Infrastructure Plan Slowly Coming Together, but Industrials Already Pricing It In

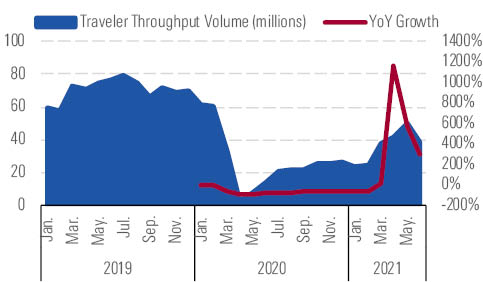

We think business travelers will fly again in late 2021.

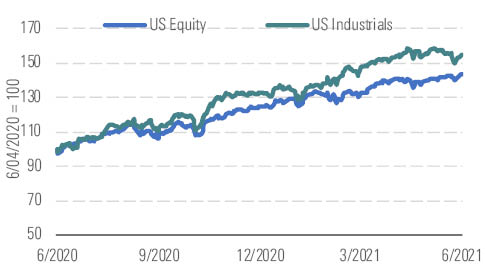

While the Morningstar US Industrials Index continued to outperform the Morningstar US Market Index over the trailing 12 months, the sector underperformed the broader market during the second quarter. Business services and aerospace and defense were the top-performing industries during the second quarter, led by staffing companies (Manpower and Robert Half), credit bureaus (Equifax and TransUnion), and aerospace suppliers (Textron and Northrop Grumman). Conversely, farm and heavy construction machinery and transportation and logistics stocks were notable laggards during the quarter. Airlines underperformed, as did farm and heavy construction machinery stocks.

Industrials have outperformed U.S. equities over trailing 12 months. - source: Morningstar

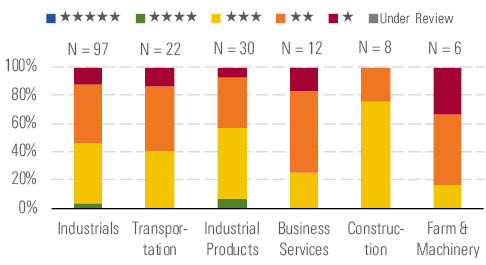

Despite the sector's second-quarter underperformance, many industrials stocks still look overvalued to us, and the sector trades at a 1.17 median price/fair value ratio. That said, we do see some attractive opportunities. Wide-moat Lockheed Martin still looks undervalued, and narrow-moat General Electric's and Crane's stock prices have recently become attractive.

Most industrials stocks are overvalued. - source: Morningstar

President Joe Biden's infrastructure spending proposal is gaining bipartisan support, although it appears the total price tag will be much lower than the $2.7 trillion the administration originally envisioned. Increased infrastructure spending should be a boon for many of the construction-oriented industrials stocks we cover, such as Caterpillar, Deere, Jacobs Engineering Group, and Aecom, but we think this opportunity is already priced into these stocks. The specter of rising interest rates caused a recent pullback in Caterpillar and Deere, which also have significant agriculture exposure, but both firms' valuations still looked stretched.

More leisure travelers have returned to the skies. - source: Morningstar

As we expected, leisure air travel has rebounded with the widespread distribution of the COVID-19 vaccine, which has benefited airlines and aerospace suppliers. However, debate still surrounds the future of business travel. We remain optimistic that business travelers will begin returning to the skies in late 2021, and we project a full recovery for North American airlines by 2024.

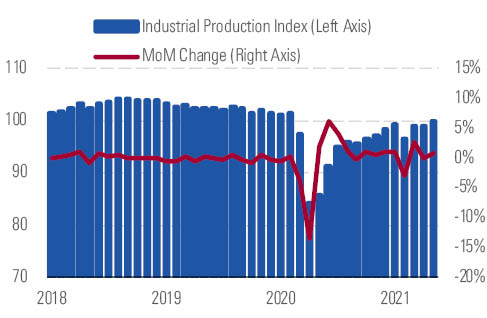

Supply chain bottlenecks have constrained industrial production. - source: Morningstar

Industrial production has been hampered by supply chain bottlenecks, but the US Industrial Production Index still managed to expand modestly in recent months. We think these constraints will gradually alleviate as producers have time to adjust.

Top Picks

Lockheed Martin LMT Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $436 Fair Value Uncertainty: Medium

Wide-moat Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since being awarded the F-35 program in 2001. We view Lockheed’s acquisition of Aerojet Rocketdyne as an opportunity to carve out share in the burgeoning hypersonics market. The U.S. National Defense Strategy prioritizes great powers conflict, requiring modernization in areas where the military possesses asymmetric weaknesses (like hypersonics). We believe demand for military modernization will offset contractionary effects stemming from the nation’s increased deficit.

General Electric GE Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $15.70 Fair Value Uncertainty: High

GE is undergoing a lean transformation under CEO Larry Culp that the market has yet to fully appreciate. We expect healthcare will continue to expand its operating margins through additional digital mix and cost productivity initiatives and grow its top line with organic investments and bolt-on acquisitions in areas like oncology. Aviation is a leader in its narrow-body engine duopoly and as such is well positioned in the broader commercial aero recovery. Over 60% of its 37,000 installed engines have yet to see a second shop visit. Given aviation’s high fixed-cost structure, a high degree of operating should buoy its incremental margins.

Crane CR Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $107 Fair Value Uncertainty: Medium

Narrow-moat Crane manufactures highly engineered products that often perform a mission-critical function and garner leading market share. The company has maintained its research and development spending throughout the pandemic, so it is well positioned to bear the fruits of its investments in innovation. For example, electrification has created many opportunities for the aerospace and electronics segment, including bidirectional power conversion, wireless sensing, and liquid cooling systems. We believe that cash proceeds from the sale of its engineered materials business will give Crane flexibility to pursue acquisitions to bolster its core segments.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)