New(ish) Investor Tries to Beat Back ‘Fear of Missing Out’

A 20-something investor finds it hard to focus given her multiple competing goals.

Editor’s Note: This portfolio makeover is from 2021. Keep in mind that the current market environment may be different than when this makeover was executed.

Lily, a 29-year-old freelance content strategist, was bitten hard by the investing bug a few years ago. She has amassed nearly 100 holdings across her various accounts but wonders if her many stocks and funds make sense as a portfolio. “How do I keep from over-diversifying?” she asked. “When I started out in investing a few years ago, I tried to beat back FOMO with a stick, but it’s so hard to stay focused.”

She acknowledges that her individual equity holdings overlap with many of the funds in her portfolio, but uses exchange-traded funds as a simple way to put cash to work in the market. "Sometimes when I see the market is having a bad day, I'll jump on [my brokerage platform] and quickly throw some cash into my favorite ETFs," she wrote. "I know I should be dollar-cost averaging, but the temptation to time the market is just too strong."

Lily is single, but she'd like to get married, start a family, and buy a house within the next five to 10 years. Thus, part of her challenge is figuring out how to asset allocate a portfolio with so many goals on the horizon. "If I want to buy a house in five years, take a break from working while raising children, and then go back to work and eventually retire in 30 years ... how can I be assured that my money is properly allocated according to the various time horizons?" She says she likes the bucket approach but isn't sure how to put it into practice.

Lily earns a comfortable income of about $100,000 a year. Though she acknowledges that she doesn't have a savings target, she says she tries "to save as much as humanly possible."

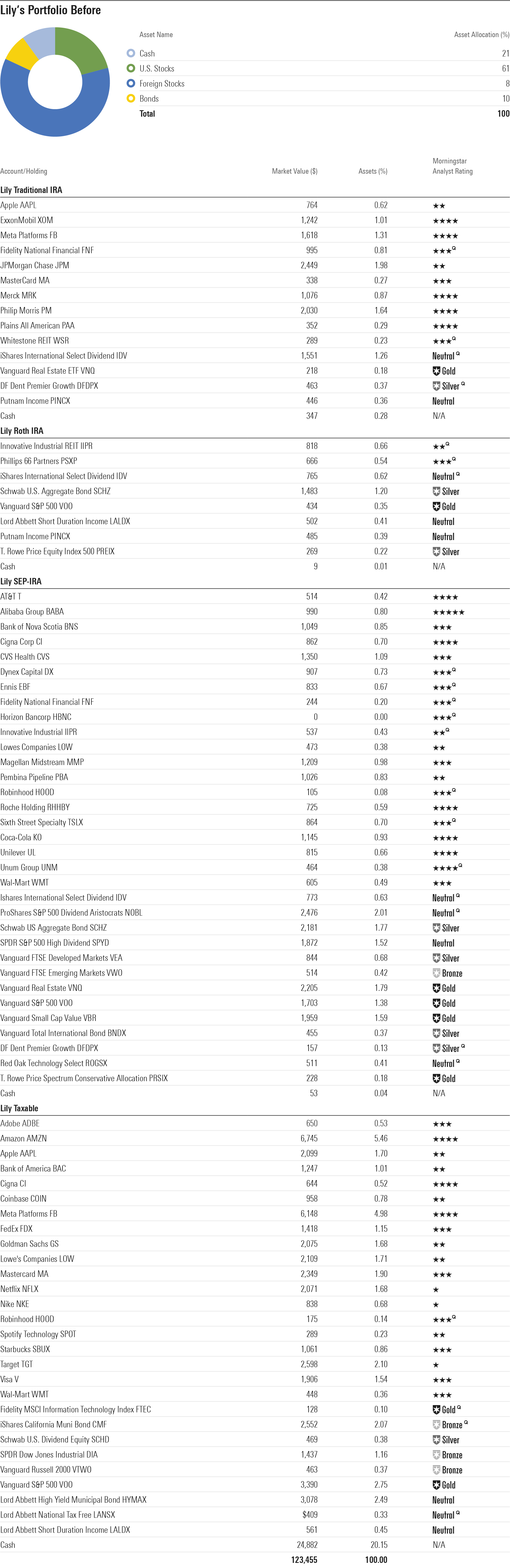

The Before Portfolio

Lily holds her portfolio in a few silos: a small Roth IRA, traditional and SEP-IRAs (a retirement account for self-employed individuals), and a taxable account. Each account holds a mix of mutual funds, mainly exchange-traded funds, as well as individual stocks. With 88 holdings, her total portfolio is diffuse: Her largest position amounts to 5% of assets, and some of her holdings are quite tiny. Lily also has a healthy cash hoard: Her total Before Portfolio includes 21% cash, 10% bonds, and 69% equity, mainly U.S.-focused. Her portfolio is well balanced across the Morningstar Style Box, though her holdings are a barbell: Her taxable account has a heavy growth bias, whereas her IRAs are value-focused.

Lily's taxable account is her largest and accounts for more than half of her assets. It includes a number of stocks, mainly growth-leaning names, as well as stock and bond mutual funds and ETFs. Lily's SEP, traditional, and Roth IRAs have a similar composition: She holds individual stock holdings as well as traditional mutual funds and ETFs.

When I asked Lily about her philosophy for choosing stocks, she noted that she's still experimenting and learning. "I look at a stock's P/E/ ratio, I check out the chart, and I try to figure out if the stock is overvalued. I really enjoy researching, and I want to carve out more time to fall further into the research rabbit hole. I know I should be digging deeper into the financials."

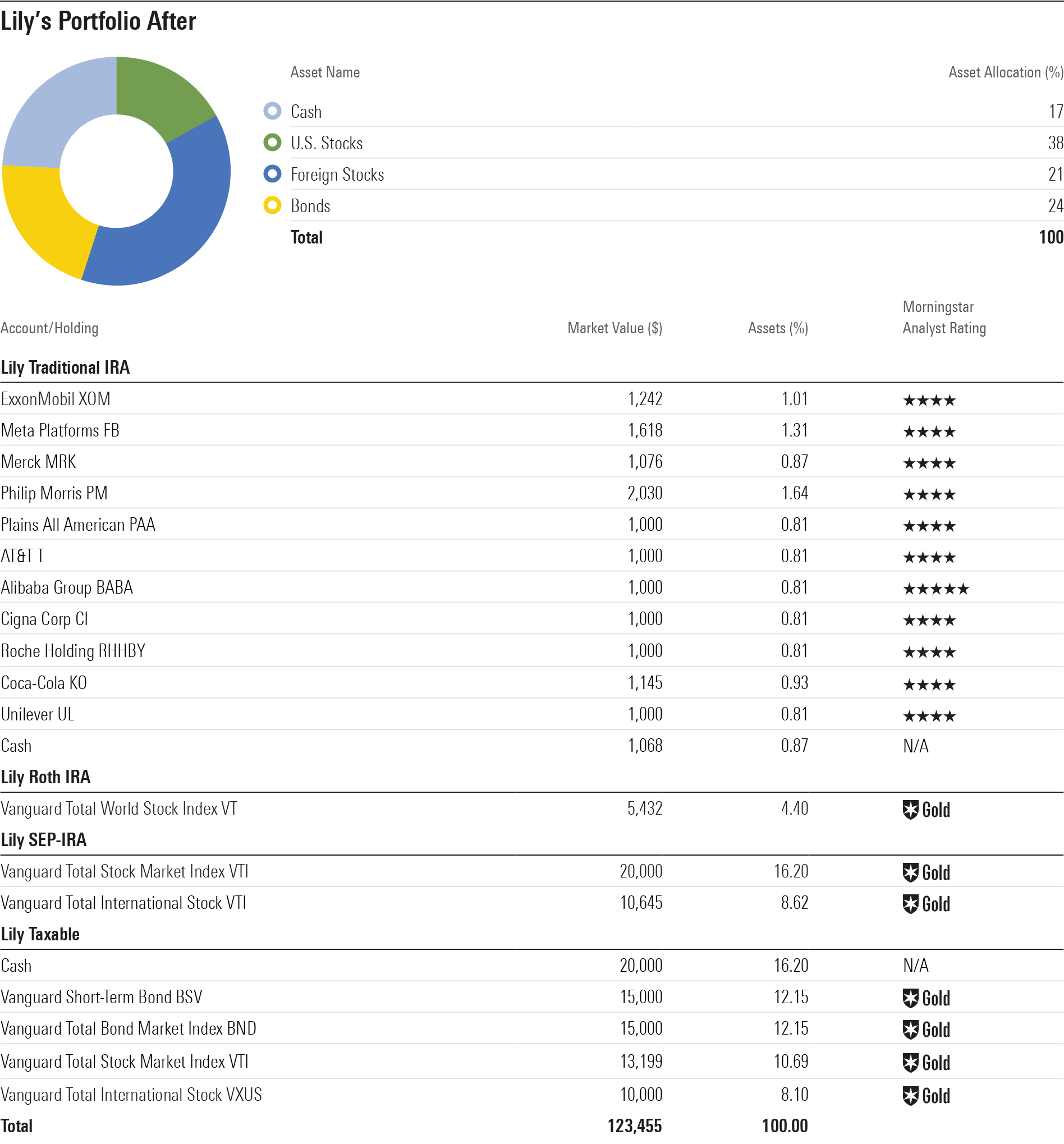

The After Portfolio

The starting point in Lily's situation is to set aside liquid reserves to serve as her emergency fund and to quantify her near- and intermediate-term spending goals--both amounts and proximity to needing the funds to spend. I targeted $20,000 to cover emergency expenses. If a home purchase is on the horizon within the next five years, she can set aside an additional $30,000 in short- and intermediate-term bond funds, as in my short-term model portfolio, and add to it on an ongoing basis as she bears down on a possible home purchase or some other near-term goal. I concentrated those savings in her taxable account, though she could also use her Roth IRA, where contributions can be withdrawn at any time without taxes or penalty. Her income puts her on the bubble for municipal bonds versus taxable bonds in this part of her portfolio. Yields are low across the board currently, but she picks up a slightly higher aftertax yield with taxable bonds than she would with munis today, even factoring in her high California state tax rate. I used plain-vanilla taxable-bond funds with very high credit qualities. As Lily reshuffles her portfolio, she'll want to keep an eye on the tax implications of selling appreciated holdings, scouting around for offsetting losses elsewhere in the taxable account.

Because holding so many disparate positions can obscure what's working in a portfolio and what's not, my After Portfolio steers most of her equity holdings into a radically simplified investment mix. The taxable account includes a broad-market U.S. equity ETF and an international counterpart for its equity exposure. Such a portfolio will tend to have the lowest drag from taxes on an ongoing basis and will have lower carrying costs than the basket of ETFs in her Before Portfolio.

Because her taxable portfolio will be her first stop for liquidity needs, my After Portfolio fully invests her IRAs into a globally diversified equity portfolio. I used total-market index funds for both her SEP and Roth IRAs. My After Portfolio also bumps up her non-U.S. position quite a bit. Lily's Before Portfolio was quite light on non-U.S. stocks, but they look more attractively valued than U.S. stocks today. I targeted a 2-to-1 U.S./non-U.S. ratio.

Lily is still learning and honing her investing strategy, so I like the idea of using a fairly small sleeve of her portfolio for individual-stock investing and any other categories she might choose to dabble in, such as small value or real estate. I chose the traditional IRA for the trading portfolio because Lily said that she loves dividend-paying stocks, which are tax-inefficient; she'll also be able to sell winners when they hit her price targets without worrying about taxes. On the other hand, she won't have the benefit of tax-loss harvesting as she would with her taxable account. For this portion of the portfolio, I cherry-picked the stocks with the highest Morningstar Ratings from Lily's Before Portfolio. Concentrating the stock picks in a single account will make it easier to monitor whether her stock holdings are managing to beat the total-market index funds elsewhere in her portfolio. If it turns out she's not adding value, there's no shame in switching to a simpler, index-focused strategy, and it will certainly require less oversight on an ongoing basis. I like the idea of Lily setting an upper limit on how much she'll hold in this trading account--10% of total assets, for example.

Editor’s note: Names and other potentially identifying details in portfolio makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice but rather to illustrate possible portfolio strategies for investors to consider in the full context of their own financial situations.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)