A financially empowered person must find a balance between economic stability and emotional well-being. Learn how advisors can help clients manage both.

By Samantha Lamas

Client Engagement

By Samantha Lamas

Read Time: 3 Minutes

Although most current definitions of financial health only focus on economic stability, every advisor knows that ignoring a client’s emotional well-being is a recipe for disaster. This is why it’s important to adopt a new definition of financial health—one that balances both a client’s economic stability and emotional well-being.

Even clients with enough assets to withstand any reasonable economic shock can be anxious about their finances, which can cause behavioral problems and overall dissatisfaction with their finances. On the other end of the spectrum, every advisor has clients who aren’t in a good place economically but still spend carelessly, ignoring the ramifications of their financial plan.

For a person to be truly financially healthy, they must find a balance between economic stability and emotional well-being.

Advisors can help a person improve their economic stability by extending their mental time horizon—helping clients get accustomed to thinking about the long-term consequences and benefits of their financial decisions. For the next step, advisors can again turn to behaviorally focused techniques to help their clients improve their emotional well-being.

When we looked at the specific patterns of thought that can impact a person’s emotional well-being, we stumbled on the importance of financial empowerment.

Financial empowerment means that a person feels in control of their money. We found that people who feel empowered in their financial lives experience more joy, peace, satisfaction, and pride concerning their finances.

The impact that financial empowerment had on a person’s emotional well-being remained significant even when we controlled for age, income, education, and gender.

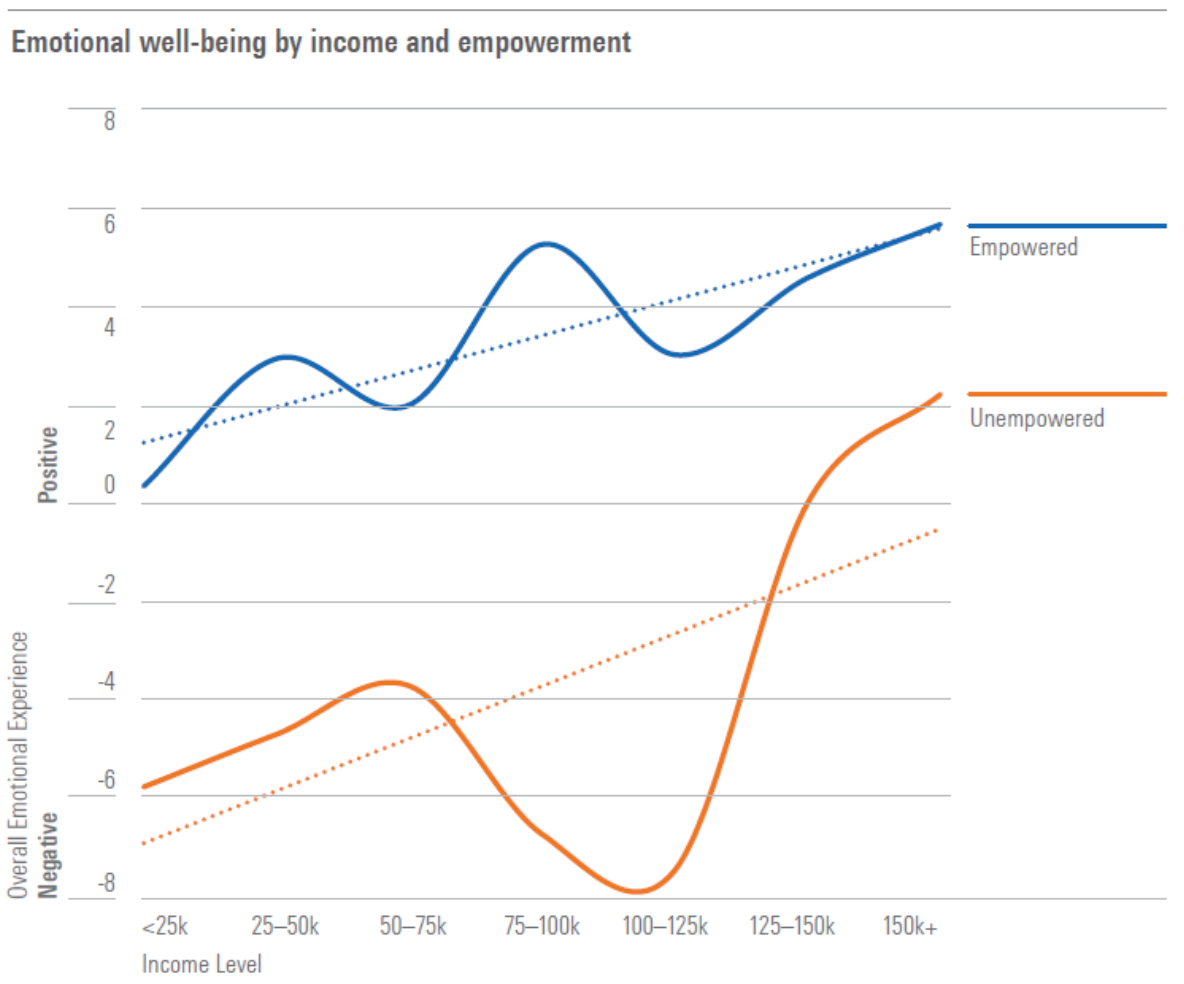

The graph below compares people who feel empowered by their finances with people who don’t, with the y-axis being a measure of their overall emotional experiences. It shows that people who feel empowered had mostly positive experiences with their finances, even those in the lowest income ranges. Those who felt disempowered were less happy than their peers and didn’t reach the positive range until their annual earnings were well above $100,000.

The lesson here is fascinating: A sense of personal power—not money itself—may be the key to emotional well-being in our financial lives.

Our study didn’t measure how much control a person actually had in their financial lives, but how much they believed they had. This suggests that it’s the feeling of power, not necessarily the exercise of it, which was linked to emotional well-being. Improving a person’s feeling of empowerment is more about helping them understand how much control they already have in their financial lives.

There are a couple of ways advisors can help clients get there:

Being financially healthy is not just about having enough money to cover your expenses—it’s also about feeling emotionally at ease with your finances. It’s that peace of mind that every client aspires to have after working with an advisor.

To help clients get to this state of mind, advisors must help clients align both their economic stability and emotional well-being. Advisors can use this framework to help guide their clients toward a stronger state of financial health.