Practice Wise - A Moviegoers' Guide to ESG Investing

When it comes to sustainable investing, unfortunately there are no shortages of real-world reminders of its relevance. But that’s not necessarily a bad thing if it reminds investors why sustainable investing makes sense in the first place.

Last month I attended the Palm Springs International Film Festival. An amazing documentary I watched was called "Maxima." This 2019 film documents the struggle of one Peruvian woman, named Maxima Acuna, in her efforts to protect her land from the encroachment of a large mining company. It's the story of an ordinary person standing up against a big corporation and is emblematic of other situations where corporate greed has taken precedence over human rights and the environment (Standing Rock, Flint water crisis, Exxon Valdez, and so on.).

It's not a stretch to then envision the economic long-term risks to those companies' shareholders, and as a result, to see the long-term benefits to a portfolio from avoiding them.

Maxima vs. the Mining Company

The movie tells the tale of Maxima taking on the Yanacocha mining company. After razing a huge territory in the Andes for gold in 1995, Yanacocha wanted to expand its operations to the Tragadero Grande as part of its proposed Conga Expansion project.

Part of the land that was to be included in this project was purchased by Maxima Acuna in 1994. With a legal deed and her family already living off the land, Maxima refused to leave, even as bulldozers approached.

According to the documentary, due to connections between the company and local authorities, Maxima was arrested for squatting on her own land after suffering beatings and destruction of her home.

Maxima decided to fight the mining company, not just to protect her own property, but also to protect the nearby Lake Perol and crops from toxic waste. The lake provides fresh water not only to Maxima and her family but also to numerous communities farther down the lowlands. Contamination would affect the lake and devastate the crops that the indigenous communities rely upon for their livelihoods and subsistence.

With the assistance of her local attorney, Dr. Mirtha Vasquez, Maxima managed to win several court battles upholding her rights against Yanacocha. Yet even with these wins, the company continued to violently harass Maxima and her family and destroy her crops. When locals began protesting, a contractor to Yanacocha spilled a large amount of mercury in an inhabited area without a warning of the dangers, resulting in ongoing neurological problems for the residents. Also, Vasquez has faced death threats to herself and to her children.

As the legal authorities in Peru were either bought off or ignored, Maxima is now being represented in the U.S. legal system. The struggle continues.

The Mining Company and ESG Investing

Yanacocha mining company happens to be owned by Newmont Mining—the only mining company listed on the S&P 500. (The World Bank held a minority interest but divested once this controversy came to light.) A company with environmental and governance issues like these surely presents an economic risk to all stakeholders, including its shareholders.

So, after viewing this film, I asked “Do our funds hold any Newmont Mining stock?”

As I explored in a recent column, my financial advisory firm has made the business decision to switch all our clients' investments to ESG-focused funds wherever possible. So, if our funds owned the stock, it would raise questions about the efficacy of those ESG screens.

The good news is that the answer is no.

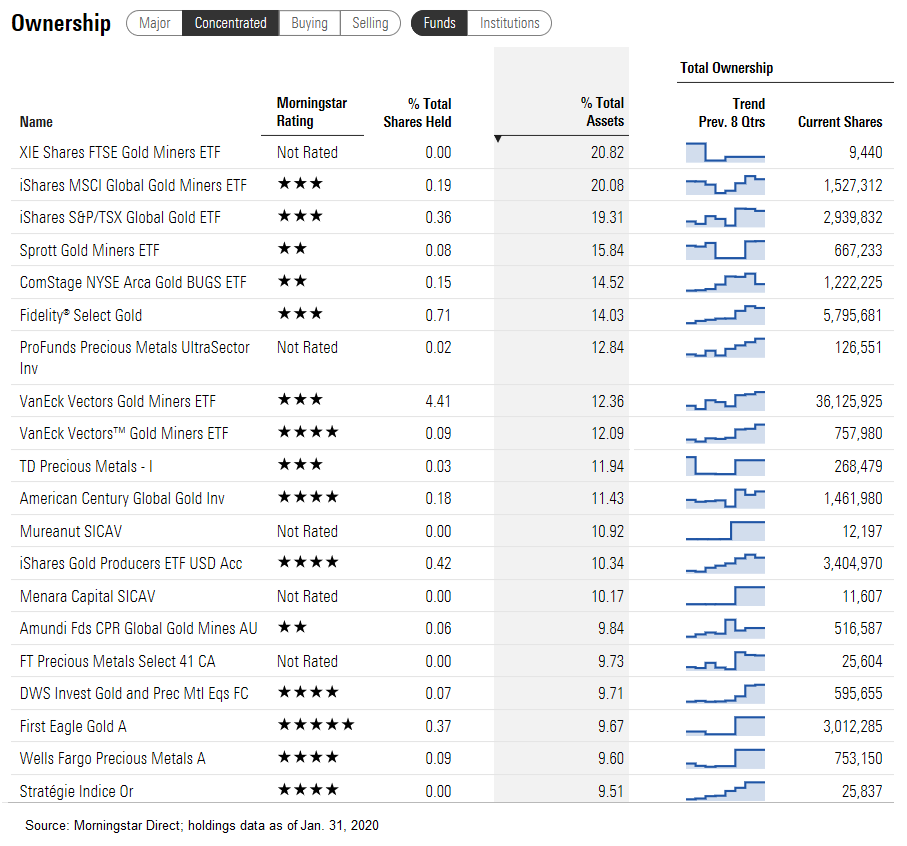

Out of curiosity, we went a step further. What funds hold the largest stake of Newmont Mining? Not surprisingly, gold funds do. If you have a gold fund in your portfolio, there’s a good chance it won’t be ESG compliant. (Click on images for better viewing)

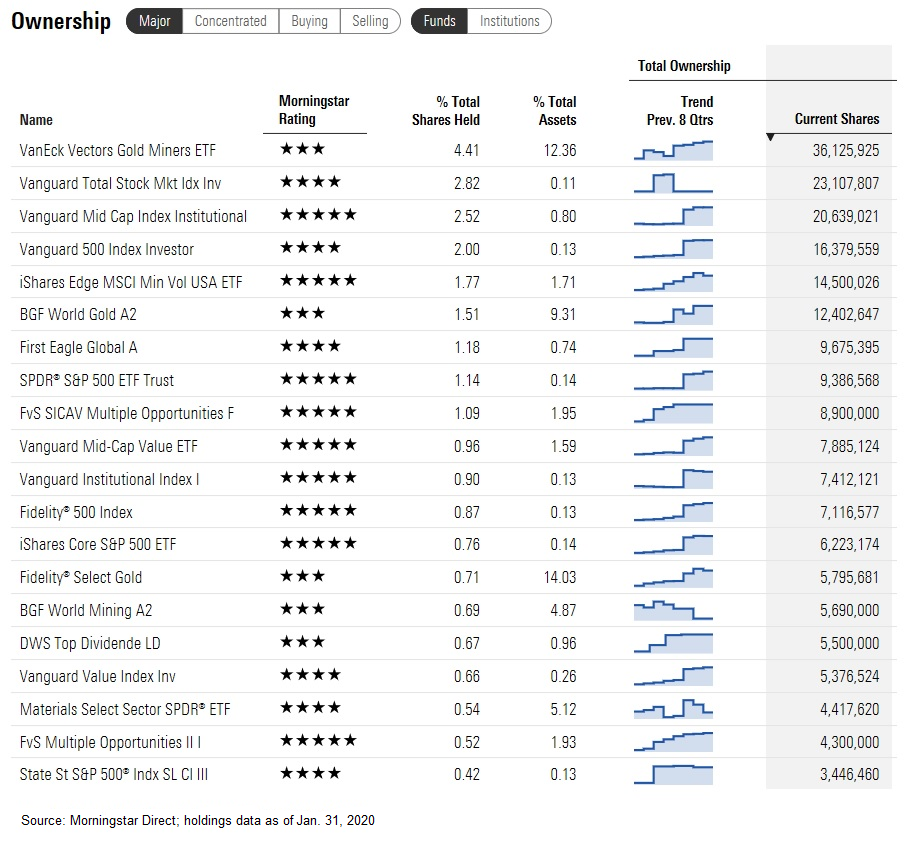

Then there are index funds and ETFs such as Vanguard Total Stock Market Index, Vanguard Mid Cap Index, SPDR S&P 500 ETF Trust, and Fidelity 500 Index. While the portfolio weightings may not be significant, these funds are some of the company’s largest shareholders.

Here we see an example of one company that, absent an ESG focus, would be held by our clients. And it’s more than the moral question, because when viewed through the lens of the potential business risks that come along with a company of this kind—such as litigation, regulation, or potential reputational damage—eliminating a company such as Newmont removes potential portfolio risk as well.

Sheryl Rowling, CPA, is head of rebalancing solutions with Morningstar and principal of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively run her advisory business, from which Morningstar acquired the Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)