Is Salesforce’s Stock a Buy, Sell, or Fairly Valued After Earnings?

With good Q1 results and a strong outlook for margins, here’s what we think of Salesforce stock.

Salesforce CRM released its first-quarter earnings report on May 31, 2023. Here’s Morningstar’s take on what to think of Salesforce’s earnings and stock.

Salesforce Stock at a Glance

- Fair Value Estimate: $245

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Salesforce Q1 Earnings

Results were good overall, with non-GAAP operating margin and revenue both ahead of consensus, fueled by strength in MuleSoft and resiliency in the core Sales Cloud and Service Cloud applications.

Some cracks emerged in the outlook for the next quarter, which included the U.S. economy decelerating more than expected, professional services driving a new layer of demand weakness, and slowing growth in current revenue performance obligations. Additionally, despite nice revenue upside this quarter, the company did not raise its full-year revenue outlook due to services weakness.

We don’t think there is a true underlying demand issue for Salesforce; this instead seems consistent with uncertain macro conditions. Enterprise buying behavior is cautious in general, with more approvals needed, elongated sales cycles, smaller deals, and faster time required to prove a service’s value. The service element is a new wrinkle in this environment for Salesforce. Indeed, we haven’t seen this at other software vendors (yet). However, software-derived revenue was strong and drove upside despite services weakness.

The key thesis points for Salesforce remain unchanged, as the company has rapidly pivoted to profitability and a more shareholder-friendly capital allocation framework that emphasizes share buybacks while de-emphasizing acquisitions.

We see Salesforce as an attractive stock with a unique opportunity to drive 1,000 basis points of margin improvement over the next several years that simply doesn’t exist within large-cap software.

Salesforce Stock Price

Fair Value Estimate for Salesforce Stock

With its 3-star rating, we believe Salesforce stock is fairly valued, in line with our long-term estimate.

Our fair value estimate for Salesforce is $245 per share, which implies a fiscal 2024 enterprise value/sales multiple of 7 times, an adjusted price/earnings multiple of 34 times, and a 3% free cash flow yield.

We model a five-year compound annual growth rate for total revenue of 12% through fiscal 2028, which we think will be driven by strength in platform and marketing clouds. Our revenue forecast assumes modest revenue acceleration after depressed growth in both fiscal 2023 and 2024. We forecast non-GAAP operating margin expanding from 23% in fiscal 2023 (actual) to somewhere in the low 30% range in fiscal 2028, consistent with management’s new profitability focus.

In our view, the company will benefit from the natural cross-selling of solutions among the clouds.

Read more about Salesforce’s fair value estimate.

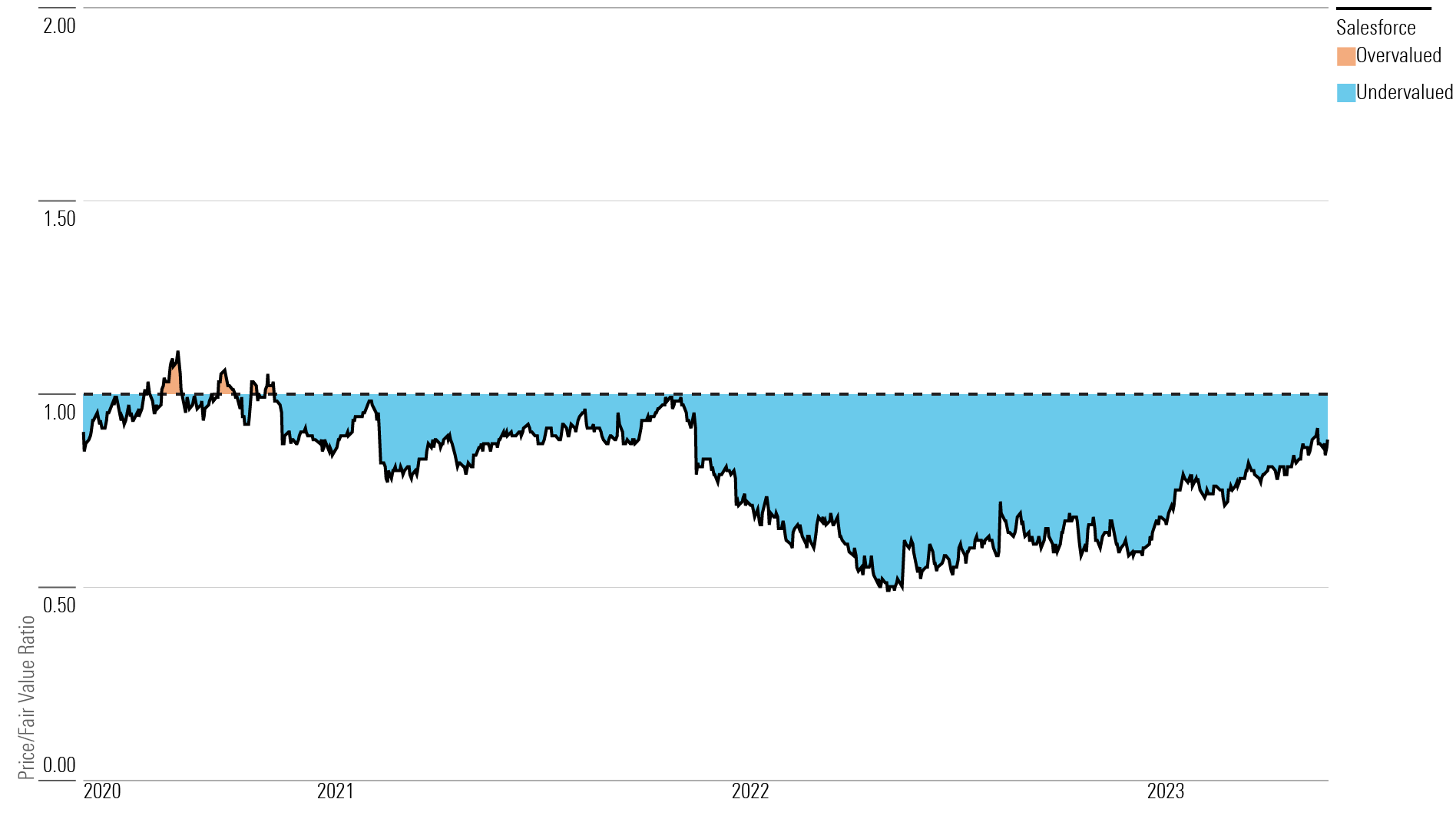

Salesforce Price/Fair Value Ratio

Economic Moat Rating

For Salesforce overall we assign a wide moat rating, arising primarily from switching costs, with support from a network effect.

Salesforce revolutionized the software industry in 2000 with the release of its Sales Force Automation, or SFA, application. Its feature set was generally similar to those offered by peers: streamlined process management for sales leads and opportunities, contact and account data, process tracking, approvals, and territory tracking. The critical difference was that the software was accessed through a web browser and delivered over the internet. Taken for granted today, this was novel at the time. The company paved the way for the software industry as it now exists by first selling the concept of software as a service to prospective customers and then selling the actual SFA product.

We believe customers are reluctant to switch away from Sales Cloud because of the time, expense, and risk of implementing new applications and migrating data, as well as the time, expense, and lost productivity of retraining a workforce on a new platform.

Read more about Salesforce’s moat rating.

Risk and Uncertainty

We assign Salesforce a Morningstar Uncertainty Rating of High. From a big-picture perspective, we believe CEO Marc Benioff would be difficult to replace. A pioneer in the software industry, he co-founded the company and led it to be a dominant force with a broad portfolio of sales and marketing solutions.

We believe the most important metric for Salesforce investors is revenue growth. Therefore, continued deceleration in the Sales Cloud, or growth that does not materialize as expected in the Service Cloud, Marketing Cloud, Commerce Cloud, or Salesforce Platform would likely have an adverse impact on the stock.

Salesforce is also likely to face new competitors as it continues to acquire its way into new markets.

Read more about Salesforce’s risk and uncertainty.

CRM Stock Bulls Say

- Salesforce dominates the SFA space, yet controls only 30% of a highly fragmented market that continues to grow by double digits each year, suggesting there is still room to grow.

- The company has added legs to its overall growth strategy, including customer service, marketing automation, e-commerce, analytics, and artificial intelligence.

- Management is likely going to focus on expanding margins after years of subscale profitability.

CRM Stock Bears Say

- As the company grows larger, it may be increasingly difficult for Salesforce to grow faster than its various end markets.

- Salesforce has entered new areas via acquisition and has arguably paid material premiums in the process. Integration risk is real, as is the risk of increasingly large, dilutive, or ill-conceived deals.

- Despite its size, Salesforce has generated substandard margins in recent years, and its renewed focus on profitability may negatively affect already-slowing growth.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio, through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T24Q4VBSYNBXJNOP62HM52FIBI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)