Should You Diversify by Style?

With stock styles often showing divergent performance, investors don't necessarily need to travel overseas to add diversification to their portfolios.

U.S. equity exposure can be broadly segmented by market capitalization (small, mid, and large) and style (value versus growth), as represented by the Morningstar Style Box. Correlations within U.S. equity groups tend to be fairly high, although small-cap stocks tend to have the lowest correlations with the broad market. In our recently published 2022 Diversification Landscape Report, however, we found there can be significant benefits to diversifying a portfolio by investment style.

Recent Performance Trends

The nine boxes included in the Morningstar Style Box go from the relative extremes of large-cap growth to small-cap value. The divergence between these two portions of the style box shows the long-running gap in returns between value and growth stocks on the one hand and large- and small-cap stocks on the other. Over the trailing 10-year period ended in 2021, the Morningstar US Large Growth Index posted annualized returns of 19.6%, about 8 percentage points better than the Morningstar US Small Value Index, which had the lowest returns of the nine equity boxes.

These long-running performance trends showed some signs of reversing in 2021, though. Value stocks finally pulled ahead after trailing their growth-driven counterparts for four consecutive years, and small-cap value issues fared particularly well. The Morningstar US Small Value Index finished the year with a total return of 31.8%, compared with 21.5% for the Morningstar US Small Growth Index and 25.8% for the Morningstar US Market Index. Smaller value stocks benefited from the strong economic recovery, as well as their larger weights in strong sectors such as energy, financials, and real estate.

The value rebound followed on the heels of disappointing results for small-cap value stocks in 2020. As the novel coronavirus kicked off a fast and severe bear market in the first quarter of 2020, the Morningstar US Large Growth Index fared best in relative terms, dropping 30.9% during the downturn from Feb. 19, 2020, through March 23, 2020. This was more than 17 percentage points better than the Morningstar US Small Value Index's 47.7% drop over the same period. Even within small-cap territory, growth stocks held up more than 12 percentage points better than value during the brief bear market.

Moreover, large-growth stocks bounced back much better than their value counterparts as the market recovered later in the year; as a result, the Morningstar US Small Value Index finished 2020 with only a 1% gain, compared with a surprisingly strong annual return of 20.9% for the Morningstar US Market Index.

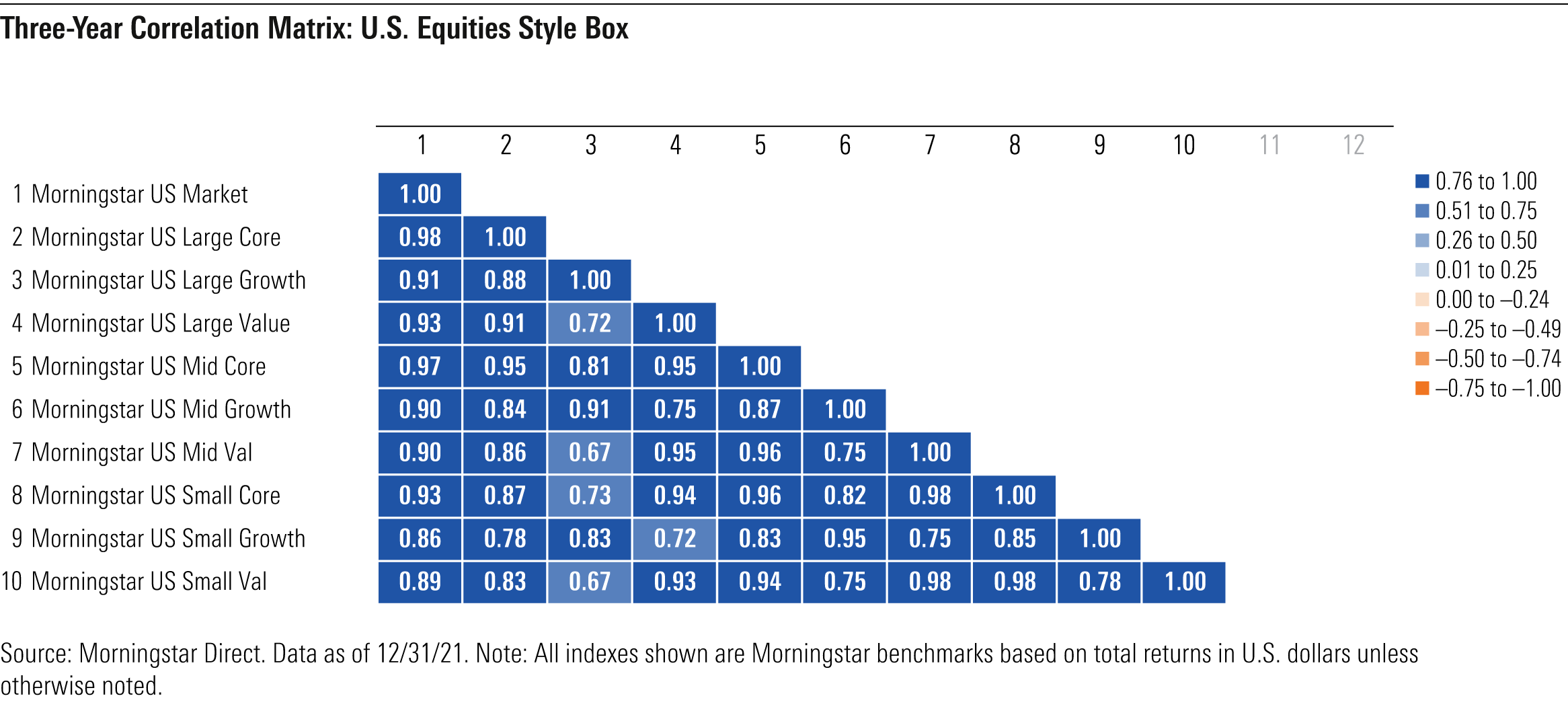

The take-home point is that a high correlation coefficient doesn't translate into similar returns; correlation measures only the direction, not the magnitude, of returns. Indeed, most of the nine boxes have had high correlations with the broader equity market over the past three years, as shown in the table below. The Morningstar Large Core Index had the highest correlation coefficient (0.98) with the broader equity market, while the Morningstar US Small Growth Index was the lowest at 0.86.

While all nine boxes showed close correlations with the Morningstar US Market Index, correlations between individual style boxes were sometimes much lower. Over the trailing three-year period ended in December 2021, the Morningstar US Mid Value and Small Value indexes both had correlation coefficients of just 0.67 with the Morningstar US Large Growth Index. That's actually lower than the correlation coefficients of many major international markets, meaning that investors don’t necessarily have to travel overseas to add diversification to their portfolios. The Morningstar US Large Value Index also had a relatively low correlation with its large-growth counterpart of just 0.72 over the trailing three-year period.

Longer-Term Trends

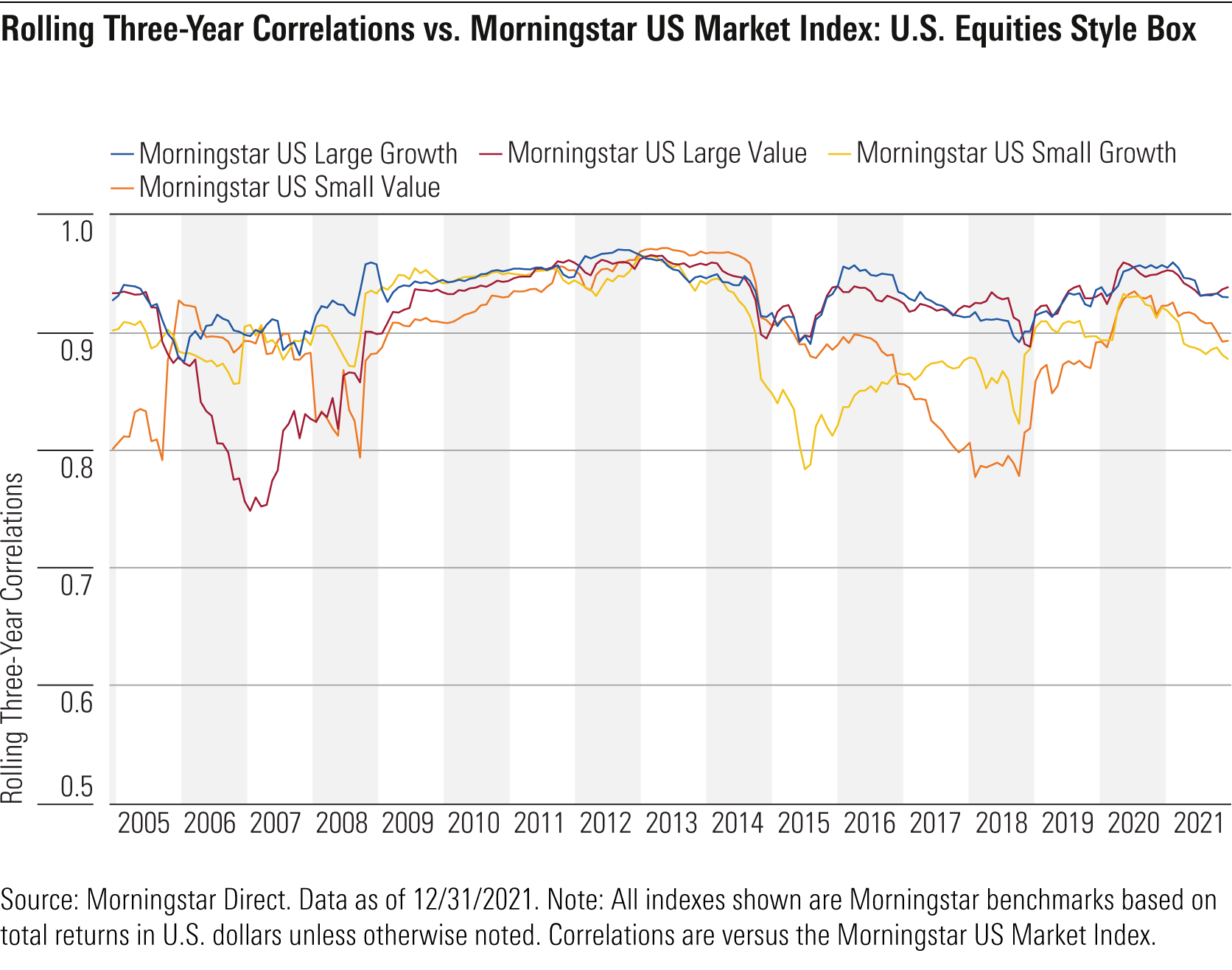

Over the trailing 20-year period, correlations for the nine style box indexes have trended slightly lower, suggesting that style-based diversification is becoming more worthwhile. There have also been some notable divergences over time: For example, small-cap stocks decoupled from the Morningstar US Market Index to the greatest degree between 2015 and 2018. From October 2015 through September 2018, the correlation coefficient for the Morningstar US Small Value Index fell to 0.78, and the same metric decreased to 0.82 for the Morningstar US Small Growth Index.

These results reinforce the importance of broad diversification. While all nine style boxes have had relatively high correlations with the Morningstar US Market Index, they have often shown marked divergence in returns across the group. Until recently, for example, investors would have paid a high price—during both rallies and down markets—for overweighting value at the expense of growth.

In fact, growth's performance edge has been so strong that many investors may still be overweight in growth relative to value, even after the resurgence in value stocks over the past few quarters. After years of outperformance, such investors may want to diversify their exposure by either trimming their positions in growth funds or by adding a small-value position as a complement. While value stocks have historically outperformed during economic recoveries, time will tell whether this is a long-term shift in market leadership.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)