Is Coca-Cola Stock a Buy After Earnings?

Coke posts solid results and appears set for continued sales and profit growth.

Coca-Cola KO released its first-quarter earnings report on April 24. Here’s Morningstar’s take on what to think of Coca-Cola’s earnings and stock.

Key Morningstar Metrics for Coca-Cola

- Fair Value Estimate: $58

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

Fair Value Estimate for Coca-Cola

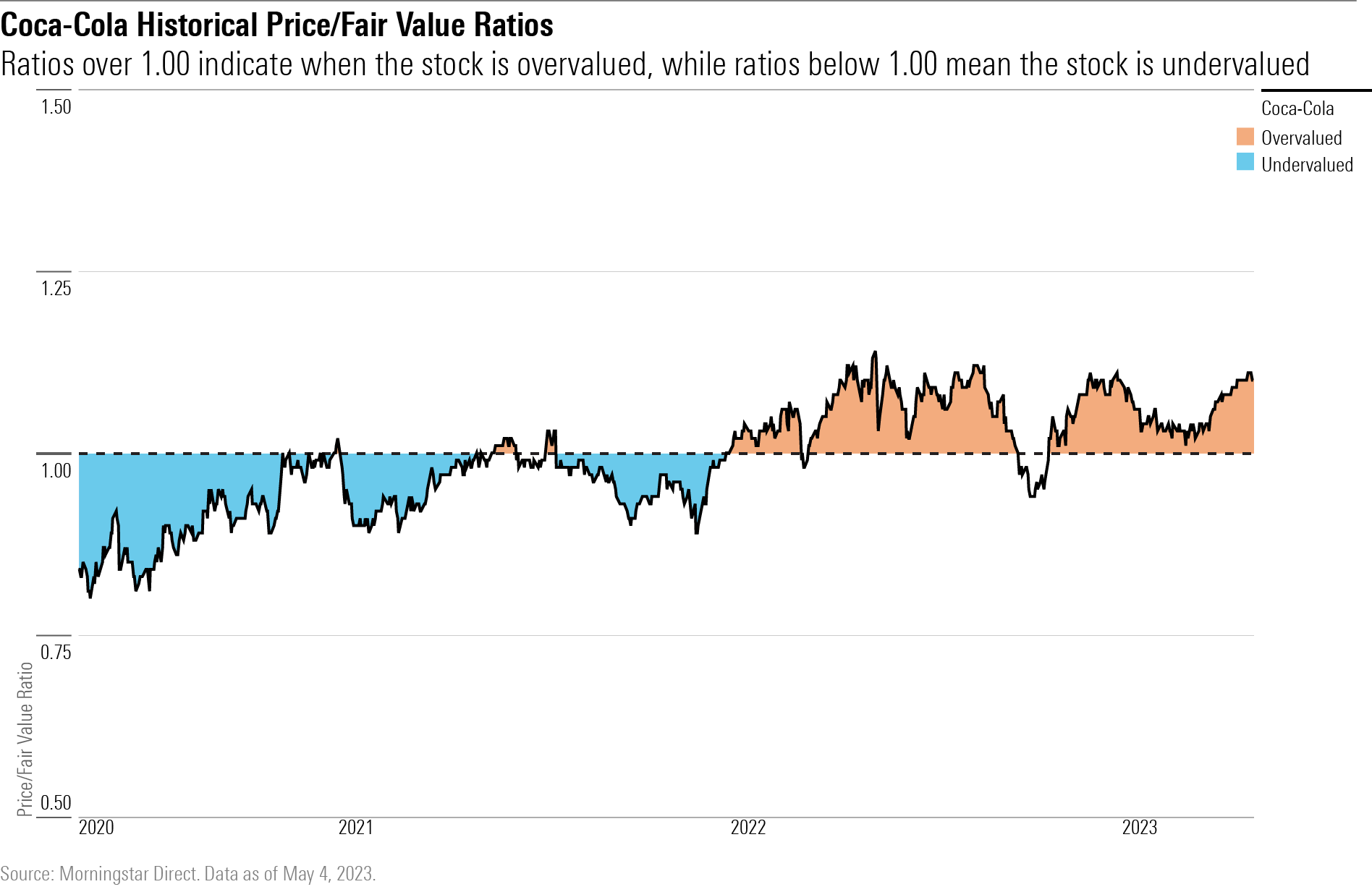

With its 2-star rating, we believe Coca-Cola stock is overvalued when compared with our fair value estimate.

We are maintaining our fair value estimate for Coca-Cola at $58 per share, which implies a 23 times multiple against our adjusted 2023 earnings estimate and a 2023 enterprise value/adjusted EBITDA multiple of 19 times. We continue to forecast mid-single-digit top-line and high-single-digit earnings growth over our 10-year explicit forecast period.

Our 5.2% compound annual growth rate projection for revenue over the next 10 years is driven by strong emerging-markets growth (we forecast Latin America and the Asia-Pacific combined to make up 30% of overall sales by 2032, up from 22% in 2022), expansion in nonsparkling categories (water, sports, and energy drinks), and the Costa business steadily adding on offerings in the on-premises channel and for retail distribution.

Read more about Coca-Cola’s fair value estimate.

What We Thought of Coca-Cola’s Q1 Earnings

- The first-quarter earnings results were slightly ahead of our estimates on topline (12% versus our 11% forecast) and adjusted earnings per share ($0.68, versus $0.67), thanks to broad-based strength on the back of a balanced mix of affordability and premiumization programs globally. We are maintaining our 10-year projections for mid-single-digit sales growth and operating margins averaging in the low 30s.

- The solid results have reaffirmed our view that consumer-centric innovations and brand marketing (which underpin its sustainable competitive position) should continue to fuel steady sales and profit expansion for Coke in the coming years, even during periods of consumer belt-tightening. In addition, Coke’s continued progress in category diversification beyond soda, coupled with successful launches of low/no-sugar versions of its classic recipes, reinforced our confidence in the firm’s ability to defend its mind shares and wallet shares in the soft-drink space.

- Coke remains an attractive long-term investment idea based on resilient topline growth, high margins, and consistent excess investment returns for more than 20 years. That said, the stock is trading at a 10% premium to our $58 fair value estimate, and we’d wait for a better entry point.

Economic Moat Rating

We believe Coca-Cola has built a wide economic moat around its global beverage operations based on strong intangible assets and a significant cost advantage that will enable the company to deliver excess investment returns above its cost of capital over and beyond the next 20 years. As the world’s best-known beverage company, Coca-Cola owns a strong portfolio of storied and iconic brands that resonate with consumers around the world, making its products the beverage of choice on both at-home and away-from-home consumption occasions. The special connection that Coca-Cola cultivates and maintains with generations of consumers has enabled the firm to dominate the carbonated soft drink category at the core of its business (69% of Coca-Cola’s 2022 unit case volume sold). Coca-Cola’s brand appeal results in a steady price premium over lesser-known brands that consumers are willing to pay up for, as well as low demand elasticity, thus affording Coca-Cola considerable pricing power. Suffice it to say, numerous attempts from retailers—especially hard discounters—over the years have barely put a dent in Coca-Cola’s ability to set price. Thanks to the strength and breadth of its brand portfolio, Coca-Cola has been able to attract to its ecosystem bottlers and distribution partners in key regions such as the United States, Western Europe, Latin America, and Asia-Pacific that have good capital, business acumen, and operational expertise. When taken together with strong pricing power and a durable cost advantage arising from scale, we see Coca-Cola as remaining in an enviable position to extract attractive economic benefits from its own operations and bottler networks.

Read more about Coca-Cola’s moat rating.

Risk and Uncertainty

We assign a Low Uncertainty Rating to Coca-Cola. We view strong bottler relationships as crucial to its business model and return profile, but in periods of high inflation, these relationships could come under pressure as the bottlers tend to bear the brunt of cost increases. Although nonalcoholic beverage demand tends to be resilient through economic cycles, Coke has high exposure to international markets (over two thirds of both revenue and profits) that leads to stepped up volatility within its operations—resulting from shifting macroeconomic and regulatory landscapes, currency fluctuation, and geopolitical risks—compared with domestically focused peers. We don’t see environmental, social, or governance risks to materially affect Coke’s operations or investment returns. As consumers become increasingly health conscious, Coke faces the challenge of reducing the health impact of its beverages without compromising on the distinct taste that sits at the core of brand loyalty.

Read more about Coca-Cola’s risk and uncertainty.

KO Bulls Say

- Coke can leverage strong bottler relationships in underpenetrated emerging markets to drive volume growth with classic recipes as well as new products tailored to local tastes.

- Heavy investments in a digitalized supply chain and data analytics have better aligned Coke and its bottlers in product planning, manufacturing, and go-to-market strategy.

- As Costa recovers from pandemic-related disruptions, it should help Coca-Cola gain a firmer footing in the coffee category and provide more consumer insights, given its global footprint.

KO Bears Say

- Secular headwinds in carbonated soft-drink demand in developed markets are a challenge to Coca Cola’s long-term growth outlook.

- The company’s brand portfolio and product lineup in nonsparkling categories are less robust, and heavy investments are needed to bolster its competitive position.

- With two thirds of revenue from international markets, Coke faces constant currency fluctuations that drive volatilities in reported earnings.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)