Morningstar Awards for Investing Excellence--Outstanding Portfolio Manager Nominees

Three portfolio managers earn accolades for industry achievements.

Today, Morningstar named three nominees for the 2022 Morningstar Awards for Investing Excellence--Outstanding Portfolio Manager: Capital Group’s Hilda Applbaum, Wellington’s Michael Reckmeyer, and Baird’s Mary Ellen Stanek. The winner, alongside the recipient of the Exemplary Stewardship award, will be announced in late April.

The candidates have produced exceptional long-term results while demonstrating shareholder alignment, courage in their convictions, and clear investment skill. Morningstar analysts pick nominees from investment strategies that earn Morningstar Analyst Ratings of Gold or Silver for at least one vehicle or share class. These nominees have navigated various market cycles over their tenures and remain among the best in their respective asset classes. They also invest significant sums alongside their strategies' investors.

Here's more detail about each nominee.

Hilda Applbaum, Capital Group

Applbaum is a seasoned and skilled asset allocator and bottom-up security selector. She began her investment career 34 years ago as a research analyst and economist at a regional bank before joining the California Public Employees' Retirement System, where she served as a principal investment officer and director of research. Applbaum joined Capital Group in 1995 to cover global convertible securities and ascended the ranks to portfolio manager. She joined the management roster for Gold-rated American Funds Income Fund of America RIDFX in October 1997 and became its principal investment officer eight years later. In that capacity, she manages a 10% sleeve of the huge $128 billion fund, monitors its 13 other distinct sleeves, and oversees its overall equity/bond split.

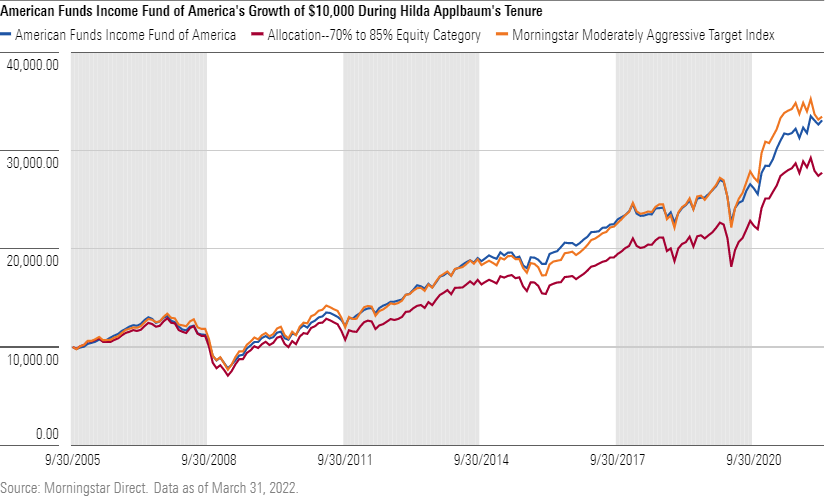

Since Applbaum took over as PIO in October 2005, the R5 shares’ 7.5% annualized gain through March 2022 beat nearly three fourths of peers in the allocation--70% to 85% equity Morningstar Category despite being at the lower end of the equity range (and occasionally below it) during that stretch. It has delivered strong risk-adjusted results by damping volatility and providing considerable ballast when markets get shaky--this, despite considerable turnover underneath the steady Applbaum. Five managers left the strategy between late 2015 and 2019, with three equity managers and one bond investor joining in 2020. Granted, Capital’s multimanager system both facilitates and supports manager changes, but it was Applbaum’s steadying hand at the top that buoyed the strategy. The fund’s 9.5% gain over the 12 months through March 2022 ranks near the category’s top decile.

Michael Reckmeyer, Wellington Management

Since becoming a named portfolio manager in 2007 and taking over as lead at the beginning of 2008, Reckmeyer has distinguished himself on all four of his funds: his 60%-65% portion of Vanguard Equity-Income VEIRX, the equity portions of Vanguard Wellesley Income VWIAX and Hartford Balanced Income HBLYX, and Hartford Equity Income HQIYX, the only strategy over which he and his team have sole charge. The funds have beaten their respective benchmarks and Morningstar Category peer norms during Reckmeyer’s tenure, with each boasting top-decile results over the past 15 years through March 2022.

The benchmark-aware process that Reckmeyer uses on all of his strategies isn’t flashy, but it is effective. He looks for companies with above-average yields, but his approach is total-return-oriented, so a company's ability to grow its dividend is just as important as its current yield; this helps him avoid stocks with high current yields but also unable to grow their dividends or businesses. It can also help him avoid companies with dividends that could not be maintained. Reckmeyer’s discipline and adherence to his approach has led to competitive performance year in and out, especially in downturns.

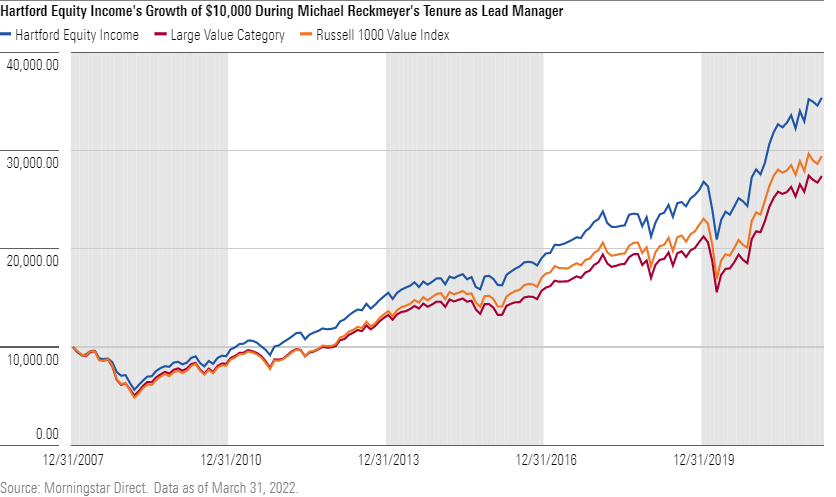

Consider Hartford Equity Income. In the eight periods its Russell 1000 Value Index has fallen 10% or more during his tenure, the fund’s Y shares have lost less each time. The fund has also preserved capital better than the index in early 2022 thus far. That’s made the fund easier to own than a comparable index fund. It has also enriched fundholders: A $10,000 investment at the start of Reckmeyer’s tenure as lead grew to $35,378 through March 2022, versus $29,447 for the index and $27,328 for the typical rival--a cumulative advantage of 20% and nearly 30%, respectively.

Mary Ellen Stanek, Baird Asset Management

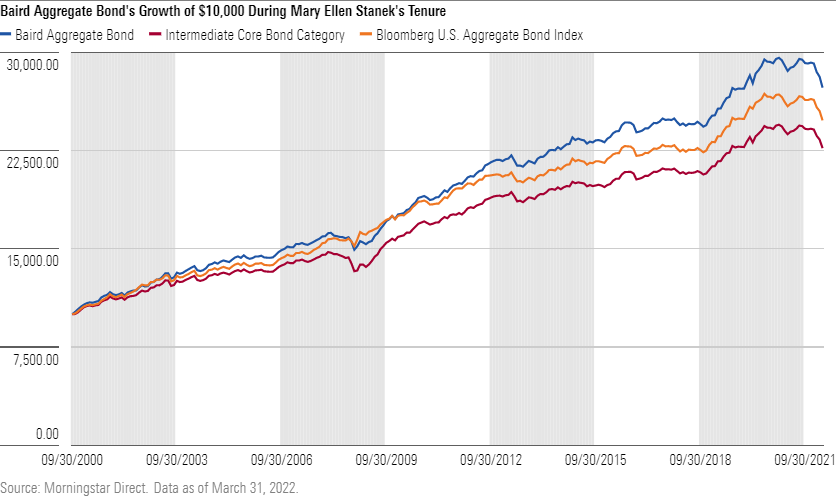

In her more than 22 years at Baird Asset Management, Stanek has stayed true to her disciplined and risk-aware approach, thoughtfully navigating various market environments. As CIO of the firm, Stanek leads on all of Baird’s taxable fixed-income strategies. These include Baird Core Plus Bond BCOIX and Baird Aggregate Bond BAGIX, which have attracted strong flows and have generated impressive absolute and risk-adjusted returns over Stanek’s long reign from October 2000 through March 2022.

While lacking the giant analyst benches of some of the larger fixed-income rivals, Stanek leads a nimble, tight-knit team that plays to its strengths. The eight-person squad consists of longtime veterans who arrived with Stanek in 2000 and midlevel leaders who have matured within her organization. There have been a couple of retirements among the old guard, but otherwise her analyst bench has grown steadily and seen few departures, reflecting Stanek’s focus on employee development and retention. She has expanded the team’s resources to handle its growing business and has fostered a culture that encourages the voices of both senior collaborators and newer associates.

Stanek has an investors-first mentality. Long before it was the industry norm, Stanek and her team launched strategies with some of the lowest fees available among actively managed peers; the managers don't have to take on more risk to clear their price hurdles and beat their respective benchmarks. Stanek and her team also produce comprehensive educational content on fixed-income markets for investors and own large stakes in the funds they run.

/s3.amazonaws.com/arc-authors/morningstar/7ea530af-5221-4333-b9d9-200e96a1641c.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7ea530af-5221-4333-b9d9-200e96a1641c.jpg)