Is Microsoft a Buy, Sell, or Fairly Valued Ahead of Earnings?

Focus on areas including Azure growth, discussion of AI, and the impact of layoffs.

Microsoft MSFT is set to release its fourth-quarter and fiscal year 2023 earnings report on July 25, 2023. Here’s Morningstar’s take on what to look for in Microsoft’s earnings and stock.

Microsoft Stock at a Glance

- Fair Value Estimate: $325.00

- Morningstar Rating: 3-stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What to Watch for in Microsoft’s Q4 Earnings

- Azure growth: Azure is the key growth driver for the company. We believe its growth has been decelerating meaningfully for the past several quarters as customers are taking the time to make sure they are maximizing their contracts during macro uncertainty.

- Discussion of AI: This has been a hot topic lately with clients and in headlines. We’ll look for any discussion around OpenAI- and Copilot-powered solutions.

- Commentary around the Activision deal: We see a clear path forward for wide-moat Microsoft’s acquisition of Activision, as a federal judge denied the Federal Trade Commission’s motion for a preliminary injunction to halt the deal. Microsoft intends to add as much Activision content as possible to Game Pass, which has an estimated 25 million subscribers. Activision has approximately 360 million monthly active users. We tend to think the purpose of deals like this is to gather exclusive content. However, part of the value of Activision is that it develops games across platforms and consoles, so we expect a relatively light slate of exclusive Xbox content over the next several years.

- Commentary on macro conditions: The demand environment and any macro pressures set the tone for other enterprise software vendors.

- Financial performance within consumer-facing areas: Keep an eye out for commentary on financial performance within areas like Bing, advertising, Windows, gaming, and LinkedIn. These came back stronger than expected last quarter and meaningfully contributed to overall good results.

- Impact of layoffs: Last, Microsoft quietly did another round of layoffs, so we will be looking for more information on where those cuts were and what the margin impact will be.

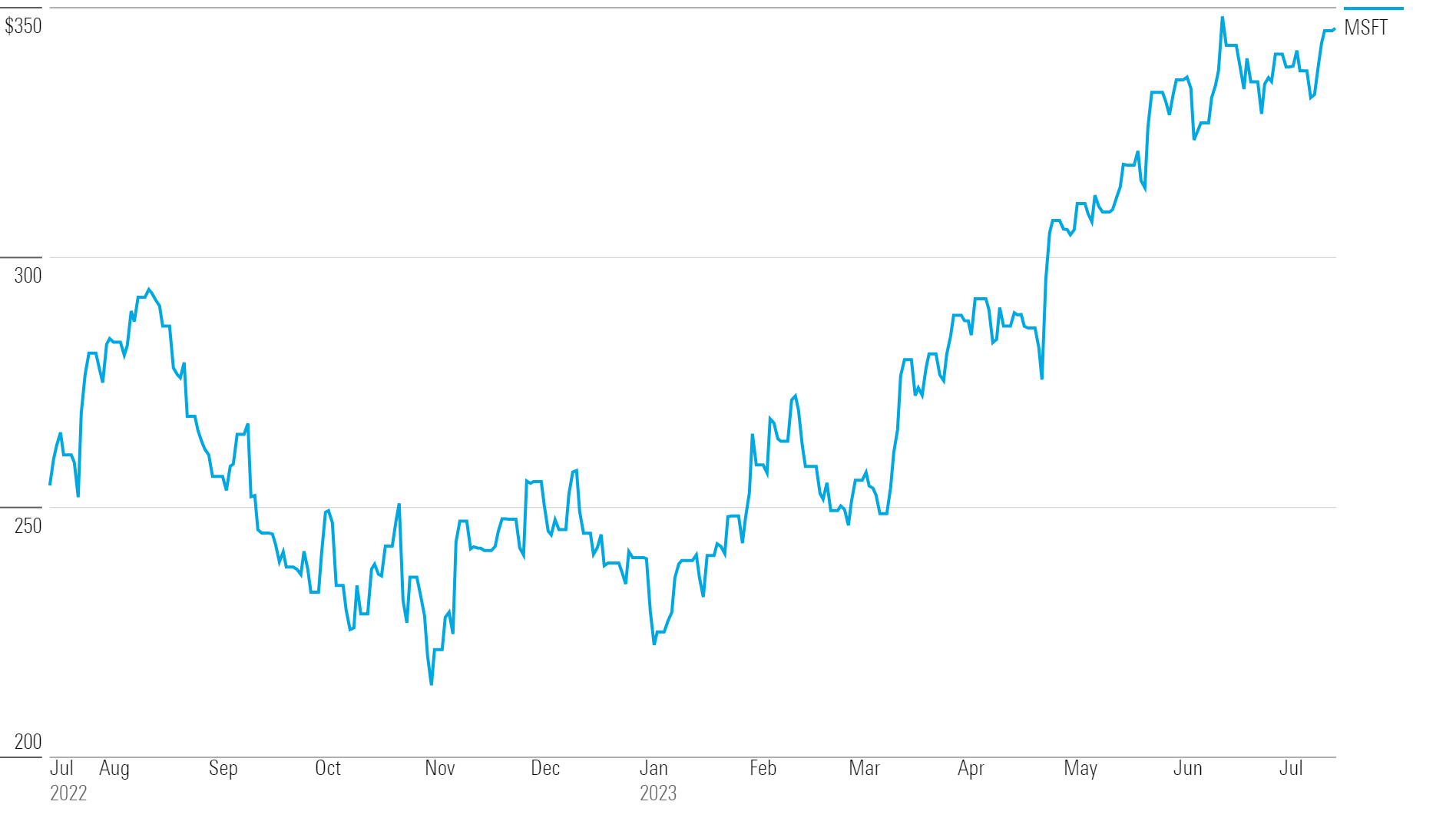

Microsoft Stock Price

Fair Value Estimate for Microsoft

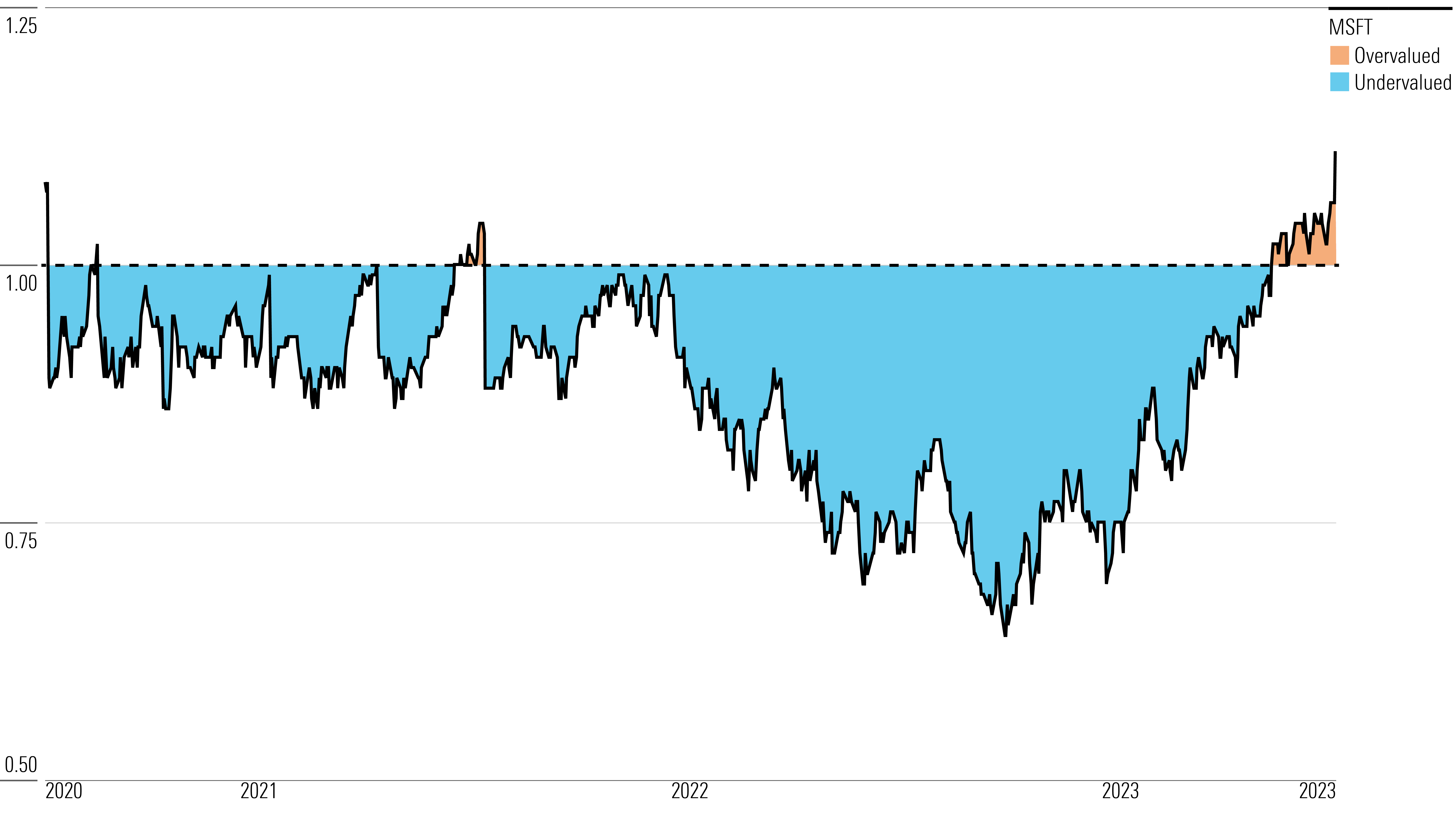

With its 3-star rating, we believe Microsoft’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate for Microsoft is $325 per share, which implies a fiscal 2023 enterprise value/sales multiple of 11 times, adjusted price/earnings multiple of 34 times, and a 3% free cash flow yield.

We model a five-year compound annual growth rate for revenue of approximately 10%. We envision stronger revenue growth ahead as Microsoft’s prior decade was bogged down by the downturn in 2008, the complete evaporation of mobile handset revenue from the disposal of the Nokia handset business, as well as the onset of the model transition to subscriptions (which initially results in slower revenue growth). However, we believe macro and currency factors will pressure revenue in the near term. We believe revenue growth will be driven by Azure, Office 365, Dynamics 365, and LinkedIn. Azure in particular is the single most critical revenue driver over the next 10 years, in our view, as hybrid environments (where Microsoft excels) drive mass cloud adoption.

We believe the combination of Azure, DBMS, Dynamics 365, and Office 365 will drive above-market growth as CIOs continue to consolidate vendors. We believe More Personal Computing will grow modestly above gross domestic product over the next 10 years.

Read more about Microsoft’s fair value estimate.

Microsoft Price/Fair Value Ratio

Economic Moat Rating

For Microsoft overall we assign a wide moat rating arising from switching costs, network effects, and cost advantages. We believe that Microsoft’s different segments and products benefit from different moat sources.

Microsoft’s Productivity and Business Processes segment includes Office, Dynamics, and LinkedIn. We assign the segment a wide moat rating based on high switching costs and network effects.

We believe that Microsoft Office, including both 365 and the perpetual license version, is protected by a wide moat driven by high switching costs and network effects. Office 365 is the cloud-based version of the traditional perpetual license Microsoft Office productivity suite. Office 365 is available for a monthly subscription. Together, the two products account for approximately 26% of revenue and are growing in the low double-digit area. Office 365 represents more than half of Office revenue. We expect perpetual license sales of Office to continue to decline in terms of both absolute dollars and as a percent of revenue, with growth in Office 365 more than offsetting the declines.

Read more about Microsoft’s moat rating.

Risk and Uncertainty

Microsoft faces risks that vary among the products and segments. High market share in the client-server architecture over the past 30 years means significant high-margin revenue is at risk, particularly in OS, Office, and Server. Microsoft has thus far been successful in growing revenue in a constantly evolving technology landscape and is enjoying success in both moving existing workloads to the cloud for current customers and attracting new clients directly to Azure. However, it must continue to drive revenue growth of cloud-based products faster than revenue declines in on-premises products.

Microsoft is acquisitive, and while many small acquisitions are completed that fly under the radar, the company has had several high-profile flops, including Nokia and aQuantive. The LinkedIn acquisition was expensive but served a purpose and seems to be working out well in our view. It is not clear how much Microsoft bought in the Permira-led Informatica leveraged buyout, and it may have been an important strategic investment, but Informatica was certainly not a growth catalyst. GitHub was expensive but strategic and seems to be shaping up as a success, while the ZeniMax deal should boost the company’s first-party video game publishing efforts. We expect the Nuance acquisition to be digestible, but the recently announced Activision Blizzard acquisition is the company’s largest ever and might warrant more attention.

Read more about Microsoft’s risk and uncertainty.

MSFT Bulls Say

- Public cloud is widely considered to be the future of enterprise computing, and Azure is a leading service that benefits the evolution to first hybrid environments and then ultimately to public cloud environments.

- Shift to subscriptions accelerates growth after the initial growth pressure, and the company has passed the margin inflection point now such that margins are increasing again and have returned to pre-Nokia and pre-“cloud” levels.

- Microsoft has monopolylike positions in various areas (OS, Office) that serve as cash cows to help drive Azure growth.

MSFT Bears Say

- Momentum is slowing in the ongoing shift to subscriptions, particularly in Office, which is generally considered a mature product.

- Microsoft lacks a meaningful mobile presence.

- Microsoft is not the top player in its key sources of growth, notably Azure and Dynamics.

This article was compiled by Monit Khandwala.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)