Addressing Common 529 Plan Concerns

We answer your questions about 529 college savings plan investment choices, fees, impact on aid, and withdrawals.

What are the investment options available in a 529 college savings plan? Is it like a brokerage account?

While 529 plan offerings differ from state to state, the basic structure is similar. All plans provide an age-based or target-enrollment series, which are set-it-and-leave-it investment options that gradually derisk during the accumulation and savings period. These series can serve as a default choice for most investors, similar to a target-date series for retirement savers. For investors who want to select their own investments, 529 plans also offer a menu of mutual funds (typically one or two dozen), such as a 60/40 balanced fund, an S&P 500 index fund, or more specialized funds such as value, growth, or small-cap funds. Finally, plans provide an FDIC-insured account or a stable-value account as its least risky option.

But unlike brokerage accounts, 529 plans generally do not provide the ability to purchase individual stocks. In fact, families cannot take an active or trading approach to these 529 accounts, as investment changes are only allowed twice a calendar year. Contributions into the account are also invested in your preselected investment option once the check or bank transfer clears. It usually is not possible to deposit the money into a cash account and then decide when to invest.

If you live in a state that does not offer much in the way of tax incentives (see more details in our article about tax benefits), you may want to shop around to find a plan that provides options that match your investment preferences. Some plans, for their age-based or target-enrollment series, use low-cost index funds as underlying holdings, but others may employ a blend approach or provide exposure to a broader range of asset classes. The static individual fund options also vary from plan to plan. Some may offer a short list of index funds, while others may provide a broad mix and include actively managed strategies from well-regarded fund families such as T. Rowe Price, American Funds, and Dimensional Fund Advisors.

Do 529 plans charge a lot of additional fees?

The answer is that it depends. Some 529 plans charge additional account or maintenance fees, but many do not. In our ratings methodology, plans with low fees relative to peers are more attractive, as the hurdle to generating performance is reliably lower than more expensive peers.

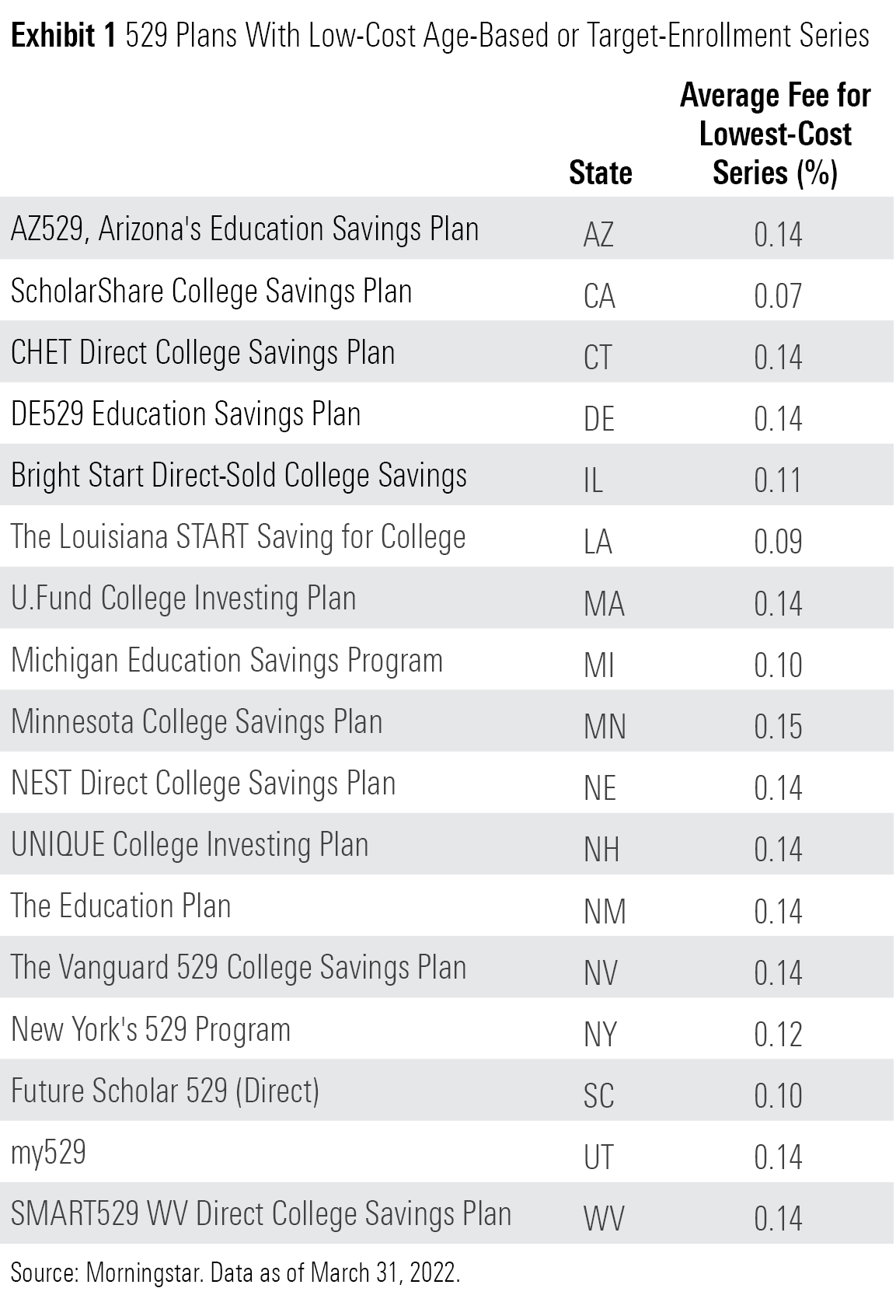

Seventeen plans offer target-enrollment or age-based series with very low costs. As of December 2021, the three largest direct-sold plans (as measured by assets under management) were New York's 529 Program (Direct), The Vanguard 529 College Savings Plan (sponsored by Nevada), and Utah's my529. These plans' target-enrollment or age-based options hold almost the same lineup of underlying funds--Vanguard Total Stock Market Index VTSMX, Vanguard Total International Stock Index VGTSX, Vanguard Total Bond Market II Index VTBIX, and Vanguard Total International Bond Index VTIBX. The Nevada and Utah series carry the same fees of 0.14%, while the New York series is slightly cheaper at 0.12%, and each plan does not charge any additional account or maintenance fees. These fees are competitive with those of Vanguard’s four LifeStrategy funds, which comprise the same aforementioned index funds (at different weightings) and cost between 0.11% to 0.14%. Exhibit 1 below lists plans that offer series with very low costs.

Conversely, there are many plans that offer series that charge relatively unattractive fees of 0.50% or more. These plans typically carry high state fees and/or high program management fees.

Does using a 529 impact my aid package?

The short answer is yes, but if you are saving for future tuition and expenses, you should still consider using a 529 plan, as investment gains from the account are not subject to capital gains taxes, if used for qualified expenses. Also, depending on where you live, there are additional tax benefits at the state level if you invest in a state-sponsored plan.

Federal financial aid, which includes both grants and loans, is based on an estimate of what a family can contribute annually from their income and assets. Income is the largest portion of the expected family contribution, typically 20% to 25% of parents' adjusted gross income (but can go as high as 47%). The contribution from assets is assessed at a much lower maximum of 5.64%, and these assets include primarily taxable vehicles such as investment accounts, savings and checking accounts, certificates of deposit, as well as 529 plans. (Retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, and home equity are not included in this calculation.) So, if a family has a 529 account with $10,000, this raises the expected family contribution by at most $564, effectively reducing a federal aid package by the same amount. But aid packages typically include a loan component, so any savings that reduce the need for future loans benefit the student.

We recommend investors consult with their tax specialists regarding their specific situation.

Is it easy to withdraw funds?

Yes. Accountholders can request a withdrawal to pay an education institution or to reimburse themselves for a beneficiary's qualified education expenses. A request can be made online, by phone, or by mail, and payment is issued either via check or electronic bank transfer. Some plans also provide auto pay. Many families pay tuition and fees first, and then reimburse themselves from the 529 plan. No documentation is needed for withdrawals. However, it is important to keep records that prove that a withdrawal is qualified, because in the event of an audit, unqualified withdrawals may translate to paying taxes on those gains. Also, money must be withdrawn from an account in the same period that educational expenses are incurred. When withdrawals begin, the 529 plan administrator will send a 1099-Q form. If the distribution doesn't exceed the amount of the student's qualifying expenses, then accountholders do not have to report any of the distribution as income on their tax returns.

If a beneficiary no longer needs the money in the account (by deciding not to go to school or by winning a generous scholarship, for example), the account owner can name a new qualified beneficiary for the account without incurring federal or state income tax penalties. Qualified beneficiaries are members of the current beneficiary's family, which includes siblings, children, nieces and nephews, their spouses, or a first cousin.

This is the third in a five-article series on 529 college savings plans. The first installment explains our ratings methodology for 529 plans and our top picks. The second article discusses the tax benefits of 529 plans.

Subscribers to Morningstar.com can access our 529 plan reports and ratings from the 529 Plan Center map. (After clicking on a state, please allow a few seconds for the plan options to download into your browser.)

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)