Looking for Gains in Treating Pain

Innovations in spinal cord stimulation bolster moats at Medtronic, Boston Scientific, and Abbott.

We’ve long viewed neuromodulation as a field that offered great promise but faced meaningful challenges to realizing that potential. Thanks to a spurt in innovation in spinal cord stimulation--the largest segment of the neuromodulation market--competitors are poised to make more progress toward addressing some of the areas where SCS has fallen short in the past, providing a catalyst for an acceleration in growth as we look to 2021-25. We like how SCS devices add to a company’s economic moat through intangible assets, including intellectual property, proprietary data gathered by the devices, and the differentiated algorithms generated.

The roughly $2.5 billion global spinal cord stimulation market remains underpenetrated with an estimated 11% of patients receiving the technology. We estimate the market should reach $5 billion by 2030, thanks to the introduction of more efficacious therapy, growing awareness of earlier intervention leading to better outcomes, and greater penetration of the underlying chronic pain patient pool.

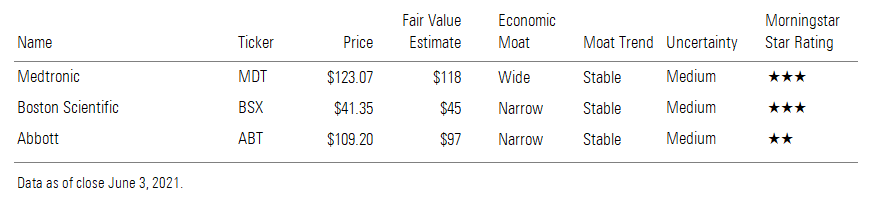

From a technology standpoint, we think wide-moat Medtronic’s MDT new differential target multiplexed platform holds much potential, though this single product is unlikely to shift the diversified company’s valuation. We also think narrow-moat Boston Scientific’s BSX differentiated dual-modality SCS system is likely to catch practitioner attention.

Spinal Cord Stimulation Device Overview

The highly consolidated spinal cord stimulation market should see an acceleration in growth thanks to an eruption of innovation, increasing awareness among physicians of the outsize benefits of earlier SCS therapy, and growth in the underlying patient pool (primarily from failed back surgeries). For SCS, where clinical data has historically been difficult to collect (mainly because the perceptible physical effects of the therapy made it challenging to blind the study to participants), a number of new advances consistently suggest significant improvement in the efficacy of SCS. We are also seeing the accumulation of new learning on the underpinnings of how acute pain in response to injury can, over time, spiral into its own chronic pain feedback loop.

The SCS market has been dominated by Medtronic, Boston Scientific, and Abbott ABT (legacy St. Jude Medical’s neuromodulation business), along with the more recent emergence of pure play Nevro NVRO. With the exception of Nevro, spinal cord stimulation remains a small contributor to revenue at the major competitors, but we still appreciate the SCS business for its moaty characteristics.

These products help bolster the intangible assets that are critical to the moats at Medtronic, Boston, and Abbott. Similar to other highly engineered medical devices, these products are protected by intellectual property. Beyond IP, the SCS devices compete on the basis of differentiated technology, often related to proprietary algorithms. The new insights into the nervous system and mechanisms that contribute to the development of chronic pain have produced a range of new targets for SCS therapy.

Paresthesia-free stimulation has been the biggest advance in SCS that has shifted the market, as this addresses the primary drawback of traditional SCS: the sensation of numbness, pins and needles, or buzzing in the painful regions. All four major competitors each carved out an area of differentiation for their SCS products, and they all largely eliminate paresthesia. It is not yet clear, based on the accumulation of early and heterogenous clinical trials, which approach holds the most potential. However, all of the new modes--high frequency, dorsal root ganglion stimulation, simultaneous dual conventional SCS and subperception stimulation, and differential target multiplexed therapy--are demonstrating impressive efficacy gains over conventional, paresthesia-based SCS.

At this point, we’re particularly intrigued by Medtronic’s DTM approach because it might hold disease-modifying properties that could play a role in halting the permanent alteration to neuronal activity that causes chronic pain to become a self-sustaining cycle. This is distinctive in this field of SCS, which is mainly focused on treating the pain. However, considering that SCS is a relatively small factor in Medtronic’s consolidated business, we think it will be immaterial in moving the company’s valuation.

In contrast, Boston Scientific’s dual-modality stimulation has also displayed impressive gains in SCS efficacy, which should capture attention from physicians, even if there is little potential here for modifying the underlying disease. Our narrow moat rating is based on intangible assets that include the company’s extensive library of intellectual property, the relationships its field force has developed with physicians, and its long record of innovation. Although we estimate its share of the global neuromodulation at roughly 23%, second only to Medtronic’s share at approximately 37%, Boston Scientific is far more than a neuromodulation company.

Neuromodulation’s Promise and Potential

Neuromodulation holds significant potential to address a range of disease states--from epilepsy to migraine headache, from obesity to restoration of motor function among patients with spinal cord injuries. The basic concept is born of the same technology that underpins cardiac rhythm management devices, with small, implantable pulse generators and thin wires that deliver electrical signals to spur or damp activity in the nervous system.

While these devices for various underlying health conditions have often seen relatively robust growth, especially compared with the growth of the larger medical device market, neuromodulation generally remains third-line treatment or is viewed as a last resort. There are two particular factors, in our view, that are likely to keep neuromodulation from becoming a first or second choice for patients. First, neuromodulation, as with any implantable device, is more invasive than other therapies. We recognize that neuromodulation will most likely remain an option that is considered only after medication, physical therapy, and less invasive measures are exhausted.

Second, as appealing as neuromodulation is as a concept, there’s still a significant gap between the benefits delivered by and drawbacks of current neuromodulation devices compared with the potential of the technology. In other words, the field remains relatively early in its innovation curve. On one hand, the reality of today’s technology will likely limit its appeal to those patients who are most eager to undertake the risk of these devices for some relief. On the other hand, this also offers device makers rich opportunities to make meaningful improvements to the technology. If anything, we’ve seen that this category of medical devices is driven by innovation and advances in differentiated technologies.

SCS Remains a Key Driver of Neuromodulation Technologies

Spinal cord stimulation, which accounts for an estimated 67% of the entire neuromodulation market, is one of the longest-standing applications of neuromodulation, originally introduced in the late 1960s. Thanks to the size of the underlying patient pool, SCS has seen significant accumulation of clinical data behind its use. Moreover, we expect continued reliance on back surgery, especially in the United States, will ultimately result in steady expansion of the pool of candidates for SCS.

While SCS systems are generally indicated for chronic pain, the underlying health conditions that contribute to this market are heterogenous. This heterogeneity is one factor that makes for a complex and often lengthy referral process before patients reach the point of considering SCS. Failed back surgery and complex regional pain syndrome currently account for the majority of SCS patients.

We anticipate steady demand for SCS flowing from several streams of patients, principally those with failed back surgery and those with complex regional pain syndrome. Growth from the first group is derived from how extremely common back pain is, with up to 80% of Americans experiencing it at some point. In particular, lower back pain is exacerbated by obesity and the load put on that portion of the spine when sitting. Further, approximately 20% of people experiencing lower back pain will see it develop into a chronic condition. We estimate SCS has seen only 11% market penetration, leaving substantial upside for growth.

Considering that we’ve seen the prevalence of spinal fusion consistently rise, we expect the increasing popularity of this procedure should also replenish the pool of candidates for SCS. We anticipate the widespread incidence of back pain and popularity of back surgery (especially in the U.S., where reimbursement is well established) should continue to guide more patients to this invasive solution.

Though complex regional pain syndrome patients remain a significant portion of the patient pool, we think the main growth of the SCS patient pool will come from failed back surgeries. With the current trend among spine surgeons to adopt robotic technology, such as Medtronic’s Mazor X and Globus Medical’s GMED ExcelsiusGPS, we anticipate these novel advances will support continued growth in fusion and other spine surgeries. There is still a dearth of data to demonstrate that these robots lead to superior patient outcomes. It will likely take another three to five years of accumulating data and studies before there is any practitioner consensus on the clinical value of the robots. In the meantime, there is little to stop enthusiastic spine surgeons from embracing the robots and using them on more patients.

While it is possible that the spine robots might lead to more successful surgeries, we continue to hold a cautious view based on how we’ve seen the orthopedic robot technology unfold for large joint replacement, where long-term clinical success has yet to be determined. In contrast to failed back surgery, growth in diagnosis of complex regional pain syndrome remains extremely low, with approximately 200,000 patients diagnosed year in and year out.

Clinical data suggests that lumbar spinal fusion is successful in only roughly half of all cases. Some of those patients who have failed primary fusions may be tempted to undergo another surgery. However, the success of ensuing back surgeries diminishes significantly, with (at best) 30%, 15%, and 5% success achieved in the second, third, and fourth surgeries, respectively. We think the larger category of patients who have failed the primary back surgery would be a suitable target for SCS, given their challenging pain conditions and willingness to resort to more-invasive measures to gain relief. Aside from the sweet spot of failed back surgery and complex regional pain syndrome, we think there are potentially other, second-tier targets that would also make sense, including patients with diabetic neuropathy or those with chronic lower back pain but who have not yet committed to anything as invasive as surgery. However, we judge these patient pools to be ancillary to the main ones.

The SCS market saw a decline in 2020 as shelter-in-place orders and procedure delays for non-pandemic-related therapy put pressure on less acute conditions, including chronic pain. But over the longer term, we anticipate chronic pain patients should return for treatment and the pandemic will not diminish underlying patient demand. We think the key factors that could accelerate growth and penetration of this market will come primarily from the robust SCS innovation that has begun to flower, coupled with growing awareness among physicians of the benefits of earlier SCS treatment.

No Obvious Winner in the SCS Race

Though there is a great deal of innovation taking place in the SCS market, there’s no obvious winner yet, from our perspective. It is difficult to fully assess and compare the efficacy of the new forms of SCS, which partially reflects the heterogeneity of the underlying health conditions. Various clinical trials are being conducted with different patient populations, confounding comparisons. Additionally, at a fundamental level, pain is elusive to measure since it relies on patient perceptions rather than an objective biomarker.

Even if there is no winning technology, we see opportunities for all the major competitors in this news-driven market to benefit from this range of new options. We think all these new waveforms and treatment paradigms should generate renewed interest among practitioners, especially given the significant improvements in efficacy over conventional SCS that the initial research has demonstrated. We also think investments in direct-to-consumer marketing for SCS could also yield benefits, as Nevro has demonstrated with its communications programs. Considering the long and winding road through many specialists before most patients arrive at SCS, we anticipate that more competitors may pursue DTC advertising to enhance the pull factor.

/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)