6 Charts: Second-Quarter Fund Returns

Latin America, commodities lead stock funds, long-term bond funds recover.

A longer version of this article is available to Morningstar Direct and Office clients here.

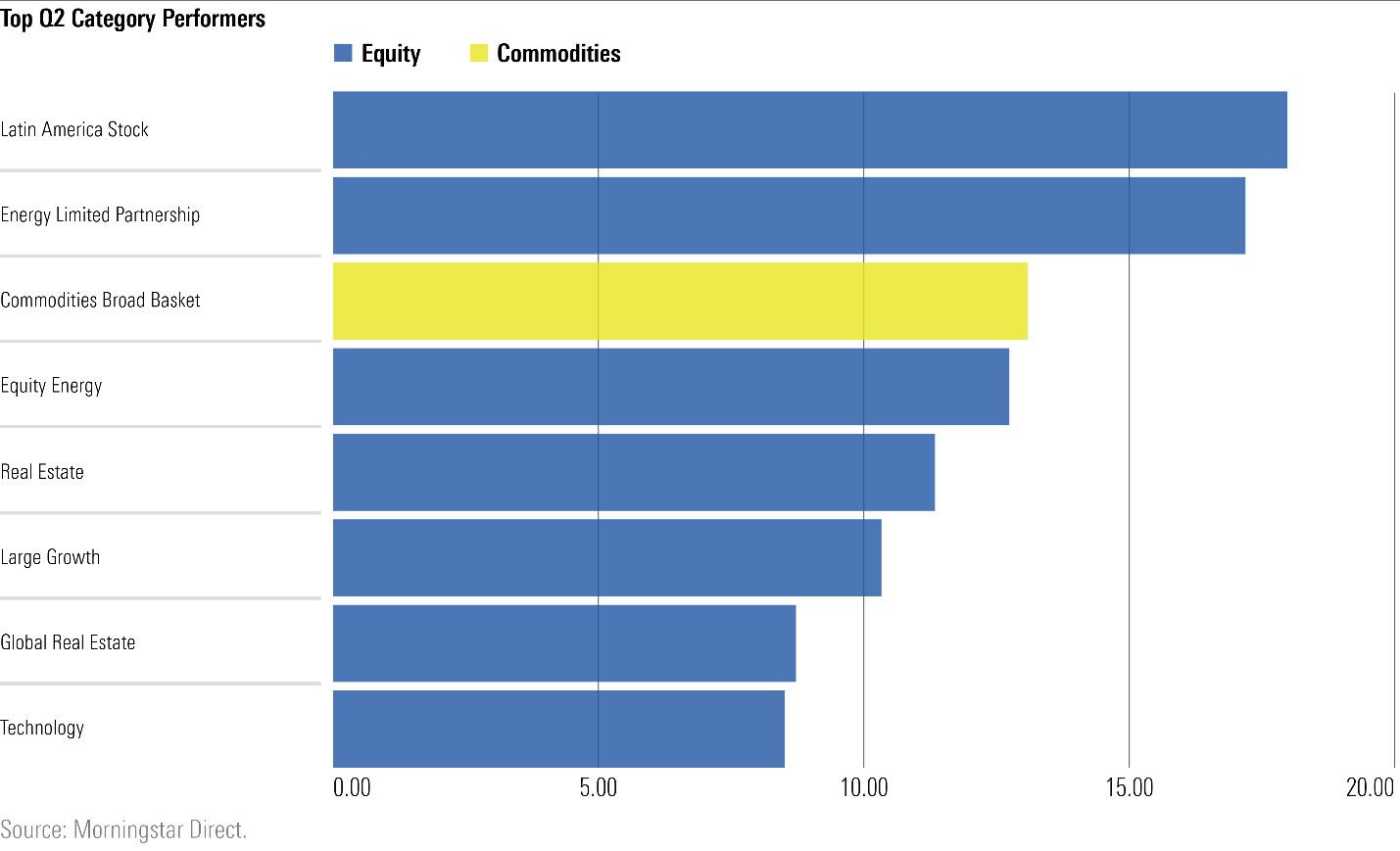

Fund investors enjoyed solid gains on most stock fund categories during the second quarter, with U.S. large-growth funds regaining strength after struggling to start the year. But it was Latin America stock, commodities, and tech-focused strategies that dominated the best performers list.

On the fixed-income side, fund returns were driven by shifting market expectations for Federal Reserve policy against a backdrop of rising inflation. After the Fed signaled in June that it may raise interest rates sooner than expected, longer-term bond funds led returns.

Here’s a look at six trends from second-quarter fund returns.

Latin America stock led all categories in the second quarter with an average return of 18%, rebounding from a first-quarter loss of 6.9%. Commodities were the only nonequity category among the top 10 performers, with returns bolstered by rising prices among economically sensitive products such as oil and timber.

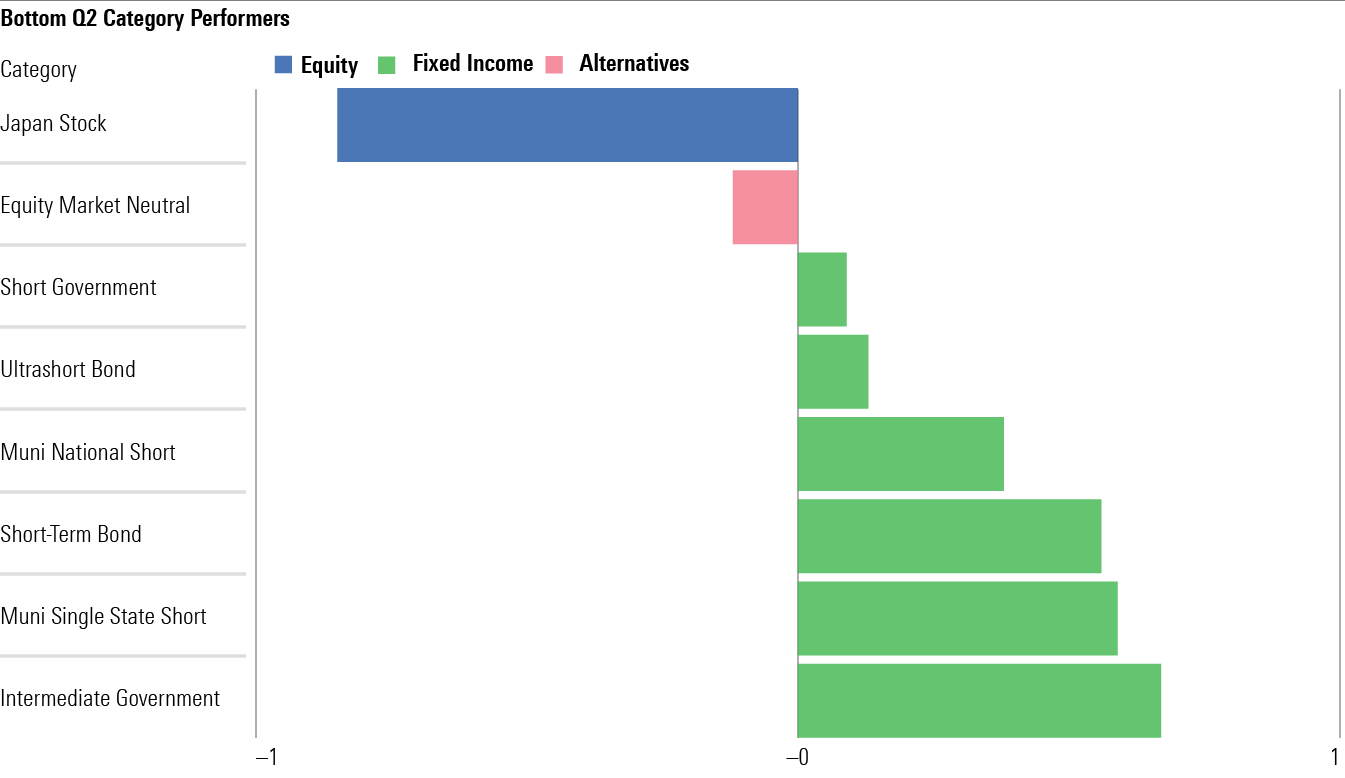

Japan stock and equity market-neutral were the only two negative categories for the quarter. Bond-fund categories, meanwhile, comprised the majority of the bottom returns list.

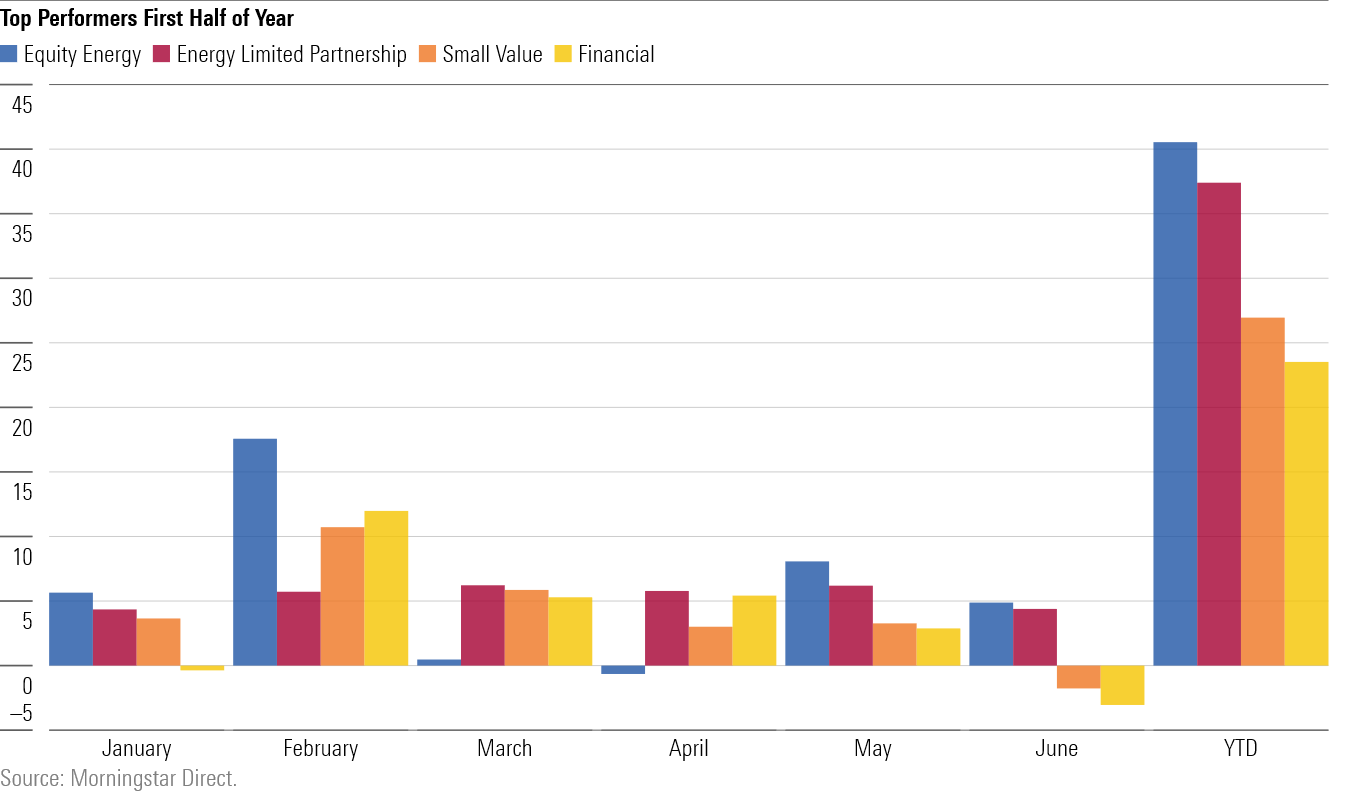

Looking at year-to-date returns, the place to be has been energy funds.

Energy limited partnership had a steady six months of performance, leading to a year-to-date average return of 38%. The equity energy category has been more volatile. But its six-month average return of 43.8% to start the year was the strongest for the category since its inception in 1981.

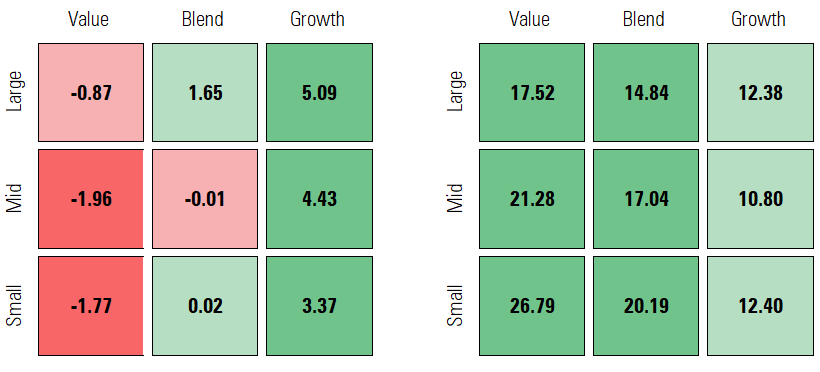

Growth outperformed value across the board for the month of June but still trailed for the year to date. June was only the second month this year that large growth outperformed large value. Returns among U.S. diversified stock categories flip-flopped in June from May, when value bested growth. Small-cap value swung 5 percentage points from a positive return of 3.3% in May to a 1.8% loss in June.

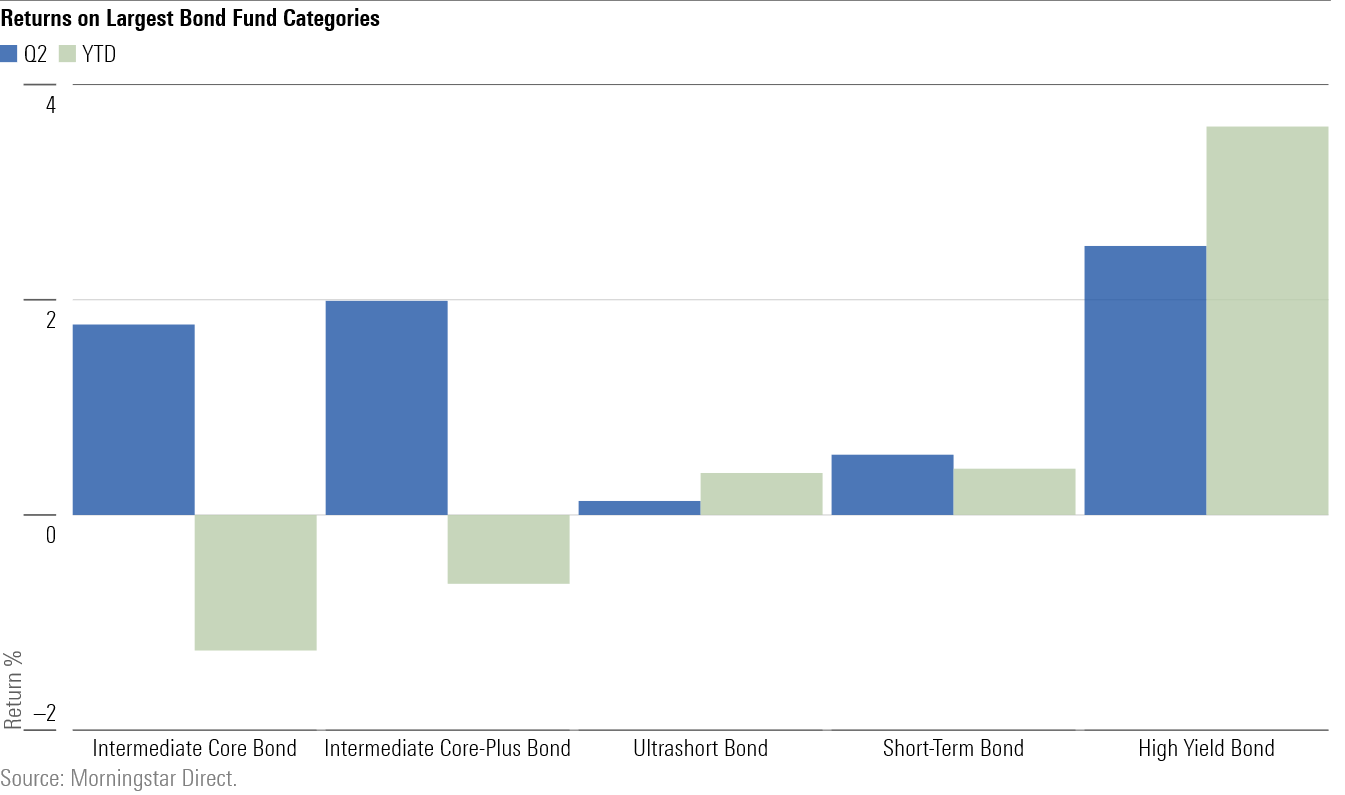

Among the largest bond-fund categories, high-yield bond went into midyear with the strongest year-to-date return at 3.6% with help from a second-quarter gain of 2.5%. Both intermediate core bond and immediate core-plus bond rebounded in the second quarter from first-quarter losses. However, core bonds were still down an average of 1.26% at midyear, and core plus was down 0.64%.

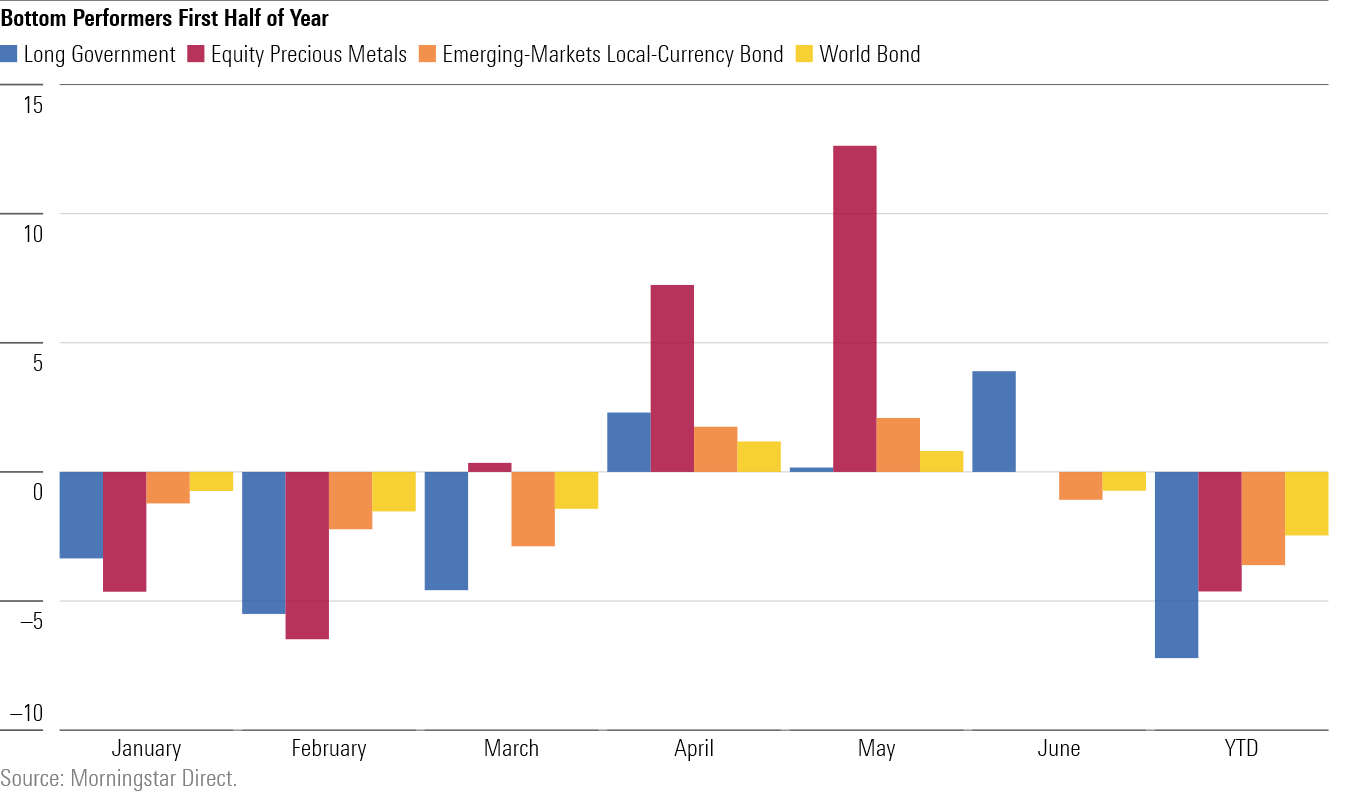

With inflation expectations on the rise in 2021, long-government bond funds were the worst-performing category so far this year, even with improved returns in the second quarter. After posting strong returns in May, equity precious metals lost 11.8% in June as the Federal Reserve signaled it was keeping watch on evidence of building inflation as the economy recovers from the pandemic.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)