Is Vanguard Truly a High-Cost Provider?

The latest lawsuit against 401(k) plans.

A Special Breed

There’s something different about 401(k) plans.

Outside of the 401(k) system, fund-related lawsuits are rare. It’s essentially impossible to win a judgment against fund companies for overcharging. No plaintiff has ever succeeded, which means that not only do accusations of excessive cost inevitably fail, but fund companies won’t settle out of court. True, shareholders can prevail with fraud allegations, but such occasions are uncommon. The fund industry is highly regulated and substantially clean.

Among 401(k) plans, however, lawsuits are legion. Last year, plaintiffs filed more than 90 cases. Most actions, to be sure, have not been against fund companies. They have instead been peripheral attacks, with the complaint filed against the 401(k) plan's sponsor. Either way, though, the fund industry is under fire. And, over time, defendants have paid more than $1 billion in settlements.

The Case Against Deloitte

Last week witnessed yet another suit, Singh, Popkin, Walker, and Mark vs. Deloitte, LLP. The filing accuses Deloitte, its board of directors, and its retirement committee of breaching their fiduciary duties by "failing to control" expenses for Deloitte's 401(k) plan. States the claim, "additional fees … can have a large effect on a participant's investment results over time." It continues, "the higher the fees charged to a beneficiary, the more the beneficiary's investment shrinks."

No argument here. If Jack Bogle did not say those very words, he certainly could have. Except … the very company that he founded is the administrator and recordkeeper for Deloitte's 401(k) plan! How bizarre. I vowed to investigate this accusation that Vanguard overcharged its client. (In addition to suing Deloitte's 401(k) plan, the plaintiffs also targeted the company's profit-sharing plan. This column will not address that complaint.)

The plaintiff's primary assertion is accurate: The account fees for Deloitte's 401(k) plan are relatively steep. Typically, 401(k) providers are paid in two ways: 1) a flat fee, assessed to each account; and 2) fund expenses. (The latter arrives directly if employees own the provider's funds, and indirectly as reimbursements--or "kickbacks," as the critics say--if they invest elsewhere.) Per the suit, Deloitte's account fee in 2019 was $66, slightly above the industry median. Plaintiffs argue that amount should be lower, given that Deloitte's plan is much larger than most and that 401(k) plan sponsors are expected to negotiate volume discounts.

So far, so bad. It seems at first glance that Vanguard rolled Deloitte’s retirement committee. However, account fees must be evaluated in context. The plaintiffs are correct that large plans pay less. All things being equal, therefore, Deloitte’s 401(k) plan should have below-average account fees. But with 401(k) plans, all things aren't necessarily equal. Fund expenses supply the counterweight. If they are sufficiently low, then a 401(k) plan may pay a relatively steep price for its account fees, yet still end up ahead on the deal.

The Evidence

Let's analyze. Vanguard publicly displays Deloitte's 401(k) plan lineup, which contains a target-date series plus various indexed and actively run funds. Many are collective investment trusts, which are substantially cheaper versions of mutual funds created by plan providers in response to requests/demands from large buyers. For example, Deloitte's target-date funds carry expense ratios of 0.04%, as opposed to 0.14% for Vanguard's standard target-date funds Vanguard Target Retirement 2030 Investor shares VTHRX and 0.09% for its Vanguard Target Retirement 2030 Institutional shares VTTWX.

In other words, Deloitte sought low fund expenses--not discounted account fees. The math for determining the success (or failure) of that strategy is straightforward, assuming that the data is available. Mostly, it is. The company's 5500 filing gives the assets that employees have placed into the plan's most popular funds, while the court document furnishes the aggregate account fees. As the Form 5500 does not specify the amounts that participants hold in each of the less commonly used funds, I estimated those costs by multiplying those funds' total assets (which I do know) by the average of their expense ratios.

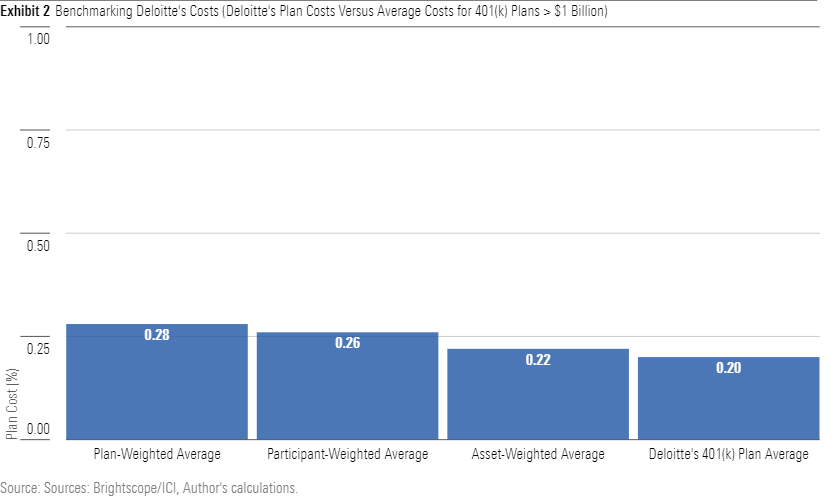

Total plan costs sum to 20 basis points per year--far below the expenses of the average 401(k) plan. Of course, that's a poor benchmark. Deloitte's plan should be compared against other jumbo plans. Last year, BrightScope, which collects data on 401(k) plans, and the Investment Company Institute, which represents fund companies, published a study about the state of the 401(k) industry. Included in the paper were estimates of total costs for 401(k) plans that held more than $1 billion in assets.

The final BrightScope/ICI figure (the asset-weighted amount) is the most appropriate of the three comparisons. It would be inexact to compare the costs of Deloitte’s $7 billion plan to those of plans that barely exceed $1 billion. However, using an asset-weighted figure levels the playing field, because that computation not only includes plans that dwarf Deloitte’s (such as the $50-plus billion plans of Boeing BA or IBM IBM), but also gives the giants more say in the outcome. And by that seemingly reasonable measure, Deloitte’s plan looks just fine.

Final Lessons

Unsurprisingly, although the plaintiffs repeatedly criticize Deloitte’s per-participant fees, they don’t attempt this column’s exercise. Their allegation, after all, seeks to win a financial judgment, not arrive at an objective truth. But surely, treating one type of plan cost as worse than another does not benefit 401(k) shareholders. For investors, a dollar saved is a dollar earned, no matter where the money comes from.

It’s hard to fault Deloitte’s negotiating strategy. Even after accepting relatively high account fees in exchange for squeezing fund fees, Deloitte’s plan spends almost twice as much on asset management than it does for administration and recordkeeping. With established plans that have high average account balances (the math changes for new plans), Deloitte’s approach is surely correct: Cut, cut, cut fund expenses.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)