8 of Our Favorite Little Funds

Here are some under-the-radar gems.

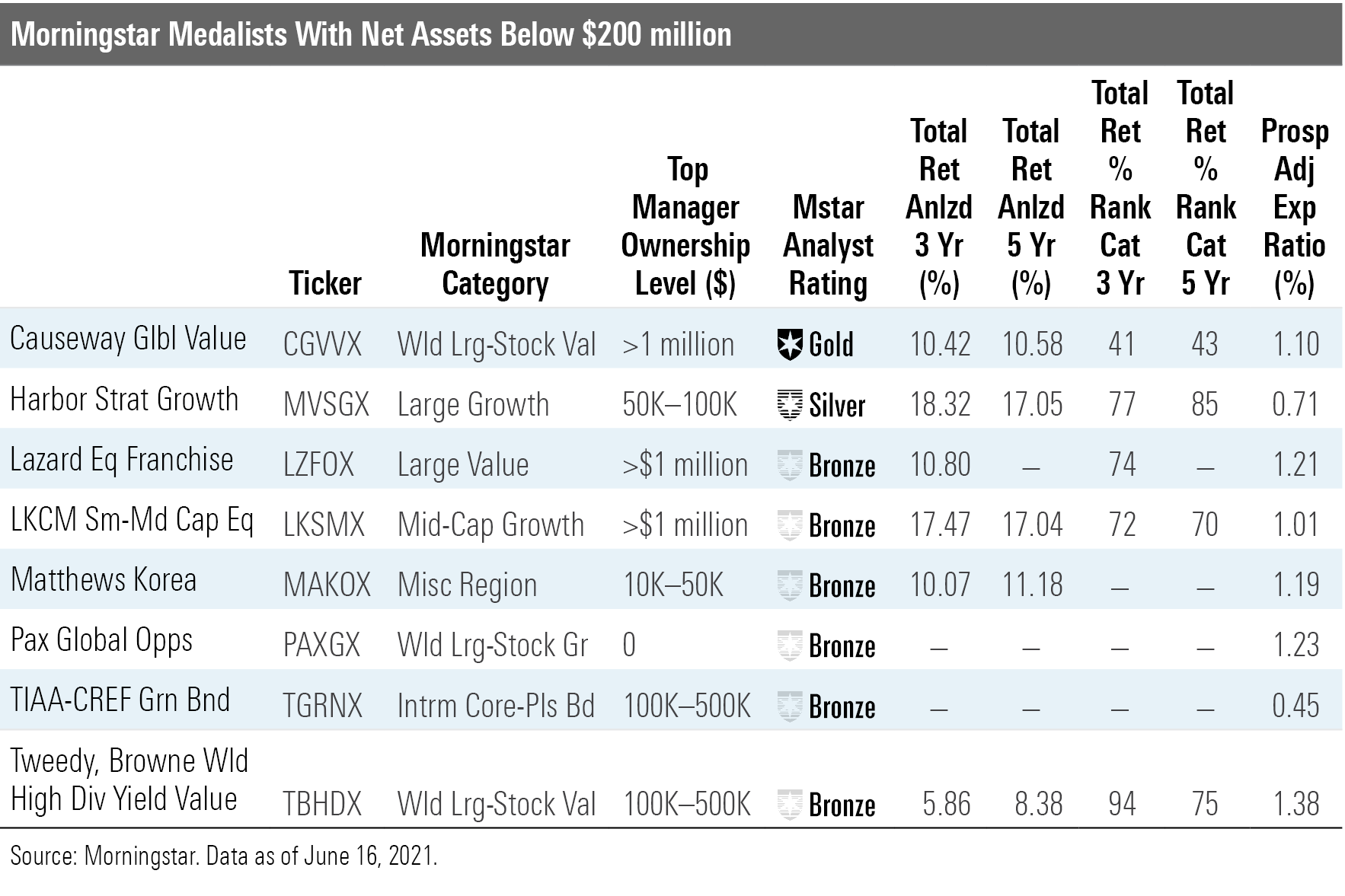

We spend most of our time here talking about the big funds you are likely to own, but we cover thousands of funds, and you don't want to miss out on those that are lesser-known but may fit a need for you. I screened for Morningstar Medalists with net assets below $200 million in order to surface some funds you might not have noticed.

It's an interesting mix of niche and broad-reaching funds. Three are even world-stock funds. Although world-stock funds are excellent core funds, they don't always draw much money because some investors prefer to keep control over their foreign- and domestic-stock allocations rather than let world-stock managers adjust that mix. The funds here all tap well-resourced teams that serve more than just the one fund, meaning you are not getting short-changed on management by picking these smaller funds.

I only have space for a short summary on each here. If you are considering investing, please follow the link for each fund through to our complete analyst review.

Let's look at some gems you might have missed.

Causeway Global Value CGVVX has been a mostly middling performer, though it should benefit from our recent move to carve up world-stock funds by investing style. It looked a lot worse when competing with growth funds. In the world large-stock value Morningstar Category, it has a top-decile one-year return, but its three-, five-, and 10-year returns are close to the category average. On the plus side, it tops the MSCI ACWI Value index over those times, including since its 2008 inception.

We give it Morningstar Analyst Rating of Gold because we're impressed by managers Sarah Ketterer and Harry Hartford as well as the team of value investors supporting them. They've built a strong record over three decades that gives us confidence the fund can do better over the next 10 years. Their dedication to value has helped the past year but held them back for many other years. They own about 50 stocks and the fund in total has a mere $61 million in assets. The fund charges 1.1% for individual investors and 0.85% for institutional.

Harbor Strategic Growth MVSGX is an appealing Silver-rated fund that is more disciplined about valuations than most growth funds. That left it out in the cold in 2020 when the likes of super-pricey Tesla were the winners rather than the tamer names this fund owns, such as Markel MKL and Microsoft MSFT. Thus, the fund has just $123 million in assets.

Mar Vista Investment Partners--a firm that emphasizes growth, valuation, and moats--subadvises the fund. That leads to a blend/growth mix and a fairly focused portfolio. It's had success with this strategy in separately managed accounts since 2004, though this fund only goes back to 2011.

TIAA-CREF Green Bond TGRNX is small because it launched in 2018 and is pretty new. It buys bonds that directly finance efforts to help the environment. I'd expect performance to be rather quirky as a result, but it boasts the support of a deep team that has plenty of experience in the field.

Generally bigger is better for bond funds because it means low costs, lots of resources, and greater influence with issuers. But since this is still a small market, the fund's small $53 million asset base could be a positive. And fees are modest for this share class, which charges 0.45%, though other share classes go as high as 0.80%.

Pax Global Opportunities PAXGX is another environmental, social, and governance fund that is small because it's relatively new. The Bronze-rated world large-stock growth fund boasts seasoned managers in Kirsteen Morrison and David Winborne. They emphasize sustainable companies whose shares are reasonably priced for their expected future cash flows. Not surprisingly, the fund has a fair amount of healthcare and tech stocks but also quite a few financials such as Prudential PLC PUK and Mastercard MA. The one negative illustrates the downside of smaller funds: Expenses are on the high side. Sometimes fund companies will keep a lid on the fees of new funds, as in the case of TIAA-CREF Green Bond, but not here. The investor share class charges 1.23%.

Matthews Korea MAKOX is a solid way to bet on a dynamic economy, though it's obviously a niche fund that shouldn't be a core position. Michael Oh and Elli Lee look for steady growing companies that may be a little smaller than the giants in South Korea. They ply a strategy that has worked well for Matthews across Asia. In fact, many other Matthews funds also invest in South Korea, so Matthews Korea is better resourced than you'd expect from a $155 million fund.

LKCM Small-Mid Cap Equity LKSMX is the smallest fund on the list with just $17 million in assets. Texas-based Luther King Capital Management runs this fund in a similar style to its other funds. Steve Purvis seeks companies with strong returns on capital and sizable market share. An emphasis on valuations makes it a mix of blend and growth stocks, and that's borne out by performance. The fund is ahead of the mid-growth category in 2021 but lagged in 2020.

Lazard Equity Franchise LZFOX has just a three-year record, but our familiarity with a longer-running version in Australia led us to give a Bronze rating to the $106 million fund. A four-manager team seeks companies with high returns on equity, low levels of debt, and modestly valued shares to build a focused portfolio. The portfolio is a mix of steady mid- and large-cap value names like H&R Block HRB and CVS Health CVS. Although recent performance has lagged the benchmark slightly, the performance going back to 2014 in Australia is solid.

Tweedy, Browne Worldwide High Dividend Yield Value TBHDX has delivered decent yield, moderate risk, and underwhelming returns. The bull case for it is a return to old-school value investing and foreign-equity outperformance versus U.S. equity as the fund has a long-standing tilt away from the United States. Tweedy, Browne boasts one of the most experienced management teams in the global-equity sphere. Three have been on the fund since its 2007 inception. The portfolio is chock-full of name brands with big dividends, such as Diageo DEO, Nestle NSRGY, and Verizon VZ.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YGF5R6YDPJESJOU7XABKHHIP3Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)