Lessons From Vanguard Target-Date’s Capital Gains Surprise

Target-date funds are best kept where most of them are: in a tax-deferred account.

Vanguard's target-date series is making headlines this week because of an unusually high capital gains distribution that has riled investors in taxable accounts and drawn scrutiny from regulators. It has sparked debate over whether target-date funds are suitable for taxable accounts.

The answer is: It depends. Target-date funds remain viable options for investors with taxable money to invest for retirement, provided they understand the tax risks associated with capital gains distributions and interest payments from taxable bonds. For investors in retirement, however, coming up with a sound withdrawal strategy is key to successful retirement spending and that’s something target-date funds aren’t currently equipped to help with.

Capital Gains Distributions: How They Work

Investors who opt to put taxable money in target-date mutual funds should bear in mind they are just as susceptible to forced selling from redemptions as any other open-end fund. The problem is specific to the investment vehicle, not the underlying strategy. Target-date funds take in investors’ cash and invest it, usually in other mutual funds, and give them shares of the target-date fund in return. If enough investors ask for their cash back, it triggers selling to meet those share redemptions. When target-date managers sell underlying holdings with embedded capital gains and can’t find any other underlying investments that generated capital losses to offset those gains, they must distribute capital gains to the remaining shareholders. If the investments sold were owned by the fund for less than one year, they are considered short-term and taxed as ordinary income at the investor’s highest tax bracket (up to 37% in 2021) plus any state income taxes. If the investments sold were held for longer than one year by the fund, those are considered long-term gains and are taxed at a more favorable 20% rate.

Problems for Larger Investors

Most investors using target-date funds don’t have to worry about tax-efficiency because they own them in tax-advantaged accounts like their company’s 401(k) or an individual retirement account. For example, Vanguard reports 99% of its target-date series shareholders own it in a tax-deferred account. For those shareholders, capital gains distributions are nonevents.

Only investors fortunate enough to max out annual contributions to 401(k)s ($20,500, or $27,000 for those over 50, in 2022) and IRAs ($6,000, or $7,000 for over 50) and still have significant additional assets to invest face potentially painful tax bills. That's not a luxury most investors have. Indeed, the median 401(k) balance was $34,000 at the end of 2020, according to a Vanguard study. With that in mind, it's mostly larger individual investors who need to beware capital gains from target-date funds, not smaller investors, despite what some media reports may have suggested.

Why Some Shareholders in Vanguard’s Target-Date Funds Saw a Spike in Capital Gains

At the end of 2021, shareholders of the investor share class of Vanguard Target Retirement were distributed capital gains that ranged from 3% to 15%, depending on the retirement vintage. What was most unusual about the capital gains distribution at Vanguard is that Vanguard indirectly caused it. The groundwork for the capital gains was laid in December 2020 when Vanguard reduced the minimum investment for the institutional share class of the series to $5 million from $100 million. The lower minimum made an additional 8,500 401(k) plans with approximately 3.2 million participants eligible to invest in the institutional share class, according to Morningstar data matched with Form 5500 data for 2019, the most recent data available. Creating more access to ultra-cheap shares (the institutional shares charge 0.09%) fits with Vanguard’s ethos.

For plans that already invested in the investor shares and met the new minimum, upgrading to the cheaper share class was a no-brainer. However, since Vanguard launched the institutional shares as a separate mutual fund in 2015, instead of a new share class, the investor funds had to sell holdings to meet the redemptions that would be reinvested in the cheaper shares. That triggered the realization of the long-term gains that were distributed.

For the 1% of shareholders that own the series in a taxable account, the capital gains would have been a surprise because the series hasn’t historically distributed large gains.

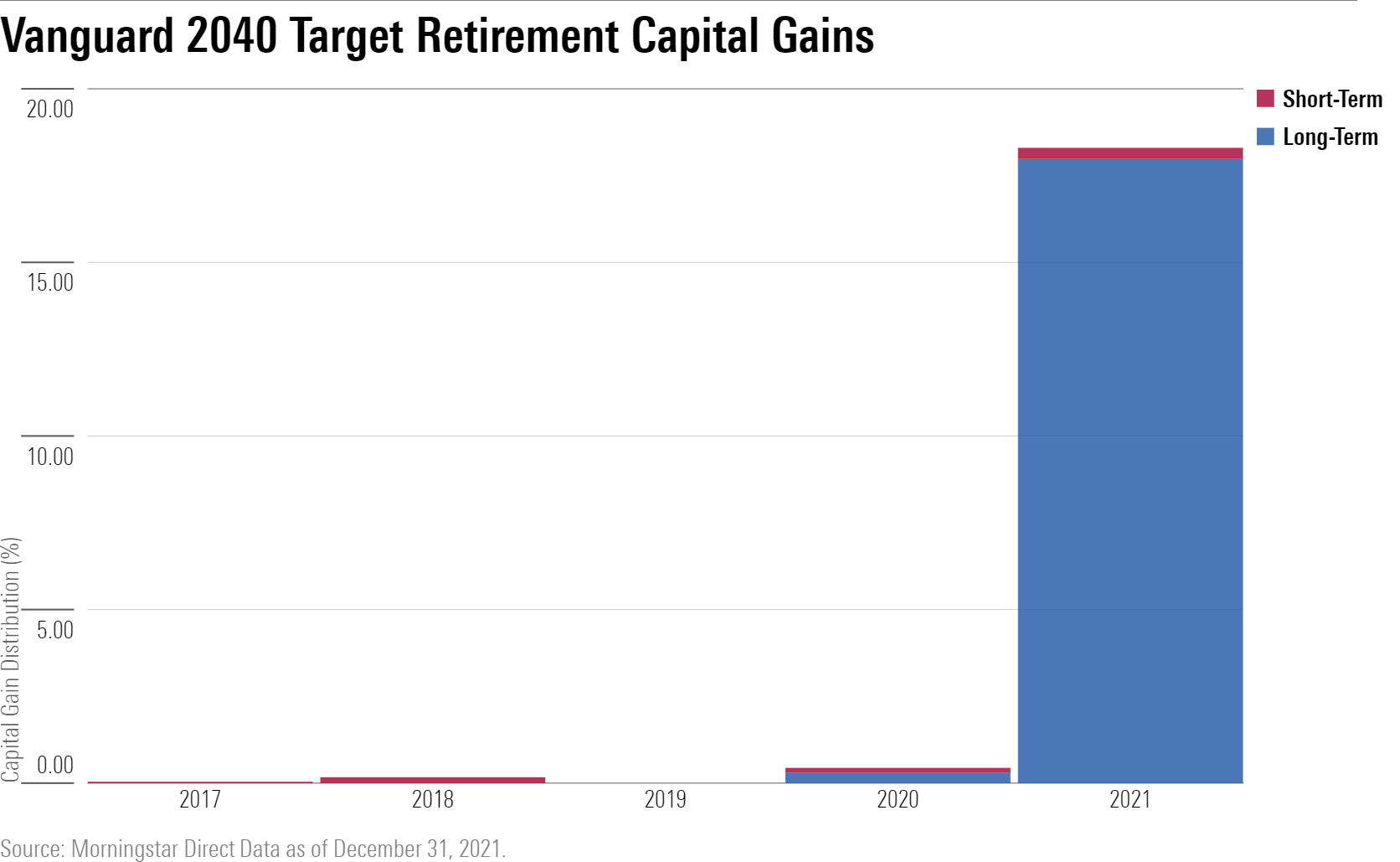

Vanguard Target-Date’s Capital Gains Track Record

Exhibit 1 shows the capital gain distributions for Vanguard Target Retirement 2040 VFORX over the past five years. This fund saw the largest distribution among the series in 2021.

It’s easy to see why this year’s distribution might have shocked investors. In previous years, capital gain distributions were minimal. That’s in large part to the series generally enjoying strong inflows and not having to sell its underlying holdings to meet redemptions. A steady flow of fresh investments also means the managers can rebalance the portfolio using money coming into the series. For example, if Vanguard Total Stock Market VTSMX, the series’ U.S. stock fund, gets too large relative to its strategic asset allocation because it’s performing better, the managers can direct new investments to the other parts of the portfolio to bring it back in line without selling the U.S. stock fund.

On the plus side, almost all the capital gains distributed in 2021 were long-term, which means they are taxed at a more favorable rate (up to 20% depending on income level) than short-term gains or income generated by underlying securities (both are taxed as ordinary income, or 37% for those that land in the top tax bracket).

Outflows Spur Capital Gains at Other Series, Too

Vanguard may have unwittingly caused its target retirement series’ capital gains distribution, but other target-date providers have also made sizable capital gains distributions after significant outflows. In 2021, Fidelity Freedom, T. Rowe Price Retirement, and J.P. Morgan SmartRetirement saw the largest net outflows among target-date mutual funds and distributed capital gains as a result. Exhibit 2 shows their 2021 capital gains distribution range across the series relative to Vanguard’s investor shares.

T. Rowe Price and Fidelity Freedom saw slightly higher short-term gain distributions in 2021 than Vanguard, though J.P. Morgan SmartRetirement had almost as high of long-term gains. Investors using these series in taxable accounts are prone to the same tax-drag as those in Vanguard’s investor share class.

Series with strong net inflows can still be subject to capital gain distributions. In April 2021, the managers of the American Funds Target Retirement series made changes to the underlying funds to allows the series' proven stock-pickers to exercise greater control of its U.S./non-U.S. equity split. Those changes contributed to capital gains distributions of 1% to 5% across the series’ R6 share classes.

Tax Considerations Beyond Capital Gains

Capital gains distributions are only one potential source of frustration for target-date investors inside taxable accounts. For fixed-income, the series use taxable bonds. The interest payments from those fixed-income holdings are taxed as ordinary income when they are distributed to shareholders (taxable-bond funds are notoriously poorly suited for taxable accounts). Income from stock dividends is taxed in a similar manner, which could lead to slightly higher taxable distributions when dividend-paying stocks play a large role in the glide path.

There may also be times when net new investments aren’t enough to help rebalance. Then a series could be forced to sell winners to buy underperformers to keep the strategic asset allocation in line. This is most likely during extreme market events like the pandemic-driven stock sell-off in 2020’s first quarter.

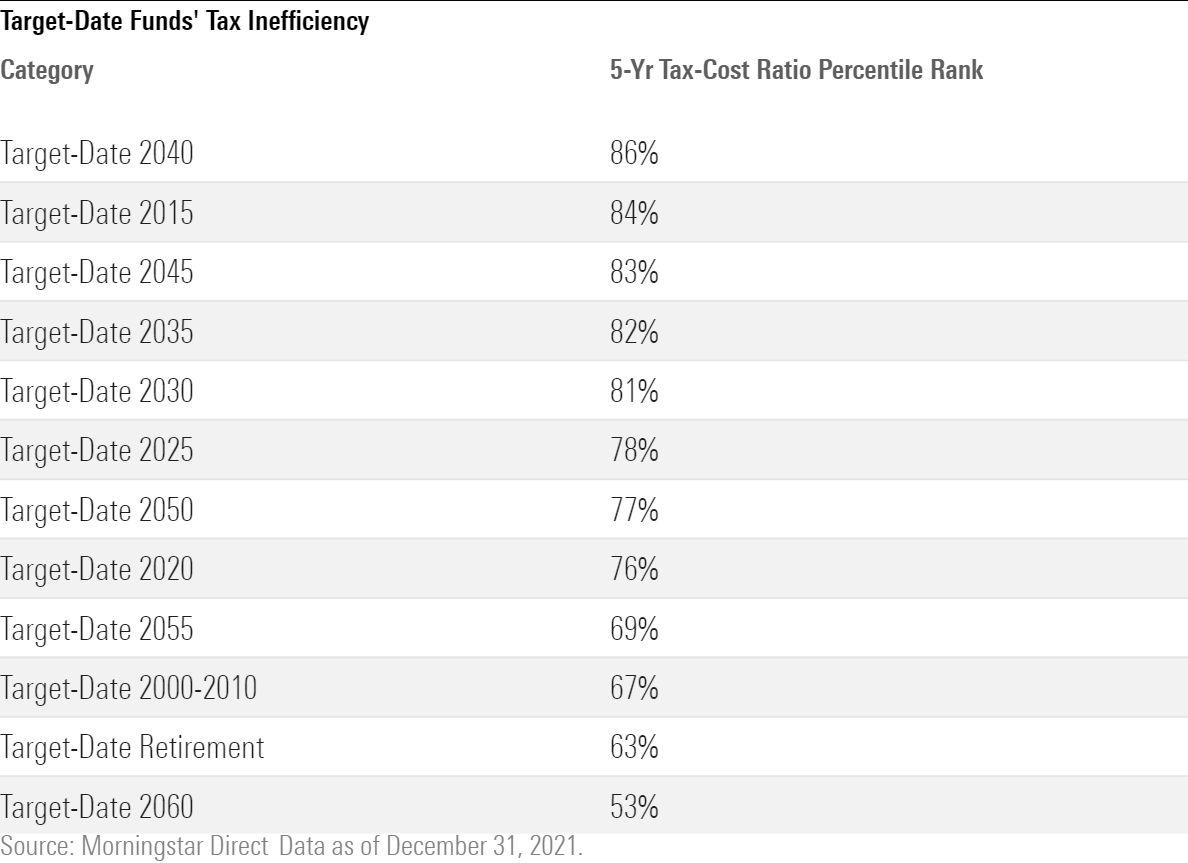

A Single Measure for Taxable Distributions: Morningstar’s Tax-Cost Ratio

The Morningstar Tax-Cost Ratio measures the impact of all taxable distributions on a fund’s total returns, whether capital gains from stocks or interest payments from bonds. Target-date categories do tend to have higher tax-cost ratios than other Morningstar Categories. Exhibit 3 shows the five-year tax-cost ratio rank of target-date fund categories relative to all categories (a lower number is worse).

Indeed, each target-date fund category ranks in the bottom half of Morningstar Categories for tax-efficiency when capital gains and income distributions are considered.

Don’t Let Uncle Sam Force You Into Portfolio Management

“Yet, investors with money left after maxing out their tax-deferred contributions shouldn’t necessarily kick target-date funds to the curb.”

As my colleague John Rekenthaler has pointed out, many of the recent criticisms of target-date funds hold little water. Claims that they don’t own enough stocks for investors near retirement fall apart in reality. As we’ve covered previously, near retirement target-date funds saw large redemptions in the 2020 bear market as investors couldn’t stick with the funds through that volatility. As many have said, having a less optimal investment strategy that someone can stick with is better than an optimal one that investors are likely to bail on during turbulence.

Of course, target-date funds aren’t the best option for every investor in every stage of life. In retirement, for example, target-date funds have yet to solve the retirement-income Rubik’s Cube. Some have begun adding guaranteed income as part of the glide path, but it’s far too early to tell how successful that will be. For more complex financial situations like determining a safe withdrawal rate, investors may want to consult a financial advisor.

The appeal of target-date funds comes from handing off decisions like asset allocation, fund selection, rebalancing, and the gradual lowering of risk as one nears retirement to professional portfolio managers at typically a much lower cost than a financial advisor would charge. For investors without the time or inclination to handle those decisions themselves or with a financial advisor, target-date funds are easy to buy and effective to hold, so long as investors understand what they’re getting into, taxes and all.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)