Financial Stocks Look Rich, but Macro Uncertainties Unlock Some Bargains

Concerns about inflation, monetary policy, and interest rates dinged performance during 2021's fourth quarter.

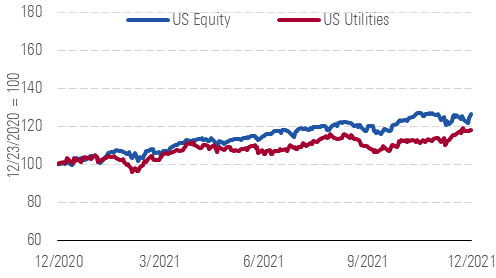

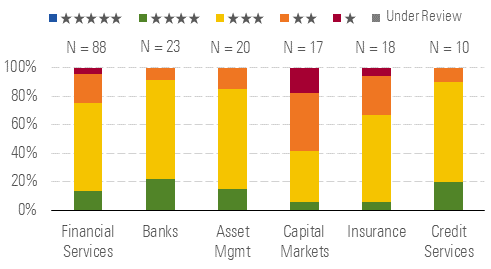

The Morningstar US Financial Services Index materially outperformed the Morningstar US Markets Index over the previous year, returning 29.9% compared with 26.3%, but underperformed in the previous quarter, up 2.4% compared with the market that's up 8.6% (Exhibit 8a). The median North American financial sector stock trades at a 2% premium to its fair value estimate compared to about a 7% premium at the end of both the fourth quarter of 2020 and third quarter of 2021. We currently rate about 15% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks with about 60% being rated fairly valued 3-star stocks and 25% rated overvalued 2- and 1-star stocks.

Financials Underperformed in Q4

Source: Morningstar analysts, U.S. Federal Reserve, St. Louis Federal Reserve Bank.

There Are Nearly as Many Undervalued as Overvalued Stocks

Source: Morningstar analysts, U.S. Federal Reserve, St. Louis Federal Reserve Bank.

Interest rates, which are a key driver of financial sector earnings, are widely expected to move higher over the next year. The Federal Reserve has a dual mandate of maximum sustainable employment and price stability. The unemployment rate has been improving, reaching 4.2% in November 2021 from 6.7% at the end of 2020 and a recent peak of 14.8% in April 2020. The improving unemployment rate and overall strengthening of the economy have led monetary authorities to ease back on its accommodative policies, such as by accelerating its tapering or scaling back of its monthly net purchases of Treasury and agency mortgage-backed securities.

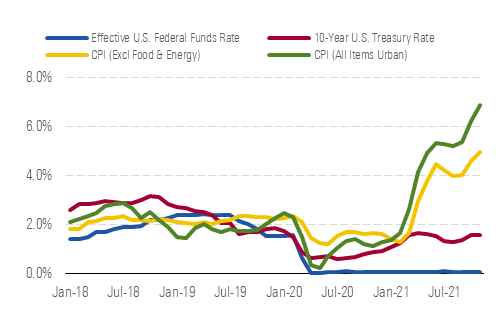

Inflation hasn't been as transitory as many originally thought. Inflation started the year around 1.5%, but since April, the Consumer Price Index excluding food and gas prices has averaged about 4%, while the Consumer Price Index including food and gas has averaged above 5% and recently has been above 6%. A mismatch of supply and demand with goods being logjammed at ports and shortages in key inputs, such as microchips, have been blamed.

Inflation Has Remained High

Source: Morningstar analysts, U.S. Federal Reserve, St. Louis Federal Reserve Bank.

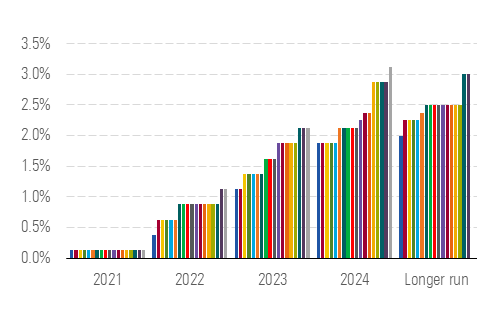

The unemployment rate and inflation currently point to a tightening of monetary policy; however, COVID variants like omicron could reduce demand and GDP growth. If demand were to take a step back and stagflation were to occur, the Federal Reserve could hold off from raising interest rates. As of the December Federal Open Market Committee meeting, a majority of FOMC participants believed three interest rate hikes in 2022 to a range of 0.75%-1% as appropriate.

FOMC Expects Multiple Interest Rate Increases in 2022

Source: Morningstar analysts, U.S. Federal Reserve, St. Louis Federal Reserve Bank.

Top Picks

American International Group

AIG

Star Rating: ★★★★

Economic Moat Rating: None

Fair Value Estimate: $65

Fair Value Uncertainty: Medium

American International Group announced upcoming changes to its management team and its intention to separate its property/casualty and life insurance operations. At the start of March 2021, Peter Zaffino took over as CEO, with former CEO Brian Duperreault moving to executive chairman. Arguably, Duperreault’s work as CEO remained unfinished, but Zaffino has been a key lieutenant in the company’s turnaround efforts, and we see this move as confirmation that AIG will maintain its positive course. From a strategic point of view, we also like AIG’s announced intention to separate its life insurance operations.

BRK.B

Star Rating: ★★★

Economic Moat Rating: Wide

Fair Value Estimate: $320

Fair Value Uncertainty: Medium

We continue to be impressed by Berkshire Hathaway's ability to generate high-single- to double-digit growth in book value per share. We believe it will take some time before the firm succumbs to the impediments created by its size and that the ultimate departure of CEO Warren Buffett (and Vice Chairman Charlie Munger) will have less of an impact on the business than many might think. Berkshire currently has a ton of cash on hand and a disciplined approach to share repurchases, which we think can be sustained at $5.5 billion quarterly, making it an ideal defensive name in a slowing economy or down market.

C

Star Rating: ★★★★

Economic Moat Rating: Narrow

Fair Value Estimate: $83

Fair Value Uncertainty: Medium

Citigroup is the most undervalued traditional U.S. bank under our coverage and is trading below tangible book value. The bank is busy shedding non-performing segments, refocusing its operations on core competencies and geographies, and is dealing with consent orders from regulators. Further, Citigroup is not one of the most rate sensitive names, which we think contributes to its current lack of popularity. While the bank faces some headwinds, we think a recovery in card balances, in the U.S. and abroad, will help to drive revenue growth for the bank. We also think a resolution of consent orders should serve as a catalyst.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)