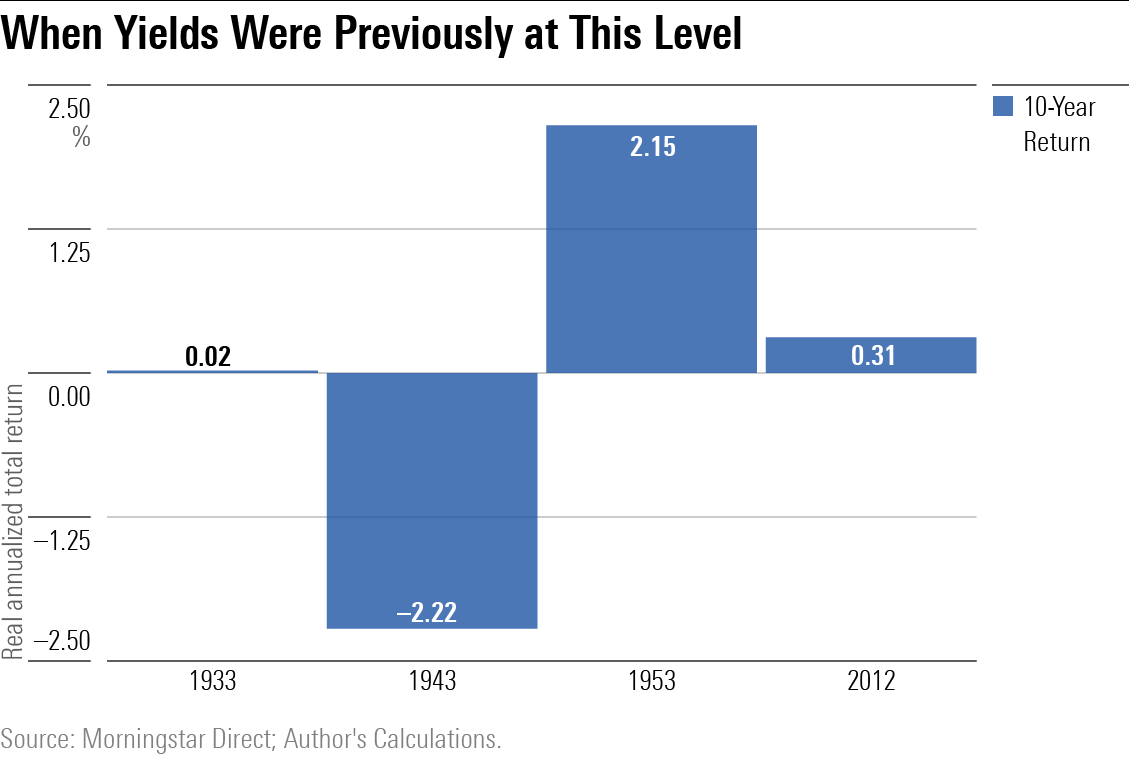

The natural question becomes: How have long bonds fared in the past, when similarly priced? Answering that thoroughly would make for a protracted and exceedingly dull study. So, I cut to the chase, by considering only 10-year results, generated from fully independent time periods that began when the yield on long Treasury bonds resembled today’s level. Those periods began in 1933, 1943, 1953, and 2012.

I then considered changes in consumer prices in order to calculate inflation-adjusted performance. Doing so better illustrates long bonds’ benefits (or failings) than using nominal figures. With real returns, a positive annualized result indicates that long Treasuries grew their investors’ wealth during the test period; a neutral return, that they retained their purchasing power but did not provide appreciation; and a negative return, that they lost real money, despite the alleged safety offered by their government guarantees and regular distribution.

A Cloudy Forecast

The lesson seems clear: Unless 3% Treasury yields presage an unexpected increase in inflation, as was the case in 1943, they will not necessarily hurt an investor’s long-term returns. But neither do they help. There have only been two stretches in modern U.S. history where 3% yields were profitable. The first came during the Eisenhower administration, and the second in the 2010s.

That makes sense. A 3% yield can provide a positive real return over a full decade only if: 1) inflation stays consistently low or 2) Treasury payouts decline further, so that they end the decade much lower than where they commenced. As mentioned above, the first outcome has occurred only twice. The latter has never happened. Not once have Treasury yields finished a 10-year period significantly below where they started, when beginning at a 3% rate.

In short, while history does not suggest that 3% yields will sink Treasury-bond investors, neither is it complementary. Even if today’s high inflation rates are temporary, as most economists claim (the public firmly disagrees), the outlook for long Treasury bonds is uninspiring. And, should inflation persist, thereby further surprising the already surprised economists, long bonds will continue to slump.

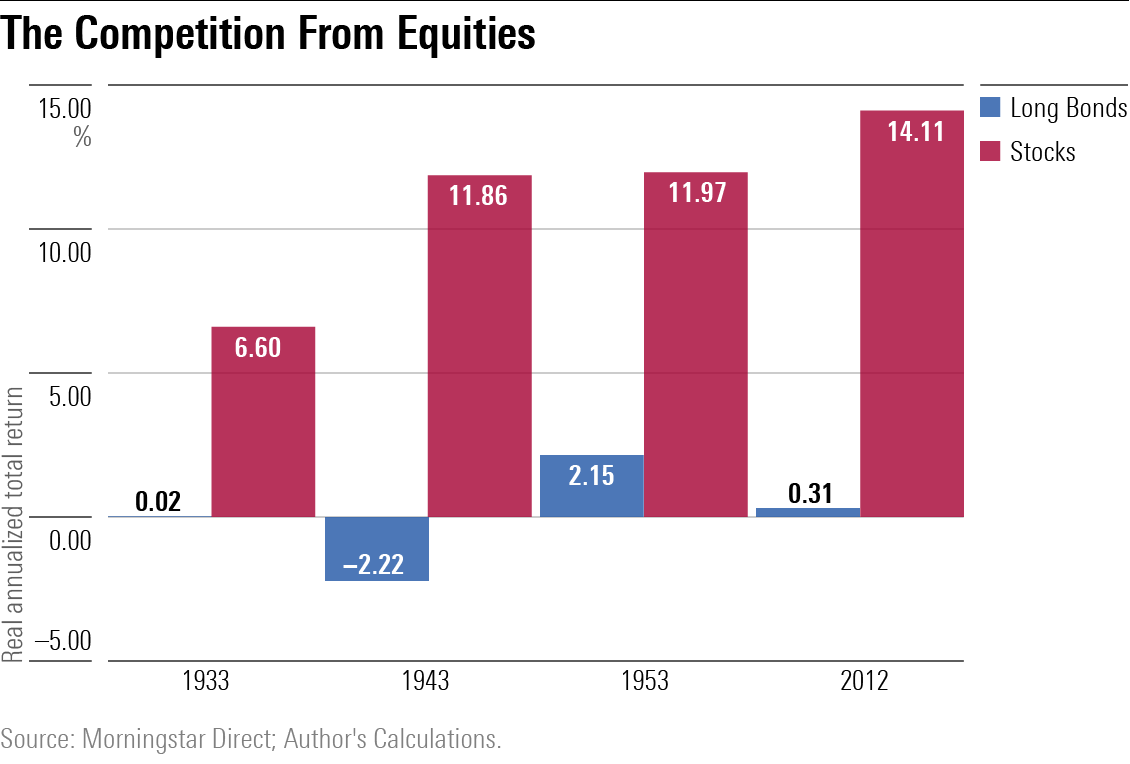

The Investment Competition

One must also consider the opportunity cost. Monies that are invested strategically into long bonds could instead be placed in equities. Doing so would increase the portfolio’s volatility, but the compensation may well justify the risk. That certainly has been the case for the four 10-year periods evaluated above. While long Treasuries posted decidedly mixed results, equities were consistently spectacular.

In truth, “spectacular” understates the matter. Buying stocks during the Great Depression led to the weakest outcome, but even so, investors who took the chance pocketed a 90% cumulative gain after inflation. Profits only increased from that point, culminating in a 274% real return for those who bought stocks in January 2012 and held for the next 10 years. (Golden investment eras are much easier to recognize in hindsight than when they occur.)

To be sure, equities and long Treasuries are different beasts. Although, as we have recently seen, rising interest rates can clobber long-bond prices, ultimately Treasury-bond owners can at least count upon receiving their original principal. Equity shareholders, of course, cannot. Thus, I make the comparison advisedly. Still, when Treasury yields have been at current levels, the differences in future performance have been stark. The margin of victory has been too large to ignore.

In short, I remain unenthusiastic about long Treasuries. No longer do I believe that they should attract only central banks that must stockpile reserves, or traders who plan to flip them to greater fools. When long bonds pay 3%, they can deliver an acceptable, if unexciting, return while protecting a portfolio’s equities against inflation—although not stagflation. But the alternatives remain more attractive. Cash is the safer path for reducing a portfolio’s risk, while equities are preferable for increasing its return.

Oh, the Irony

I have no idea if these findings are correct, as I have not yet read the paper, but a Wharton professor and Federal Reserve governor (David Garrett and Ivan Ivanov, respectively) claim that by enacting a law that prevents its municipalities from doing business with municipal-bond underwriters that have instituted environmental, social, and governance policies, Texas lawmakers have cost their state $500 million in borrowing costs.

If so, that means in passing a law to punish investment organizations for paying attention to factors that (allegedly) deviate from the sole purpose of investing—to receive the highest possible return—Texas lawmakers have themselves deviated from the sole purpose of investing.

Appendix - The indexes used for Exhibits 2 and 3 consist of: 1) Ibbotson Associates SBBI Long-Term U.S. Government Bond Index, 2) Ibbotson Associates SBBI U.S. Inflation Index, and 3) Ibbotson Associates SBBI Large-Company U.S. Stock Index.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)