Taking Stock of China’s Bond Market

A primer on the Chinese bond market and the ETFs offering exposure to it.

A version of this article previously appeared in the October 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

The Chinese economy is a juggernaut; its bond market is a burgeoning superpower. As of the end of 2020, the Chinese bond market was the world’s second-largest. The total value of Chinese bonds stood at nearly $19 trillion, representing 15% of the global bond market.

Today, Chinese bond yields are materially higher relative to the United States, United Kingdom, and eurozone. And Chinese bond prices are not highly correlated with either U.S. Treasuries or the U.S. stock market. At face value, this would appear to make them a decent diversifier in a U.S.-centric portfolio. But an allocation to Chinese bonds isn’t a free lunch. Despite its size, this market is still in its infancy, and there are many complications and nuances investors must consider. Also, just a couple of exchange-traded funds currently provide exposure exclusively to the Chinese bond market, and the several ETFs that hold sizable allocations to China in their portfolios have disparate goals and exposures.

Nonetheless, exposure to the Chinese bond market has the potential to complement a core holding. Here, I provide an overview of the Chinese bond market and assess the ETF options offering exposure to it.

China’s Bond Market

The Chinese bond market consists of three submarkets, defined by where bonds are issued and their currency denomination.

The largest is the Chinese onshore local-currency bond market. These are bonds issued in mainland China and denominated in renminbi. Totaling $17.5 trillion, this is easily the largest of the three submarkets. Most Chinese government and policy bank bonds are issued in mainland China in renminbi. These bonds’ relatively high yields and low credit risk make this submarket the most attractive.

The second-largest submarket is the Chinese onshore hard-currency bond market. These are bonds issued by China or Chinese entities in mainland China in developed-markets currencies, usually U.S. dollars. Corporate bonds account for the largest slice of this pie.

The third submarket is the Chinese offshore local-currency bond market. These are bonds issued outside of mainland China (primarily Hong Kong) and denominated in renminbi.

Within these three submarkets, there are generally three categories of issuers: governments, policy banks, and corporates.

Government bonds include Treasury bonds issued by China’s Ministry of Finance and bonds issued by local government entities (akin to municipal bonds in the U.S.). Per Bloomberg data, local government bonds were the largest issuer class in China, accounting for nearly 23% of the total onshore local-currency market, as of the first quarter of 2021. The local government debt market was tiny before 2015 and has mushroomed since, as the Chinese government allowed local governments’ financing vehicles to swap their debt for government and muni bonds to boost local governments’ credit profiles and reduce their borrowing costs. The Chinese Treasury bond market is actually smaller than the local government bond market, accounting for just 18% of the onshore local-currency market as of 2021.

Policy bank bonds are sometimes categorized under the umbrella of government bonds but they have been separated from government bonds by major index providers. The State Council of China created three policy banks to foster economic growth: the China Development Bank, the Export-Import Bank of China, and the Agricultural Development Bank of China. These bonds are considered risk-free assets because they are explicitly backed by the Chinese government. But policy bank bonds typically provide slightly higher yields than Chinese Treasury bonds as their tax treatment is less favorable for domestic Chinese investors. The size of the policy bank bond market is roughly the same as the Chinese Treasury bond market, but policy bank bonds are more liquid.

The Chinese corporate bond market is diverse and fragmented. It is dominated by state-owned enterprises, as companies without explicit government support were largely prohibited from issuing bonds until 2007. State-owned enterprises still account for most of the market today. Approximately 97% of Chinese local-currency corporate bonds are rated AA or higher; this can make it hard to gauge the credit risk of Chinese companies from their credit ratings, as the local scale they are rated on lacks meaningful depth. While many Chinese firms have received below-investment-grade credit ratings, they are exclusively hard-currency bonds.

Historically, foreign investors’ access to the Chinese bond market was restricted to the hard-currency and offshore local-currency markets. Two recent events opened the local-currency market, enabling international participation in the Chinese Treasury and policy bank markets. The inception of Bond Connect in 2017 streamlined market access for non-Chinese investors, while the inclusion of Chinese local-currency government bonds in major bond indexes invited greater participation. As of October 2021, three major bond index providers have included (or have announced they will include) Chinese Treasury bonds: Bloomberg (as of April 2019), JPMorgan (as of February 2020), and FTSE Russell (as of October 2021). Policy bank bonds are included in Bloomberg indexes only.

ETFs Offering Chinese Bond Market Exposure

As of October 2021, two ETFs provided pure exposure to the onshore local-currency market: Krane Shares China Credit Index ETF KBND and VanEck China AMC China Bond ETF CBON. The ETFs manage exposure to Treasury bonds, policy bank bonds, and corporate bonds so that the sector weight at each rebalance is 25%, 25%, and 50%, respectively, for KBND, and 20%, 30%, and 50%, respectively, for CBON. CBON launched in November 2014, while KBND began tracking its current index in June 2021.

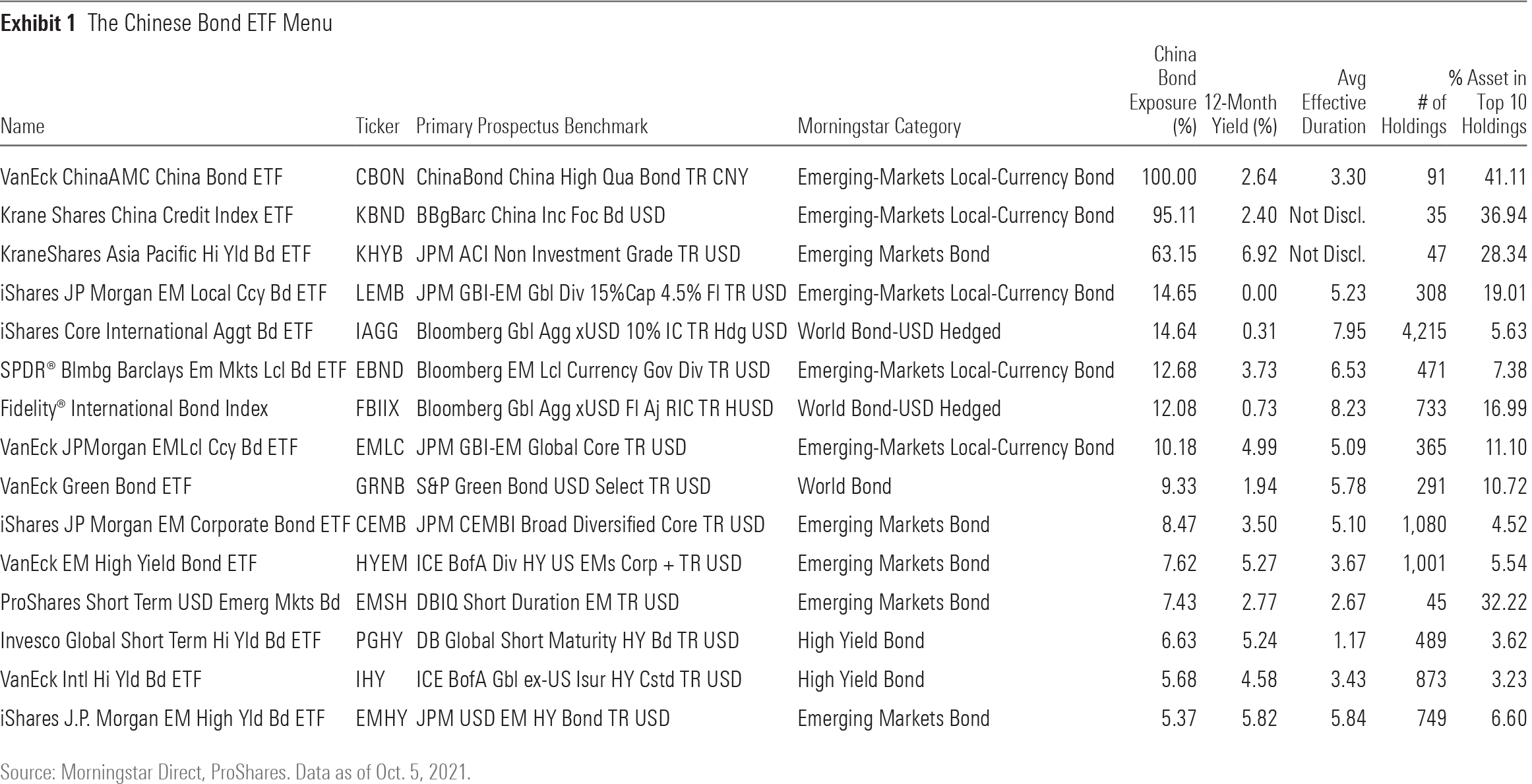

Although pure-play options are limited, several ETFs have sizable allocations to Chinese bonds; as of October 2021, 13 ETFs had allocations of at least 5%. But as seen in Exhibit 1, they are a motley crew.

The choice between pure-play and non-pure-play is the primary consideration for exposure to the Chinese bond market. Each choice has pros and cons. Evaluating them requires an understanding of the risks entailed with each option.

Understanding the Risks

Chinese bonds offer higher yields than similar bonds from developed-markets issuers, but the extra yield is compensation for risk. Notably, the Chinese bond market is much less liquid than the U.S. investment-grade bond market, so information is incorporated into prices less quickly and less reliably. For example, the International Monetary Fund noted that, as of 2017, Chinese banks owned 70% of all Chinese Treasury bonds and tended to hold them until maturity. Gleaning useful information from the market is also difficult for corporate bonds given the lack of granularity that characterizes the onshore market’s credit rating scale, as nearly all Chinese corporate bonds receive AAA or AA ratings from Chinese credit rating agencies.

Pure-play exposure to the Chinese bond market is a risky proposition. In addition to the risks inherent in Chinese debt, the two funds currently offering pure-play exposure hold compact and heavily concentrated portfolios. Consequently, the poor performance of one corporate issuer could have a material impact on performance.

Non-pure-play exposure to Chinese debt entails a smorgasbord of risk. For instance, local-currency emerging-markets bond funds tend to offer exposure to at least a dozen other currencies, and the issuers represented often lack the attributes that make Chinese debt appealing (such as growth and stability). Diversified hard-currency emerging-markets bond funds court a lot of exposure to credit risk by either restricting their remit to corporate bonds or non-investment-grade bonds.

An ETF offering exposure to the investment-grade ex USD global-bond market is the most prudent option for non-pure-play exposure. These ETFs tilt heavily toward China, providing attractive yields without incurring much credit risk. But hedging currency risk also damps diversification potential from a U.S. investor’s perspective.

Putting It All Together

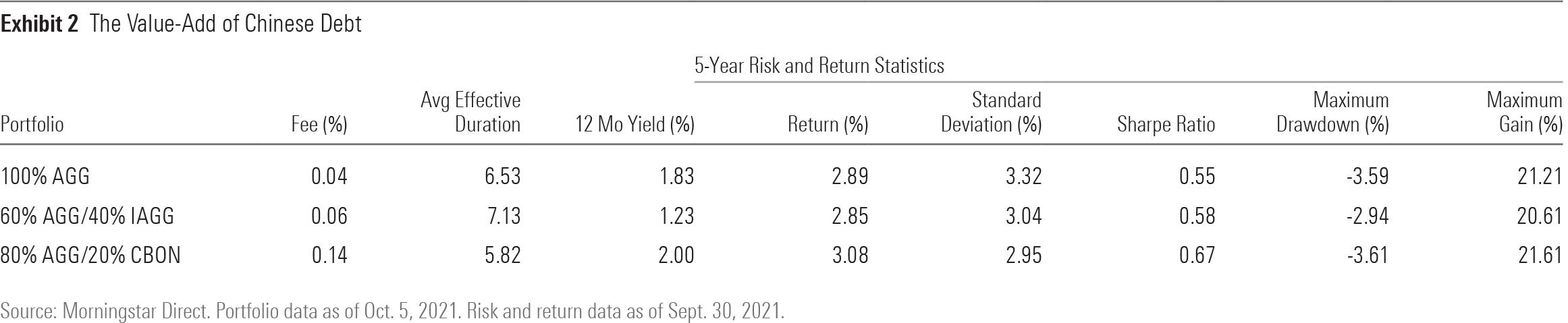

Despite the risks, exposure to local-currency Chinese debt can add value to a bond portfolio. Exhibit 2 depicts the performance of three bond portfolios over five years through September 2021. The three portfolios represent a core bond holding without any Chinese debt exposure (iShares Core U.S. Aggregate Bond ETF AGG), a core bond holding with non-pure-play Chinese debt exposure via an investment-grade ex USD global-bond ETF (60% AGG and 40% iShares Core International Aggregate Bond ETF IAGG), and a core bond holding with Chinese debt exposure through a pure-play ETF (80% AGG and 20% CBON). The core bond holding without Chinese debt provided the least-attractive risk-adjusted performance.

Of course, the past is not a prologue, and there is no guarantee the next five years will produce the same result. Interest rates were volatile in the U.S. during the prior five years, which was detrimental to AGG’s performance given its tilt toward U.S. Treasuries. And IAGG did not hold any Chinese debt until April 2019, so its performance will likely be more volatile in the future. But the diversification and additional yield provided by local-currency Chinese bonds should continue as its bond market continues to mature and international participation continues to increase.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)