Wide-Moat Funds Play Defense Well

These funds tend to hold up better than the market in a recession.

The article was published in the March 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Will Colgate-Palmolive CL still be around in 10 years? What about Procter & Gamble PG, McDonald's MCD, Johnson & Johnson JNJ, or Microsoft MSFT? It seems a pretty safe bet that all of them will be and likely fairly healthy companies at that.

No wonder these firms have wide Morningstar Economic Moat Ratings from our stock analysts. Moats refer to competitive advantages that would be hard for competitors to match. It would be very hard to replace Microsoft's software on a typical company's computers given how embedded Microsoft is within corporate platforms. Likewise, a competitor couldn't easily build up the brand recognition of McDonald's or steal shelf space from Procter & Gamble. Morningstar's definition says a company with a wide economic moat can fend off competition and earn high returns on capital for more than a decade.

It's a concept that drives Warren Buffett's stock selection. He tends to buy for multiple decades and wants the safety of companies that will endure. These companies have pricing power because of their moats, and they tend to have big cash stakes and healthy balance sheets. They make great defensive plays because they can ride out recessions much better with all those advantages. A company that has lots of debt or is vulnerable to someone building a better mousetrap is much less likely to survive multiple recessions intact.

Fund managers with a heavy concentration of wide-moat stocks usually fall into one of two groups. The first is quality-oriented investors. They often talk about moats and quality in interchangeable terms. They like the stability and defensive characteristics of these companies, and mostly what separates them is how much they will pay for the companies. Most of the funds can be found in the large-blend Morningstar Category, but there are some in value and growth.

The second group focuses on dividend growth. These managers want companies that are likely to raise their dividends consistently. It doesn't always produce a yield greater than the S&P 500's, but income can grow nicely over time. And the companies likely to raise dividends are mostly wide-moat companies. Pricing power naturally leads to dividend growth. But wide-moat companies also tend to have strong balance sheets and respectable rates of growth in sales and earnings. Naturally, they are well-positioned for dividend growth. So, dividend-growth managers may not talk about moats, but they really are in the same place as the quality investors.

We collect moat data on mutual fund portfolios. We calculate the percentage that each portfolio has in wide-moat stocks, narrow-moat stocks, and no-moat stocks. That data can help you to understand how defensive a fund is.

Before we get any further, I'll note a couple of limitations to moats. First, they are pretty well known and understood, so buying a wide-moat business usually requires you to pay a premium over other names in that industry. That somewhat diminishes return potential.

Second, moats can be less helpful in times of valuation contraction, like the one we've seen this year. Thus far in 2022, the economy has been growing quite robustly, so the kind of defense that moats provide hasn't been needed. Instead, we're seeing high-multiple stocks cut down because they've had such a great run. Wide-moat stocks and the funds that love them haven't looked so great, though there have been some exceptions.

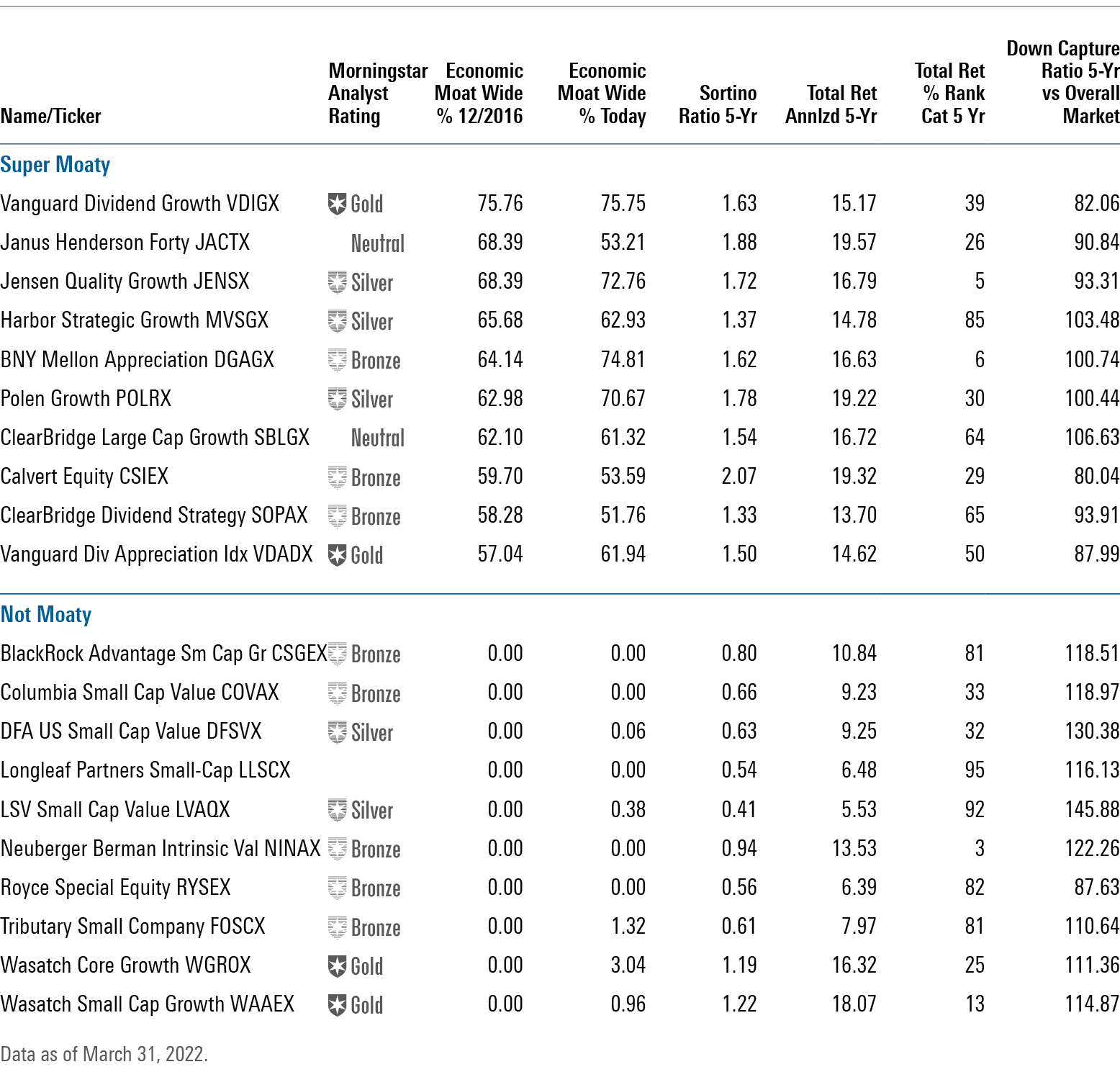

To see the impact of moats, I went back to data from the end of 2016. I pulled equity funds from FundInvestor's Morningstar 500 that had 50% or more of their portfolios in wide-moat stocks, and I pulled equity funds with 5% or less in wide-moat stocks. Then I looked ahead to see what the risk, return, and moat profiles are today.

Very Moaty Funds

In all, there were 31 funds in 2016 with more than half of their assets in wide-moat stocks. Thirty of them were domestic-stock funds, and one was a foreign-stock fund. Vanguard Dividend Growth VDIGX had the highest percentage of wide-moat stocks at 76%, followed by Janus Henderson Forty JACTX and Jensen Quality Growth JENSX.

The ensuing five years contained one bear market and some dramatic rallies for aggressive growth. So, from a wide-moat perspective, the period was a real challenge. Here's how things looked using portfolios dated between December and March:

The funds remained quite moaty. Overall, they averaged 58% of assets in wide moats versus 57% five years ago. This is one thing that's appealing about wide-moat funds: They are consistent in owning wide moats because the types of stocks with wide moats don't change much over time. So, if you bought a wide-moat fund for its defensive characteristics and return potential, it probably still has those qualities.

There were three funds whose moat weightings declined significantly: AMG Yacktman Focused YAFFX and AMG Yacktman YACKX fell to 28% and 30%, respectively. Touchtone Sands Capital Select Growth PTSGX dropped to 33%. The three funds are rather flexible, focused funds that aren't really dedicated to quality. Yacktman, for instance, is mostly interested in value first and tends to own a mix of cyclical lower-moat names alongside higher-quality names.

Vanguard Dividend Growth remained heavily invested in wide moats with 76% of assets under management, and BNY Mellon Appreciation DGAGX had 75% of AUM in wide-moat stocks at the end of February 2022.

The wide-moat-heavy fund group returned a nifty 17.36% annualized through January, on average. That's great, but I wouldn't expect a repeat of returns that rich. (You may have heard that past returns are no guarantee of future returns.) Those returns landed in the top 40% of peers, on average—a solid showing. On a risk-adjusted basis, they produced a 1.66 Sortino ratio (a rich man's Sharpe ratio) compared with 1.45 for Vanguard Total Stock Market Index VTSAX, which returned 16.08%. Not too shabby.

The group also produced a five-year downside-capture ratio of 96% relative to the S&P 500. That means that funds suffered about 96% of the market’s losses in downturns. Relative to their category benchmark, downside capture averaged an even better 91.6%. Thus, they look better on a risk-adjusted basis because of those defensive characteristics. On the other hand, the 91.6% tells you that these funds are certainly not impervious to bear markets—they just hold up better in recessions.

Medalists With Wide Moats

Besides Vanguard Dividend Growth and Jensen Quality, Harbor Strategic Growth MVSGX, BNY Mellon Appreciation, and Polen Growth POLRX are Morningstar Medalists with heavy doses of wide-moat stocks. Some are in the large-growth category, while others are in large blend, but they all have some common threads running through their investment philosophies.

Not So Moaty

I found 56 Morningstar 500 stock funds with less than 5% in wide-moat stocks. The list, which is dominated by small- and mid-cap funds, ended the period with just 2%, on average, in wide-moat stocks. Only two funds went on to have double-digit wide-moat weightings, so it would seem the not-moaty funds were consistent, too. And their performance was not so hot. They had returns of 11.6% annualized and a percentile rank of 48%. Not bad, but the Sortino ratio was 0.86, and the downside-capture ratio versus the market was 121%. Ouch. The funds tended to have more exposure to cyclical stocks and thus were hit harder in the coronavirus selloff. However, small caps lagged large caps in the past five years, so it isn't as poor as those figures suggest at first glance.

When we look at downside capture relative to the category index, it's a more respectable 94.5%. Both downside-capture ratios were worse than the wide-moat group, but many of the low-moat funds were in small value or an adjacent part of the Morningstar Style Box. They may have offered better protection against price risk than our wide-moat funds even if, overall, their defenses were not as strong.

Conclusion

There are good low-moat and wide-moat strategies. I wouldn't suggest avoiding low-moat funds entirely, but it helps to see which funds are better at playing defense in recessions. The consistency of moats on the fund and stock levels adds appeal as they represent competitive advantages you can depend on, unlike performance, which is more elusive.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)