Looking Under the Hood: Fidelity Charitable Gift Fund

We examine the ongoing fees and underlying investment options for the biggest donor-advised fund in the U.S.

As I covered in a previous article, donor-advised funds have several advantages. Donor-advised funds are public charities that qualify as section 501(c)(3) organizations. That means donors can benefit from an immediate tax deduction when they contribute cash or other assets to the fund. Although contributions are irrevocable (meaning you can’t withdraw donations if you change your mind or need extra cash), the donor retains an advisory role over how to invest the assets and how much to contribute to various charities over time.

In this article, I’ll explore how Fidelity Charitable stacks up in terms of its underlying investment options, as well as the administrative fees and account minimums.

Nuts and Bolts

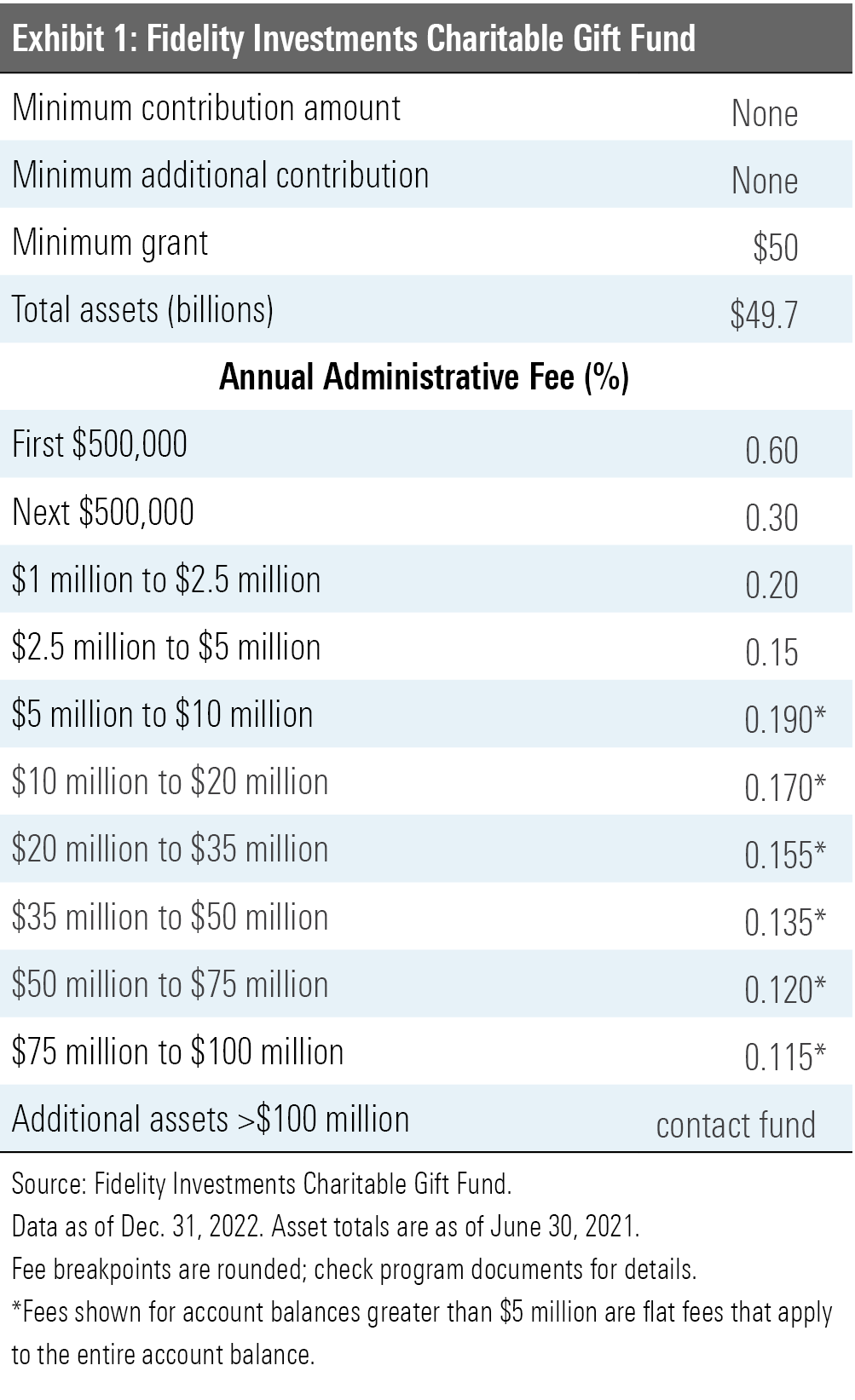

Like the Schwab Charitable Fund—the second-largest donor-advised fund affiliated with an investment management firm—Fidelity Charitable doesn’t currently require a minimum contribution amount to set up a new account or to make additional contributions. Donors can make grants in any amount of at least $50.

Like most other donor-advised funds, Fidelity Charitable also comes with an additional layer of administrative costs. The fund charges a 0.60% annual administrative fee (or $100, whichever is greater) for accounts with balances up to $500,000. Accounts with balances greater than $500,000 are subject to lower fees in percentage terms, as shown in the table below.

Fidelity Investments Charitable Gift Fund

Fidelity Charitable’s fee structure is slightly different from those at Schwab and Vanguard. For accounts with asset values of $5 million or more, it charges a flat fee that applies to the entire account balance instead of a tiered fee structure that applies different fees to different portions of the asset total.

These charges are in addition to the fees on the underlying investments (operating expenses for mutual funds and exchange-traded funds, or trading commissions for individual stocks and bonds). All of these fees come out of the amount donated, making donor-advised funds less cost-efficient than donating directly to a charity.

Investment Options

Fidelity Charitable offers four main investment pools: diversified asset-allocation pools based on the Fidelity Asset Manager series, single-asset pools for a variety of asset classes, sustainable and impact investing pools, and the Fidelity Charitable Legacy Pool for investors who anticipate passing the fund along to their heirs. The lineup mainly consists of Fidelity offerings, but it also includes several funds managed by third-party managers. Overall, the underlying options are relatively strong, although operating expenses are higher, on average, than those for investment pools offered by the Vanguard Charitable Endowment.

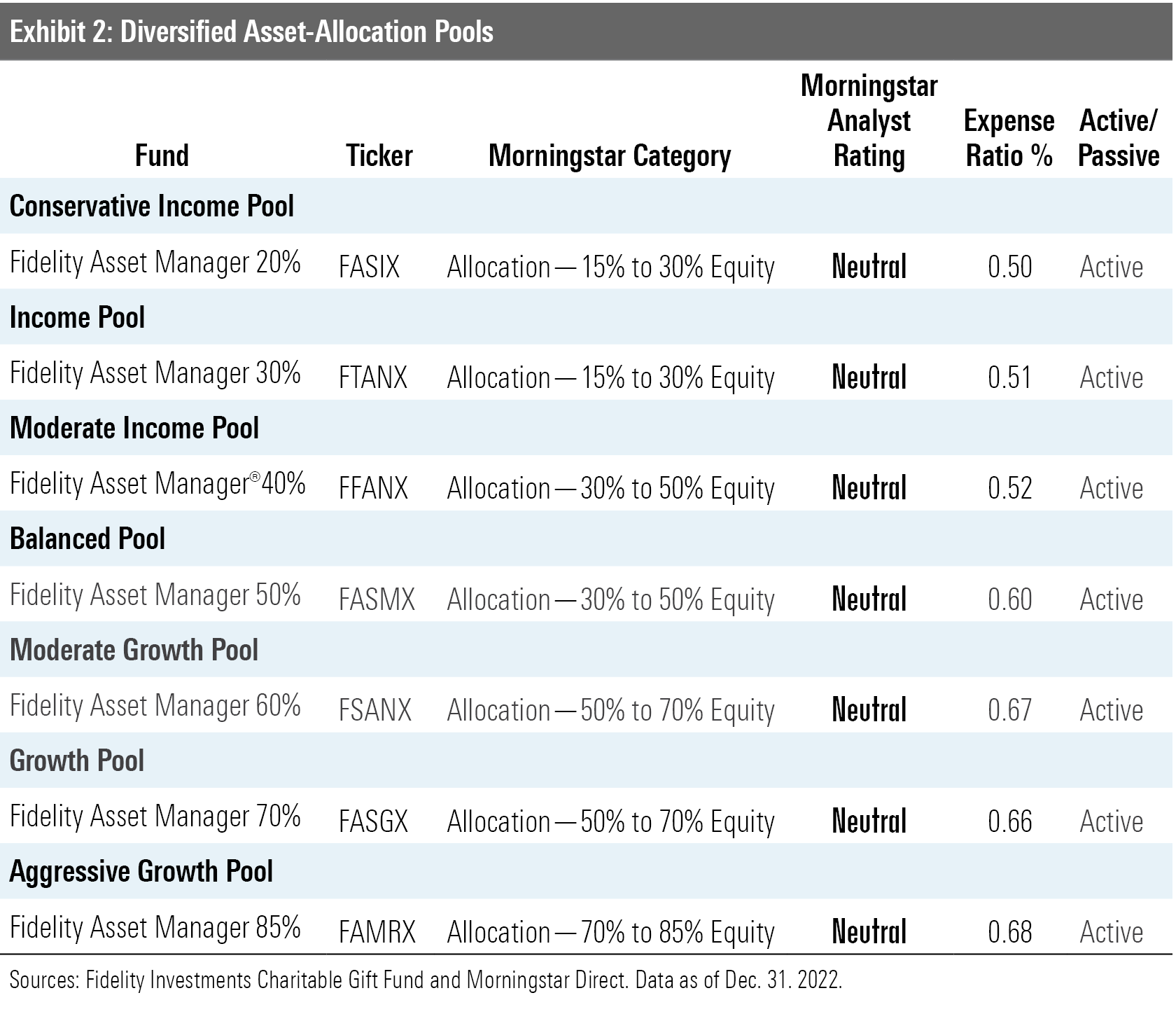

Asset-Allocation Pools

The asset-allocation pools offer a diversified mix of equities and fixed-income securities, with risk levels ranging from conservative to aggressive. The target equity allocations range from 20% to 85% of assets. Although the underlying Fidelity Asset Manager funds are actively managed, they typically don’t stray too far from their target allocations. Comanagers Geoff Stein and Avishek Hazrachoudhury make only small tactical tilts within each asset class based on top-down macroeconomic factors, investor sentiment indicators, relative valuations, and Fidelity’s cross-asset factor model. Funds in the series have generally landed fairly close to their custom benchmarks over time and earn Morningstar Analyst Ratings of Neutral.

Diversified Asset-Allocation Pools

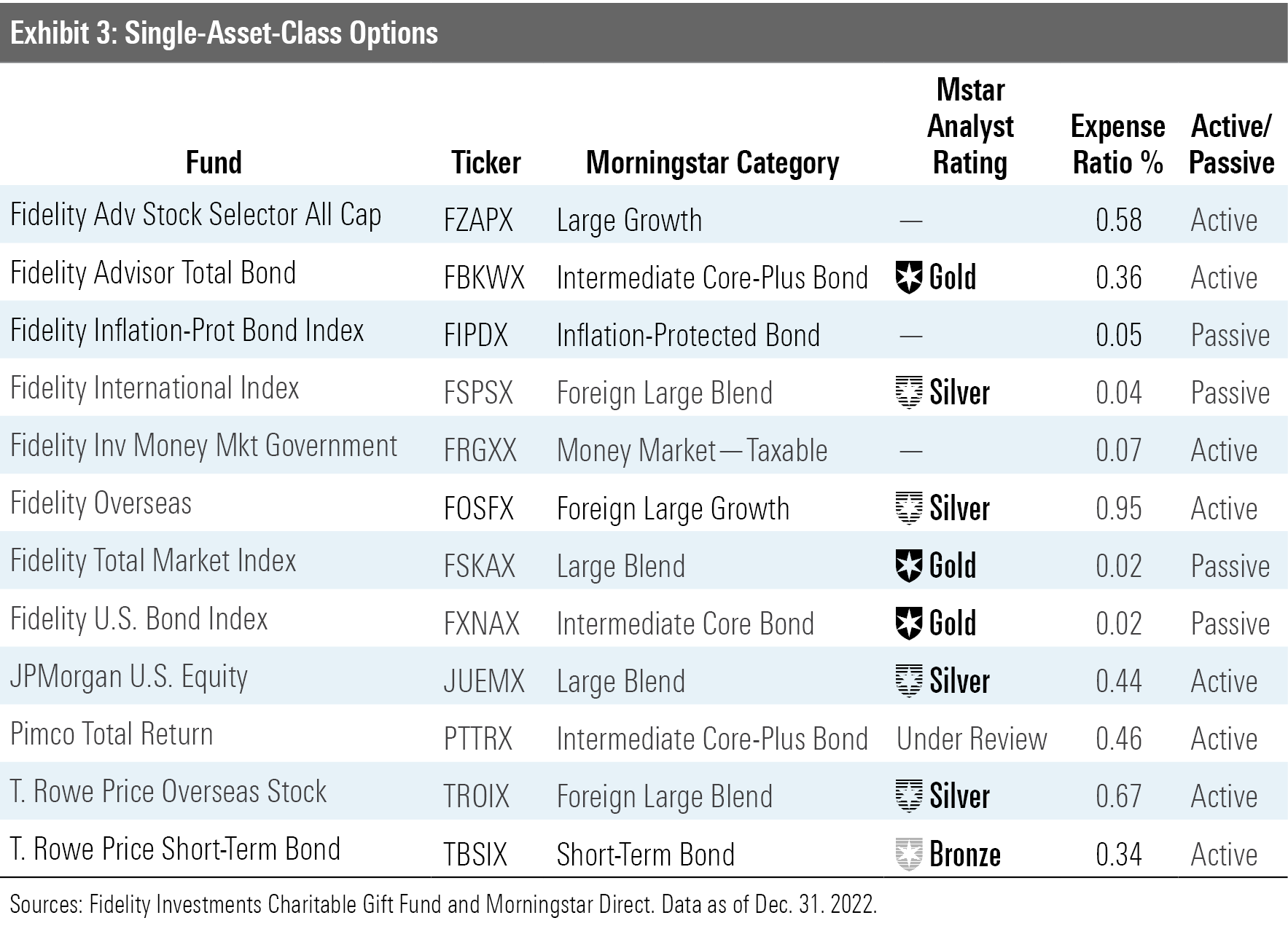

Single-Asset-Class Options

For investors who prefer to build their own portfolios, Fidelity Charitable offers a variety of funds covering both active and passive vehicles covering domestic stocks, international stocks, bonds, and cash. The lineup includes both in-house funds and third-party offerings with Analyst Ratings ranging from Bronze to Gold.

Single-Asset-Class Options

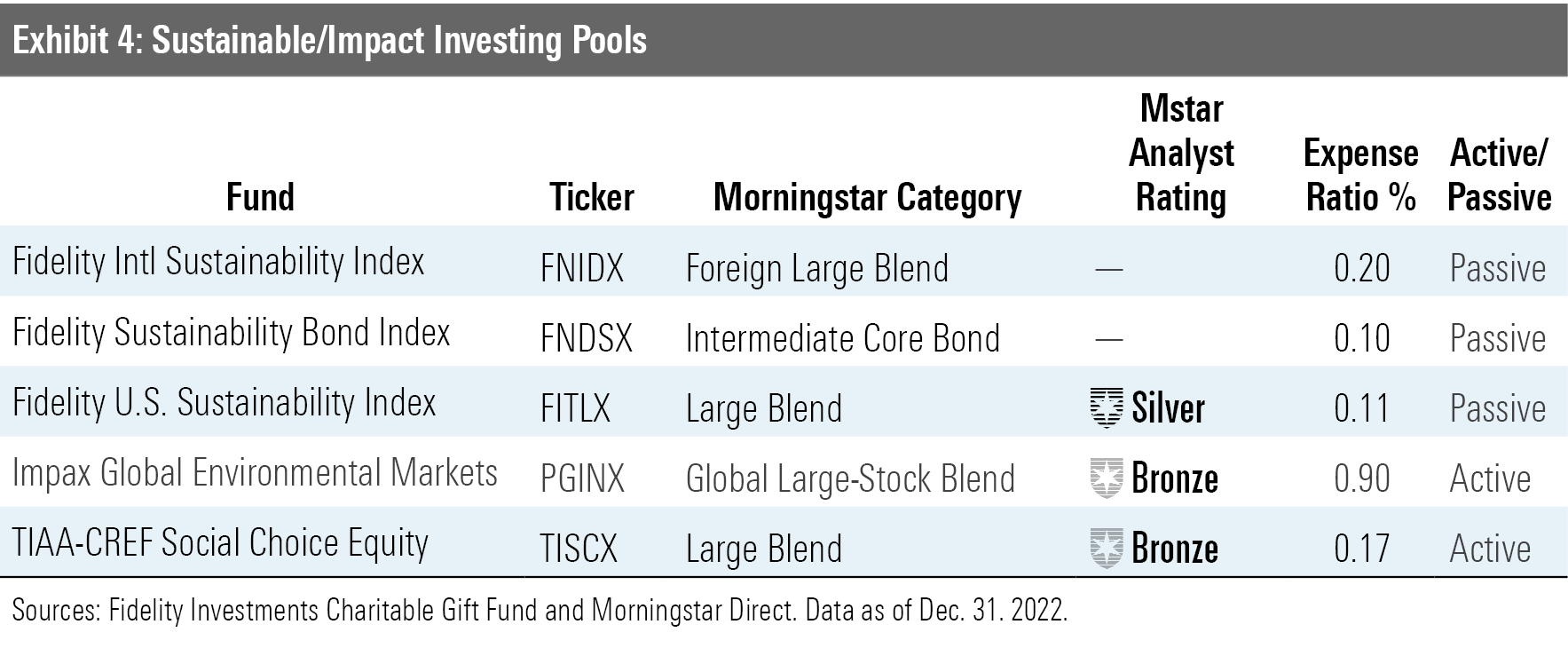

Sustainable/Impact Investing Pools

Fidelity Charitable currently offers five pools geared toward investors who want to include social and environmental factors. The two passive equity offerings—Fidelity U.S. Sustainability Index FITLX and Fidelity International Sustainability Index FNIDX—track the U.S. and international versions of the MSCI ESG Leaders Index, which focuses on companies with high environmental, social, and governance performance relative to their sector peers, based on MSCI’s research. Fidelity has also added a passively managed bond fund, Fidelity Sustainability Bond Index FNDSX, which tracks the Bloomberg MSCI US Aggregate ESG Choice Bond Index.

On the active side, Impax Global Environmental Markets PGINX invests in companies focusing on areas such as alternative energy and energy efficiency; water infrastructure technologies and pollution control; environmental support services and waste management technologies; and sustainable food, agriculture, and forestry. TIAA-CREF Social Choice Equity TISCX provides exposure to the broad U.S. stock market at a relatively cheap price but emphasizes companies with a socially responsible bent. Comanagers Jim Campagna, Darren Tran, and Lei Liao try to keep the portfolio’s risk profile in line with its Russell 3000 Index benchmark while favoring stocks that meet a strict set of ESG standards.

Sustainable/Impact Investing Pools

Other Investment Options

Fidelity also offers the Charitable Legacy Pool geared toward donors who want to generate returns that can support current grants and preserve principal to sustain charitable giving over a longer period. The goal of the pool is to provide inflation-adjusted returns and preserve capital through different market cycles.

The charitable legacy portfolio is composed of about 50 funds from both Fidelity and third-party asset managers. The pool offers broad exposure to equity securities (about 43% of the portfolio), including U.S. (16%), international (19%), and emerging markets (7%). The fixed-income portion (30% of assets) includes a 15% weighting in investment-grade bonds, 5% in high yield, 3% in non-U.S. bonds, 2% in emerging markets, and 5% in inflation-protected bonds. The pool also has a 15% weighting in real assets, including commodities, real estate, and natural resources, as well as a 12% stake in absolute return funds. The expense ratio is 0.67%, which is based on the expense ratios on the underlying funds.

Finally, donors with account values of at least $250,000 can nominate their investment advisors to manage donated assets, while those with at least $5 million can participate in the DonorFlex program, which allows them to recommend investments in other vehicles, including mutual funds, ETFs, hedge funds, private equity funds, and Treasuries.

Conclusion

Overall, Fidelity Charitable ranks as a solid choice among donor-advised funds. However, Vanguard offers more compelling fee breaks for donors who plan to maintain an account balance of $1 million or more.

A version of this article was previously published on May 24, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)