Bitcoin Could Spread to More Fixed-Income Funds

It’s most likely to appear in more-aggressive strategies, so mind your manager’s approach.

Bitcoin has established a beachhead in traditional mutual fund portfolios. It’s small and likely to remain so for a while because it’s volatile, not like any other asset class. Even the cryptocurrency pioneers are tiptoeing into it, and not always just to capture its wild, eye-catching gains. Bitcoin’s off-the-charts volatility, covered in this article by Morningstar portfolio strategist Amy Arnott, makes it more likely to appear as a small part of some equity or alternatives funds. It’s unlikely to spread widely in fixed-income strategies: The data from Arnott’s piece notes that bitcoin has been 24 times as volatile as the Bloomberg Barclays U.S. Aggregate Bond Index over the past three years.

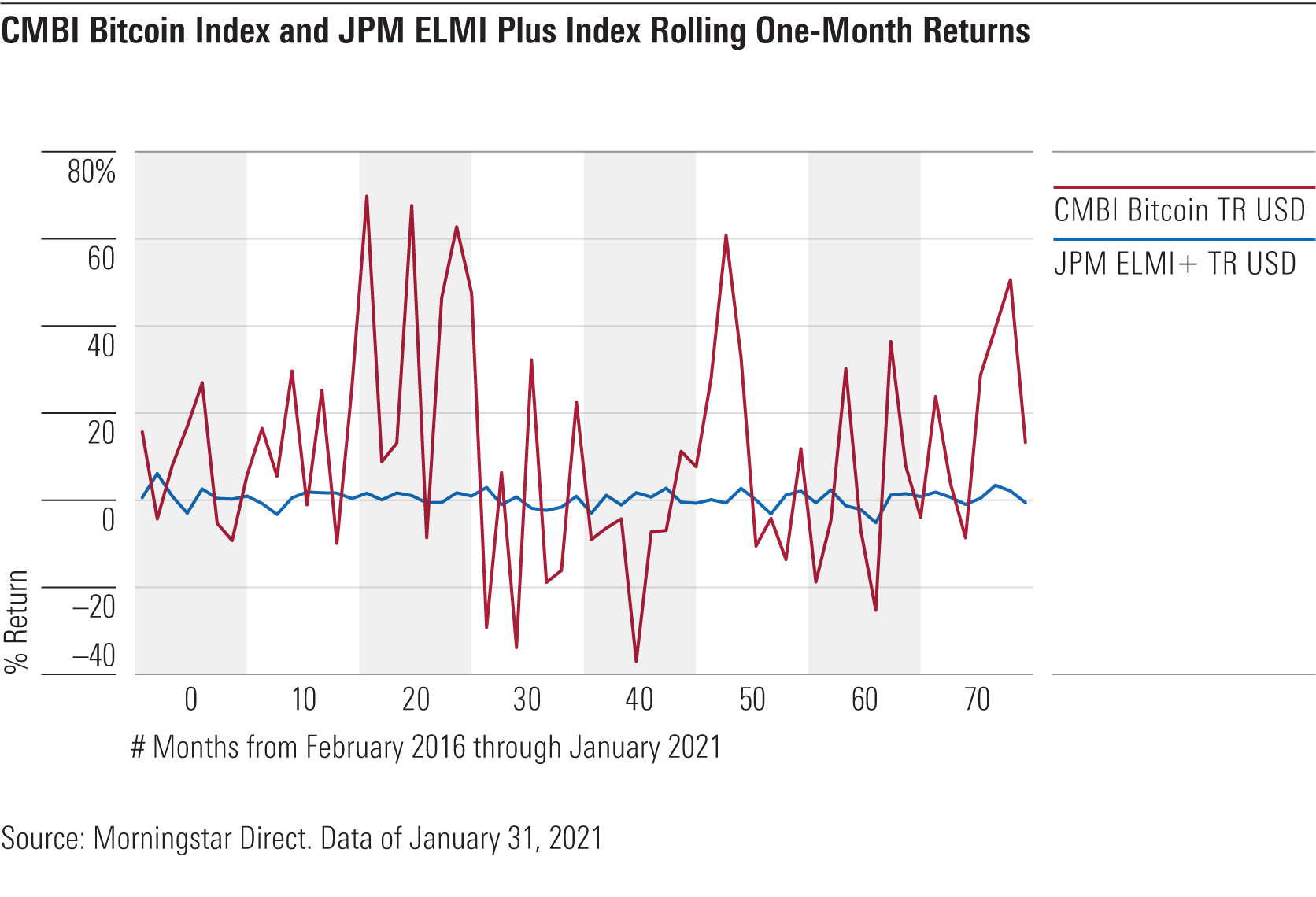

It’s hard to compare investing in bitcoin to anything at this point, but consider emerging-markets currencies, which have been among the most potent tools available to fixed-income managers. Sharp declines in those currencies can easily erode or wipe out income streams, and the volatility of the JPM Emerging Local Markets Index Plus lands reliably between the Aggregate Index and the S&P 500 rather than anywhere near bitcoin levels.

Investing in bitcoin makes investing in emerging-markets currencies look like a safe haven: The following chart shows one-month rolling returns of the CMBI Bitcoin Index and JPM ELMI Plus Index over the past five years.

At this point, nontraditional bond funds, which have the most latitude to take risks, are the most likely to incorporate some form of bitcoin exposure. In fact, BlackRock added prospectus language in January giving two of its mutual funds the flexibility to invest in bitcoin futures. That included nontraditional bond strategy BlackRock Strategic Income Opportunities BSIIX as well as BlackRock Global Allocation MALOX.

Rick Rieder, BlackRock’s global fixed-income chief investment officer, sees value in the asymmetry of bitcoin’s return profile. While some cite the cryptocurrency’s arguable similarities to gold, suggesting that it could provide a hedge against inflation or during market turmoil, Rieder remains skeptical about viewing it as part of an asset class. Rather, he views bitcoin futures as a call option on strong features including the development of its market infrastructure, large institutional investors entering the market, and the resulting increase in liquidity. Rieder does not rule out the possibility of bitcoin’s price growing eight- or tenfold but aims to keep BlackRock Strategic Income Opportunities' position very small given its volatility.

Guggenheim’s Scott Minerd has been frequently quoted on his bitcoin views, saying in December 2020 that bitcoin could eventually be worth as much as $400,000 but showing more restraint about its valuation at the start of this year based on the shallow investor base. The firm had filed for SEC approval in November to allow Guggenheim Macro Opportunities GIOIX, also in the nontraditional Morningstar Category, to invest up to 10% of assets in Grayscale Bitcoin Trust GBTC, an exchange-traded fund. The firm removed that language in an updated version of the filing in January 2021, though. Had Guggenheim proceeded and taken on even a small portion of that 10% allocation, it likely would have made the firm one of the largest owners of Grayscale, not to mention making the strategy one of the biggest risk-takers in its category.

Bitcoin will keep finding its way into more aggressive strategies, and given its risks and volatility, that's worthy of skepticism. A very small bitcoin position within a diversified, unconstrained strategy could make sense, and BlackRock has the team and risk management capabilities to handle it. On the other hand, larger bitcoin positions (greater than 50 basis points, for example) or a spread into more conservative, Aggregate-Index-linked categories should raise concerns.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4fee84cd-dfe7-4e42-8e83-05484be1844f.jpg)