- All investing comes with risk. The question for advisors is how much risk clients are willing to take to reach their goals and how they’ll react to market volatility.

- Most advisors don’t use a validated test, which explains why some advisors might mistrust investment risk profiles.

- Research shows that psychometric questionnaires give better insight into real-world behavior and remain stable over time.

Risk

Do You Trust Your Investment Risk Tolerance Tools?

Here’s how to build accurate risk profiles for financial plans.

Key Takeaways

Read Time: 6.5 Minutes

The science behind investment risk profiles can feel fuzzy.

When the market is booming, how can you predict how clients will feel or behave in a recession? Losing money in theory is very different from watching the stock market tumble or your retirement savings dry up.

No wonder why many financial advisors see risk profiles as just another compliance requirement to cross off.

A proven approach to risk assessment could offer advisors a significant competitive advantage. Here’s how.

Why Are Investment Risk Profiles Important in Financial Planning?

According to Spectrem Group, over 20% of clients leave their advisor within the first year, on average. One of the top three reasons that clients cite is the advisor’s poor understanding of their willingness to take risks.

All investing comes with risk. Advisor have to ask: How much risk clients are comfortable taking to reach their goals? How much risk can they afford to take given their other sources of income and wealth? How will they react to market volatility? And how long do they have before they need their money?

Risk profiles can help your clients understand the long-term plan and how their investment decisions align with their goals.

In many countries, suitability requirements include risk profile considerations to protect clients from inappropriate investments:

- MiFID II in the European Union.

- Know Your Client under the client-focused reforms in Canada.

- Regulation Best Interest in the United States.

But these laws often focus on principles and don’t always spell out a method of measurement or approach.

Here’s our view on what goes into an accurate and complete risk assessment.

What Is a Risk Profile?

An investor risk profile is an assessment of how much risk an investor can tolerate and afford to take.

Most advisors don’t use a validated risk tolerance questionnaire, which might explain why some advisors mistrust risk profiles. When the market is up, their tests might indicate that clients want to take more risks, and when the markets fall, that they want to take fewer risks.

Part of the confusion comes from the different terms used interchangeably. Complete risk profiles incorporate:

1. Risk tolerance.

2. Risk composure.

3. Risk capacity.

4. Time horizon.

Home-grown questionnaires often lump these factors into a single scoring formula, hopelessly confounding the results and drivers of the ultimate risk recommendation.

If a client invests in risky meme stocks and sells too quickly during market drops, a 20-year time horizon won’t limit the damage. If a client is grappling with credit card debt when the stock market is wobbling, even the highest risk tolerance won’t matter if they can’t pay their bills. These mish-mashed questionnaires measure nothing clearly, providing little usable insight for advisors.

But breaking down and understanding these components individually and clearly can add dimension to a clients’ overall risk profile. Let’s take them one by one.

No. 1 – Risk tolerance: How much risk are clients comfortable taking?

Risk tolerance measures a client’s willingness to take risks in the long run for the opportunity to meet their financial goals. The academic literature (and data from the two million respondents who took our risk assessment) suggest that risk tolerance is a psychological trait, and thus relatively stable over time.

Picture a continuum from minimizing unfavorable outcomes on one end to maximizing favorable outcomes on the other. Are investors willing to take on investments for a chance at higher returns? Or are they risk-averse and more comfortable with a dependable, but lower-returning investment?

Morningstar evaluates risk tolerance with questions like:

- How do you usually feel about your major financial decisions after you make them?

- Have you ever invested a large sum in a risky investment mainly for the “thrill” of seeing whether it went up or down in value?

- You’re considering placing one-quarter of your investment funds into a single investment. This investment is expected to earn about twice the CD (certificate of deposit) rate. However, unlike a CD, this investment is not protected against loss of the money invested. How low would the chance of a loss have to be for you to make the investment?

No. 2 – Risk composure: How do clients feel in down markets?

No investor feels good when their portfolio is going down. Risk composure measures how well your clients can regulate their emotions, stick to their long-term convictions, and make investment decisions based on data instead of feelings.

Does your client leap into investment fads because they’re afraid of missing out on the chance to get rich quick? When the market drops, do they panic and contemplate selling off their portfolio?

Risk composure also depends on investing experience and financial knowledge.

Often, the more a person knows about the financial markets, the more resilient they are to fluctuations. Researchers call this ambiguity risk. Inexperienced investors think the worst-case and best-case outcomes are more extreme and more likely than they are.

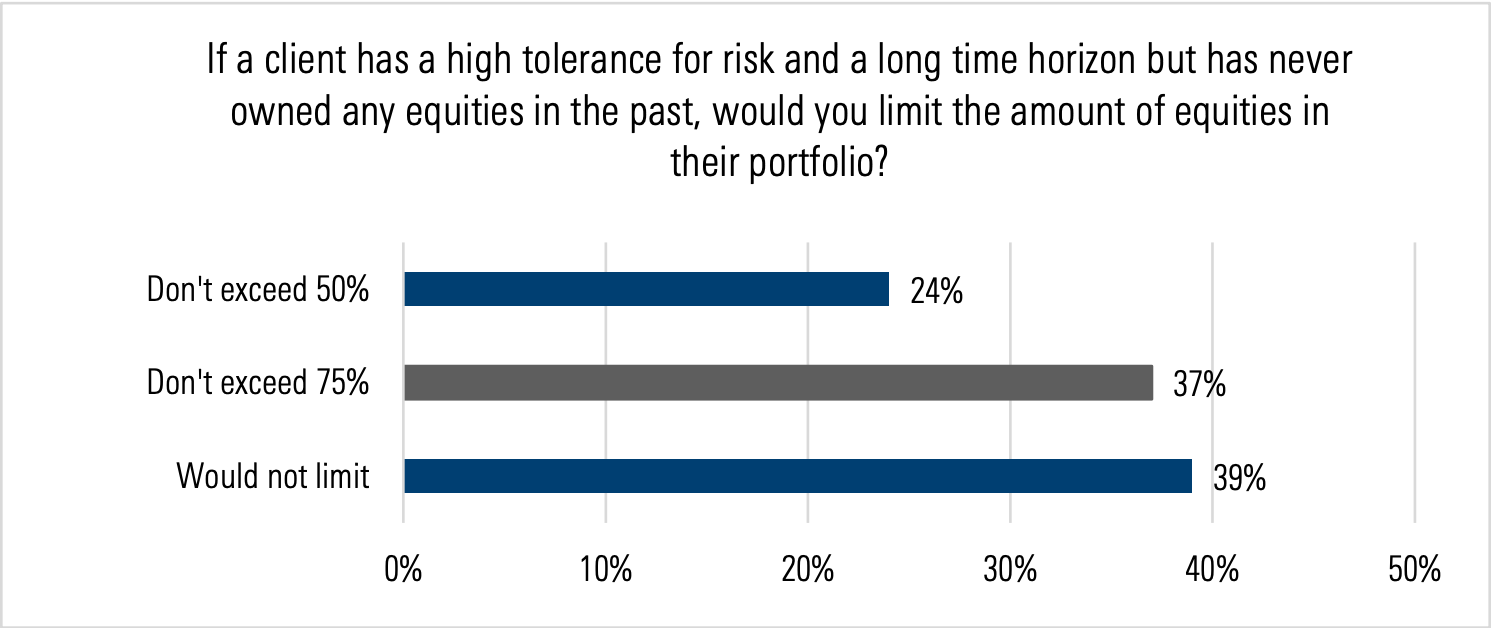

In one Morningstar survey, most advisors (61%) said they would limit equities in a portfolio for a client who was new to investing [PDF].

Risk composure helps you understand how well clients will stick to the plan during periods of instability.

For example, if an investor sold off their stocks in the 2020 downturn, crystallizing their losses, you might recommend that they take the edge off an otherwise high-equity investment portfolio, even if their risk tolerance suggests a long-term comfort with taking risk.

No. 3 - Risk capacity: How much financial risk can a client afford?

Risk capacity focuses on the client’s financial circumstances, including income and other cash flow needs.

One thrill-seeking investor might love betting big to watch investments rise and fall, but that doesn’t mean they can afford their risk appetite.

Is your client confident in their job security, or do they want to preserve a financial cash cushion? How much do they have in emergency savings? Do they need to make regular debt payments like a mortgage or car loan?

What sources of guaranteed retirement income will be available to them? If the worst-case scenario happens with their investments, would they be comfortable with the outcome?

Answers to all of these questions can help you fine-tune a client’s risk tolerance and calibrate the amount of risk a client should take in their portfolio.

Risk composure helps you understand how well clients will stick to the plan during periods of instability.

For example, if an investor sold off their stocks in the 2020 downturn, crystallizing their losses, you might recommend that they take the edge off an otherwise high-equity investment portfolio, even if their risk tolerance suggests a long-term comfort with taking risk.

No. 3 - Risk capacity: How much financial risk can a client afford?

Risk capacity focuses on the client’s financial circumstances, including income and other cash flow needs.

One thrill-seeking investor might love betting big to watch investments rise and fall, but that doesn’t mean they can afford their risk appetite.

Is your client confident in their job security, or do they want to preserve a financial cash cushion? How much do they have in emergency savings? Do they need to make regular debt payments like a mortgage or car loan?

What sources of guaranteed retirement income will be available to them? If the worst-case scenario happens with their investments, would they be comfortable with the outcome?

Answers to all of these questions can help you fine-tune a client’s risk tolerance and calibrate the amount of risk a client should take in their portfolio.

No. 4 - The Impact of Time on an Investment Strategy

Time horizons may constrain how much risk investors can take on.

With a near-term time horizon, following a less risky path is more critical because investors have less time to wait out a market downturn. If clients must pull out money during a market dip, they lock in their losses and miss out on the market recovery.

With a longer time horizon, investors have more room to pursue aggressive portfolios, provided they are comfortable doing so (higher risk tolerance). If your client is 25 years old and saving for retirement, they can wait for the market to correct and gradually rise, even if the value of their account goes down temporarily.

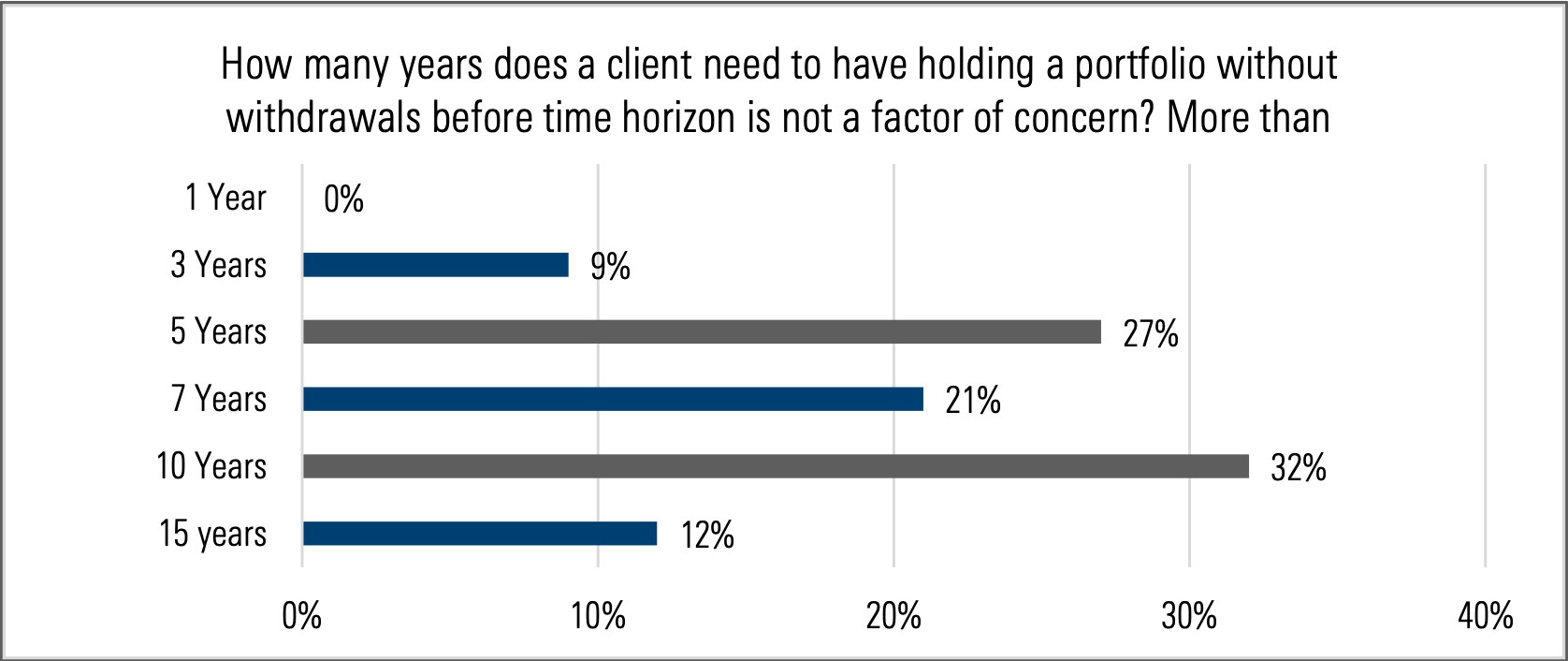

A Morningstar survey found that advisors hold varied opinions on how long a client needs to hold a portfolio without withdrawals so that time horizon is not a concern [PDF].

As a result, a good risk profiling system needs to be able to separately capture and account for varying time horizons in a discrete and transparent manner.

Morningstar’s Approach to Risk Profiling

The field of psychometrics combines psychology and statistics, setting the standard for evaluating tests. With psychometrics, we can understand if a test is valid (measuring what it’s supposed to measure) and reliable (accurate and consistent over time).

Effective tests use clear questions investors can easily understand. Research shows that psychometric questionnaires [PDF] provide better insight into real-world risk-taking behavior and remain stable when the client is retested.

In its two decades of use, over 250 researchers have independently conducted studies using Morningstar’s risk profile questionnaire.

.png)

Some questionnaires over-rely on a gambling metaphor. If you had a certain amount of money, how much would you bet?

These generic questions lead to weak risk profiles that might show how clients act at a roulette table, but not how they’d view risk-taking for long-term financial goals and objectives.

Our questionnaire takes a broader look at different types of risk:

- Making Financial Decisions

- Employment

- Financial Disappointments

- Financial Past

- Investment

- Government Benefits and Taxes

You’ll gain insight into whether clients can take on more risk to reach their long-term goals or need to reduce risk for their financial situation.

Morningstar experts continually fine-tune the questionnaire over time by adding test questions to the 25-question version. If those perform better over time, they become a scored part of both the 10- and 25-question test.

Although every client who completes our questionnaire will get a best-fit risk group, our results flag differences between your client and the typical Low, Average, or High risk tolerant investor based on their answers. Did the answer align with others in their best-fit risk tolerance group, or did it deviate?

These normal differences give you an opportunity to dig deeper and build the client relationship, helping you fine-tune investment portfolios for clients as unique individuals.

Morningstar also separates the collection and application of other risk profile elements, like time horizon and risk composure (using goal setting and forecasting). Advisors can clearly apply the appropriate elements when needed through consistent adjustments to the risk tolerance results for a given client or investment plan.

Accurate Risk Profiles Put Data in the Driver’s Seat

Investors can’t control most things about the stock market.

With proven risk profiles, you can refocus investors on what they can control. Risk profiles help you build personalized portfolios focused on each client’s individual preferences. They help you build a long-term investment plan clients will stick to and one that gives them confidence in their financial future.

As a personal touch, accurate risk profiles make investors feel understood and seen by the person they’re entrusting with their money.