Russia Attack Roils European Markets, Oil Surges

Economically sensitive stocks take a hit, but renewable energy names are buoyant

Russian forces’ assault on Ukrainian territory early Thursday was accompanied by air and missile attacks across the country. It all adds up to the worst-case scenario so far contemplated by analysts, investors, and, most of all, Ukrainians themselves.

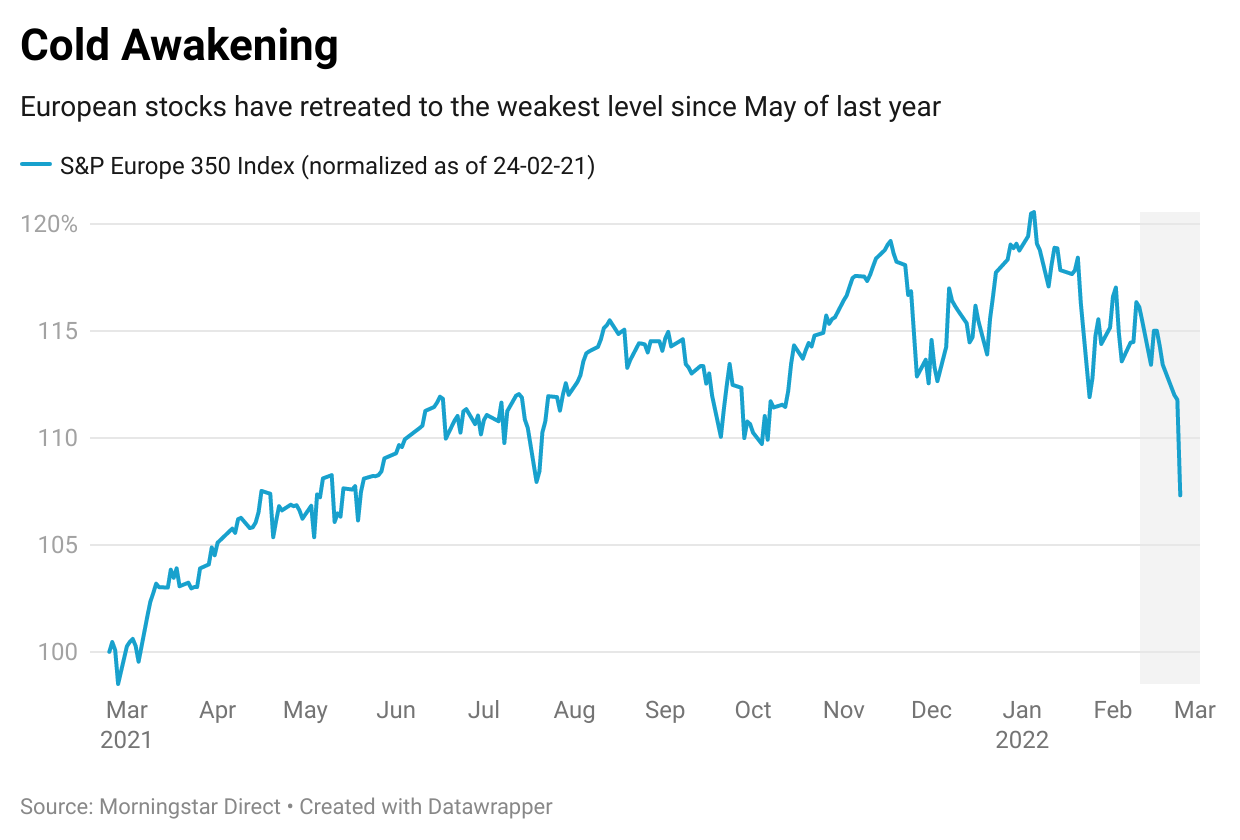

Markets were quick to price in the escalation, with stocks in the S&P Europe 350 slumping 4%. Economically sensitive industries like banking, car makers and industrials underperformed, though the worst-hit stocks in the region were those exposed to Russia and Ukraine.

They included Polish retailers LPP down -22% and Allegro ALEGF down 10%, banks Pekao, down 9% and Eastern Europe-focused budget airline Wizz Air WZZAF down 8%. Anglo-Russian miner Polymetal International POYYF nosedived 27%, marking the worst performance in the benchmark.

Unsurprisingly, the fallout in Russia itself dwarfed losses in Europe, as plunging banks and energy firms dragged the country's MOEX benchmark 19% lower. Gazprom GZPFY collapsed 51%, Lukoil LUKFY lost 40% and Sberbank AKSJF lost 50%), weighing on the index the most, while the ruble fell as much as 10% to a record-low.

Concerns over supply disruptions fired up energy markets, meanwhile, pushing Brent crude oil futures above the $100 mark for the first time since 2014. Natural gas, where Russian supplies account for an even greater share of the total, skyrocketed by as much as 30% in futures trading on London’s Intercontinental Exchange.

Combined, those moves in oil and gas markets helped cushion declines among energy majors including Shell, SHELL, BP BP and Eni ENI , each of which posted only small declines. Outside energy, defensive industries including real estate, food makers and utilities were the least badly hit among stocks as investors fled toward haven assets.

As part of the investor flight from riskier investments, German bunds and 10-year US treasuries each gained about 0.5% while spot gold climbed as much as 2%. Settling the recent debate regarding whether Bitcoin has become a haven asset – or even a gold proxy – the cryptocurrency slumped 5% to its lowest point since January.

An outlier on Thursday were renewable energy stocks, which tend to underperform as investors flee from risk, but stand to benefit from reduced fossil fuel supplies. Orsted DNNGY, Vestas VWDRY , Nordex NRXXY and GCTAY were clear outperformers.

Asian markets were not spared from the Russia-Ukraine ripples, with stocks in the Hang Seng Index slumping 3.2% and the CSI 300 dropping 2.0%. China’s oil stocks showed resiliency but shares in automakers, property developers and banks all headed south. Taiwan's TAIEX and South Korea’s Kospi both closed with a 2.6% drop and Japan’s TOPIX fell 1.3%.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)