14 Undervalued Small-Cap Stocks

These stocks all have narrow or wide economic moats and are undervalued by our metrics.

Small-cap stocks are as popular with investors as BTS is with teenage girls: As of this writing, the Morningstar US Small Cap Index is outpacing the broad Morningstar US Market Index by 7 full percentage points so far this year. After lagging the broad market rebound in 2020, smaller companies staged a comeback in the latter part of that year and have been on a roll ever since.

"Small-cap stocks lagged the broader market in 2020 as investors were concerned about their ability to survive the pandemic," notes Morningstar chief markets strategist Dave Sekera. "But now, with the vaccine rollout well on its way and a clear pathway to economic normalization on the horizon, small-cap stocks have outperformed as the market is pricing in a strong earnings rebound in the near term."

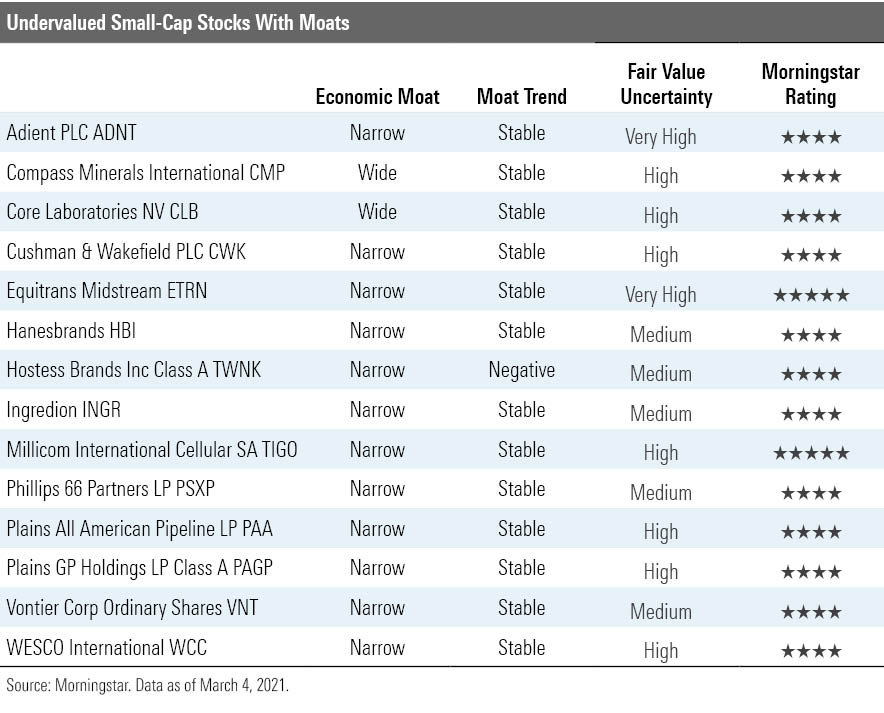

Today, we are looking at high-quality small-cap names that are undervalued. Specifically, we have screened for stocks with Morningstar Economic Moat Ratings of wide and narrow that land in the small-cap portion of the Morningstar Style Box and that are trading in the range of Morningstar Ratings of 4 and 5 stars. Fourteen stocks made the cut.

Here are recent analyst notes about three of the names from the list.

Compass Minerals International CMP "Compass Minerals' operational turnaround is still a work in progress as it reported disappointing fourth-quarter results. Lower salt prices and volumes combined with lower prices and higher unit production costs in the North American fertilizer business weighed on profits as adjusted EBITDA declined over 31% year on year. We had largely expected the lower profits as Compass had previously reported fourth-quarter salt volumes and its expectation for deicing salt price changes in the 2020-21 winter. With our long-term outlook intact, we maintain our $80 per share fair value estimate and wide moat rating for Compass Minerals.

"Compass shares were down nearly 8% on the day as the market renews its skepticism for the company's turnaround plan. However, we remain optimistic that salt profits will be fully restored. As such, we view shares as attractive with the stock trading firmly in 4-star territory.

"Our optimism for the salt business comes from our view that Compass will be able to continue to reduce unit production costs, leading to profit margin expansion over the next several years. During the fourth quarter, we calculated a 4% decline in unit costs versus the prior year quarter, which marks the third straight quarter of a unit cost decline.

"We expect prices for the 2021-22 winter will rise due to more favorable winter weather so far this year. Deicing salt price movements tend to be determined by the harshness of the previous winter. Following the mild winter in 2019-20, prices fell as producers were left with excess salt inventories. However, following a normal or harsher winter, prices tend to rise. Further, one of Compass' competitors recently announced it will permanently shut down a salt mine, which should reduce supply. As such, we expect higher prices and further cost reductions will boost salt EBITDA margins to the low-30% range in 2022."

Seth Goldstein, senior analyst

Hostess Brands TWNK "We are impressed with the resilience narrow-moat Hostess demonstrated in its fiscal 2020 results, despite ongoing traffic declines at convenience stores (c-stores), its largest channel, representing about 30% of company sales. Consolidated fiscal 2020 organic sales grew 4.6%, above our 3.0% estimate, and the 17.2% adjusted operating margin topped our 17.0% forecast. Management issued fiscal 2021 guidance for sales growth of 3.0%-4.5% and EBITDA of $255 million-$265 million, which brackets our estimates of 3.2% and $257 million, respectively. But earnings per share guidance of $0.80-$0.85 fell short of our $0.90 target due to a higher expected tax rate. Given the elimination of the B share class during 2020, and all related future noncontrolling interest payments, Hostess' long-term tax rate increases to 27% from 21.5% previously. Better 2020 operating results should fully offset the higher tax rate, and we do not expect to materially alter our $17.60 fair value estimate. With shares trading at a 15% discount to our valuation, they offer an attractive risk/reward.

"Over the long term, we continue to expect 3% annual organic sales growth, which we think the market fails to appreciate. The recently acquired Voortman brand should gain market share as Hostess expands it into its existing distribution channels. The Hostess brand is currently distributed to 91% of U.S. food, drug, mass, and c-store outlets compared with 61% for Voortman. Another growth lever is Hostess’ further penetration into the breakfast category, as the firm is in the early stages of this initiative, with several innovations slated to launch in 2021 and beyond. These efforts are being met with much success, with Hostess breakfast products growing 9.6% in the fourth quarter, compared with 4.3% for the overall breakfast category, taking Hostess’ market share to 18.6%. Hostess is also realizing success targeting younger consumers, with a 29% increase in penetration of age 35 and under households during 2020."

Rebecca Scheuneman, analyst

WESCO International WCC "After taking a fresh look at our key valuation assumptions following Wesco's fourth-quarter 2020 earnings release and its 10-K filing, we've raised our fair value estimate 7% to $107 per share. Our decreased cost of debt assumption, which lowered our weighted average cost of capital to 7.8% from 8.7% previously, was the primary driver behind our increased fair value estimate. Recall that Wesco's $4.7 billion acquisition of close peer Anixter International in June 2020--during the middle of a global pandemic--caused the firm's net debt/EBITDA ratio (excluding synergies) to swell to 5.7. Wesco's and Anixter's history of generating solid free cash flow throughout the business cycle gave us comfort that the combined entity could return to a more normalized capital structure within a few years. Still, at the time, we felt there was enough uncertainty around the path of the global economy and deal integration to take a more conservative stance on Wesco's credit risk.

"However, we've since been impressed with Wesco's integration and deleveraging efforts. The firm is already benefiting from cross-selling opportunities and expects to achieve $130 million of cumulative cost synergies in 2021 after realizing $39 million of savings during the second half of 2020. Management is still targeting $250 million of cost synergies by 2023, which we view as an achievable, if not conservative, target.

"Furthermore, Wesco's 2020 adjusted free cash flow of $586 million was about 20% higher than we had expected. To be fair, part of this strong cash flow performance is attributable to reduced working capital that we expect will reverse in 2021. Even so, Wesco's elevated free cash flow allowed the firm to reduce net debt by $389 million in 2020. Wesco finished 2020 with $4.5 billion of net debt, but we're modeling about $2.5 billion of free cash flow over the next five years. As such, management's goal of reducing its leverage ratio to 2-3.5 by 2023 is very achievable, in our view."

Brian Bernard, director

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)