Ultimate Stock-Pickers: Top 10 Buys and Sells

Trading activity picked up, but our top managers remained net sellers in the fourth quarter as they maintained a cautious stance toward the market.

Our primary focus with the Ultimate Stock-Pickers concept for the past eight years has been to uncover investment ideas that our equity analysts and top investment managers find attractive, and to reveal these names in a timely enough manner for investors to gain some value from them. As part of this process, we scour the quarterly holdings of 26 different investment managers--22 of which manage mutual funds covered by Morningstar's fund research group and four of which manage the investment portfolios of large insurance companies--as they become available, attempting to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period.

In our last article, we walked through some of the buying activity of our Ultimate Stock-Pickers during fourth-quarter 2016 and the beginning of 2017. This was an early read on the purchases being made during that period (focusing in on high-conviction purchases and new-money buys), based on the holdings of around 90% of our top managers. While our Ultimate Stock-Pickers were net sellers (albeit at a declining pace) during all four quarters of 2016, they did engage in an increased amount of buying and selling activity during the most recent period.

With all of our top managers having reported their holdings, we have a more complete picture of what they were up to during the period leading up to and following the U.S. presidential election (which was far more active than the third quarter of 2016). The net conviction selling of our top managers during the period and the tone of their quarterly commentaries demonstrates an approach to the current environment that can best be described as cautious. Despite this overall caution, our Ultimate Stock-Pickers still found some specific names that piqued their buying interest even as they took full advantage of ongoing market gains to trim other positions.

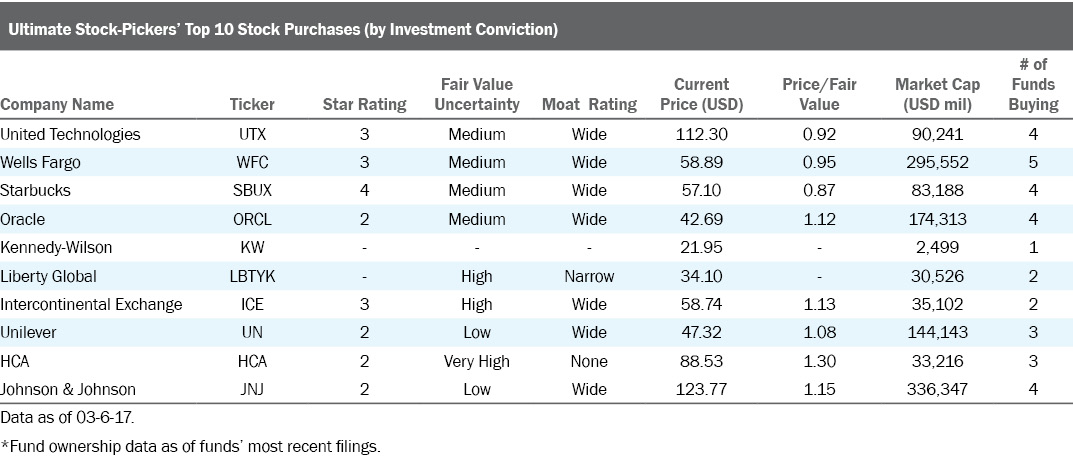

The conviction buying that took place during the latest period was once again focused on high-quality names with defensible economic moats, exemplified by a high number of wide- and narrow-moat companies on our list of top 10 (and top 25) high-conviction purchases for the fourth quarter. As for the selling activity, most of it looked to be focused on the trimming of larger holdings to manage position size or to simply pare back stakes that more closely approached our top managers' own internal estimates of fair value.

Wide moat-rated

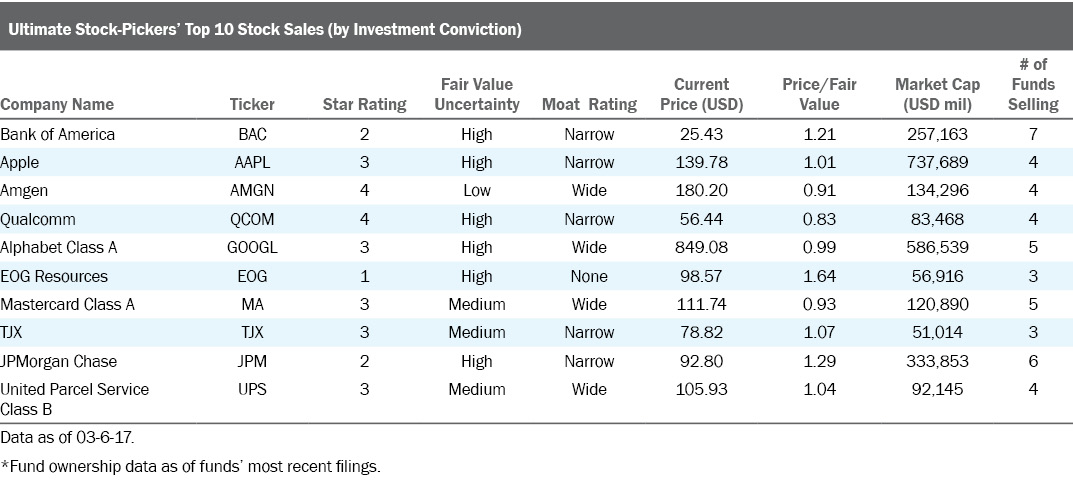

The most notable conviction sale during the period remained

Even with this activity, our top managers remained underweight in communication services, energy, and utilities relative to the weightings in the S&P 500 as of the end of December. Our Ultimate Stock-Pickers also continued to hold significantly overweight positions in the financial services, industrials, and technology sectors (with their exposure to consumer cyclical, consumer defensive, real estate, healthcare, and basic materials being less than 150 basis points from the benchmark index). Compared with last quarter, our managers saw their aggregate holdings shift more into industrials, financial services, healthcare, and shift out of real estate and consumer defensive names.

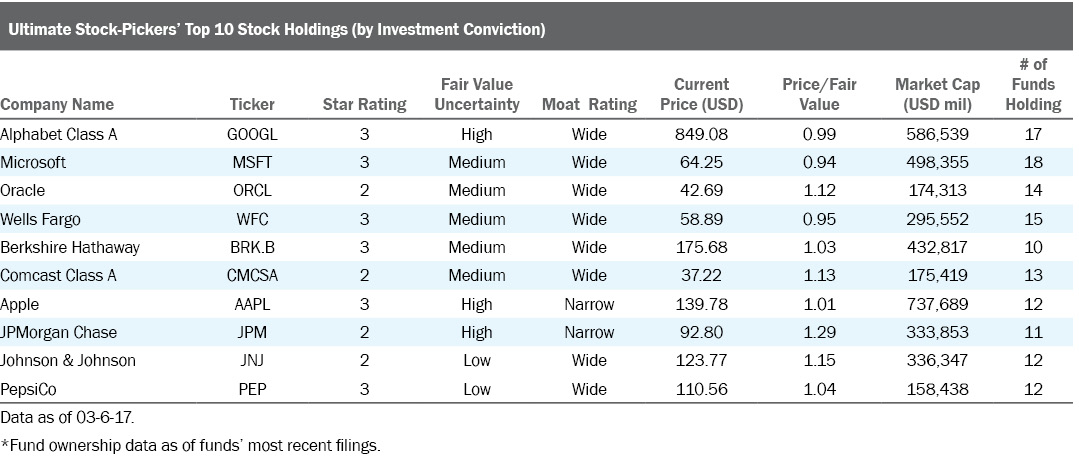

The overall makeup of the top 10 stock holdings by investment conviction did not change all that much during the period, with only two companies--

Taking a closer look at the high-conviction buying during the most recent period, only three of the 10 names that showed up on our list were also represented on our list of top 10 high-conviction purchases in our last article. For those who may not recall, when we look at the buying activity of our Ultimate Stock-Pickers we tend to focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances where managers make meaningful additions to their existing holdings, or where they make significant new-money purchases, with a focus on the impact that these transactions have on their overall portfolio.

Our list of top 10 conviction stock purchases was far more diversified than the concentrated list of consumer cyclical stocks we saw the last time we looked at our Ultimate Stock-Pickers top 10 buys and sells. Best Idea

While most observers had believed that Berkshire's purchase of Apple was the work of one (or both) of Warren Buffett's lieutenants--Todd Combs and Ted Weschler--the Oracle of Omaha recently revealed that he personally purchased 123 million of the 133 million shares Berkshire currently holds (which was more than the 57 million shares of Apple that the insurer held at the end of 2016). This makes Apple Berkshire's third-largest stock holding after Kraft-Heinz and Wells Fargo. Buffett's involvement in the purchases were first alluded to by Charlie Munger at the Daily Journal's annual meeting, with the Oracle himself talking more explicitly about Berkshire's purchase of Apple in an interview with Becky Quick on CNBC:

Well, I would say Apple's — I mean, obviously it's very, very, very tech-involved, but it's a consumer product to a great extent too. And I mean, it has consumer aspects to it. And one of the great books on investing, which I've touted before, is one that Phil Fisher wrote back around 1960 or thereabouts, called "Common Stocks and Uncommon Profits." And he talks about something called the scuttlebutt method, which made a big impression on me at the time. But I used it a lot, which is essentially going out and finding out as much as you can about how people feel about the products that they ... it's just asking questions, basically. And Apple strikes me as having quite a sticky product and enormously useful product that people would use, and not that I do. But it's a decision-based ... but again, it gets down to the future earning power of Apple when you get right down to it. And I think Tim has done a terrific job, I think he's been very intelligent about capital deployment. And I don't know what goes on inside their research labs or anything of the sort. I do know what goes on in their customers' minds because I spend a lot of time talking to 'em.

When I take my great-grandchildren to Dairy Queen they bring along friends sometimes. They've all got an iPhone and, you know, I ask 'em what they do with it and how ... whether they could live without it, and when they trade it in what they're gonna do with it. And of course, I see when they come to the furniture mart that people have this incredible stickiness of — with the product. I mean, if they bring in an iPhone, they buy a new iPhone. I mean, they're ... it just has that quality. It gets built into their lives. Now, that doesn't mean something can't come along that will disrupt it. But the continuity of the product is huge, and the degree to which their lives center around it is huge. And it's a pretty nice, it's a pretty nice franchise to have with a consumer product.

Buffett also alluded to the fact that while he wasn't sure whether Apple could grow enough to overcome the law of large numbers (which is a problem that Berkshire also faces), he spoke affirmatively of Apple's use of its excess cash to aggressively buy back shares. Apple had been a Best Idea for much of 2016, but was pulled for a brief period (basically October and November of last year) before being added again in December. The stock rallied off its late November levels, leading it to once again be removed from the Best Ideas list at the end of January, with Morningstar analyst Brian Colello citing valuation reasons, as the shares had appreciation to within striking distance of his fair value estimate. That said, Colello agrees with Buffett's assessment of Apple's moat, which is built on the high switching costs that the firm benefits from. He attributes this advantage to Apple's iOS platform, which tends to make current iOS users more reluctant to stray outside of the Apple ecosystem for future purchases. Colello views Apple as well-positioned to develop new services, as well as expand existing platforms, further enhancing the user experience and switching cost advantages. This, in his view, should help the firm retain customers and generate significant repeat purchases. He sees many of the non-phone products and services Apple is building--including the Apple Watch, iCloud, and Apple Pay--as improving the iOS ecosystem. This should further enable Apple to sell future iPhones at premium prices to its loyal customer base.

Like Buffett, Colello also lauds Apple's decision to initiate dividend and stock buyback programs, as well as taking on debt in order to fund such programs. He further believes that Apple's ongoing operations will continue to generate operating margins and cash flows well above peers, which bodes well for future returns for investors. He currently views the company's shares as fairly valued--trading in line with his $138 per share fair value estimate--but in the event of a pullback believes the stock to be a worthy consideration for long-term investors.

The most compellingly mispriced security on our list of top 10 conviction purchases is wide-moat rated

Morningstar analyst R.J. Hottovy views Starbucks as one of the most compelling growth stories in the global consumer space today. He believes it is poised for top-line growth and margin expansion from menu innovations, sustainable cost advantages, and the further evolution of its traditional storefront and consumer packaged goods platforms. Although Hottovy acknowledges that Starbucks is already the leading specialty coffee retailer in the U.S., he believes the company still has meaningful domestic growth potential. This includes new store formats such as premium Roastery and Starbucks Reserve locations, as well as smaller-format express stores (mainly drive-throughs and kiosks). Hottovy also believes the firm can drive greater domestic growth from greater peak hour capacity via digital enhancements, by expanding food offerings and other capabilities, and increased usage of its Mobile Order & Pay and My Starbucks Rewards platforms. While he acknowledges the potential for increased store congestion due to mobile ordering, he'd rather have demand outpacing capacity than the other way around.

Hottovy believes the high demand for Starbucks products lends credence to the strength of the company's brand, which is the extremely valuable intangible asset behind his wide moat-rating. In his view, store configurations and best practices are easier issues to improve than a lack of demand. He also notes that Starbucks is much more than a retail story, arguing that the company is just starting to scratch the surface of its long-term growth potential. Hottovy believes that many of Starbucks' core retail competencies should facilitate these efforts, putting it in a position to capture retail and wholesale share in markets beyond simply selling coffee to consumers. He also expects the company's international opportunities to be another growth lever that it can pull, particularly in China, India, Japan, and Brazil. While he acknowledges that competitive threats exist in both the retail and wholesale channels, Hottovy believes the firm's strong brand equity, bargaining clout with suppliers, and leverageable model will help to stave off rivals.

Best Idea and wide moat-rated United Technologies is another interesting name to hit our list of top 10 conviction purchases. The firm has been in the news more recently because of President Trump's self-proclaimed successful negotiations with the company's Carrier subsidiary to keep certain manufacturing jobs in the state of Indiana prior to his inauguration. Morningstar analyst Barbara Noverini recently commented that management at United Technologies expressed enthusiasm over the potential for friendlier business policies supported by the Trump administration. While she believes it is currently too early to incorporate factors such as corporate tax reform and infrastructure stimulus into her base-case scenarios for the company, she does note that the firm should benefit from any sort of infrastructure stimulus or corporate tax reform that works its way through the system.

In a recent note, Noverini noted that while many industrial peers look fully priced to slightly overvalued, she still sees shares of United Technologies as a top pick. While Noverini expects the company to struggle to grow earnings in the near term as it faces a steep Geared Turbofan production ramp-up and works through pricing pressure in Otis China, she continues to believe the firm's portfolio is primed for significant longer-term value creation. Noverini lauds United Technologies for streamlining its aerospace business by reducing exposure to a difficult military market and shifting focus toward the commercial aerospace market, which is enjoying a cyclical upswing. She also believes that as legacy engines and services move toward the GTF, it will eventually secure a long runway of aftermarket services that will boost segment cash flows for decades. Industry forecasts suggest the number of aircraft in service could double by 2030 as growth in revenue passenger miles continues to climb, providing tailwinds for this business. As for Otis, Noverini expects urbanization and economic growth in emerging and developing markets will benefit the segment, which is involved in the installation and maintenance of elevators, escalators, and moving walkways, helping to blunt the effect of existing pricing and product pressure.

Looking more closely at the top 10 sales by investment conviction, the largest casualty was narrow moat-rated Bank of America, where seven managers sold shares during the period (five of which sold meaningful stakes), with no buyers among our Ultimate Stock-Pickers. With little insight from our top managers, we have to assume that most of the selling was the result of the stock's strong market performance the past several years. During the past five years, the bank has tripled in value, which equates to a 26% CAGR on a total return basis (at the end of last week) compared with a 10% annualized gain for the global bank category and a 14% annualized return for the S&P 500 TR Index. Since the start of the fourth quarter of 2016, the bank's shares have risen in price more than 60%, with much of that gain coming after the results of the U.S. presidential election were known. Morningstar analyst Jim Sinegal believes the company's shares are currently overvalued, trading at a more-than 20% premium to his $21 per share fair value estimate, and does not expect to see much asset growth from Bank of America in the near term. With many financial firms trading above our analysts' fair value estimates, Sinegal still sees some value Wells Fargo and

As for the other sales, Qualcomm was the one that stood out the most, as it was not only the most undervalued stock on all of our lists, but is currently a Best Idea for Morningstar analyst Abhinav Davuluri. During the most recent period, four of the eight managers that held the shares at the beginning of the fourth quarter were sellers during the most recent period, most likely due to bad press associated with litigation that cropped up in the back half of 2016. Three of our top managers--

Morningstar's analyst has taken a slightly different attitude, believing that the market has overreacted to the legal allegations filed against Qualcomm by South Korea, the U.S., and Apple. The bad news for Davuluri is that the company will be involved in a prolonged litigation process. The good news is that there is a strong chance that profitability will not be harmed in the near term, as there are no indications that licensees will stop paying royalty fees. He notes that there have been similar situations in the past where firms continued paying such royalties even while undergoing arbitration. Davuluri also believes that in the end, Qualcomm will be able to defend its overall licensing business successfully in spite of these near-term challenges. He expects his fundamental thesis on Qualcomm, as it pertains to its ability to collect fair and reasonable royalties on its essential patent portfolio, to be upheld. To adjust for these recent difficulties, Davuluri has adjusted his fair value estimate for the firm down to $68 per share from $72, far less than the market drop in the stock price from the mid $60's to below $53 per share at one point. While the name may not be for everyone, given the outstanding litigation risk, Davuluri believes an appropriate margin of safety exists for prospective investors in this narrow-moat firm.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Joshua Aguilar has an ownership interest in Apple. Eric Compton has an ownership interest in Allergan. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)