Equity Precious-Metals Funds Shine in a Dark February

Few Morningstar Categories came out ahead in a volatile month.

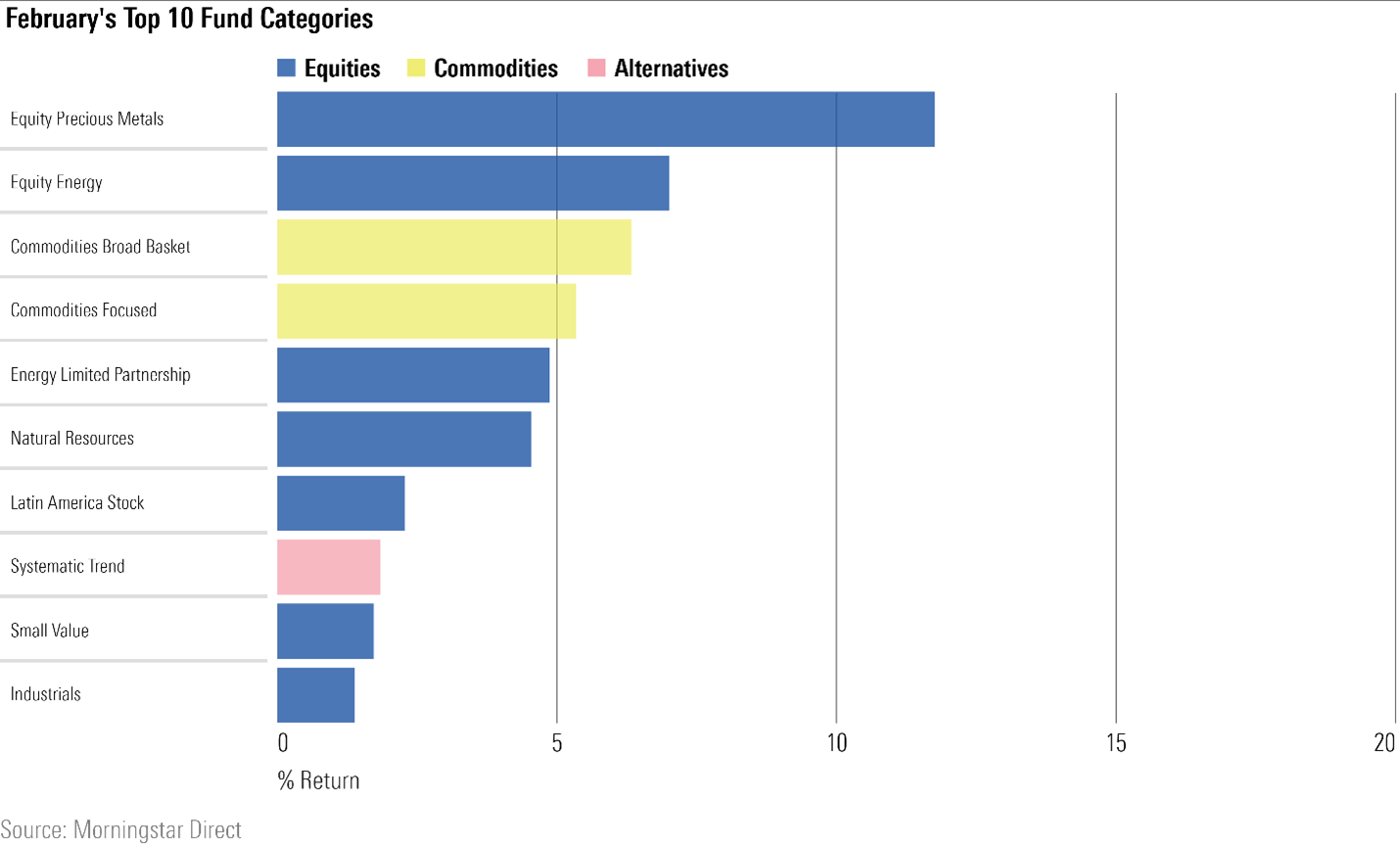

Like January, February was a rough month for most Morningstar Categories. Only 13 of the 108 fund categories were in the black.

Equity Precious-Metals Funds Soar

Categories linked to commodities were the strongest performers. The equity precious-metals category stood out with an average return of 11.8%--well ahead of equity energy, which came in second with an average return of 7.0%.

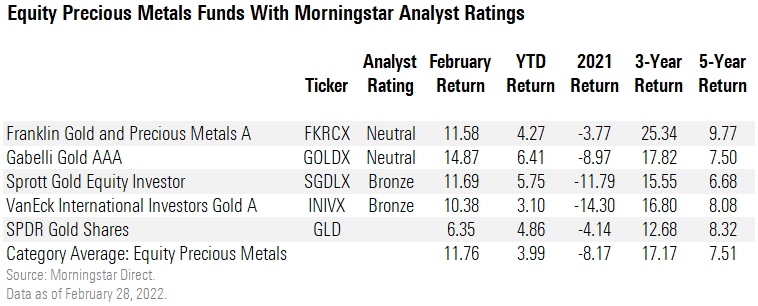

The equity precious-metals category nearly doubled the return of the price of gold; SPDR Gold Shares GLD was up 6.3% in February. That's because the SPDR ETF holds the commodity itself, while the category overall is invested more heavily in gold-mining companies. As Morningstar associate director Tom Nations explains, "One way to view it is gold miners are a leveraged bet on the price of gold."

Morningstar's manager research analysts cover four funds in the equity precious-metals category, and only one bested the category average in February, Gabelli Gold GOLDX, which has a Morningstar Analyst Rating of Neutral. Unlike some of the other analyst-covered strategies, Gabelli Gold doesn't hold any gold bullion. Nations says that holding gold bullion instead of mining companies damps returns when the price of gold appreciates but provides some downside protection when things turn south.

Gabelli Gold also has larger-than-average stakes in some widely owned names in the category. As of Dec. 31, it had a 5.6% stake in Wesdome Gold Mines WDOFF, a gold producer and miner from Canada that was up 30.9% in February. Morningstar Direct's equity attribution analysis indicates that this pick contributed the most to the fund's outperformance.

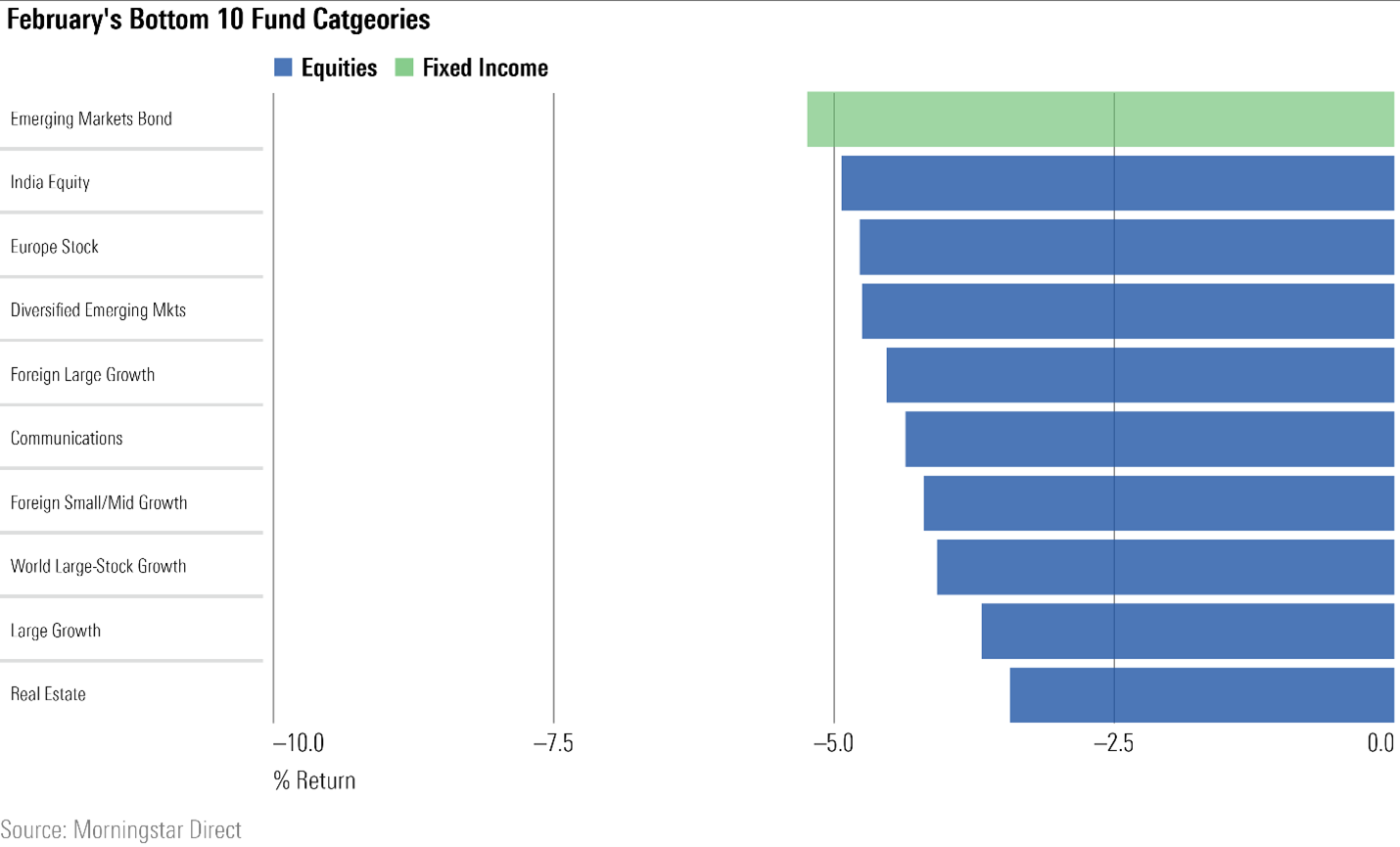

Emerging-Markets Bond Funds Plunge

Emerging-markets bond was the worst-performing category, with a 5.2% loss in February. It was the only fixed-income category to make the bottom-10 list. India equity came in second-to-last, with several other international-equity categories close behind.

Funds with outsize bond positions in Russia and Ukraine were hit hard in late February. Analyst Mike Mulach surveyed the scene and spoke with a number of managers in the space to see how they reacted to the conflict.

Among funds on Morningstar's analyst coverage list, Neutral-rated Invesco Emerging Markets Sovereign Debt ETF PCY was the biggest loser, dropping 8.4% in February. Morningstar's March 2021 analyst report noted that the fund places a greater emphasis on the highest-yielding bonds than its category peers do, which results in significantly less exposure to the markets' largest issuers and favors smaller, riskier issuers that underperform in periods of volatility.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)