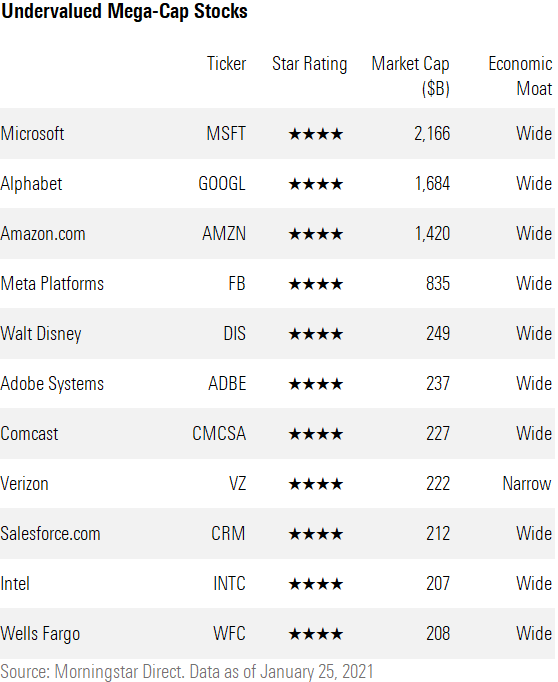

11 Undervalued Mega-Cap Stocks to Consider

The downturn in the market this year has pushed numerous mega-cap stocks into buying range.

Mega-cap stocks are some of the largest and best-known companies in the world. The definition of a mega-cap stock may differ among investors, but for this article, we define mega-cap companies as those with market capitalizations in excess of $200 billion that are included in the Morningstar U.S. Market Index, a broad proxy for the U.S. equity market.

Since the beginning of the pandemic, many mega-cap stocks have soared higher as they were able to capitalize on the changes brought about in consumer behaviors. Other mega-cap stocks rose as some investors sought out the safety of large-cap stocks.

Before the pandemic, 27 companies from the index had market caps above $200 billion as of Dec. 31, 2019, with a total market capitalization of $11.4 trillion. At that time, of those 27 companies:

- Seven were undervalued and had Morningstar Ratings of 4 stars

- 12 were fairly valued and rated 3 stars

- The remaining eight were overvalued and rated 1 or 2 stars.

As of Jan. 25, the index includes 38 companies with market capitalization of $200 billion or more. The total market cap of the mega group today is $19.5 trillion. Of those 38 companies:

- 11 are undervalued and rated 4 stars

- 15 are fairly valued and rated 3 stars

- The remaining 12 are overvalued and rated 1 or 2 stars.

Here are the 11 undervalued mega-cap stocks that we think investors should consider.

Here's an in-depth look at the business strategies of two of the names from the list--plus one company that lands just outside of the mega group that we find compelling. Premium Members can dig into the research and ratings for the remaining companies on each stock's individual analyst report.

Alphabet

“Alphabet dominates the online search market with Google’s global share above 80%, via which it generates strong revenue growth and cash flow. We expect continuing growth in the firm’s cash flow, as we remain confident that Google will maintain its leadership in the search market. We foresee YouTube contributing more to the firm’s top and bottom lines, and we view investments of some of that cash in moonshots as attractive. Whether they will generate positive returns remains to be seen, but they do present significant upside.

"Google’s ecosystem strengthens as its products are adopted by more users, making its online advertising services more attractive to advertisers and publishers and resulting in increased online ad revenue, which we think will continue to grow at double-digit rates after the pandemic and during the next five years. The firm utilizes technological innovation to improve the user experience in nearly all its Google offerings, while making the sale and purchase of ads efficient for publishers and advertisers. Adoption and usage of mobile devices has been increasing. The online advertising market has taken notice and is following its target audience onto the mobile platform. We have seen Google partake in this on the back of its Android mobile operating system’s growing market share, helping it drive revenue growth and maintain its leadership in the space.

"Among the firm's investment areas, we particularly applaud the efforts to gain a stronger foothold in the fast-growing public cloud market. Google has quickly leveraged the technological expertise it applied to creating and maintaining its private cloud platform to increase its market share in this space, driving additional revenue growth, creating more operating leverage, which we expect will continue. Regarding Alphabet's more futuristic projects, although most are not yet generating revenue, the upside is attractive if they succeed, as the firm is targeting newer markets. Alphabet's autonomous car technology business, Waymo, is a good example: Based on various studies, it may tap into a market valued in the tens of billions of dollars within the next 10-15 years."--Ali Mogharabi, Senior Equity Analyst

Amazon.com

“Amazon dominates its served markets, notably for e-commerce and cloud services. It benefits from numerous competitive advantages and has emerged as the clear e-commerce leader given its size and scale, which yield an unmatched selection of low-priced goods for consumers. The secular drift toward e-commerce continues unabated with the company continuing to grind out market share gains despite its size. Prime ties Amazon’s e-commerce efforts together and provides a steady stream of high margin recurring revenue from customers who purchase more frequently from Amazon’s properties. In return, consumers get one-day shipping on millions of items, exclusive video content, and other services, which result in a powerful virtuous circle where customers and sellers attract one another. The Kindle and other devices further bolster the ecosystem by helping attract new customers, while making the value proposition irresistible in retaining existing customers. Through Amazon Web Services, Amazon is also a clear leader in public cloud services.

"Additionally, the firm’s advertising business is already large and continues to scale, thus offering an attractive option for marketers looking to access a vast audience with a variety of proprietary data points about those very consumers. AWS, advertising, and subscriptions are growing faster than e-commerce with the exception of the 2020 spike in online shopping. We expect these three areas to be the main growth drivers over the next several years. This is critical, as each of these segments drives higher margins than the corporate average, which in turn should allow both operating profit and EPS to outgrow revenue as margins continue to expand.

"From a retail perspective, we expect continued innovation to help drive further share gains. We also look for continued penetration into categories such as groceries and luxury goods that have not previously translated into the same level of success as other retail categories. We also see technology advancements in AWS and a bigger push to service enterprise customers as helping to sustain the company's lead there. Overall, we see strong revenue and free cash flow growth for years to come." --Dan Romanoff, Senior Equity Analyst

AT&T

AT&T's stock price has been under pressure, and its market cap has recently slipped to $190 billion; AT&T therefore isn’t technically a mega-cap stock; however, we couldn’t help but discuss it here because we think it’s a compelling valuation story with ongoing hard catalysts that will help unlock shareholder value.

“We believe AT&T’s management is now putting the firm on the right path, shedding assets and teaming WarnerMedia with Discovery in a structure that makes strategic sense. The remainder of AT&T will refocus on the telecom business, investing aggressively to extend its fiber and 5G networks to more locations, which we believe will build on the firm’s core strengths.

"AT&T is now the third largest wireless carrier in the U.S., but we believe it has adequate scale relative to Verizon and T-Mobile to generate solid profitability. AT&T also benefits from its ownership of deep network infrastructure across much of the U.S. and its ability to provide a range of telecom services, particularly among enterprise customers. The plan to extend fiber to 3 million homes and businesses annually through at least 2025 builds on this position and should allow it to serve those locations directly and enhance wireless coverage in the surrounding areas.

"Also, we believe the T-Mobile merger greatly improved the industry’s structure, leaving three players with little incentive to price irrationally in search of short-term market share gains. We don’t believe Dish Network presents a credible threat to the traditional wireless business. AT&T is also positioned to benefit as Dish builds out a wireless network as the firms recently signed a 10-year wholesale agreement that generates revenue for AT&T and gives it access to Dish spectrum.

"AT&T shareholders will own 71% of the new Warner Bros. Discovery. Warner remains a media powerhouse in its own right, with a deep content library and the ability to reach audiences across a wide variety of platforms. The firm's direct-to-consumer plans around HBO Max are gaining momentum, which should nicely augment and eventually supplant traditional distribution channels like cable TV. Adding Discovery's nonscripted prowess and international presence should give the new firm wider options to craft service offerings. Placing Warner under Discovery management as a stand-alone firm brings focus and the flexibility to pursue a wide array of distribution partnerships."--Michael Hodel, Director of Equity Research

In our next article, we will review those 12 overvalued mega-cap stocks to avoid.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)