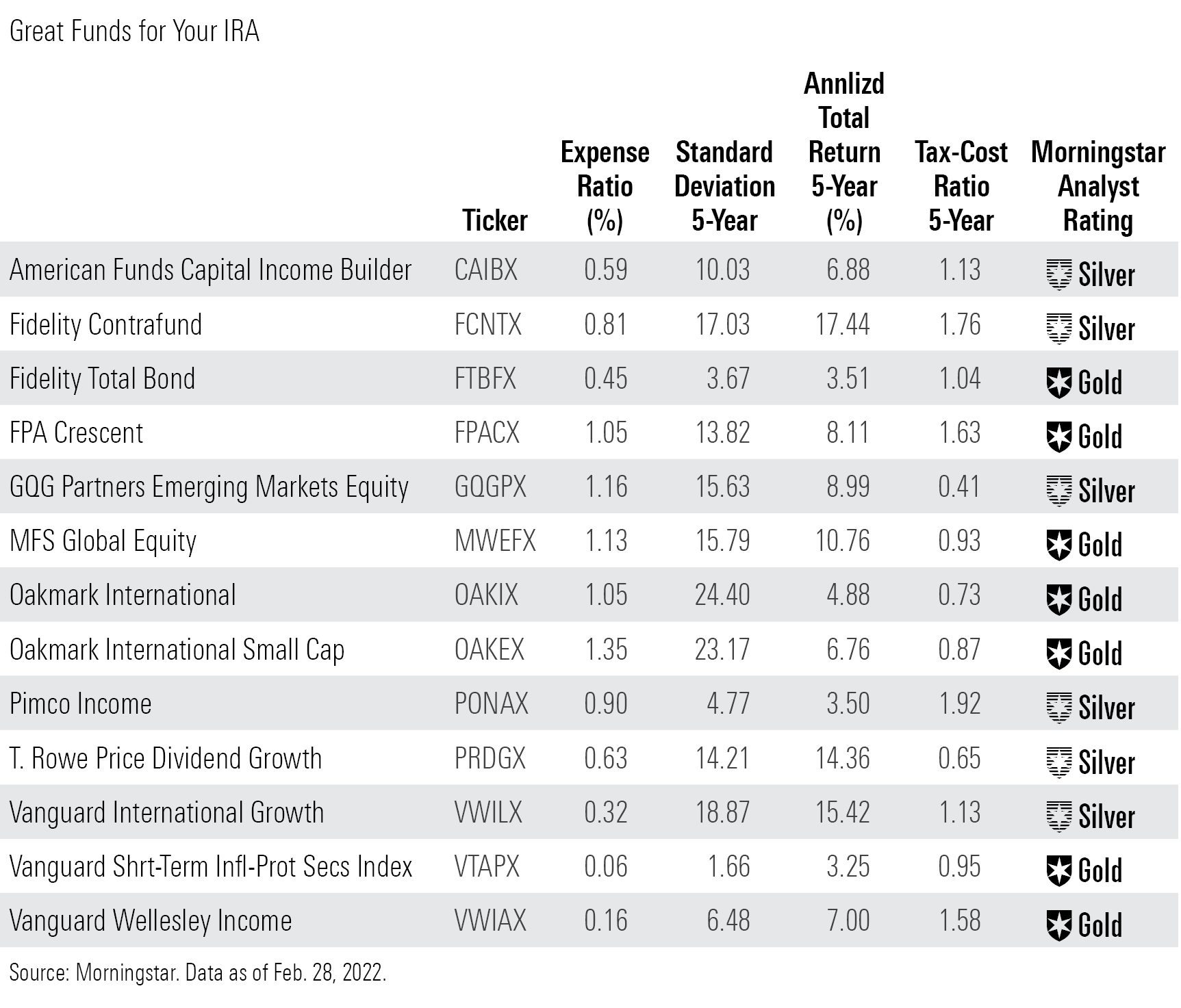

13 Funds to Buy For Your IRA

I've got you covered from high risk to low risk.

The article was published in the February 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

If you haven't contributed to an IRA lately, you have until April 15, 2022, to make your investment. IRAs come in different forms, but they all offer some tax advantages that make them compelling choices for long-term investments. You may want to ask your accountant or financial planner about eligibility and whether an IRA makes sense for you.

I've chosen some funds that are good fits for IRAs for a variety of reasons. All of them have some tax disadvantages, which are wiped away by the IRA tax shelter and thus a better fit for a tax-sheltered account. I also chose some that are simply best suited for a long-term time horizon and thus a good fit for a retirement account.

To provide some added color, I've added five-year tax-cost ratios. This tells you in basis points what you would have lost to taxes if you held the fund in a taxable account. As you can see, the sums are fairly modest relative to returns, with a couple of exceptions, but they are still larger than you'd see for the most tax-efficient vehicle types, such as index funds and municipal-bond funds. Note that the two funds giving back the biggest percentage of their returns are relatively low-risk bond funds that very much belong behind a tax-sheltered wall.

I've grouped them in order of volatility, with the highest five-year standard deviation at the top. Those near the top require a true long-term outlook, while some of the milder ones might work even when you start withdrawing money during retirement. If you are considering investing in one of these funds, be sure to click through the links to read the full analysis.

Oakmark International OAKIX and Oakmark International Small Cap OAKEX

These funds have produced top-percentile 15-year returns, and as our Morningstar Analyst Ratings of Gold indicate, we think there's a decent chance they can beat their benchmarks in the future. David Herro and team have proved to be savvy value investors who carve their own path. But there's a catch: These are focused value funds and as such can have some pretty serious dry spells. It can happen because of a recession or just because growth is in favor. And if the dollar rises at the same time, it won't be pretty. That's why I thought of these funds for an IRA. It helps to do the mental accounting of saying: "This is a long-term investment that I will ride through ups and downs." Because these funds go through some deep valleys before they get to the mountaintop.

A second thing to note is that Herro is likely not too far from retirement, though he hasn't put a date on it. But he has succession plans in place. Michael Manelli is a comanager on both funds, and Justin Hance is a comanager on Oakmark International Small Cap. So, if you are buying this for the next 10 to 20 years, you likely will see a transition, but we think Manelli and Hance are capable successors.

Vanguard International Growth VWILX

Vanguard International Growth shows how good things can be with actively managed Vanguard funds. The fund charges only 0.32% in a Morningstar Category where many funds are quite pricey. And Vanguard's manager selection team has done a fine job of selecting subadvisors at this Silver-rated fund.

Baillie Gifford runs 70% of assets, and Schroders manages the other 30%. The fund is an excellent way to gain exposure to the fastest-growing companies outside the United States.

Fidelity Contrafund FCNTX

Speaking of the fastest-growing companies, many of them are in the U.S., and Will Danoff is an excellent manager to find the best ones for you. As I write this, highly valued growth stocks have been falling because of steep valuations and an economic rebound that's drawing attention to value stocks. But in the long term, you absolutely want to own some of the best companies. We rate the fund Silver, rather than Gold, because it has such a large asset base, not because we have concerns about Danoff's abilities.

MFS Global Equity MWEFX

MFS has built a strong reputation for appealing global funds because it has a deep team of managers and analysts around the world. This fund is in the world large-stock blend category. Roger Morley and Ryan McAllister look for companies with competitive advantages and strong balance sheets. They've hit upon an appealing risk/reward profile that has generally outperformed the fund's benchmark with only moderate risk. This Gold-rated fund makes a nice core holding.

GQG Partners Emerging Markets Equity GQGPX

Emerging-markets funds also endure some big short-term losses, so I like this Silver-rated fund for retirement accounts. It's run by Rajiv Jain, who won the Morningstar Fund Manager of the Year award while at Vontobel. He's continued his success in the five years since he started GQG. Jain seeks well-run companies with growth potential, and he's mainly invested in three industries: technology, financials, and energy. A lot of the fund's fastest-growing stocks are Chinese internet plays like Tencent and NetEase NTES. (Not a great place to be lately.) He has built the team out to 17 analysts and has enjoyed strong asset growth and solid performance.

T. Rowe Price Dividend Growth PRDGX

This fund represents a midpoint on the list and in risk. Its volatility is a little below the U.S. stock market's, whereas those listed above are much more volatile than the U.S. stock market. The dividend-growth strategy works nicely at pushing the fund into higher-quality defensive names, and that’s a welcome thing for many investors. To find stocks with the potential to boost dividends, you need to find companies with healthy balance sheets and growing revenues. Tom Huber has stocks like Microsoft MSFT, Danaher DHR, and Accenture ACN in the top holdings. Over the years, Huber has produced excellent risk-adjusted performance, earning the fund a Silver rating.

FPA Crescent FPACX

Not a traditional balanced fund by any stretch, FPA Crescent still has appeal for Steve Romick's own brand of aggressiveness and caution.

He mostly invests in equities but is very focused on limiting downside. To do that, he buys cheap stocks but also holds cash and other bonds, and he even shorts stocks. Generally, that mix has worked wonders, though there have been a couple of moments when a value selloff hurt it. Still, I think its overall profile makes it an appealing fund that you could hold well past your retirement date.

American Funds Capital Income Builder CAIBX

This fund nicely captures something that American Funds is very good at: producing a good yield without taking on too much risk to get it. So many funds produce big yields by taking huge gambles that blow up every few years. American is better at that. The team invests in solid dividend-producing companies that are not hanging by a thread, and it mixes investment-grade and high-yield on the bond side to deliver nice yield. The fund has a 70% equities/30% bonds mix, and within equities it is pretty evenly split between domestic and foreign. All that income can give you a sizable tax bill, so having it in a tax-sheltered vehicle is a smart move.

Vanguard Wellesley Income VWIAX

This fund marks another big drop off in volatility because it has much less in equities than all the funds listed above. This fund holds about 35% in equities and 65% in bonds. It's run by Wellington with Michael Reckmeyer at the helm on the stock side. Reckmeyer is set to turn over the reins to Matthew Hand in June 2022. Hand has worked with Reckmeyer since 2004, so we expect a smooth transition. The equity portfolio has a decided tilt to the value side of the Morningstar Style Box, with an emphasis on healthy dividend payers. An added appeal is that this fund only charges 0.16%, making it one of the better bargains in the fund world.

Pimco Income PONAX

Now we move from a cautious allocation fund to an aggressive bond fund. Dan Ivascyn and Alfred Murata have a wide latitude to invest in bonds that provide big yield and return prospects. The fund owns nonagency mortgages as well as more-traditional investment-grade and high-yield bonds. You want managers as skilled as this pair to keep risk under control while still delivering hefty yields. The one real drawback is that they are running a massive amount of money in this strategy, and that limits how much value they can add with smaller bond types and issuers. I would use this in a portfolio that has some lower-risk bond strategies to balance this very aggressive one.

Fidelity Total Bond FTBFX

Ford O'Neil has made this Gold-rated fund a compelling investment. The fund lands in the intermediate core-plus bond category because it takes on more risk than the core bond benchmark, the Bloomberg U.S. Aggregate Bond Index. However, it doesn't take on nearly as much risk as Pimco Income. It keeps interest-rate risk in line with the benchmark and seeks to instead add value with security selection and yield-curve positioning. To understand what the fund's parameters do to risk and return, examine the past calendar-year returns. The fund's worst loss was 0.92% in 2013, and its biggest gain was 9.87% in 2019. The loss was 2 basis points worse than the category average, and the gain was 93 basis points more than the average. So, we're talking moderate bets here and a skilled manager to make them.

Vanguard Short-Term Inflation-Protected Securities Index VTAPX

This fund is particularly compelling for IRAs that have bond-heavy portfolios. The fund offers inflation protection at a time when that risk is quite real. But because it is short-term, it doesn't have as much interest-rate risk as other Treasury Inflation-Protected Securities funds. In addition, TIPS generate lots of taxable income because their prices are adjusted to reflect changes in inflation. When they are adjusted up, it generates a tax bill for investors. Thus, it's an appealing investment, but only in tax-sheltered accounts.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)