Systematic Trend Funds Buck the Trend in April

Technology funds tanked and most other fund categories lost money in April.

Stocks and bond funds saw another month of poor performance in April amid worries about higher interest rates, high inflation, and the path of the economy.

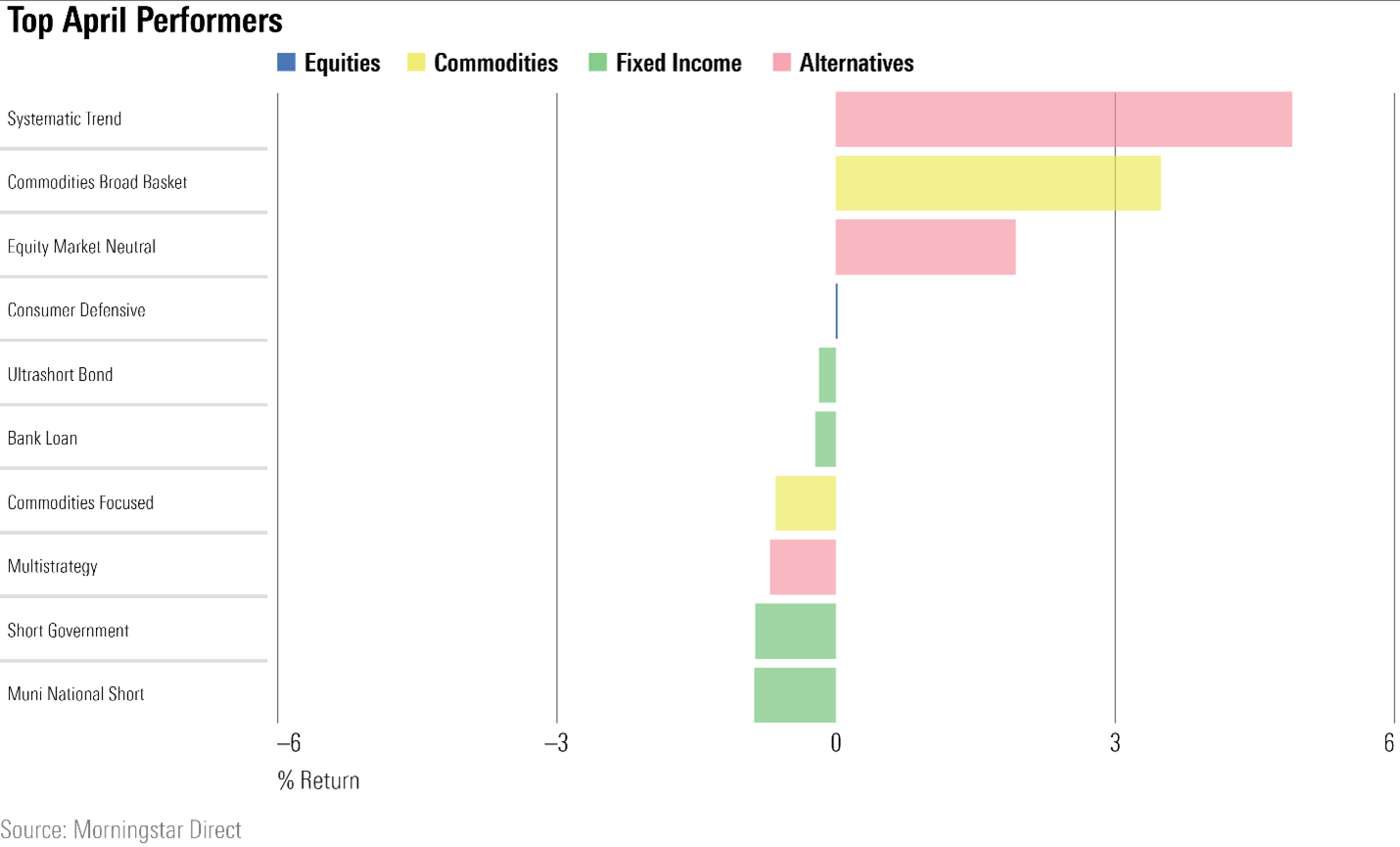

Just four of 109 Morningstar Categories were up in April 2022, the worst showing overall since the novel coronavirus struck in March 2020.

The top performer, systematic trend, rose 4.9% for the month. Of the four categories that were positive in April, two were alternatives categories: systematic trend and equity market neutral, up 3.5%. The commodities broad basket category was up 1.9%. The consumer defensive specialty category came in fourth, just barely in the black (up 0.02%).

Systematic trend funds mainly implement trend-following, price-momentum strategies by trading long and short liquid global futures, options, swaps, and foreign-exchange contracts. Strategies invest across geographies and assets, including equities, fixed income, commodities, currencies, and more.

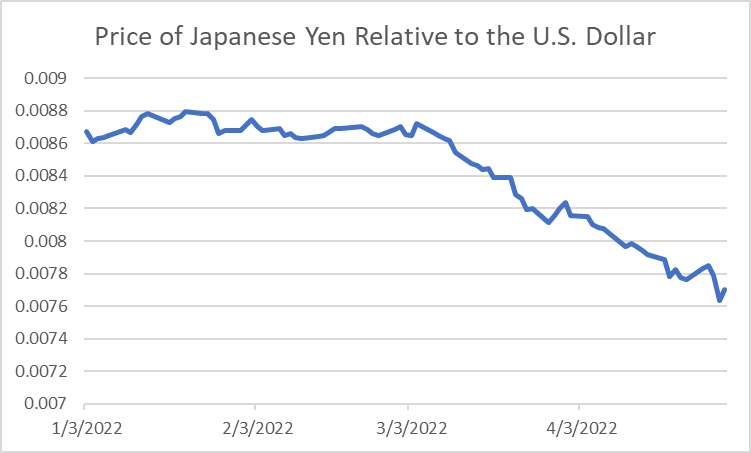

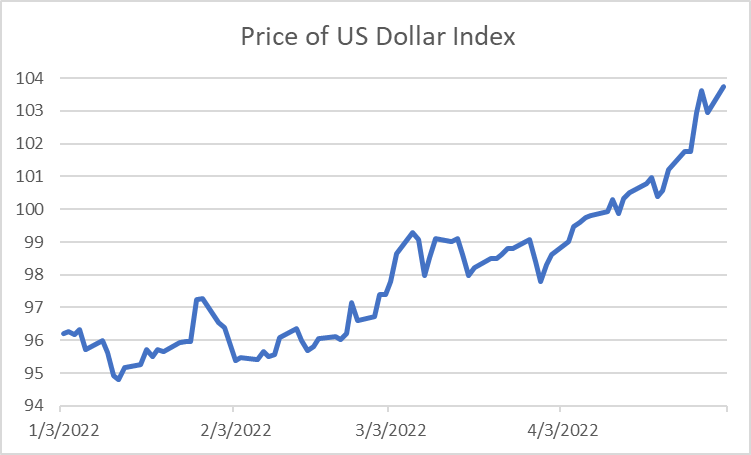

What made April a strong month for systematic trend funds? A persistence of larger trends over several months, continuing into April, created a perfect environment for systematic trend funds to flourish. Commodity and currency price trends were especially large drivers in April, says senior analyst Bobby Blue.

Two examples in currencies were the price changes of the Japanese yen and U.S. dollar. The key thing to observe, says Blue, is the consistent trend down for the Japanese yen and strength of the up trend for the dollar against basically every other currency.

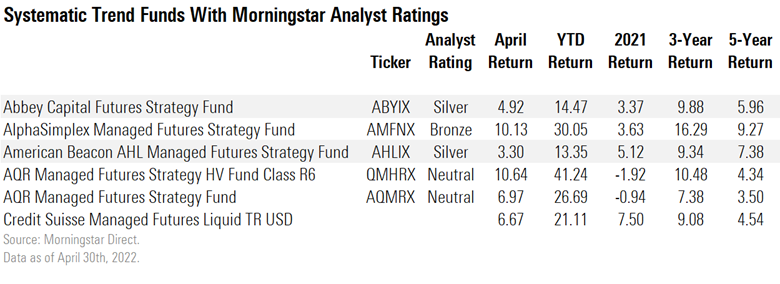

We looked at the cheapest share class of the systematic trend funds on Morningstar Manager Research’s coverage list. AQR Managed Futures Strategy HV QMHIX, which has a Morningstar Analyst Rating of Neutral, was the top performer among our analyst-covered funds, finishing in the second percentile of the category overall. Bronze-rated AlphaSimplex Managed Futures Strategy ASFYX also had a strong month, besting 85% of category peers.

AQR Managed Futures Strategy HV trades more than 100 markets across four asset classes: equities, fixed income, currencies, and commodities.

“AQR has long focused on using price-based trend-following strategies to construct this portfolio, but, at the end of 2018, the team introduced fundamental trend signals based on macro- and microeconomic data,” wrote analyst Erol Alitovski in the strategy’s Dec. 3 report. “The trend of innovation continues with even more enhancements making their way into the portfolio in 2021 by way of factor trend signals.”

AlphaSimplex Managed Futures Strategy spreads out its risk. It combines proprietary adaptive horizon models—a unique feature of ASG’s approach—with more-conventional trend-following models like moving average crossover signals. That allows the strategy to profit from trends in various markets. “These models analyze previous market patterns and modify positioning if the past patterns provide clues for the future,” wrote Alitovski in the fund's Nov. 24 report.

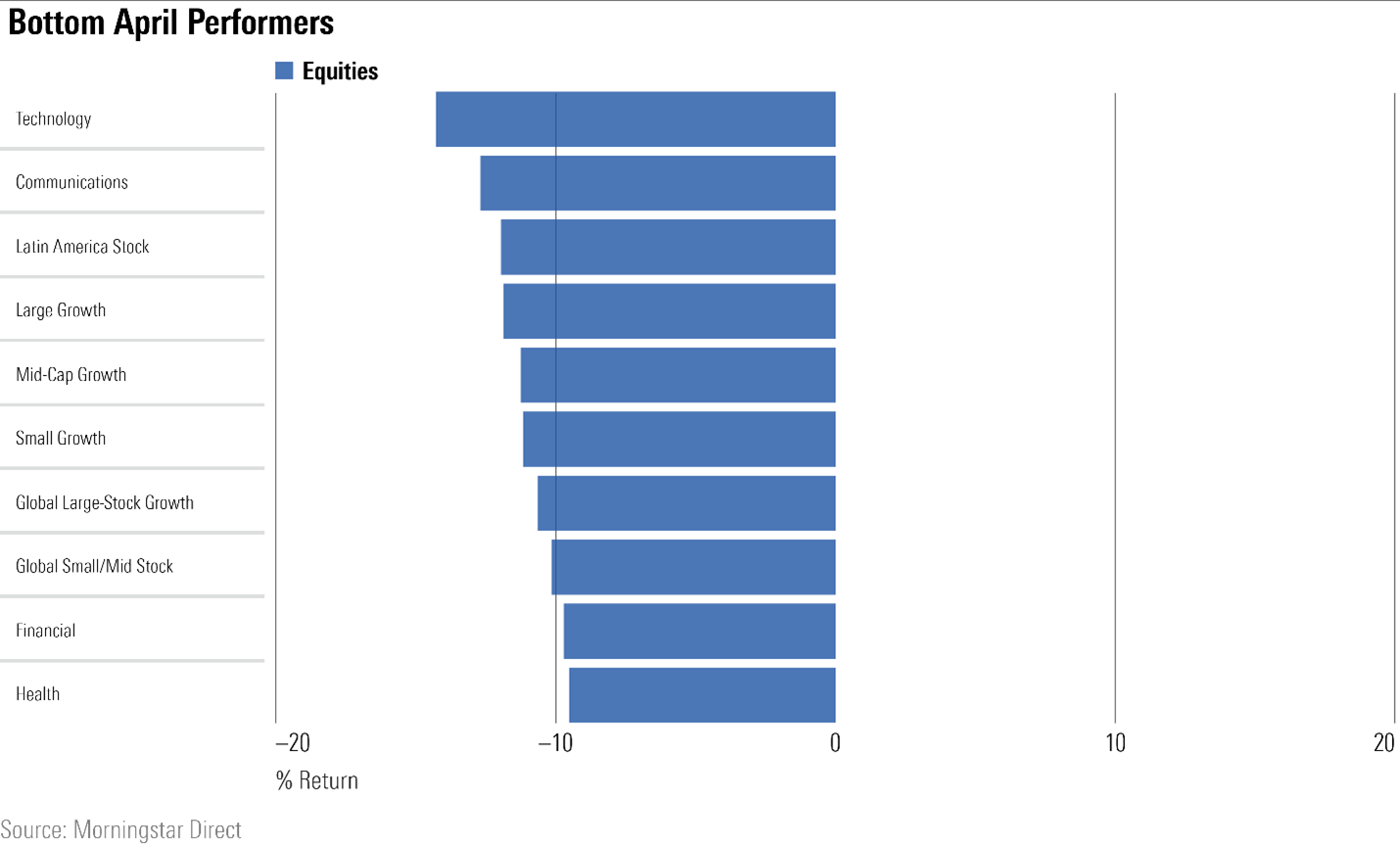

Bottom Performers

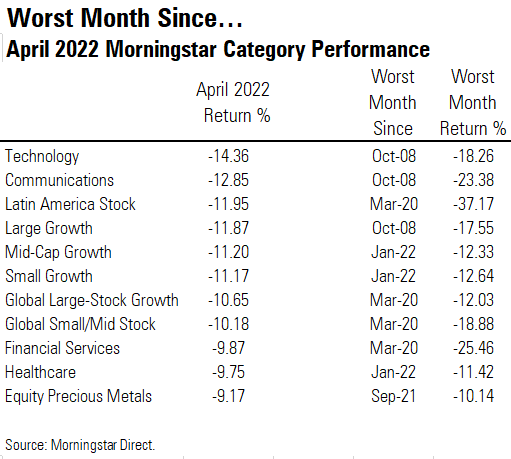

The bottom 10 categories were all equities. Technology funds were the worst performers, averaging a 14.3% loss. It was the category’s worst month since October 2008, when it fell 18.3%.

Several of these categories had their worst month since 2008. A number of bond categories struggled as well.

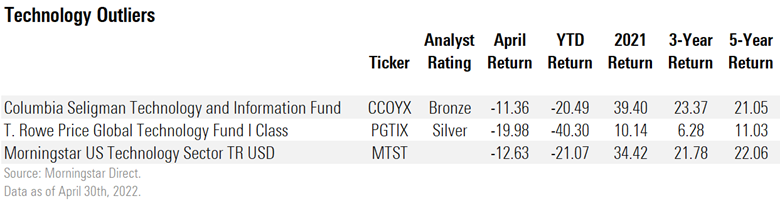

Despite losing 11.39% in April, Bronze-rated Columbia Seligman Tech & Info CCOYX was the top-performing technology fund on the analyst coverage list, finishing in the 23rd percentile of the category. Manager Paul Wick stands out in the tech sector with his emphasis on reasonable valuations and sustainable growth. “Wick believes that tech investing should follow the same rules as general investing. That is, he cares more about financial results than fads or flashy product launches” says analyst Stephen Welch.

As of March 31, 2022, the fund had a 2.2% stake in Western Digital WDC, up 6.9% in April. This was the fund’s largest contributor. The fund also benefited from SailPoint Technologies SAIL and Twitter TWTR. While this strategy had only small stakes, both stocks were up more than 20% for the month.

T. Rowe Price Global Technology PGTIX was the bottom performer among analyst-covered tech funds, losing 20.0%. Alan Tu, the manager of the Silver-rated fund, “takes a long-term view on competitively advantaged companies and is willing to make high-conviction bets,” notes director Katie Rushkewicz Reichart.

The fund’s largest detractor was Atlassian TEAM, which fell 23.5% in April. As of March 31, 2022, the stock was the fund’s largest holding.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)