Sustainable Equity Funds Outperform Traditional Peers in 2020

A strong year for ESG equity index funds.

After holding their own in the fourth quarter, sustainable equity funds finished 2020 with a clear performance advantage relative to traditional equity funds. Sustainable funds are those that emphasize the use of environmental, social, and governance criteria to generate financial return and broader societal impact. For most of the year, the kinds of stocks that sustainable equity funds prefer--those of companies with better ESG profiles and that are aligned with the transition to a low-carbon economy--outperformed.

In conventional terms, many of those tend to be quality-growth stocks. The approval of COVID-19 vaccines late in the year spurred a rally among cyclical value and traditional energy stocks, which to that point had lagged severely during the pandemic. As a result, sustainable equity funds performed on par with their traditional peers in the fourth quarter.

Overall, it was an impressive year for sustainable funds. In 2020, three out of four sustainable equity funds beat their Morningstar Category average, and 25 of 26 ESG equity index funds that I've been following this year beat index funds tracking the most common traditional benchmarks in their categories. (Prior quarterly updates are available here, here, and here.)

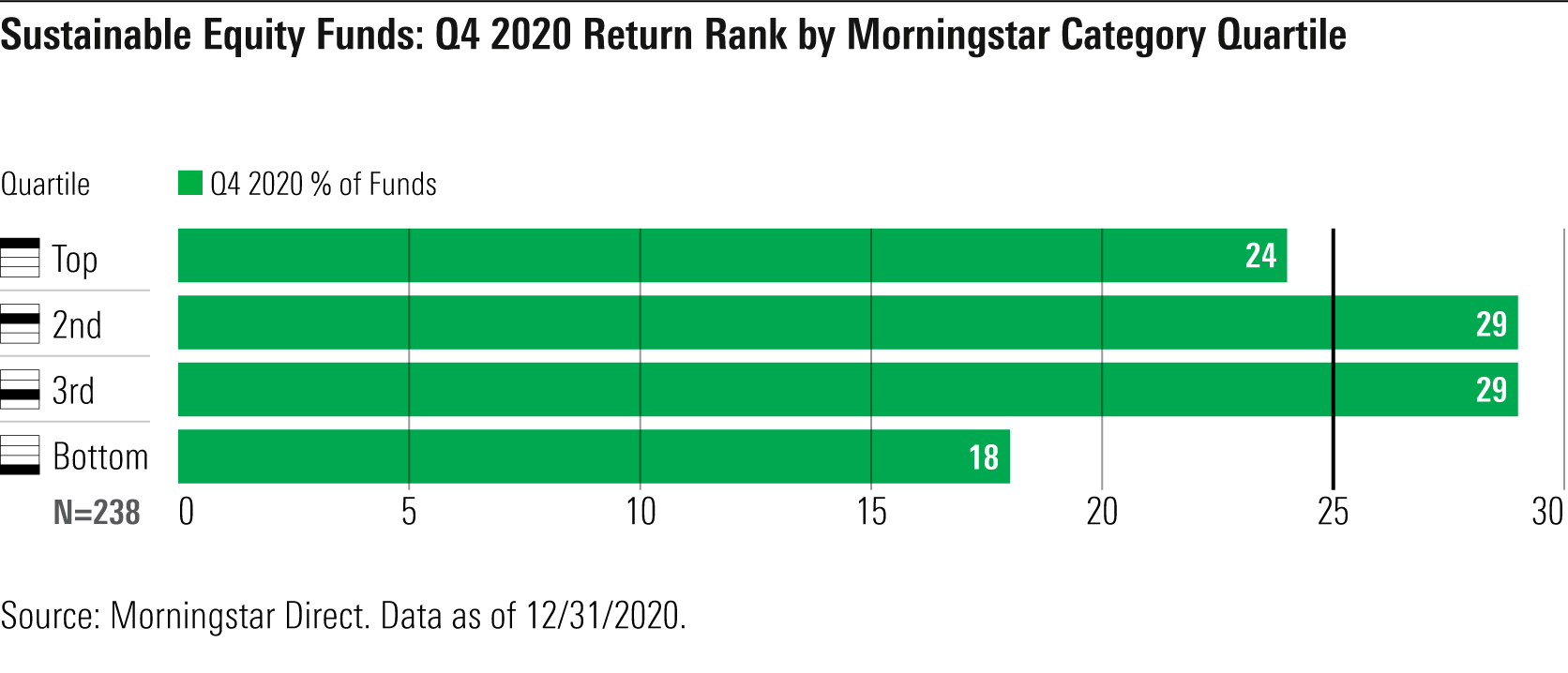

Category-Relative Performance Stands Out in 2020 In assessing the performance of sustainable funds, keep in mind that they cover a variety of investment areas, just as do traditional funds. Grouping sustainable funds with all funds that invest in the same parts of the market allows for direct comparisons between sustainable and traditional funds. We do this by assigning sustainable funds to categories based on the area of the market on which they are focused, just as we do for all funds.

For the fourth quarter, sustainable equity funds performed in line with their traditional peers. Their category ranks were fairly evenly distributed from the first through the fourth quartiles. Slightly more than half (53%) of sustainable funds finished in the top half of their category. More sustainable funds placed in the top quartile (24%) than the bottom quartile (18%).

For the entire year, however, sustainable equity funds significantly outperformed relative to their traditional fund peers by this measure. Three out of four placed in their category's top half, and far more sustainable funds ranked in the top quartile (42%) than in the bottom quartile (6%).

Sustainable Index Funds Outperform Investors have increasingly gravitated toward index funds, and sustainable fund investors are no exception. Assets in passive sustainable funds have grown rapidly in recent years, and through the third quarter of 2020, passive sustainable funds attracted more than twice the flows of actively managed sustainable funds.

Index funds can provide useful insights into why performance differs between sustainable and traditional strategies. Sustainable index funds are not all structured the same way or track the same indexes, but they provide investors broad, diversified exposure similar to conventional market-cap-weighted index funds. The difference is that the sustainable index funds use ESG criteria to determine which stocks make it into the index and their weightings.

At the beginning of the year, I selected 26 sustainable index funds that provide close comparisons to traditional index funds that invest in the United States, developed markets outside the U.S., and emerging markets. For the year overall, 25 of these 26 sustainable index funds outperformed.

In the first quarter, 24 sustainable index funds outperformed a comparable traditional index fund, net of fees. In the second quarter, 18 did so, and in the third quarter, 16 outperformed. In the fourth quarter, only 11 outperformed.

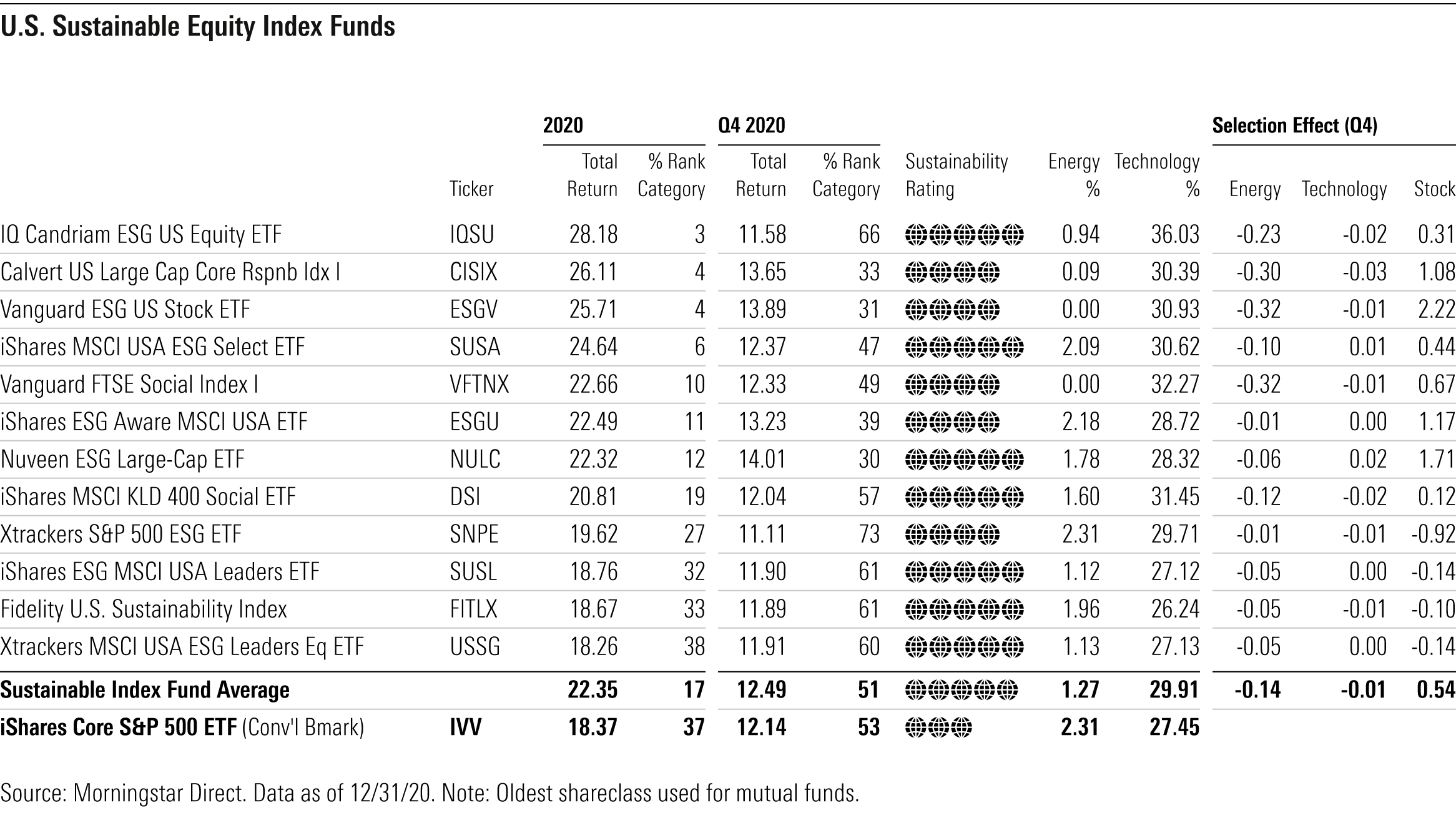

U.S. Large Cap. In the fourth quarter, six U.S. large-cap sustainable index funds beat a representative S&P 500 index fund, net of fees, and six lagged. While the representative fund, iShares Core S&P 500 ETF IVV, posted a 12.1% gain in the fourth quarter, the sustainable funds' average return was 12.5%, and four funds posted returns above 13.0%. The worst return was 11.1%.

For 2020 overall, 11 of 12 sustainable funds beat the S&P 500 index fund, led by IQ Candriam ESG US Equity ETF IQSU and Calvert US Large-Cap Core Responsible Index CISIX, both of which are based on proprietary ESG indexes. The 22.4% average sustainable index fund return easily beat IVV's 18.4% return for the year. The only sustainable fund underperformer was Xtrackers MSCI USA ESG Leaders Equity ETF USSG, which trailed IVV by just 0.1%.

Developed Markets-ex U.S. In the fourth quarter, only three of 11 sustainable index funds focusing on large caps in developed markets outside the U.S. outperformed a representative MSCI EAFE index fund, net of fees. However, the 15.6% average sustainable fund return was not far off the 16.3% return of iShares Core MSCI EAFE ETF IEFA.

For 2020 overall, all 11 sustainable funds beat the MSCI EAFE fund. The leader was Calvert International Responsible Index. Based on Calvert's proprietary index, the fund posted a 15.3% return for the year, miles ahead of IEFA’s 8.6% return. Next best was Vanguard ESG International Stock ETF, which tracks the FTSE Global All Cap ex US Choice Index. The fund posted a 13.5% return. Overall, the 11 sustainable funds posted a 12% average return for 2020, well ahead of the MSCI EAFE index fund.

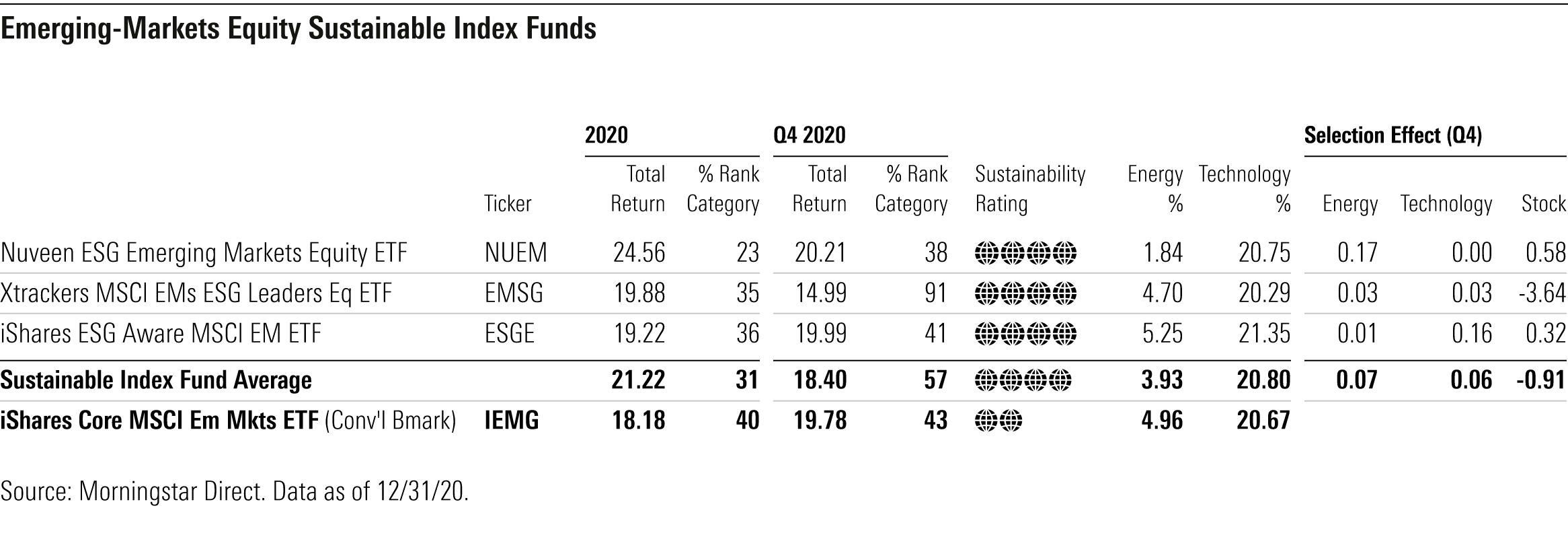

Emerging Markets. Two of the three sustainable emerging-markets index funds outperformed iShares Core MSCI Emerging Markets ETF IEMG for the quarter and all three comfortably outpaced IEMG for the year. The best of the group was Nuveen ESG Emerging Markets Equity ETF NUEM, which posted a 24.6% return for the year. The fund tracks the TIAA ESG Emerging Markets Equity Index, provided by MSCI.

The late-year gains of cyclical value and traditional energy stocks hindered sustainable funds' relative performance in the fourth quarter. Among U.S. and developed-ex U.S. index funds, energy sector weightings were, on average, negative, based on attribution analysis.

Throughout the year, stock selection has been a big positive for sustainable index funds. It was a mixed bag in the fourth quarter, however, with U.S. funds benefiting by 0.54%, on average, but stock-selection effects were negative for funds outside the U.S.

A Focus on Creating Value for All Stakeholders Despite 2020 being a generally terrible year because of the global pandemic, it wasn't a terrible year for investing, and, relatively speaking, it was a good year for sustainable investments. The better relative performance of sustainable funds is tied to their focus on companies with better ESG profiles and their alignment with the transition to a low-carbon economy. In 2020, sustainable funds demonstrated that investing with an emphasis on how a company manages material ESG risks and how it manages key stakeholders can produce good returns in an uncertain economic environment.

Like any investment approach, sustainable investing will not always outperform over short-term periods. But over the longer term, ESG insights can help investors develop a more complete picture of a company, one not reliant only on financial indicators. ESG analysis can provide an early warning on developing environmental or social risks before they affect company value and can help evaluate the sustainability of a firm's long-term business model and how well a firm treats its stakeholders.

The realization that a growing portion of their investor base is composed of sustainable investors is helping companies move away from a short-term shareholder-centric approach to a longer-term perspective that focuses on creating value for all stakeholders, with better outcomes for society and the planet. We saw this year that companies that are moving in this direction performed better during the global pandemic for all their stakeholders.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)