DoorDash Stock Jumps as 4Q Beat Breaks Losing Streak

With demand for food delivery remaining strong, the shares are still undervalued.

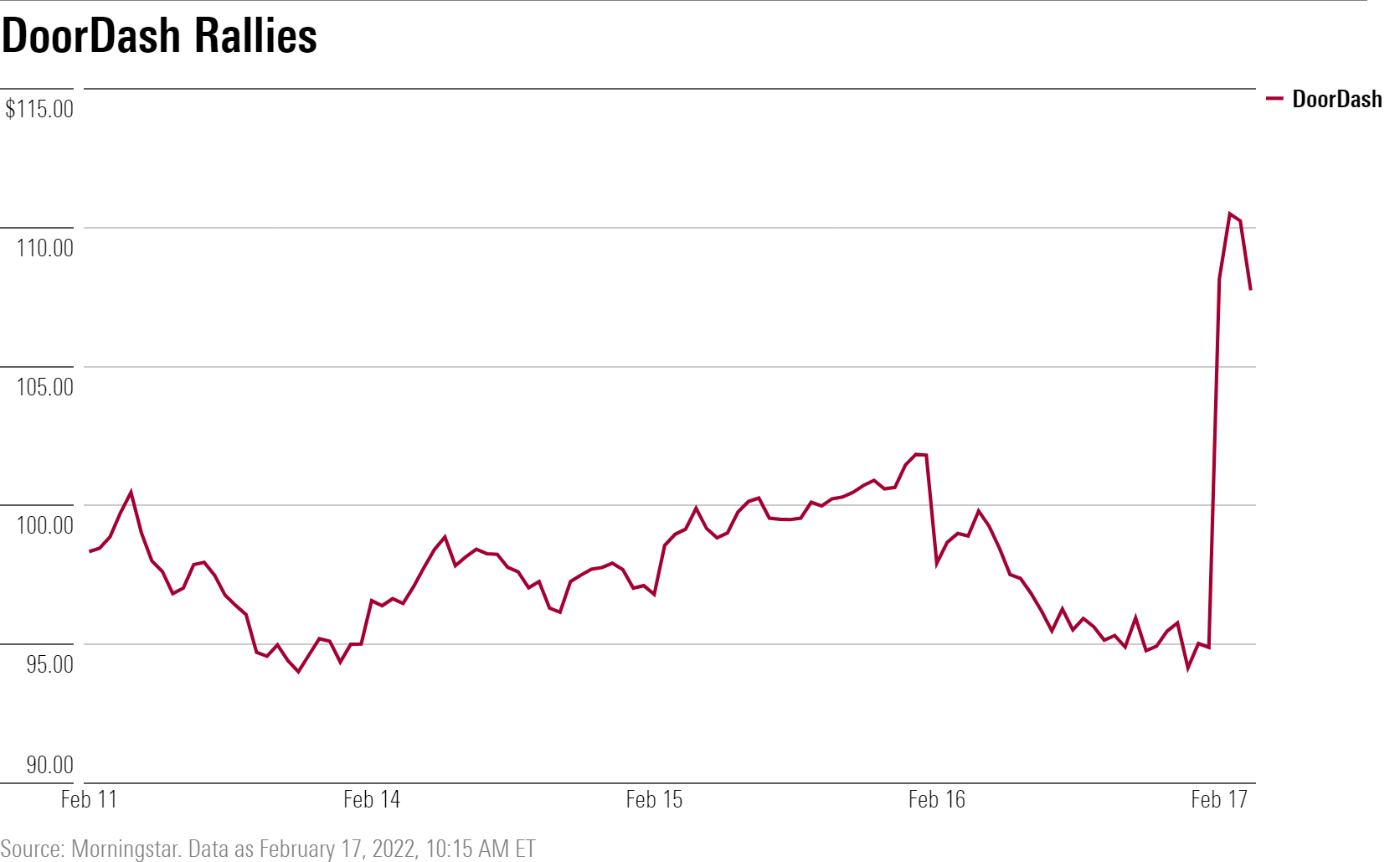

Shares in DoorDash DASH jumped as much as 20% Thursday after the food delivery firm beat earnings forecasts and insisted pandemic growth levels can be maintained in 2022.

The results show "the firm’s network-effect moat source remains intact, demonstrated by continuing growth in orders, order frequency, and merchants on the firm’s platform,'' according to Morningstar tech sector analyst Ali Mogharabi.

"We think DoorDash’s more aggressive investments to widen its delivery service and geography, combined with more couriers, could yield attractive returns in terms of more subscribers and higher frequency,'' Mogharabi says.

Thursday's rally came after a 35% year-to-date decline for the stock. The recent weakness matched that of other global food delivery companies like Just Eat Takeaway TKWY, off 12% this year, and Deliveroo ROO, down 30%. Despite the latest jump, DoorDash is trading at a 51% discount to Morningstar's new fair value of $163. Mogharabi raised the valuation estimate from $160 Thursday. Mogharabi also highlighted signs of improving demand, citing a 35% jump in total orders compared to the same quarter last year. Continued adoption of food delivery among consumers and DoorDash's branching out into delivering goods other than food helped with the expansion, he wrote in a note.

"With additional delivery service categories, DoorDash appears to keep consumers on the platform longer, which has driven a higher subscriber count.''

First-Day Pop

DoorDash floated in late 2020 with an IPO price of $102. On the first day of trading, shares surged 80%. Its stock then rode repeated coronavirus waves, peaking at $245 in November 2021, before sliding to below $100 in a few months. The company has also been caught up in the recent tech sell-off, which claimed Facebook owner Meta Platforms FB as a casualty. But as that example showed, investors are looking for bargains in this beaten-up sector.

DoorDash bought Finland’s e-commerce platform Wolt in November 2021. Although at expensive terms, Mogharabi expects the deal to partially drive 18% annual growth for DoorDash in the next five years.

"As the network effect strengthens and consumer and deliverer acquisition costs decline, we expect further operating leverage leading to DoorDash generating operating income in 2023,'' he said.

/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31386fbf-60e6-4ce6-aad8-4a4cb1fc6847.jpeg)