Passive Sustainable Funds Maintain Their Momentum

Adoption of these sustainable index funds and ETFs is on the rise in the United States but still lags Europe.

Globally, sustainable investing has gathered impressive momentum in recent years. Most sustainable funds are actively managed, but passive sustainable funds are growing in number, size, and complexity and are making their own mark on the landscape.

The uptake in passive sustainable funds has been driven by changing attitudes from both investors and fund providers. It reflects a growing recognition that environmental, social, and governance, or ESG, factors can be material to long-term financial performance, as companies face greater scrutiny from consumers, regulators, and employees alike over their ESG practices. The crisis caused by the coronavirus pandemic has further highlighted the importance of building sustainable and resilient business models based on multi-stakeholder considerations.

In our recent report, "Passive Sustainable Funds: The Global Landscape 2020," we presented a taxonomy that is designed to help investors navigate the cluttered landscape. We leveraged this framework to analyze trends in asset growth, asset flows, product development, and fees in the U.S. passive sustainable fund market.

Defining the Universe of Passive Sustainable Index Funds and ETFs We have defined passive sustainable funds as those index funds and exchange-traded funds globally that:

- use ESG criteria as a key part of their selection or weighting process,

- indicate that they pursue a sustainability-related theme, and/or,

- seek a measurable positive impact alongside financial return.

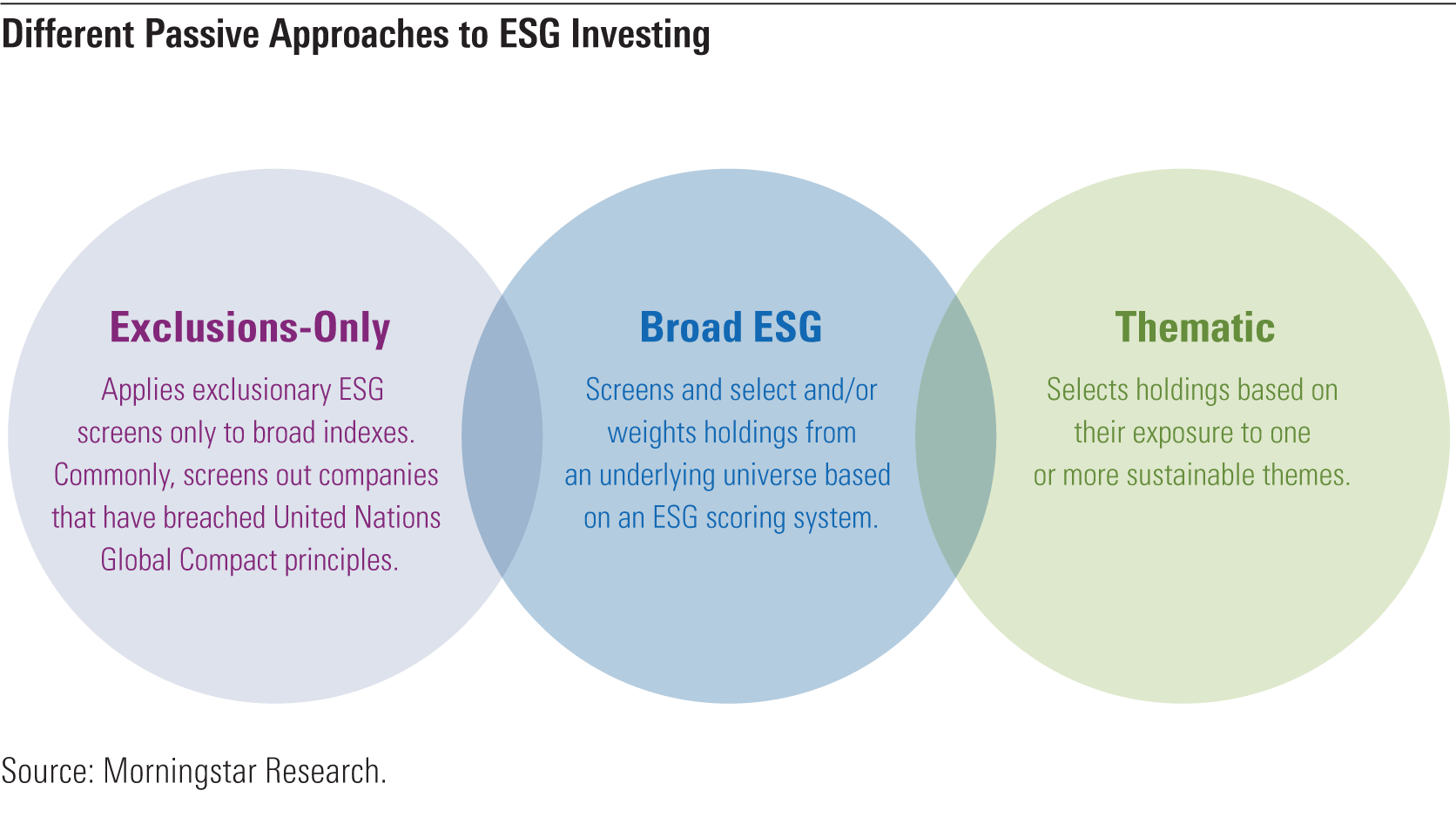

To help navigate the diverse and expanding landscape, we have subdivided the sustainable passive universe into the smaller groupings shown below.

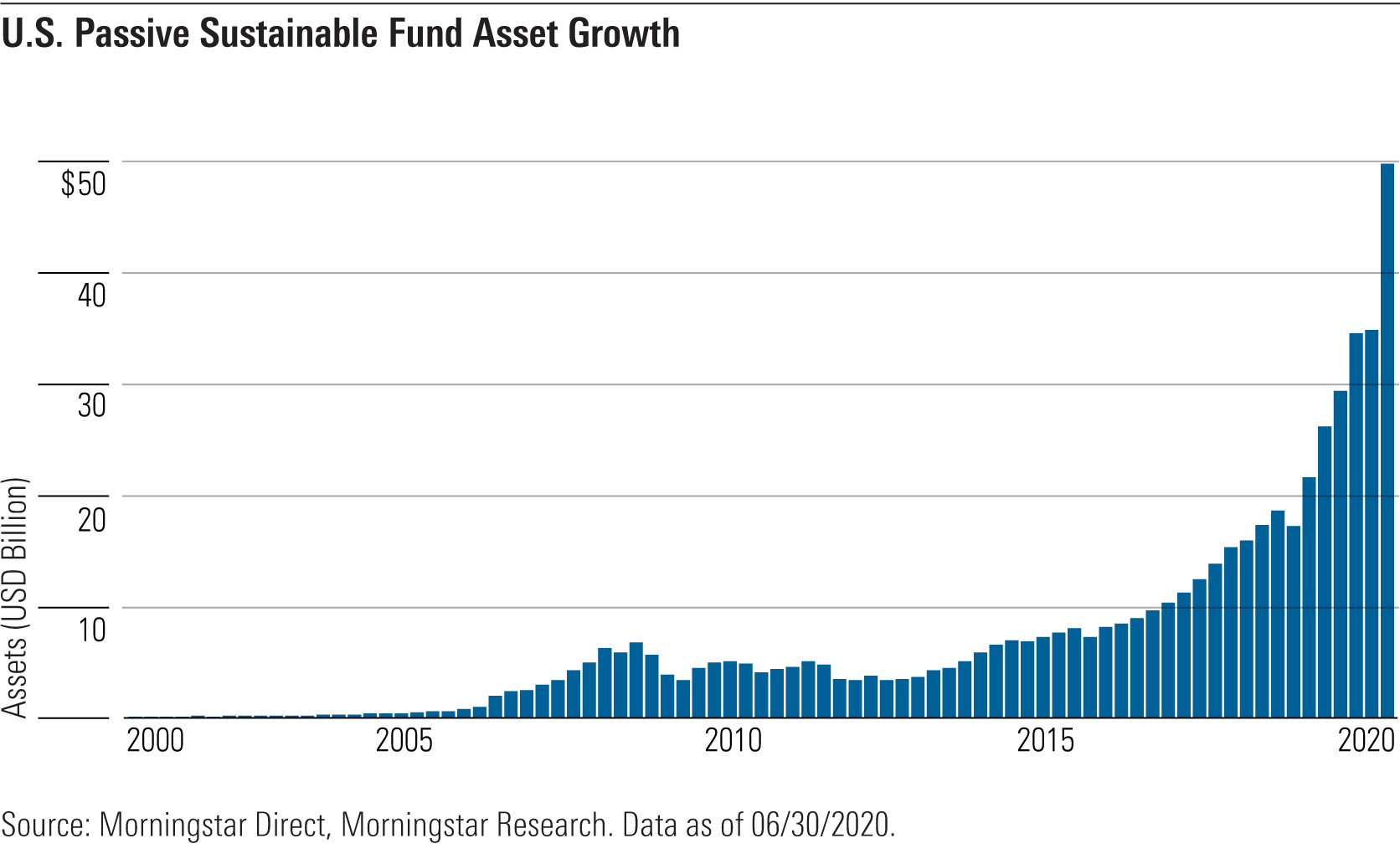

The Growth of the U.S. Passive Sustainable Fund Universe Passive sustainable funds have grown considerably in the United States over the past decade, though U.S. adoption is well behind Europe.

As of the end of June 2020, as shown on the chart below, these U.S. funds had grown to $50.0 billion in assets, up from $4.1 billion 10 years earlier. Inflows account for nearly all this growth.

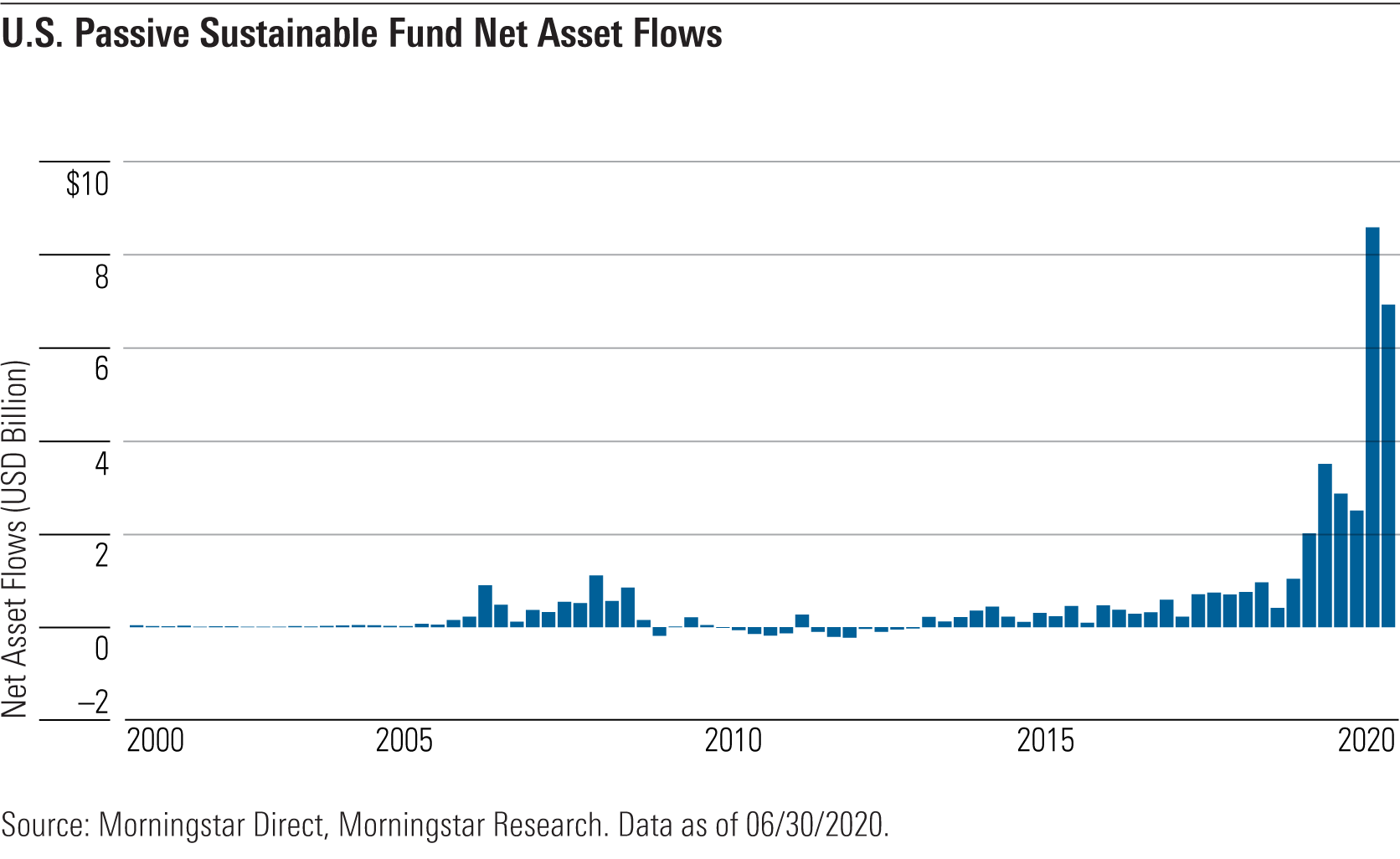

Over that same 10-year period, as shown below, these funds attracted an estimated $36.1 billion in net inflows, $29.7 billion of which came from January 2019 through June 2020.

Despite their considerable growth, passive sustainable funds only represent about 0.6% of the total assets invested in U.S.-domiciled index funds. So, there is still significant room for growth.

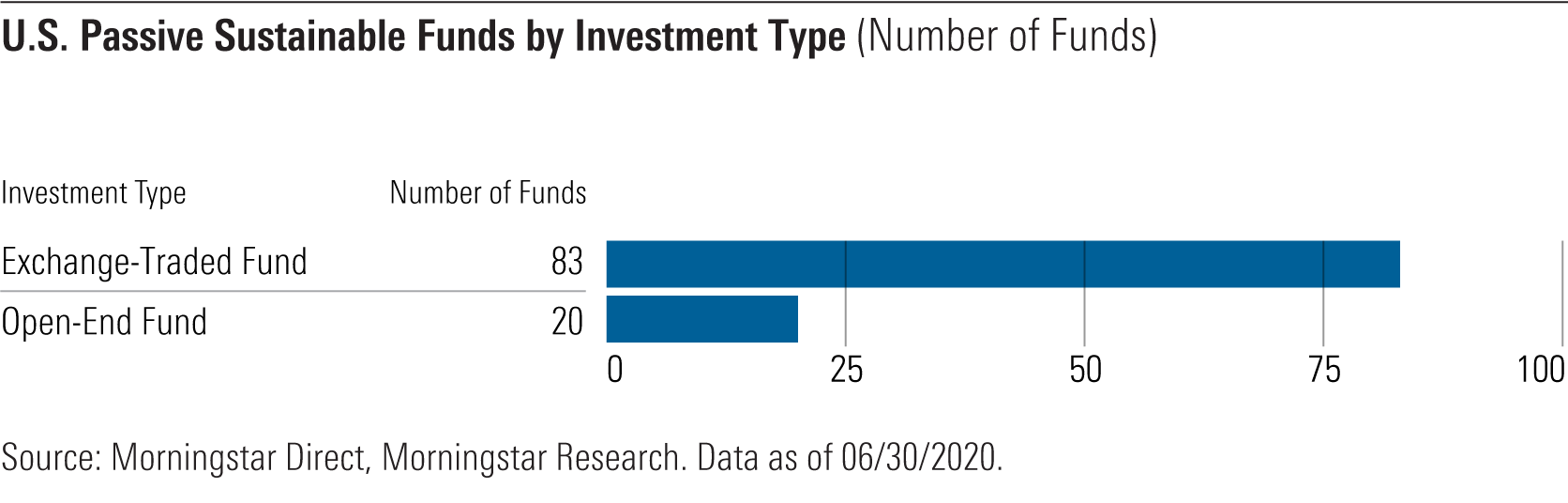

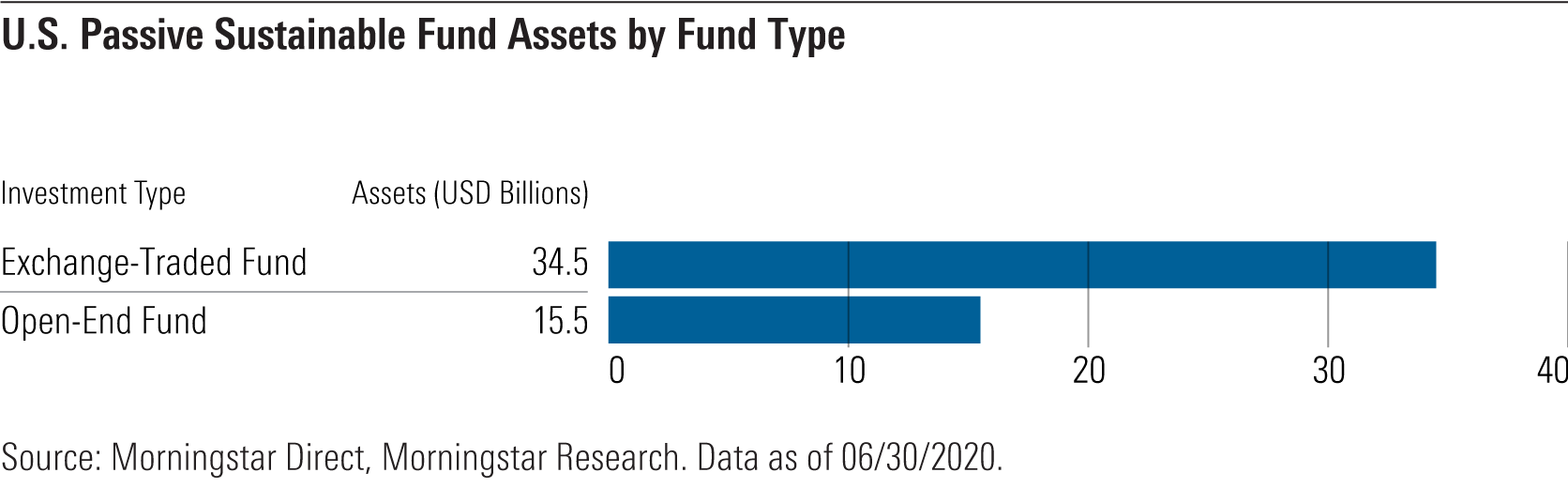

Sustainable ETFs Take the Lion's Share of Assets Exchange-traded funds are more prevalent than sustainable index mutual funds, and they account for most of the assets invested in passive sustainable funds, as the exhibits below illustrate. They have also taken the lion's share of inflows over the past decade.

The dominance of the ETF wrapper isn’t surprising, in light of its tax efficiency and distribution advantages, as anyone with a brokerage account can access these funds.

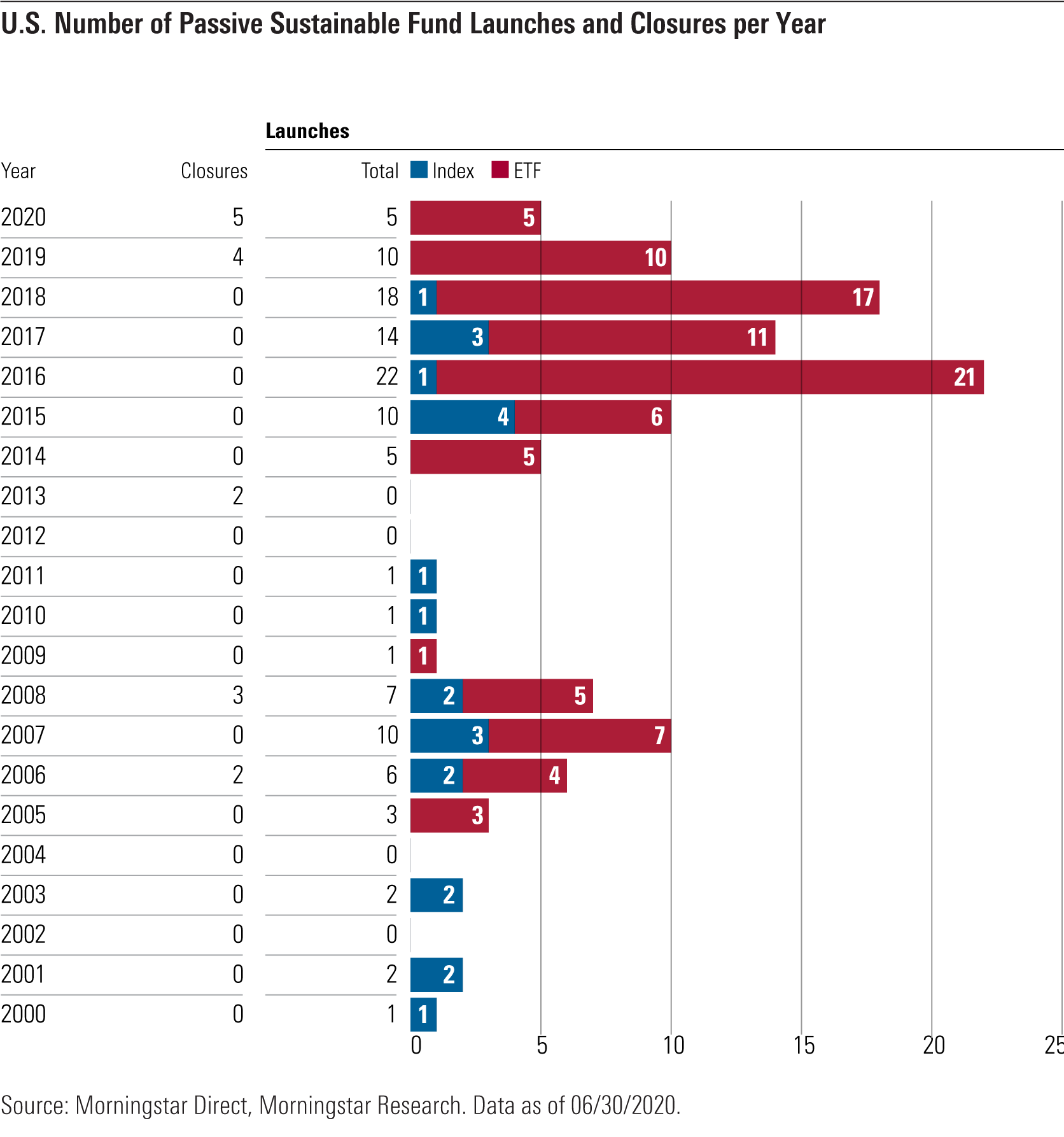

Passive sustainable product development has accelerated in recent years. Since the beginning of 2016, 69 products in this area have been brought to market, which is more than the total number of such funds launched before 2016. As the chart below shows, almost all of these were sustainable ETFs (64).

Diversity in Approaches to Sustainable Index Funds and ETFs

There is considerable diversity in the range of approaches these funds take. Some, like iShares ESG MSCI USA ETF ESGU, with a Morningstar Analyst Rating of Silver, hug their starting universes tightly, explicitly constraining tracking error against the market, and modestly tilt toward firms with strong sustainability practices. Others, like Bronze-rated Xtrackers MSCI USA ESG Leaders Equity ETF USSG, more aggressively pursue ESG leaders and take greater active risk.

Beyond the degree of active risk these funds take, there are also differences in how these funds define sustainability. For example, USSG and ESGU focus on the ESG risks and opportunities in each industry that could be financially material, while Goldman Sachs JUST US Large Cap Equity ETF JUST targets firms that score well on corporate responsibility issues that are important to Americans, based on survey data.

There is currently no standard definition for sustainability, which increases investors' due-diligence burden and the risk that a fund will not meet investors' expectations. It is imperative to research these funds before jumping into them.

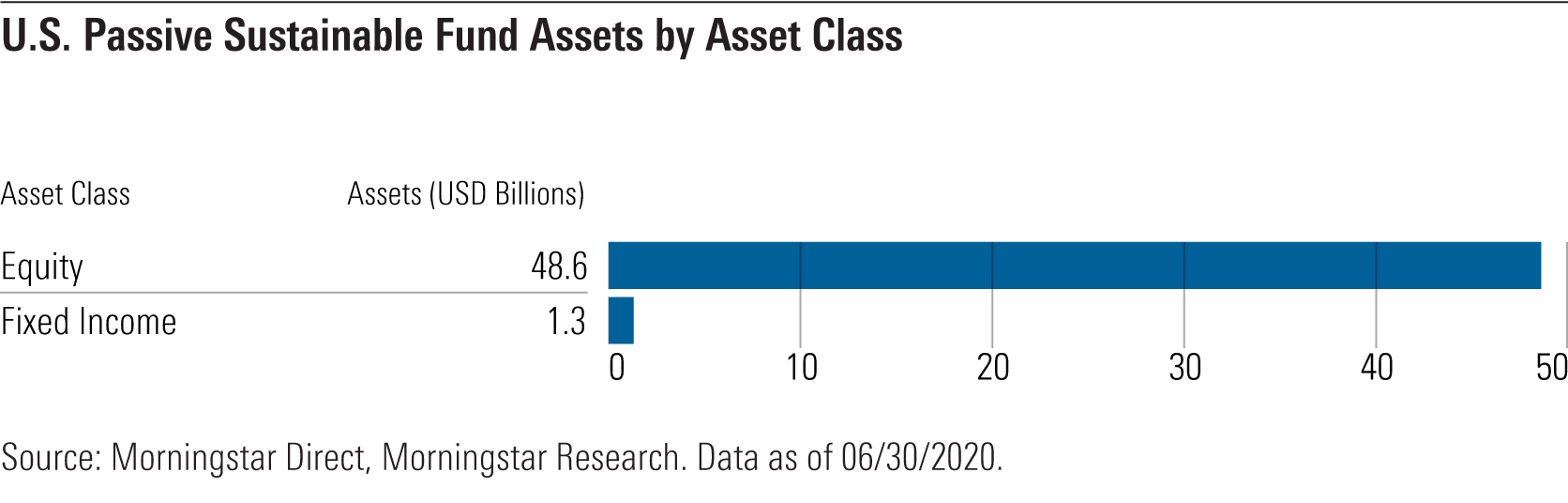

Passive Sustainable Fund Investors Favor Broad Equity Funds Nearly all the assets invested in passive sustainable funds are parked in equity funds, as the exhibit below shows. Sustainable equity index funds are also much more common than sustainable fixed-income or allocation index strategies. At the end of June 2020, there were only 12 sustainable fixed-income index funds, eight of which were launched in the past three years.

It can be challenging to apply sustainability screens outside the corporate sector of the bond market. The U.S. government and agencies, like Freddie Mac and Fannie Mae, are among the largest debt issuers in the U.S. There aren’t many alternatives that provide similar exposure, limiting the opportunity to screen for issuers with more sustainable practices. Sustainable screens can also have an unintended impact on traditional risk metrics, like duration and credit quality. As such, many sustainable fixed-income index funds listed in the U.S. explicitly constrain their key risk factors relative to their starting universes and predominantly apply sustainability screens in the corporate bond sector.

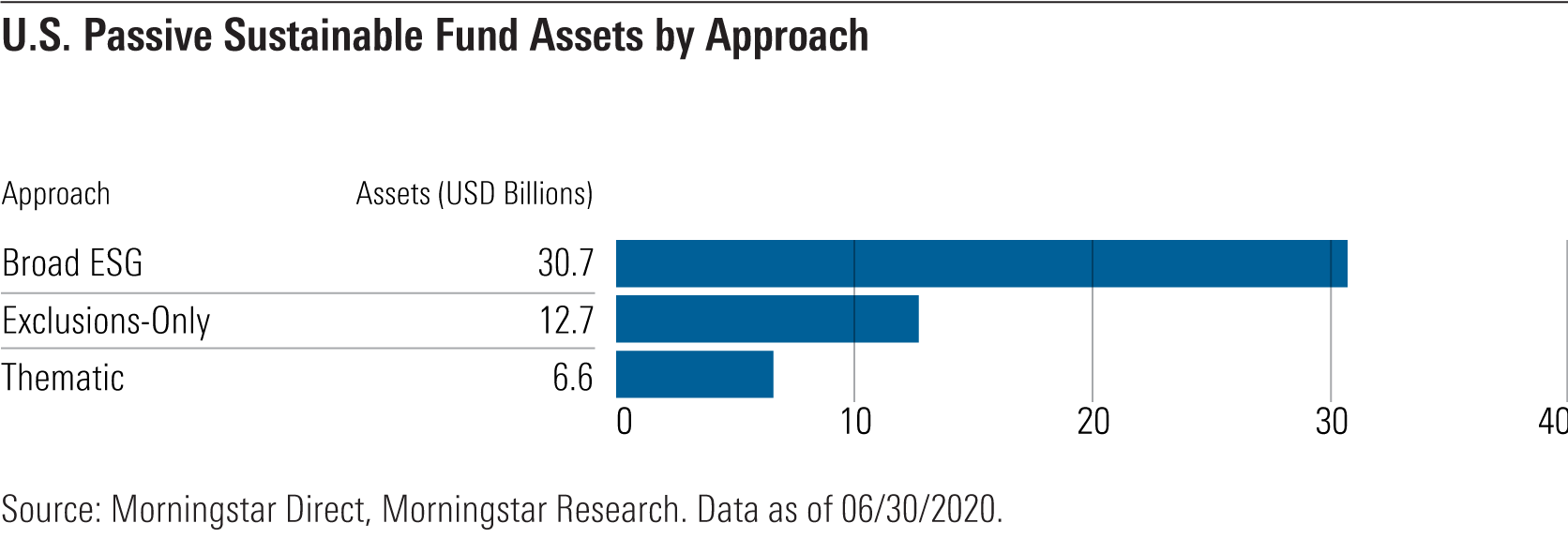

In addition to the preference for equity strategies, investors in sustainable funds have overwhelmingly flocked to Broad ESG funds, as the exhibit below shows.

Here’s how these approaches differ:

- Broad ESG funds tend to offer broad exposure to the market, filter out controversial firms, and tilt toward companies with strong ESG practices.

- Funds that rely on Exclusions-Only, like the omission of fossil-fuel companies or firms involved in controversial businesses, represented the second-largest group by assets. Like Broad ESG funds, most funds in this group offer broad exposure to the market.

- Thematic funds account for a small share of total assets invested in passive sustainable funds. Although they represent nearly one third of all such funds by count, their asset share was 13.3% at the end of June 2020.

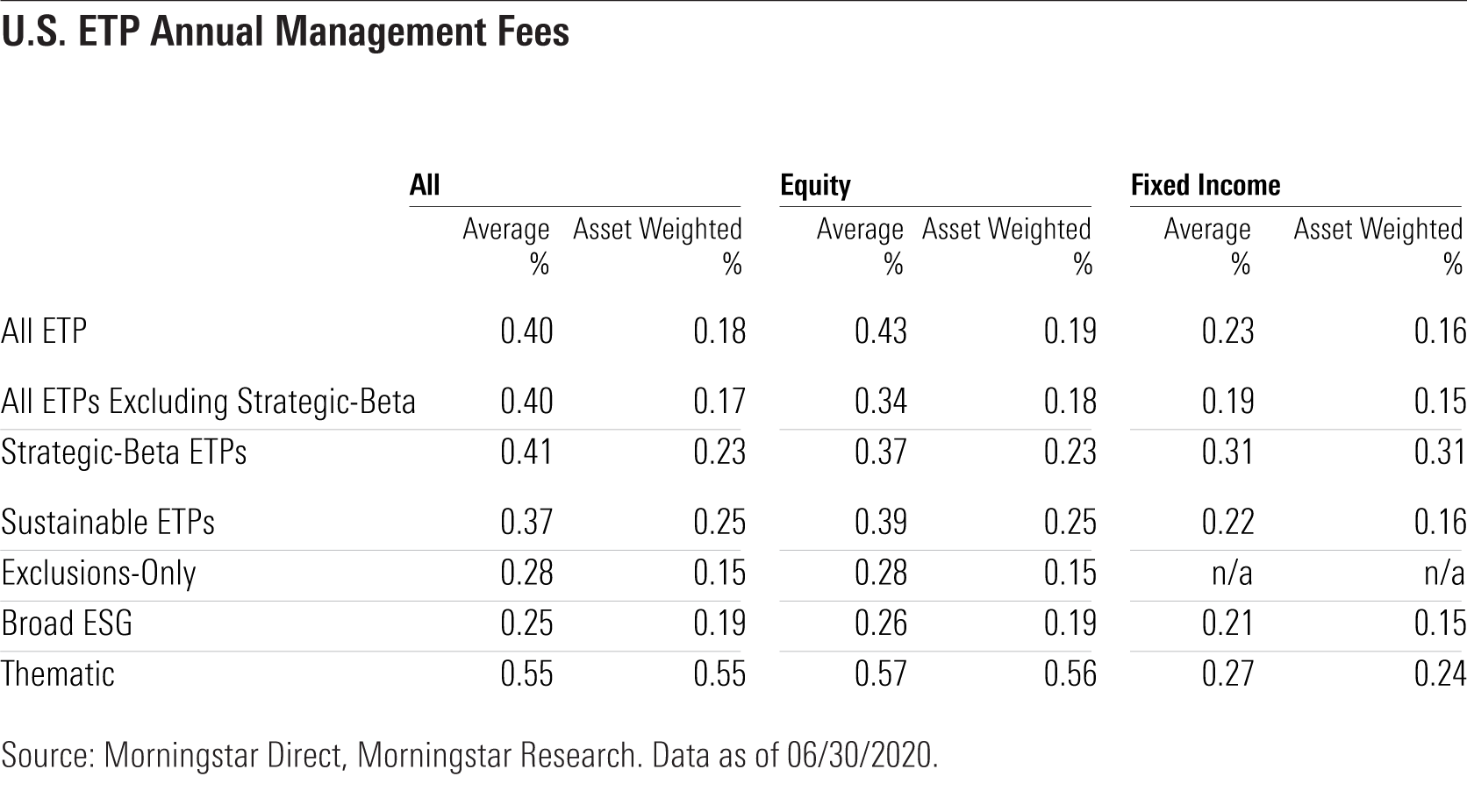

How Fees in Sustainable ETPs Compare With Traditional ETFs While sustainable exchange-traded products usually don't match the fees of the lowest-cost traditional index funds in their Morningstar Categories, on average, they charge similar fees to ETPs that don't focus on sustainability, as shown below. Broad ESG and Exclusions-Only funds tend to charge lower fees than their Thematic counterparts.

Across the board, investors tend to favor lower-fee funds, which is why the asset-weighted average fees are lower than the simple averages. Thematic sustainable funds were the only exception. In that group, the asset-weighted and simple average fees were the same. Here, it is harder to find substitutes, as Thematic funds tend to be more differentiated than Broad ESG and Exclusions-Only funds.

This article is adapted from research that was originally published in Morningstar Direct's Research Portal. If you're a user, you have access. If not, take a free trial.

/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/93a178f7-9fba-48fa-b146-9b56e127ae6c.jpg)