Morningstar's Take on the Third Quarter

Our analysis of the third quarter in stocks and funds.

As the third quarter of 2020 comes to a close, Morningstar's analysts have provided in-depth reviews and outlooks across equity sectors and fund categories.

Equities 33 Undervalued Stocks for the Fourth Quarter Here are our analysts' top ideas in each sector.

Economic Outlooks: We Don't Think the Market's Too Optimistic We forecast a strong long-run U.S. recovery.

Quarterly Markets Summary: 7 Charts on Q3 Stock and Bond Markets We share some highlights from this quarter. Stock Market Outlook: Finding Opportunity Beyond Mega-Caps Although the market's largest names are pricey, we see several pockets of value. Healthcare: Drugmakers, Managed-Care Firms Undervalued We expect a coronavirus vaccine to be released within the next six months. Utilities: Some High-Quality Utilities Available at Reasonable Prices Sector fundamentals remain strong and dividends keep growing. Basic Materials: Opportunities in Basic Materials Limited to Agriculture and Chemicals Lithium demand took a hit as a result of the pandemic, but we expect it to rebound. Communication Services: Facebook Powering the Communications Sector Traditional media stocks still look the most attractive. Energy: Energy Stocks Historically Cheap We expect demand to catch up in 2021 and 2022. Consumer Defensive: Consumer Defensive Sector Looks Fully Valued Alcohol and tobacco stocks are trading at the greatest discounts to our fair value estimates. Technology: We'd Welcome a Pullback in Overvalued Tech We're still fond of software and cybersecurity firms. Financial Services: Banks Still Look Cheap Some high-quality financial services firms are trading at decent discounts. Industrials: Where to Find Attractive Stocks in Industrials Sector The aerospace, defense, and industrial distribution industries look undervalued. Real Estate: Lots of Opportunities in Yield-Rich Real Estate Sector A fourth of the real estate sector trades in 5-star territory. Consumer Cyclical: Travel and Leisure Companies Ready as Americans Venture Out Again We expect car and local travel to rebound before international and air travel.

More Gains for International-Equity Funds in the Third Quarter Strong growth in Asia, especially China, drives stellar emerging-markets returns.

Tap Into This Cheap Beverage Maker In the somewhat frothy consumer defensive sector, alcoholic beverage producers look cheap.

Coronavirus Zapped Energy Stocks When will crude oil recover? Healthcare Sector Adjusts to Pandemic's Pressures And four companies we like right now. Where to Find Bargains Today? Look to Small- and Mid-Caps, Value Stocks Several mega-cap stocks significantly overvalued. Tech Bridged Gaps Created by Coronavirus And what we expect from October.

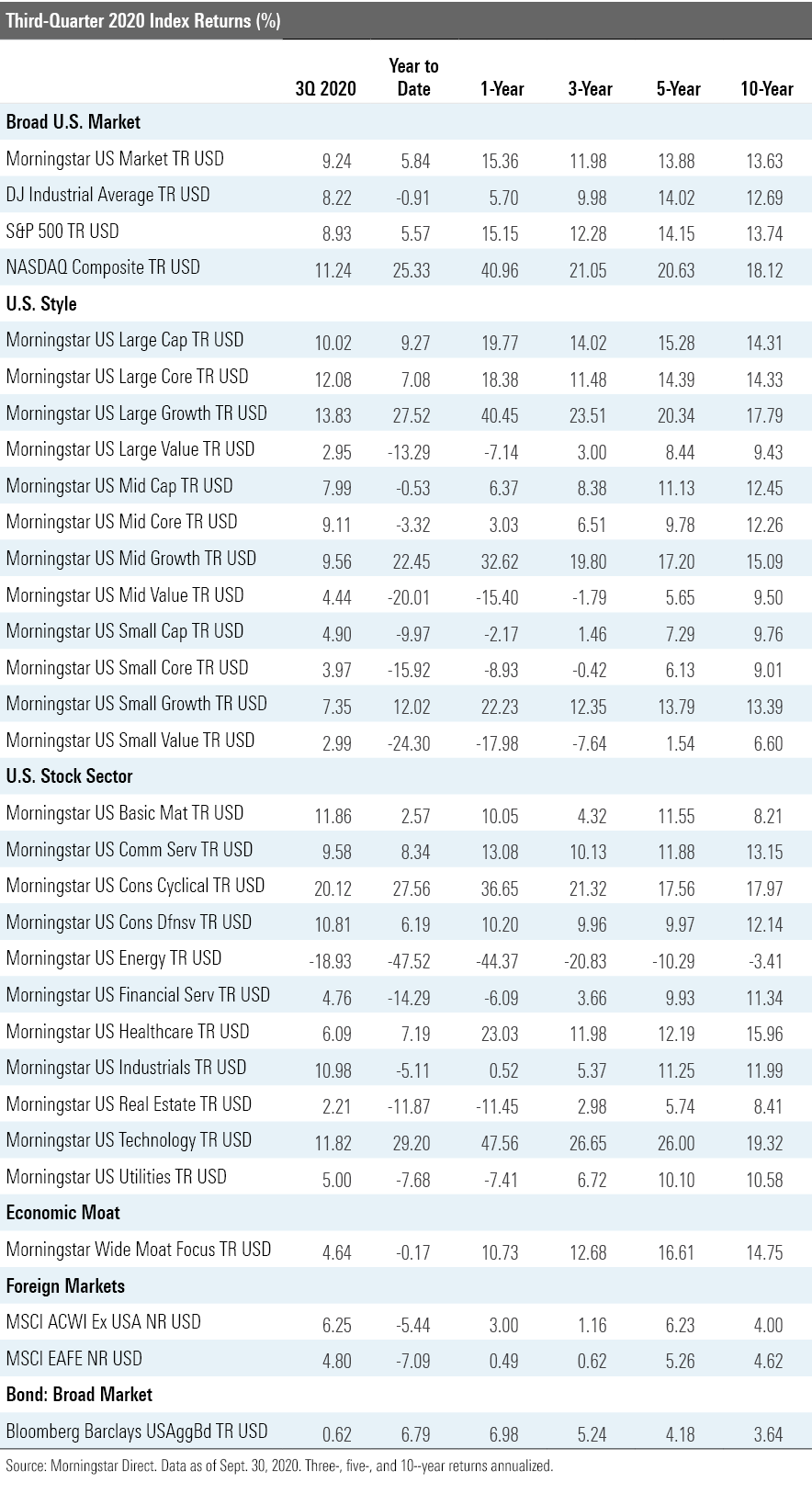

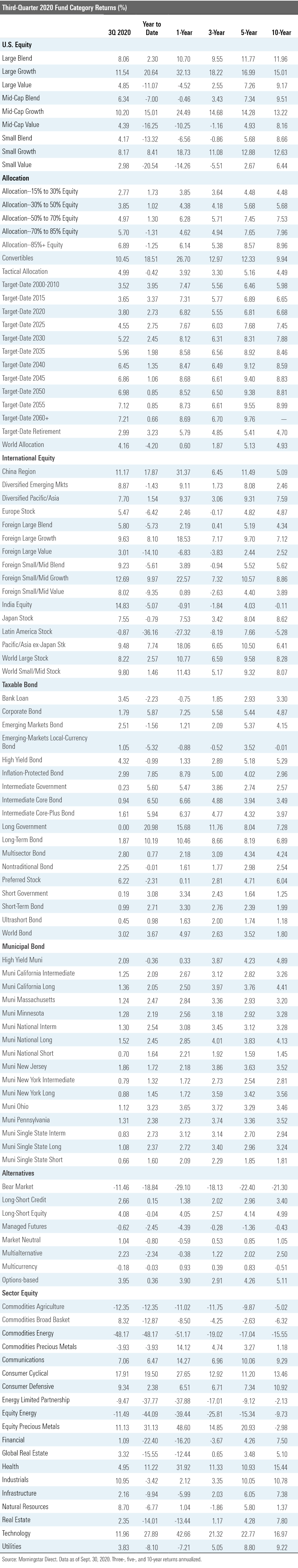

Funds U.S. Equity Funds Press Higher but Fade Late in the Third Quarter Investors pile into what's working. Fixed-Income Sectors Rise in the Third Quarter Fed policy shift sets the stage for years to come.

Download the quarter-end data.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)