Why Portfolio Diversification Still Works

Despite the recent rise in correlations across asset classes, it still makes sense to spread out your bets.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Correlations often tend to increase during periods of market stress, making portfolio diversification tough to find when investors need it most. This pattern held true in early 2020 as many major asset classes (except high-quality bonds and cash) moved in tandem during the coronavirus-driven market downturn. And over the past 20 years, correlations have edged up for several asset classes, including commodities, corporate bonds, global bonds, high yield, REITs, and Treasury Inflation-Protected Securities.

In our 2021 Diversification Landscape, we took a deep dive into how different asset classes performed in 2020, how these asset classes' correlations have changed, and what those changes mean for investors and financial advisors trying to build well-diversified portfolios. We also looked at the diversification benefits of adding various assets to a U.S. equity portfolio, including taxable bonds, municipal bonds, international equity, commodities, alternatives, sector-specific indexes, investment styles, and factor profiles. (Morningstar Office and Direct clients can find the full paper here.)

The upshot: Diversification still works, but it's not easy.

Implications of Correlation on Portfolio Diversification

Diversification has often been called the only free lunch in investing. As Harry Markowitz first established in his landmark research in 1952, a portfolio's risk level isn't just the sum of its individual components but also depends on correlation, or how the holdings interact with each other. Correlation is a statistical measure that ranges from 1 to negative 1 and captures how two securities move in relation to each other (although it only captures the direction, not the magnitude, of those movements).

Combining asset classes with correlations below 1.0 reduces the portfolio’s overall risk profile. It's one of the few cases where the whole can be more than the sum of the parts; a well-constructed portfolio can have better risk-adjusted returns than its component parts alone.

The problem is that correlation coefficients shift over time, so what worked in the past won’t necessarily work in the future. In addition, adding asset classes to reduce volatility can also drag down returns, sometimes over multiyear periods. Moreover, asset class correlations often climb during periods of market crisis--in other words, exactly when you need diversification the most.

Because many investors have significant holdings in U.S. equities, we used that as our starting point (as represented by the Morningstar US Market Index). We measured the diversification value of different asset classes relative to this benchmark.

Key Asset Class Correlations in 2020

While the COVID-19-driven bear market in early 2020 was unusually swift and severe, basic portfolio diversification helped buffer some of the losses. The overall equity market dropped 34.5% from Feb. 19 through March 23, 2020, but high-quality fixed-income holdings held up well during the flight to safety. Cash and short-term Treasuries held their value, while longer-term Treasuries posted gains. As a result, a basic portfolio mix of 60% stocks and 40% core bonds would have lost about 13 percentage points less than an equity-only portfolio during the market downdraft.

Among other asset classes, results were mixed on the diversification front. Gold excelled in its role as a safe haven and lost a modest 2.3% during the February/March downturn. Commodities more broadly and REITs, on the other hand, both suffered sharp losses.

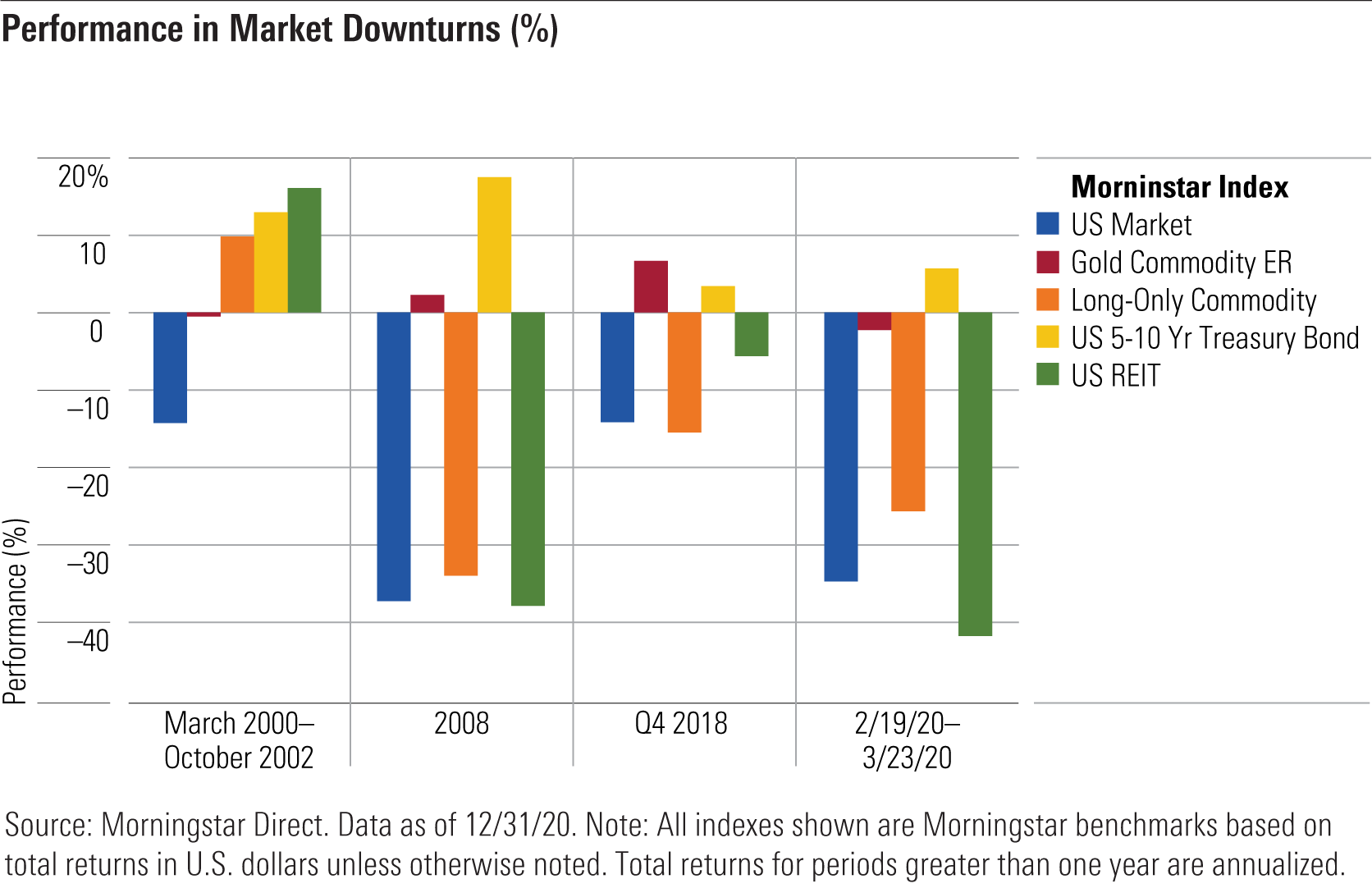

As the chart below shows, it’s not unusual for asset classes to show mixed results during a market downturn. Every bear market is different, so asset classes that hold up in one market environment may not work in the next. For example, value stocks held up remarkably well during the tech/media/telecom meltdown that started in March 2000, while growth stocks suffered deep losses. But the pattern was exactly the opposite in the COVID-19-driven bear market in early 2020.

Performance in Market Downturns

During 2020, many major asset classes’ correlations moved higher, but Treasuries were a major exception. Correlations for cash, short-term, and intermediate-term Treasuries remained negative versus equities and trended down for 2020 overall. This probably reflects the sharp divergence between “risk on” and “risk off” assets, which became more extreme as investors fled stocks for the relative safety of high-quality bonds.

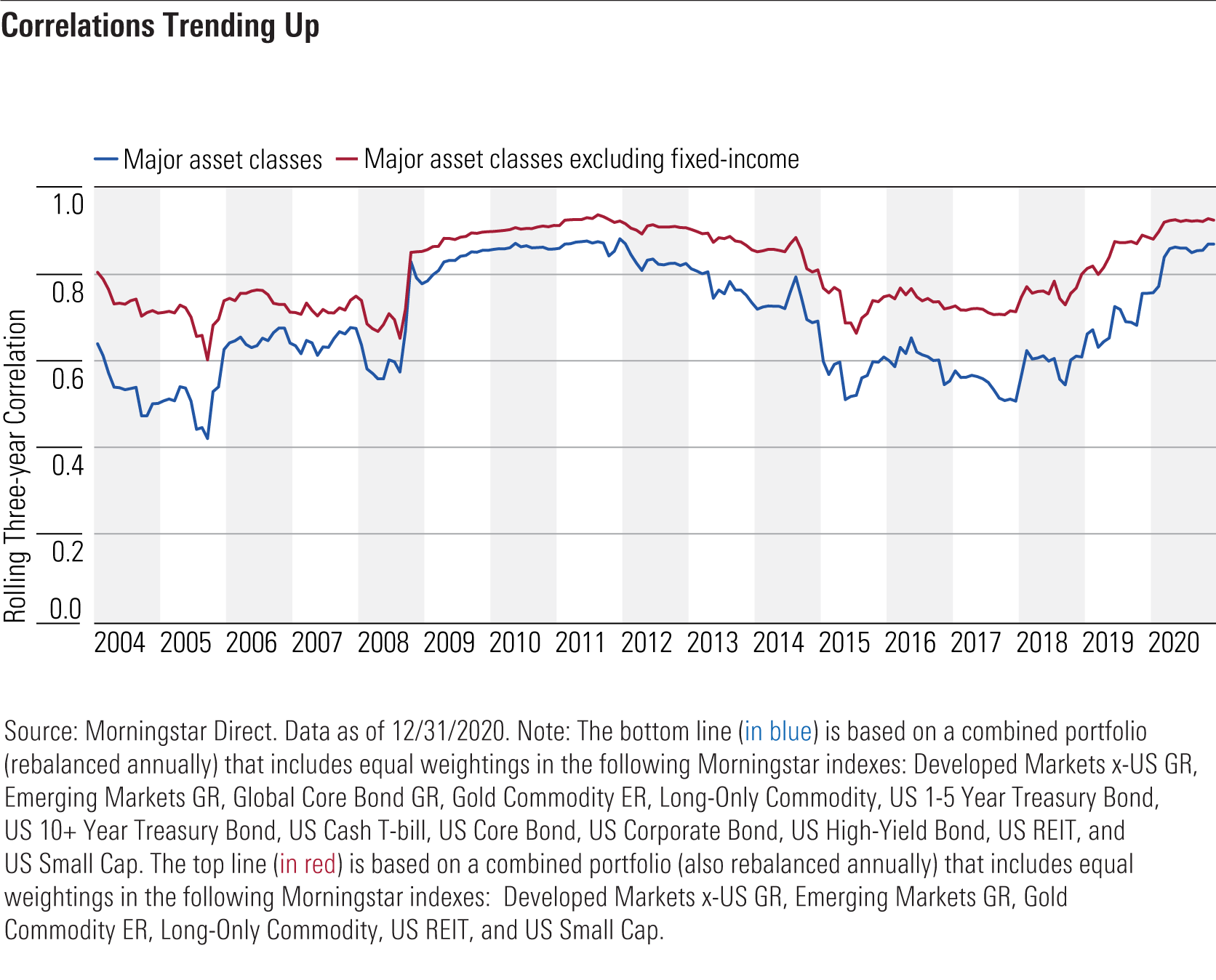

The increase in correlations for several areas during 2020 continues a longer-term trend. Correlations for several asset classes--including smaller-cap stocks, REITs, and high-yield bonds--have edged up over time. Investors looking to build diversified portfolios must therefore choose carefully and recognize the challenges of shifting correlations over time. It's also worth noting that adding more asset classes doesn't necessarily improve portfolio diversification.

The graph below shows trends in correlations for an equally weighted portfolio composed of 14 major asset classes, as well as a portfolio composed of six major asset classes excluding bonds. Even with bonds included, the trailing three-year correlation for a diversified portfolio (measured against the Morningstar US Equity Index) is close to a 20-year high, almost reaching the levels shown in the wake of the global financial crisis. Even areas often touted for their diversification benefits--including REITs, smaller-cap stocks, lower-quality bonds, and some commodities--have often moved more in tandem with the broad U.S. equity market than investors might expect.

Correlations trending up

What Asset Class Correlation Means for Your Portfolio

Overall, the rise in correlations across many major asset classes in 2020 illustrates the complexity involved in building a diversified portfolio. Not only are correlations constantly shifting, but they also often rise during periods of market volatility.

Even so, the basic arguments in favor of portfolio diversification still hold. A diversified portfolio still reduced volatility and limited losses during the market downturn in early 2020, albeit maybe not as much as investors would have hoped. Diversification also looks better over longer periods: From 2001 through 2010, for example, a diversified approach would have improved risk-adjusted returns (as measured by the Sharpe ratio) by about 0.5 percentage points per year. Broadly diversified portfolios have also historically held up better during periods of rising interest rates or above-average inflation.

Finally, holding a diversified portfolio helps investors expand the opportunity set and ensure they don’t miss out on areas that can enhance long-term returns. International stocks are a prime example. While they haven't improved returns or reduced risk when added to portfolio focused on U.S. stocks over the past 20 years, they probably won't underperform forever. Currency exposure is another important aspect of international diversification. Now that the U.S. dollar has started showing signs of weakness, international diversification could become increasingly important.

It's also important to look at asset class correlations in the context of overall market trends. Specifically, the past 20 years have been marked by declining interest rates and benign inflation. In a period of equity market weakness precipitated by rising yields, Treasuries and other high-quality bonds may be less reliable diversifiers, particularly given how low their yields are in absolute terms. For example, in the 15-year period from 1967 to 1981, as Treasury-bond yields rose sharply, Treasuries were less effective as equity diversifiers; they exhibited a modest positive correlation with stocks.

The Continuing Benefits of Diversification

Even in a more challenging environment, assets such as cash, Treasuries, and gold have continued to provide valuable diversification benefits. While diversification doesn't work with every asset class in every market, it's still an important tool for improving risk-adjusted returns over the long haul.

Christine Benz and Kevin McDevitt contributed to this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)