5 Things to Keep in Mind About Impact Investing

Much like traditional investing, it’s important to know your goals.

In January, Chicago announced the sale of its first series of social bonds, touted as an “opportunity to fight climate change, create affordable housing, and strengthen our neighborhoods.” Indeed, the proceeds of the roughly $160 million offering are earmarked for affordable housing construction, vacant lot cleanup, planting trees, and purchasing electric vehicles, among other things.

Interest in impact investments is growing, such as Chicago’s social bonds. Young investors say they want to make an impact with their investments in particular. The social bonds were oversubscribed by in-state retail investors, who ultimately held about 24% of the issuance. That’s an impressive number. Over the past decade, Chicago bond offerings only had about 1% retail ownership.

Impact investing is a lot like traditional investing, except with the added criteria of finding companies or funds that can make a positive impact on environmental, social, or governance issues. This can range from companies making electric vehicles that help address climate change, to funds that invest in companies providing renewable energy, sustainable agriculture, education, or other sustainable products.

But measuring environmental or societal impact is not always so clear. As investors consider incorporating impact into their investment strategies, we see five key things to keep in mind.

#1: Impact doesn’t necessarily mean investment return. But there are opportunities to find both.

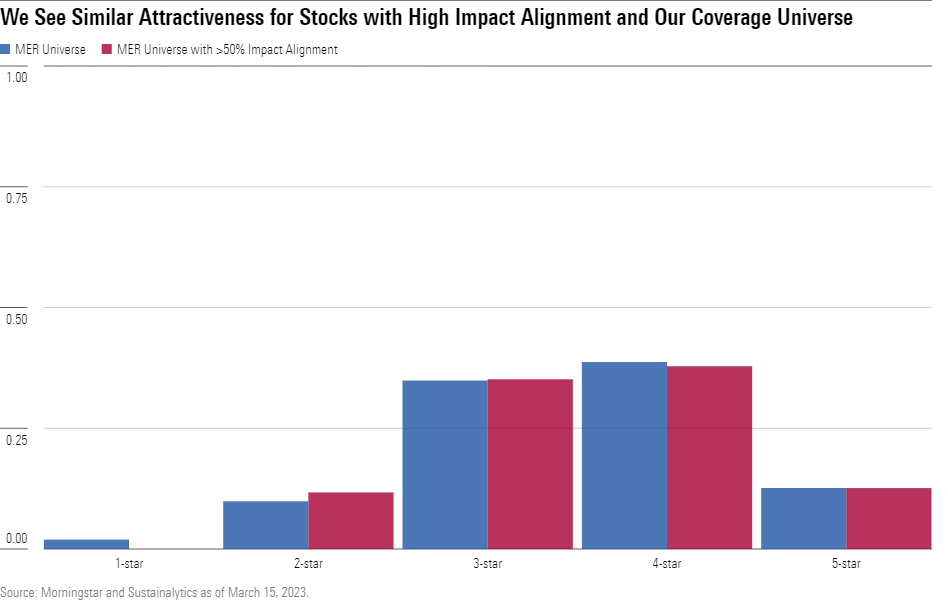

A company that generates meaningful revenue that aligns with any sustainable theme isn’t necessarily an undervalued investment. Price obviously plays a large role in investment return over time, but it’s independent of a company’s impact. Just like a high-quality balance sheet or wide economic moat doesn’t guarantee a profitable investment over the long run, impact metrics should not be looked at in isolation. As shown below, the distribution of star ratings across companies with high impact alignment (just over 100 stocks) isn’t materially different from our broader coverage of nearly 1,500 stocks globally. Indeed, the median price/fair value discount is nearly the same at 87.0% for all covered stocks, compared with 87.6% for covered stocks with high alignment.

Still, the existence of five-star stocks with high alignment indicates that it’s possible to find investments that fit both criteria. For recent picks that fit this theme, see “8 Stocks for Impact-Minded ESG Investors.”

#2: Buying a stock in the secondary market may not have a direct impact.

With green and social bonds, the proceeds raised go directly to the issuer, who can deploy them toward impactful projects. But as an investor looks to make impact with their equity portfolio, it’s important to know that usually, when you buy a stock, the proceeds go the previous holder who sold it to you, not to the company behind the stock. For all intents and purposes, nothing happened to the company, as it didn’t get new funds to put toward any project, let alone one with impact. Now, becoming a shareholder does afford you the chance to participate as an owner, influencing management through proxy votes and shareholder activism. But arguably, it would be more accurate to say that investors should aim to align their equity portfolio with their personal preferences rather than expect to directly drive impact.

#3: It’s important to prioritize your impact goals, because impact investing often requires choices.

The U.N. established 17 Sustainable Development Goals, intended to end poverty, improve health and education, reduce inequality, spur economic growth, combat climate change, and preserve oceans and forests. And while all these targets are admirable, economics and limited capital are still at play. As such, any impact investment will naturally align better with one goal over another. For example, a project that aims to reduce world hunger may not also improve gender equality. Thus, it’s important for each investor to decide which issues deserve priority in their portfolio.

#4: There are limits to measuring impact.

As impact investing grows in popularity, investors need to understand the limitations around impact measurement. At present, most ratings appear to be based on the percentage of a company’s revenue aligned to each sustainability goal. We see a couple of major drawbacks with such approaches.

First, because the measurement focuses on percentage of revenue, these metrics ignore the size of the company. On the positive side, this makes ratings more comparable and less likely to reward large companies for simply being large. However, this means the rating may be less helpful to an investor trying to understand their portfolio’s impact. For example, two companies could both be generating more than 50% revenue toward clean energy. But if one company generates $10 billion in revenue and the other is a startup that generates $1 million in revenue, clearly the contributions to the sustainable goal are not equal.

Second, a focus on revenue is an imperfect measurement of contribution toward a sustainable issue. There’s some inherent conflict between a company maximizing revenue and the value a consumer generates from its products. For example, the recent price cuts by electric vehicle producers hurt revenue but also make their cars more affordable. Current metrics are focused on revenue partly because of limited data availability and the need for comparability across companies’ various reporting standards. Still, an investor should probably use these metrics as a starting point for their own diligence.

#5: It’s up to each individual to decide whether an impact investment is worth it.

According to Morningstar’s Sustainable Investing Framework, sustainable investing seeks to deliver competitive financial results, while also driving positive ESG outcomes. As an investor’s sustainability goals are personal and measurement is imperfect, it’s ultimately up to each investor to decide if both the financial return and impact have been satisfactory.

Because of their popularity, the Chicago social bonds paid a lower yield versus comparable nonsocial bonds. As with all sustainable investments, it will be up to the investors of those bonds to decide if the lower financial return they received was worth the positive impact those projects generated.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/W33JXIXP5RG7LMJEHRPL74K7AQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)