Are Sector Funds Worth Owning?

The data suggest that industry-specific funds don't do much to diversify a U.S. equity portfolio.

Investors have been pulling money from sector-specific equity funds so far in 2022, but these funds, which focus on specific industries like technology or energy, still hold about $1.5 trillion in assets.

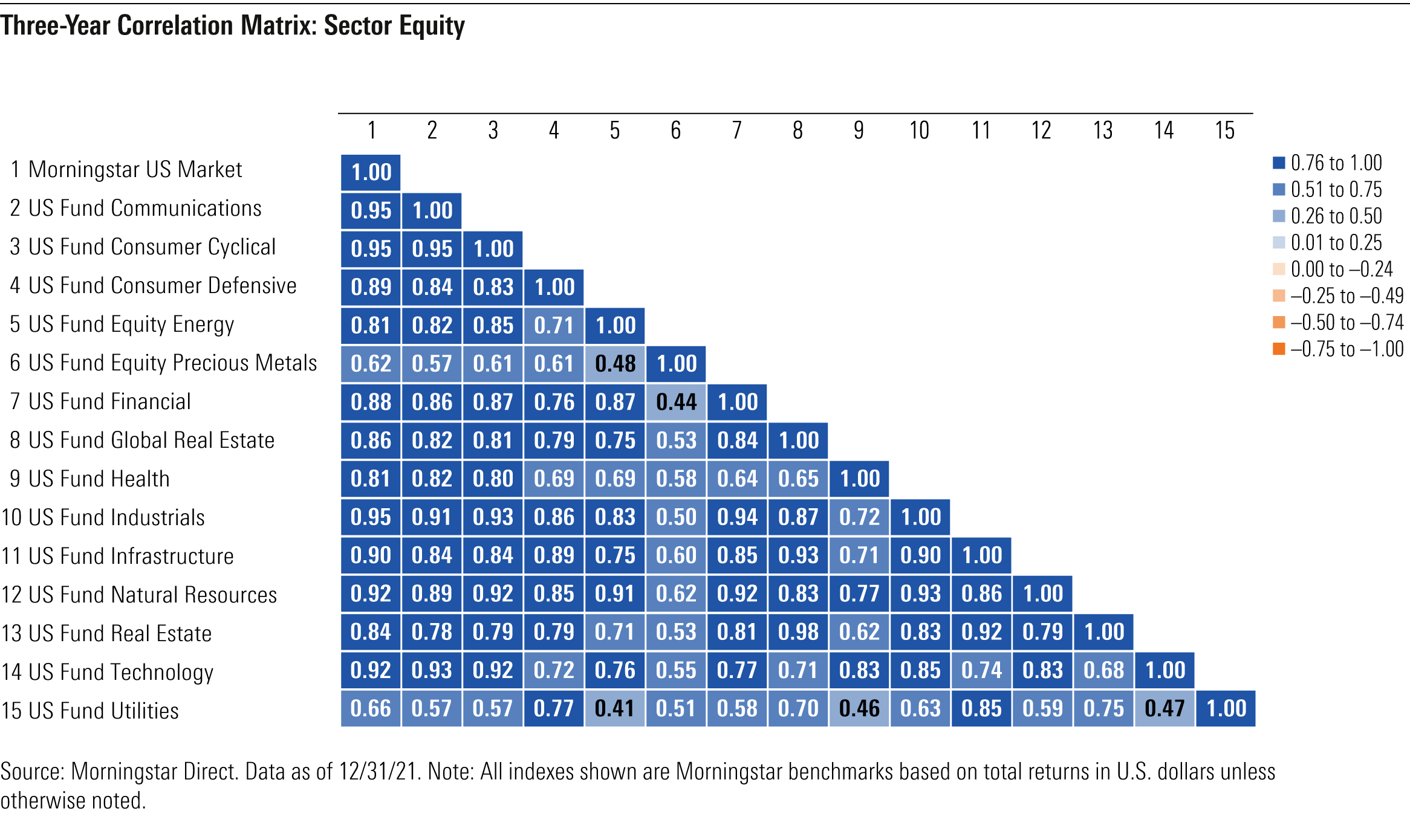

Many investors who own sector funds hold them alongside broadly diversified equity funds. The question is, does holding investments focused on individual sectors confer any diversification benefits, above and beyond what comes along with investing in the broad market? The short answer? Not really, except for one minor exception. The utilities sector has exhibited the lowest correlation with the broad market of any single sector. Still, it’s a niche sector that composes less than 3% of the broad market. Meanwhile, real estate investment trusts, a category that many investors have historically looked to for diversification, have delivered performance that is increasingly correlated with the U.S. equity market.

In Search of Diversification

In our recently published 2022 Diversification Landscape Report, we looked at how different investment types performed in the past couple of years, how correlations among them have changed, and what those changes mean for investors and financial advisors trying to build well-diversified portfolios. We used U.S. equities as the baseline: Which other assets help diversify U.S. stocks? While our research makes a case for high-quality fixed income and international stocks, among other asset classes, it paints a less flattering picture of the value of holding other asset types, including sector-specific funds.

The Why of Sector Funds

Sector-specific investments focus on a single industry, such as technology, healthcare, or real estate. Sector indexes are often heavily tilted toward the biggest players in that industry. Within the Morningstar US Technology Sector Index, for example, Apple AAPL and Microsoft MSFT make up nearly 40% of assets.

Some investors may employ sector funds to capitalize on industries that they believe are beaten down but due for a recovery or that they think will benefit from secular growth trends, such as healthcare. Alternatively, investors might add sector exposure to provide their portfolios with a higher stream of income (for example, utilities or real estate) or to counterbalance overweightings elsewhere in their portfolios.

Recent Performance Trends

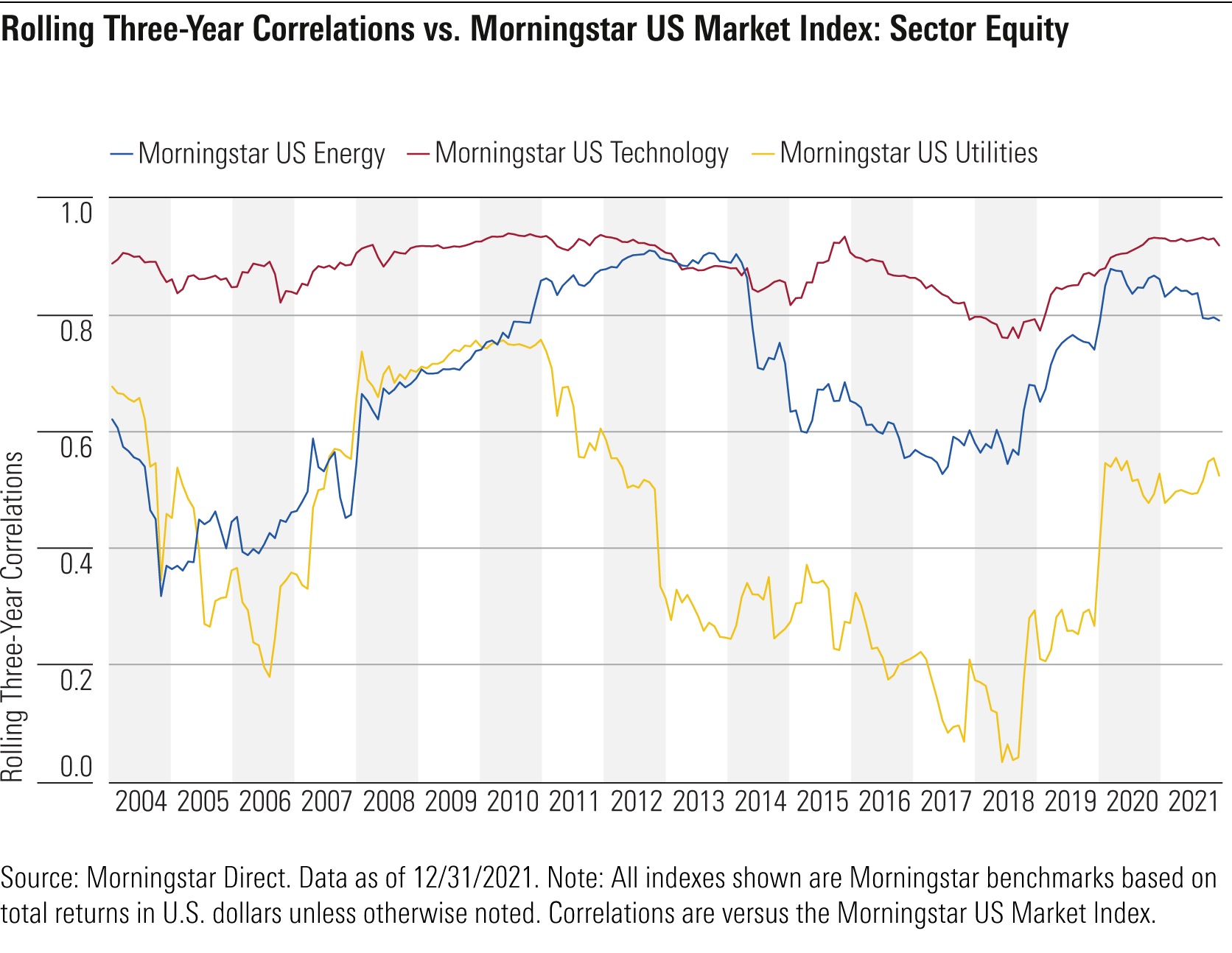

In 2021's broad-based equity rally, nearly every part of the U.S. market benefited, elevating correlations. The key exception was the energy sector, which, while generating very high returns in 2021, exhibited a dramatically low correlation with the broad market, especially the tech stocks that had grown to dominate U.S. market indexes. While tech stocks performed well in 2021, energy stocks performed even better, with the Morningstar US Energy Index surging ahead with a 55.2% gain for the year. And though inflation and the threat of higher interest rates have weighed on the broad market over the past several months, energy stocks have held up relatively well because the underlying companies typically benefit from higher commodity prices.

In 2020, most stock sectors generated positive returns for the year and fell in unison during the first-quarter swoon. Yet in a strong year for U.S. stocks overall, utilities dramatically underperformed the broad U.S. market, losing a bit of value even as the Morningstar US Market Index gained 21%. For the three-year period ended Dec. 31, 2021, the utilities sector was the least correlated with the broad U.S. market of any one single sector.

Longer-Term Trends

Over longer periods, utilities have also done well from the standpoint of diversification, at least relative to other sectors. While the sector's correlation with the broad market has been positive, it has been substantially lower than those of other sectors. That held true over every longer-term period: three, five, 10, 15, and 20 years. While the 10 other sectors have generally exhibited a higher correlation with the broad market over time, utilities' correlation has remained low.

Some advisors recommend that investors carve out a separate sleeve of real estate equities with an eye toward boosting yield and diversification. While the case for REITs as an income source may be intact, the Morningstar US Real Estate Index was an underwhelming diversifier over long-term periods, typically hovering around 0.70 or even higher. What's more, REITs' correlation with the equity market has generally increased over the past few decades.

Portfolio Implications

With the exception of utilities and, very recently energy, sector-specific indexes generally exhibited performance that was closely aligned with the broad market. Thus, there doesn't appear to be a strong portfolio construction case for layering on sector-specific exposure in a diversified equity portfolio that also includes exposure to that sector. (Investors may wish to emphasize them for valuation or other factors, but that is a separate issue.)

Utilities have exhibited the most different performance pattern of any of the sectors over longer time frames, and the sector also features a higher yield than the broad market. However, it's worth noting that utilities also can be adversely affected in periods of rising interest rates, as investors often throw them overboard in favor of safer bonds when yields increase. That hasn't been the case recently, as rising rates have spooked stocks, but it's a potential risk factor and weighs against the usefulness of utilities for diversification purposes.

Could Your Portfolio Use a Makeover? Submit your information for a chance to have Christine Benz review your portfolio and provide improvement suggestions based on your needs.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)