U.S. Fund Flows Show Investors Turning to ETFs in September

Open-end funds headed for worst year ever as exchange-traded funds get inflows.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. This is an excerpt from the Morningstar Direct U.S. Asset Flows Commentary for September 2020. Download the full report.

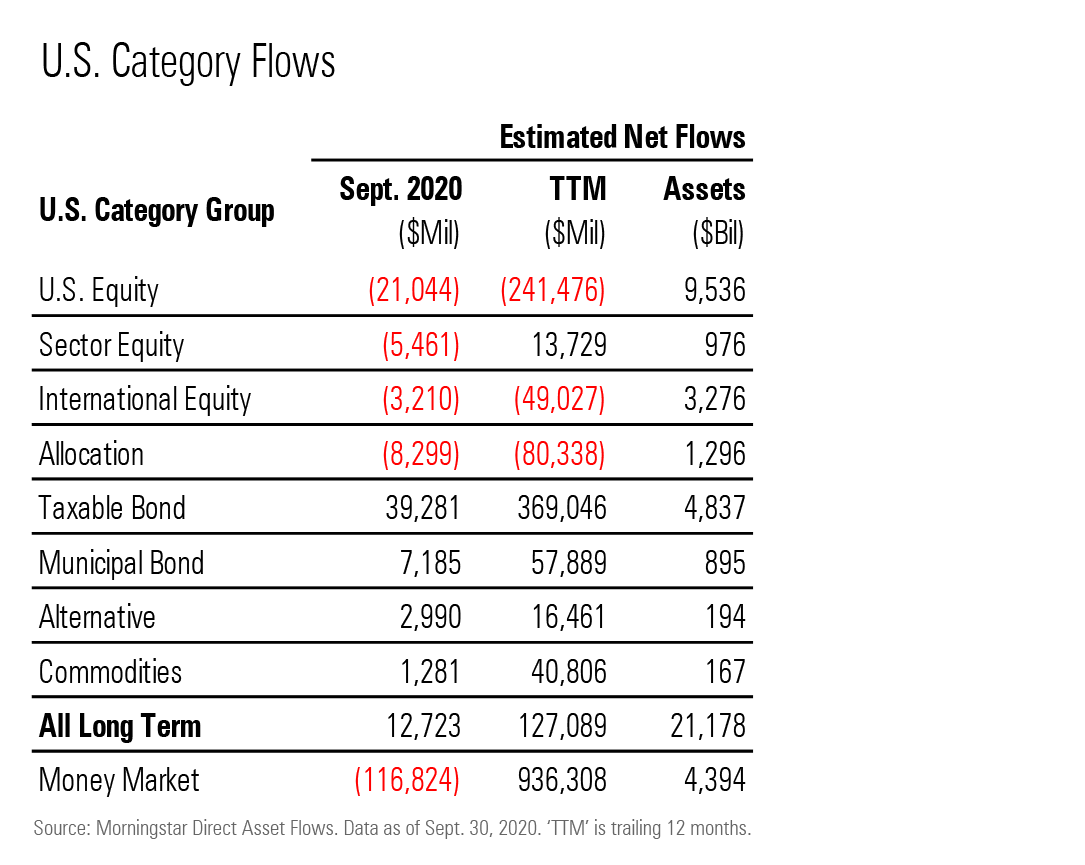

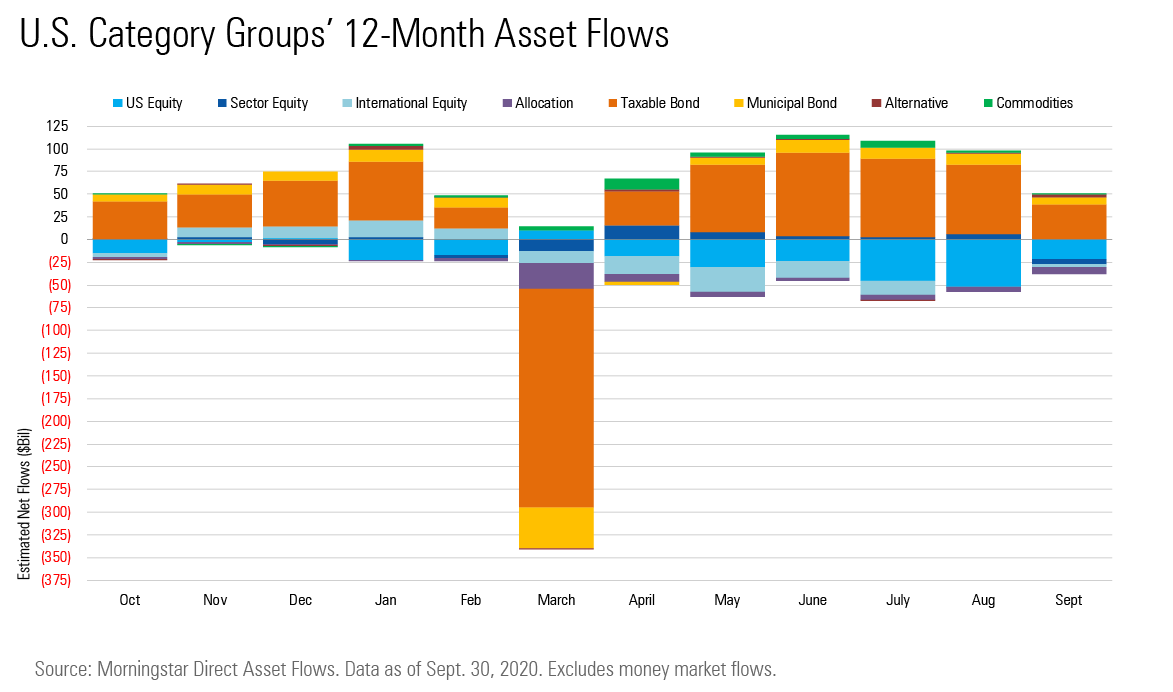

In a month when the S&P 500 crested at a new all-time high (on Sept. 2) before pulling back, long-term mutual funds and exchange-traded funds had inflows of $13 billion in September 2020--their sixth consecutive month of inflows since the $325 billion bloodletting in March. Money market funds had a hefty $223 billion of outflows in 2020's third quarter, the most since 2010's first quarter but only a fraction of the $1.5 trillion they collected from April 2019 through June 2020.

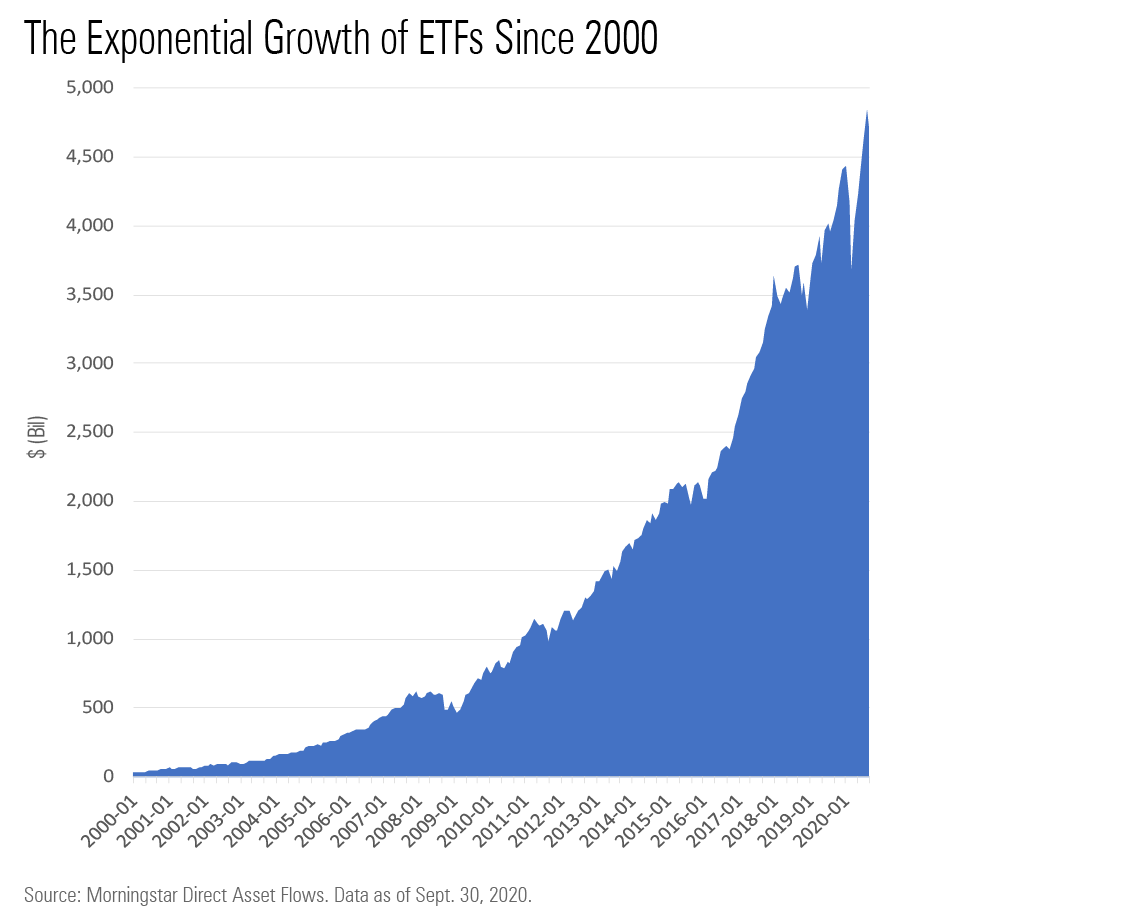

Among long-term funds, the paths of open-end funds and ETFs have increasingly diverged. Open-end funds are on track for their worst calendar year ever, having suffered $317 billion of outflows so far in 2020. (Open-end funds suffered record calendar-year outflows of $169 billion in 2018, which topped the previous record of $157 billion set in 2008.) ETFs, by contrast, have collected $313 billion for the year to date. That is by far the widest asset-flows disparity between the two investment types in data going back to 1993. In September, open-end funds shed $22 billion while ETFs picked up $34 billion.

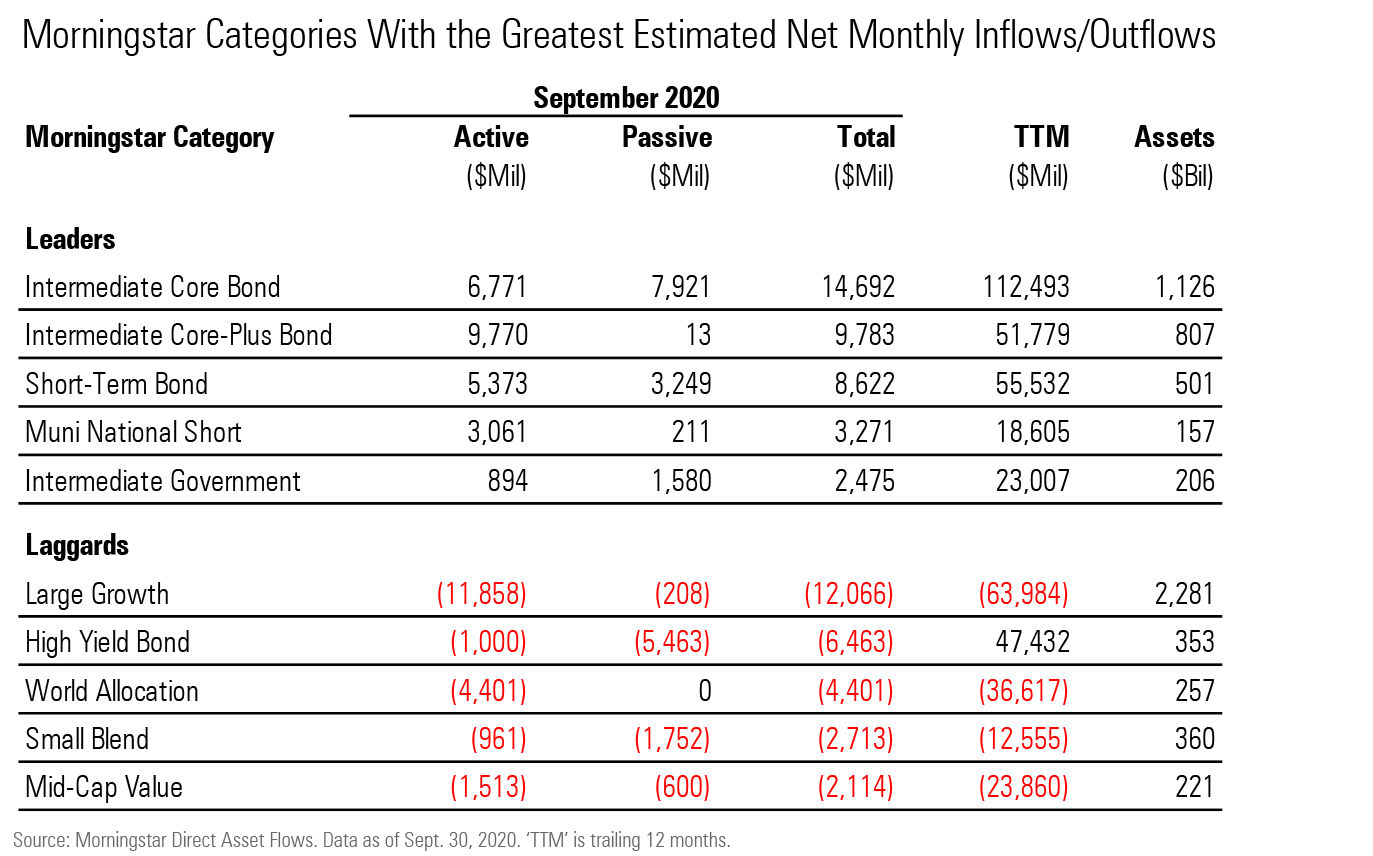

Taxable-bond funds continued to lead all category groups with another $39 billion of inflows in September. They also netted a healthy $202 billion for the quarter--just shy of the record $203 billion they raked in during the previous quarter. As in August, investors continued to seek middle-of-the-road risk exposure in September, plowing nearly $15 billion into intermediate core and $10 billion into intermediate core-plus funds. A record $60 billion entered intermediate core bond products in the third quarter.

Not all taxable-bond funds drew investor interest, however. High-yield bond funds, which have benefited in recent months from the Federal Reserve's corporate-bond purchasing program, posted $6.5 billion of outflows in September. Bank-loan funds, whose stakes in floating-rate securities looked less appealing following Fed chair Jerome Powell's assertion in early September that interest rates are likely to remain low for a period "measured in years," had net redemptions of $1.3 billion in September.

Meanwhile, investors continued to pull money out of equity funds. Although the $21 billion that left U.S. equity funds in September was the smallest amount since April's $18 billion, the group suffered record quarterly outflows of $119 billion. The large-growth Morningstar Category, which was the best-performing equity Morningstar Style Box category in the third quarter and for the year through September, saw $12.1 billion of outflows. Only the large-blend category bucked the trend, with $2.2 billion of inflows in September. Much of that went into core passively managed strategies, such as iShares Core S&P 500 ETF IVV and Fidelity 500 Index FXAIX.

International-equity funds' $3.2 billion of outflows in September marked the group's seventh-consecutive month of outflows--its longest such streak since June-December 2008. Sector equity funds gave back $5.5 billion in September, including $1.8 billion each from health and technology funds. In the multi-asset space, allocation funds have struggled with outflows for years. The group has had outflows every month since June 2015, including $8.3 billion in September.

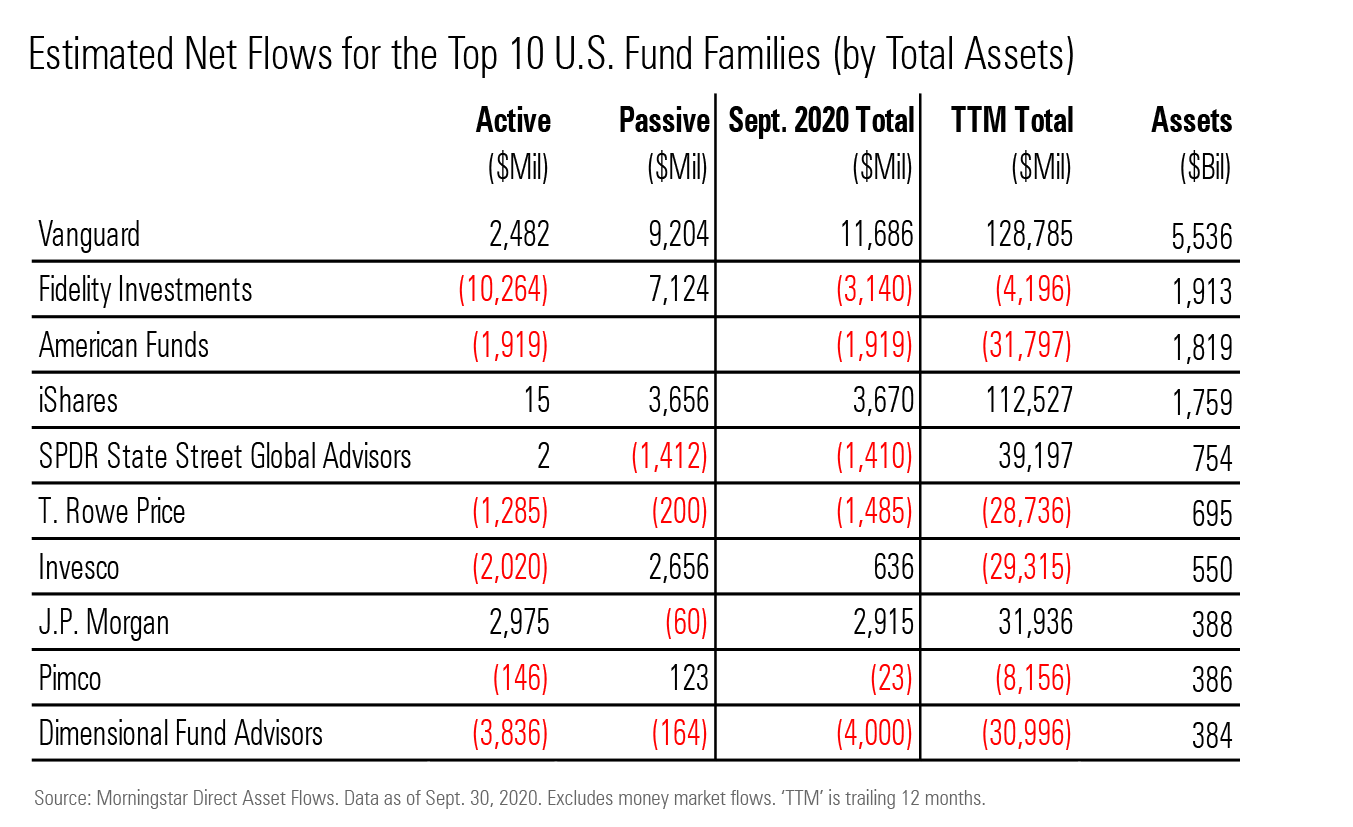

Vanguard was the top flow-getter in September, taking in $11.7 billion in long-term assets. Both its actively and passively managed funds had inflows during the month. The firm benefited from investors' interest in taxable-bond funds; Vanguard's offerings in that category collected $13.2 billion. Vanguard also led all fund families with $29 billion of inflows for 2020's third quarter.

In addition, the firm reported that it converted a sizable $20 billion of assets from Vanguard Total International Stock Index VTIAX to a collective investment trust. Such conversions can look like outflows from funds, but Morningstar adjusted its flow estimates to account for Vanguard's action. (Vanguard Total International Stock's total assets showed a sharp drop, however, from nearly $428 billion in August to $400 billion in September.)

The iShares fund family came in second in September with $3.7 billion of inflows. The firm saw inflows across most of its lineup. Defying the trend, its international-equity funds added $1.3 billion. Elsewhere, its taxable-bond funds gathered $1.2 billion, and its U.S. equity products grew by $900 million. As noted earlier, iShares Core S&P 500 ETF was a big target of new money, pulling in $3.7 billion (more than any other fund during the month), while iShares Core U.S. Aggregate Bond ETF AGG garnered $2.0 billion.

Note: The figures in this report were compiled on Oct. 13, 2020, and reflect only the funds that had reported net assets by that date. Morningstar Direct clients can download the full report here.

/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)