As Private Equity Goes Mainstream, Investors Need Help

How can private equity be benchmarked?

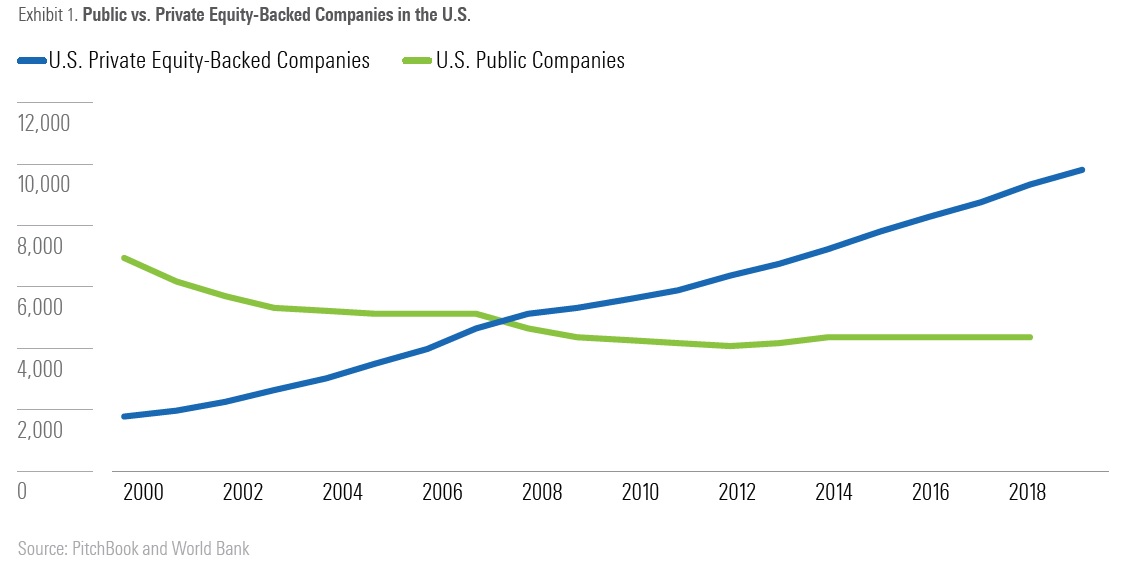

The growth of private markets continues to be a powerful force shaping the investment landscape. In the United States, businesses have raised more money through private equity than in the public market for each of the last 10 years, and the trend is accelerating.

The growth of private markets is widening the range of investment opportunities for investors. Institutional investors are increasing their stakes in private equity, while regulatory changes are opening new channels for retail investors to access these investments, including through 401(k) plans.

As investors make private equity a larger part of their portfolios, it becomes more important to measure private markets and to provide a framework for evaluating such investments. Unfortunately, private equity does not readily lend itself to benchmarking in the way that public equity does, and this poses some tough challenges for asset managers and investors.

Shift From Public to Private--"Gradually and Then Suddenly" The way businesses have raised capital has undergone a dramatic transformation over the last quarter of a century. There are more alternatives today for companies to raise capital from public or private investors than there were in the past. Private markets have become a favored alternative source of company financing. The data is striking--the number of U.S.-listed public companies, which peaked in 1996 at around 8,000, has fallen by almost half to 4,400 in 2019. It is not just the absolute number of companies but the notional value of capital raised that has shifted to private markets from public. For instance, in 2018, private equity provided 5 times more capital to companies than was raised through IPOs. The trend is not limited to the U.S. market.

The demand from institutional investors has contributed toward this extraordinary shift in recent years. Looking ahead, as regulators soften their stance toward who can access private equity, the demand from retail investors is likely to rise. Two recent regulatory changes may well have a far-reaching impact on the opening of private markets to a broader swath of wealthy retail investors. In June, the U.S. Department of Labor issued an Information Letter clarifying the use of private equity in professionally managed funds offered in defined-contribution retirement plans such as 401(k)s. Private equity adoption will probably come first through target-date funds that offer diversified portfolios and slowly shift asset allocation over time as workers age. And in August, the SEC expanded the definition of so-called "accredited investors" or "qualified investors." The new definition will broaden the range of investors who can gain exposure to private markets.

Measuring Private Equity At the 2019 Berkshire Hathaway annual shareholders meeting, Warren Buffett famously quipped, "We have seen a number of proposals from private equity funds where the returns are really not calculated in a way that I would call honest."

Within the context of the generally accepted best practices of benchmark design, we recognize that private equity poses three major challenges.

- Unambiguous: There is no consensus agreement on how to accurately represent the investable universe of private equity funds. It consists of opportunities not uniformly accessible to all investors.

- Investable: Unlike public markets, private markets offer no investable beta that serves as a passive alternative. It is not practical for any investor to construct a private equity portfolio with sufficient diversity to represent the total market.

- Measurable: Private equity investments are not marked-to-market daily, unlike public market investments. Private equity returns reflect the appraised value of the underlying portfolio of companies, which are calculated once a quarter or at the time of secondary market transactions.

These are thorny issues that we wrestle with as we work to solve the benchmarking puzzle for private markets. We are working closely with our colleagues at PitchBook, a financial data and research company that specializes in private equity, to develop proper measurement tools and a level of analysis needed to understand the drivers of performance.

As an index provider, we recognize that the process of finding a suitable private market benchmark is often dependent on its intended use. Fortunately, a range of public and private equity indexes can help assess the investment selection and management skills of the general partner relative to its peers.

a. Public equity benchmarks. Investors make long-term commitments to private equity investments with the expectation of earning returns in excess of those available in the public market. Therefore, public market indexes act as good reference points for measuring whether a manager is contributing to the achievement of the private equity target return or the opportunity cost of forgoing investment in public markets. Furthermore, given expectations of the illiquidity premium, simple market indexes "plus premium" can be more reflective of investment mandates.

b. Public market equivalent. The performance of the fund is compared with the performance of a hypothetical fund that generates the same positive or negative cash flows as the fund, but those cash flows are used to participate in public markets (which can be tailored to any index). PME is designed to give investors more of an apples-to-apples comparison between private market funds and public benchmarks. PME was originally developed by Austin Long and Craig Nickels in the late 1990s. And there have been several subsequent iterations of PME that were designed to address its limitations.

c. Peer group benchmarking. Peer group benchmarks assess a fund manager's performance relative to his or her peers. The dispersion of returns among various private equity funds is notoriously high. The decision to pick the right private manager plays an important role in portfolio allocation. The performance of the fund is compared with the performance of a portfolio of private equity funds with similar strategies, vintage years (or inceptions), and geographies. Our colleagues at PitchBook offer a range of benchmarks that aim to help both LPs (limited partners, or investors) and GPs (general partners, or PE managers) better understand fund performance relative to broader asset classes and other private market strategies.

d. Listed private equity index. Given the nature of private equity, there is no efficient way to gain passive exposure to the asset class. We recently launched the Morningstar PitchBook Listed Private Equity Index, which is an index of listed companies with significant private equity exposure. While it is somewhat diffused exposure to private equity, it democratizes access to a large and growing segment of equity markets.

Final Word Private markets will continue to increase their role in global capital markets. As private investments become more accessible, investors are likely to increase their allocations to private equity as part of their overall investment portfolios.

Investors in public equity have been accustomed to high standards of measurement, with access to benchmarking tools and analytics that enable sound investment decisions. That’s not the case with private equity. The very nature of private markets implies that there is no perfect way to evaluate and benchmark private equity investment returns. However, there are a variety of public and private equity indexes which, especially when used in combination, can help investors accomplish their specific goals.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)