On the Road to Vehicle Electrification

Here are the auto-parts suppliers that should benefit.

Automakers’ product plans for vehicle electrification are already on the road to mass adoption of hybrid electric vehicles and battery electric vehicles. With a mapped-out route to electrification, hybrid and battery electric products will be arriving en masse through 2022 and beyond. The relatively short and steep route to electrification has been mapped by government clean air regulations around the world, largely following the European Union’s rules for carbon dioxide emissions.

However, owing to capital intensity and high competition, we see no possibility for automakers to extract economic rents solely due to the adoption of electrified vehicles. We believe automotive-parts suppliers are more likely to extract economic rents from powertrain electrification. Vendors have long been the source of much of the industry’s innovation. Parts suppliers’ moatiness is driven by intangible asset (intellectual property) and switching cost moat sources, enabling them to capitalize on electrification.

We think powertrain-parts suppliers, like our favorites BorgWarner BWA and Delphi Technologies DLPH, have been overly discounted by the market for their exposure to internal combustion engine powertrains, especially diesel. In our opinion, current market valuations treat these stocks as though margins were in a permanent state of erosion. We think BorgWarner and Delphi Technologies will benefit from growth in powertrain electrification, offsetting exposure to a declining internal combustion engine market, as well as intangible asset and switching cost moat sources that will result in economic profit generation.

Overview of Automakers' EV Plans The eight automakers we looked at--BMW, Daimler, Fiat Chrysler, PSA Peugeot Citroen, the Renault-Nissan-Mitsubishi alliance, and Volkswagen--are bringing numerous electrified vehicle nameplates to market through 2022. Our electrified vehicle count includes hybrid electric and battery electric vehicles. Hybrid electric vehicles include full and plug-in hybrids where the electric motor is the primary powertrain. We exclude mild hybrids where the electric motor only assists the primary combustion engine powertrain. Clean air regulations are tightening to the extent that automakers will not be able to comply without electrification. The number of electrified nameplates (model variants like coupe, sedan, and saloon or wagon are counted as one nameplate) jumps by a 24% per year average to 141 from 74 at the end of 2019.

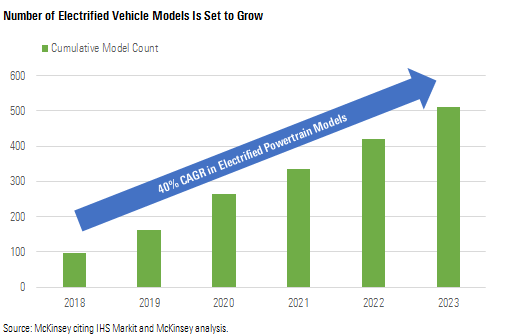

Using data from a recent McKinsey report, the total number of plug-in hybrid and battery electric models launched by all aforementioned automobile manufacturers from 2018 through 2023 will grow at an annualized rate of 40%, from 96 in 2018 to 511 models in 2023. McKinsey’s model count differs from our nameplate count in that we count one nameplate even though the nameplate may have coupe, sedan, and saloon (wagon) model variants with electrified powertrains. By McKinsey’s count, in this example, the number of models could be up to three. Still, the number of electrified powertrain vehicles being launched around the world over the next five years is substantial.

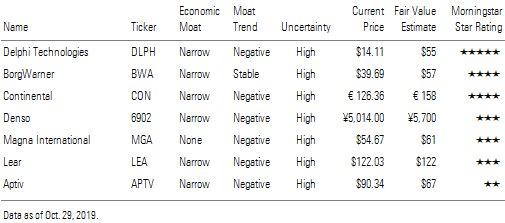

Suppliers That Benefit From Electrified Vehicle Plans On the basis of valuation and business concentration, we think BorgWarner and Delphi Technologies represent the best alternatives for investors looking to play auto-supplier stocks with propulsion technologies that enable vehicle makers to reach clean air regulation targets. Other powertrain suppliers we cover that benefit from increasing propulsion efficiency include Aptiv APTV, Continental CON, Denso 6902, Lear LEA, and Magna MGA. Even so, the majority of each of these companies' businesses lies outside powertrain product applications. Narrow-moat BorgWarner currently trades at an attractive 30% discount to our $57 fair value estimate, while narrow-moat Delphi Technologies trades at a compelling 74% discount to our $55 fair value estimate.

Continental, Denso, and Magna have specific powertrain groups that are making or developing products that increase propulsion efficiency. Aptiv and Lear benefit from powertrain electrification via their electrical architecture operations (wireharness, junctions, connectors, and other components). We expect the electrical system groups of Aptiv and Lear to benefit because vehicles equipped with electrified powertrain require more robust electrical architectures. However, electrical architecture revenue growth for these companies will be more heavily influenced from a business concentration perspective by signal and power distribution products’ increasing penetration in cabin electronic devices, body and chassis controls, lighting, advanced driver-assist systems, and autonomous driving technologies.

Aptiv and Lear will benefit from powertrain electrification, but the business concentration is greater in other vehicular applications outside of powertrain. For example, Aptiv said in its 2018 annual report that it booked $2 billion in new electrification business that will represent $1 billion in annual revenue by 2022, representing average annual revenue growth in high-voltage product lines of 40%. As a result, we estimate Aptiv’s 2018 revenue from high-voltage products was roughly $260 million versus total signal and power solutions segment revenue of $2.1 billion. Contrast this with Aptiv’s 2018 bookings for new active safety system products at $4.0 billion and total gross business bookings of $22 billion.

Comparing BorgWarner and Delphi Technologies Although both BorgWarner and Delphi Technologies are solely focused on propulsion systems, investors should be aware of important distinctions between the two, other than size--BorgWarner's 2018 revenue, at $10.5 billion, was a little more than twice that of Delphi Technologies at $4.9 billion.

As clean air legislation becomes more stringent, automakers will shift production to smaller engine displacement, meaning that the average number of cylinders for engines produced in both traditional internal combustion engines and hybrid propulsion systems will decline. To highlight our point, in 2018, the Honda Accord no longer offered a 6-cylinder engine and instead used a turbocharged 4-cylinder engine for its higher-horsepower option. This represented incremental turbocharger penetration for a supplier like BorgWarner, but a loss of revenue for a fuel injector and valvetrain supplier like Delphi Technologies. Even the 2018 Ford Mustang, the iconic American pony car, no longer offered a V-6 option; the base version had a turbocharged 4-cylinder, although Ford did still offer a V-8 engine option (which also utilizes fuel-saving technologies).

Most of BorgWarner’s traditional internal combustion engine propulsion products will be needed to support light-vehicle original equipment manufacturer customers’ efforts to meet clean air regulations at roughly the same price levels, independent of the displacement or number of cylinders. While we expect the absolute number of internal combustion engines will slowly decline, we think BorgWarner benefits from increasing penetration rates of certain products like turbochargers, engine timing chain and systems, exhaust gas recirculation valves, dual-clutch modules, transmission electronic control modules, stop-start modules, and all-wheel drive systems (especially in light of the growing global demand for sport utilities and crossovers).

In contrast, Delphi Technologies’ main products are fuel injection and valvetrain systems along with the sensors and software controls for each. The company makes fuel injection systems for both diesel- and gasoline-powered internal combustion engines. Diesel engines use direct injection, where the fuel is injected directly into the combustion chamber, or cylinder. Gasoline engines can be direct or indirect, where air and fuel are mixed before introduction to the engine cylinder. Valvetrain systems enable intake (air only when direct injected, air/fuel mixture when indirect injection) and exhaust for each individual engine cylinder. Valvetrain systems include actuation and timing, both of which can be electronically varied to customize engine performance, improving fuel efficiency.

Even if the absolute number of internal combustion engines is unchanged and only average displacement and number of cylinders decline, because fuel injectors and valvetrains depend on displacement and cylinders, a supplier’s revenue from these products would still decline. We believe that global average displacement and average number of cylinders declines faster than the decline in internal combustion engines that arises from battery electric vehicle penetration, creating a potential double negative impact to Delphi Technologies’ traditional revenue sources.

One possible scenario where valvetrains might not decline as much would be if average valves per cylinder grows at a rate that outpaces the loss in displacement and number of cylinders. However, we see this as an unlikely scenario because many of today’s engines already utilize overhead-cam-driven valvetrains with two valves for intake and two for exhaust for each cylinder, compared with older engine technology that used a push-rod-actuated single valve, one for intake and one for exhaust, for each cylinder.

Delphi Technologies has other products that will still be needed regardless of engine size, but penetration of those products will not be driven by clean air regulations to the degree of BorgWarner’s product portfolio. Electronically controlled variable valve timing and variable valve actuation will see increased penetration to improve internal combustion engines’ fuel efficiency. Even so, variable valve actuation is more susceptible to declining average cylinder count than variable valve timing. Variable valve actuation is performed at the cylinder while variable valve timing is performed at the cam that drives cylinder valves. However, ignition systems, certain powertrain sensors, and evaporative emissions systems most likely will not experience increased penetration rates to overcome declining internal combustion engine penetration. Still, we think that Delphi Technologies’ electrification products like powertrain electronic control modules and software, along with high-voltage inverters, DC/DC converters and inverters, plus on-board chargers enable higher content per vehicle and margin potential than BorgWarner’s electrification business lines, more than offsetting Delphi Technologies’ higher risk exposure in its traditional powertrain products.

To be fair, BorgWarner also produces ignition systems and variable valve timing systems, but in our opinion, its new technologies like eGearDrive, hybrid drive motors, electric drive motors, battery thermal management, battery electric vehicle cabin heaters, and battery chargers more than offset declining average internal combustion engine displacement and number of cylinders. Also, BorgWarner’s variable valve timing controls the cams that drive the valvetrain, insulating the business from decline in average number of cylinders.

Consequently, we believe that BorgWarner will experience less downside from traditional powertrain but slightly less upside from electrification, while Delphi Technologies will experience slightly more downside from traditional powertrain and slightly better upside from electrification. This translates into our estimates that BorgWarner revenue will average annual growth of 2-4 percentage points and Delphi Technologies revenue will average 1-3 percentage points better than the average annual growth in light-vehicle demand.

BorgWarner Investment Thesis We think BorgWarner's economic moat sources derived from powertrain intellectual property and switching costs are not adequately reflected in the market's valuation. The market, in our view, has valued the shares as though revenue will decline long-term on shrinking internal combustion engine demand, especially diesel, despite BorgWarner's increasing dollar content penetration in internal combustion engines, exposure to globally popular sport utilities, and electrified powertrain growth potential.

We forecast annualized revenue growth that exceeds global vehicle demand growth by 2-4 percentage points, agnostic to the direction of customers’ powertrain technology. The company reports $2.0 billion-$2.4 billion booked net new business backlog through 2021, which implies a 5%-6% organic average annual revenue growth rate.

During the past 10 years, EBITDA margin has had a high, low, and median of 17.2%, 9.7%, and 16.7%, respectively. We assume a 15.0% normalized sustainable midcycle EBITDA margin. Investors would have to believe a 12.4% midcycle EBITDA margin for our model to generate a fair value equivalent to the CapIQ sell-side consensus price target. In our opinion, the market values BorgWarner as though fundamentals are in permanent decline, giving no credit for the company’s economic moat in powertrain technologies and consistent generation of returns on invested capital above the cost of capital. Management adheres to a policy for each project to generate a 15% return on invested capital.

Delphi Technologies Investment Thesis Delphi Technologies was spun off from Aptiv (formerly Delphi Automotive) at the end of 2017, so we do not have long-term economic profit data. However, we calculate that Delphi Technologies had a 10-percentage-point economic profit in 2018 on an 18% return on invested capital (including goodwill) and an 8% weighted average cost of capital. The company's narrow economic moat flows from a continuously filling pipeline of innovation (intangible asset) and high customer switching cost moat sources. We think Delphi Technologies benefits from globally ubiquitous clean air legislation that requires passenger vehicle and commercial truck manufacturers to enhance efficiency of internal combustion engines and electrify powertrains.

A CEO departure in October last year, guidance cuts last year and this year, and the risk from exposure to internal combustion engines, especially diesel in Europe, have weighed on the shares. The board comprises several experienced industry executives including chairman Tim Manganello, the former chairman and CEO of BorgWarner. Richard Dauch, appointed CEO in January, is also well experienced and has begun initiatives to optimize growth opportunities and cost structure.

The company’s electronic controls are especially interesting because the electronic “brains” behind powertrains will become more sophisticated in hybrids and battery electrics compared with internal combustion engine-only powertrains. We expect growth products like powertrain electronic control modules and software, along with high-voltage inverters, DC/DC converters and inverters, plus on-board chargers, to offset the effect of greater penetration of smaller-displacement engines (fewer cylinders) that negatively affects the volume growth of fuel injector and valvetrain product lines.

Our base-case model scenario assumes 2% revenue growth and 14.8% average EBITDA margin during our Stage I forecast. Since 2012--the last information we have available as Delphi Technologies was spun off from Aptiv at the end of 2017--pro forma revenue has grown at an average annual rate of 1% and the high, low, and median EBITDA margins are 17.1%, 14.7%, and 15.4%, respectively. We assume a 15.5% normalized sustainable midcycle EBITDA margin.

We assume lower revenue growth than BorgWarner because we believe the company’s traditional product lines are relatively more at risk, but we also believe that Delphi Technologies’ powertrain electrification product portfolio offers more than offsetting growth opportunity, enabling 1-3 percentage points in revenue growth above the rate of change in global light-vehicle demand. We assume a slightly higher midcycle margin than BorgWarner due to Delphi Technologies’ powertrain electrification technologies.

For our model to generate a fair value equivalent to the CapIQ sell-side consensus price target and the current market valuation, investors would have to believe midcycle EBITDA margins of 10.0% and 8.4%, respectively. In our opinion, the market has overly discounted Delphi Technologies’ valuation as though the current fundamentals and unfavorable operating environment will only continue to degrade.

/s3.amazonaws.com/arc-authors/morningstar/f34aaf21-a6ec-4ce4-964e-1bfba836175c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f34aaf21-a6ec-4ce4-964e-1bfba836175c.jpg)